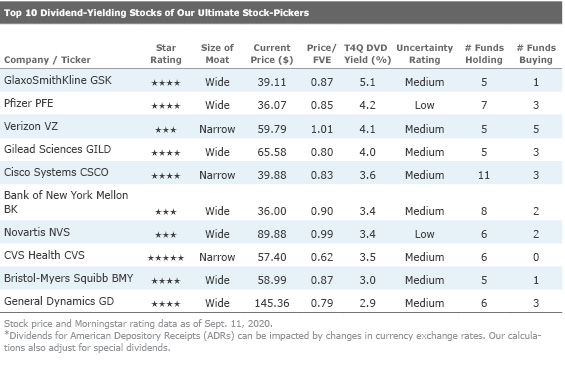

Our Ultimate Stock Pickers' Top 10 Dividend-Yielding Stocks

Many of the highest-yielding names are undervalued today.

The vast majority of our Ultimate Stock-Pickers are not dividend investors. That said, a handful of them—Amana Trust Income AMANX, Columbia Dividend Income LBSAX, Oakmark Equity & Income OAKBX, and Parnassus Equity Income PRBLX—focus more on income-producing stocks in their pursuit of investment return. Warren Buffett at Berkshire Hathaway BRK.B has spoken highly of companies that return capital to shareholders and is not against investing in and holding higher-yielding names.

As you may recall from our previous dividend-themed articles, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to find the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of the dividend-paying stocks held in the portfolios of our Ultimate Stock-Pickers and then narrow it down by concentrating on firms that we believe have sustainable competitive advantages that should allow them to generate the excess returns necessary to maintain their dividends over the longer term. We also look for firms where there is lower uncertainty on our analysts' part regarding future cash flows. We accomplish this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, have wide or narrow economic moats, and have uncertainty ratings of either low or medium.

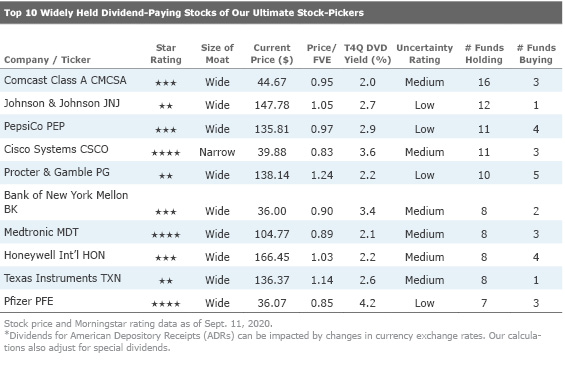

Once our filtering process is complete, we create two different tables—one that reflects the top 10 stocks with the highest dividend yields and another that lists stocks that are widely held by our Ultimate Stock-Pickers and pay dividends in excess of the S&P 500, which is currently yielding 1.71% as of August 2020. We note that the dividend yield calculations in each of our two tables are based on regular dividends that have been declared during the past 12 months and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Looking back to our list of top 10 dividend-yielding stocks from last time around, we note that a large portion of the new list is composed of the previous list. Wide-moat rated GlaxoSmithKline GSK, Pfizer PFE, Gilead Sciences GILD, Novartis NVS, and Bank of New York Mellon BK, and narrow-moat rated CVS Health CVS and Cisco Systems CSCO were part of the old list, as well. Wide-moat rated Gilead Sciences and Bank of New York Mellon, and narrow-moat rated Cisco Systems and CVS Health moved up the list, and wide-moat rated Novartis moved down the list. The top 10 widely held dividend-paying stocks also changed slightly, but nine of the 10 names were present on the old list, as well. Texas Instruments TXN emerged as a new name on the top 10 widely held dividend-paying stocks this period, replacing Chubb CB.

In the last edition of the Ultimate Stock-Pickers article discussing dividend yielding stocks, we highlighted the impact of the viral spread of COVID-19 on markets. While markets nosedived from late February into late March, they have now largely recovered as global lockdown restrictions have become less strict and signs of early economic recovery have taken place. Even so, the recovery in the stock market came on the back of mixed economic and vaccine data, with stops and starts in terms of progress on both fronts. Given the recent run-up in the stock market, based on our aggregate price to fair value estimates, we view the financial services, utilities, and energy sectors as the only undervalued sectors today, with investors still focused on "pandemic-proof" companies such as those in the technology space.

Searching for yield in this type of environment can be risky. Price risk remains elevated as does the risk that companies may not be able to sustainably maintain current dividends due to economic strain. To alleviate some of these risks, we eliminate high-uncertainty rated stocks from our screening process. Unsurprisingly, given the recent market movements, most of the stocks that made our lists are also trading at or below their current fair value estimates. Wide-moat rated Pfizer, Gilead Sciences, and General Dynamics GD, and narrow-moat rated CVS Health and Cisco Systems are all trading at or over a 15% discount to fair value. The average price to fair value estimate for the top dividend-yielding stocks was 0.85, indicating that we view these high-yielding stocks as attractively priced. The top 10 dividend-yielding stocks are heavily overweight in the healthcare sector, which contributed six names to the top 10 list. The mix is marginally different for our top 10 widely held dividend-paying stocks list, which includes three healthcare stocks, two consumer defensive stocks, and two technology stocks. The most widely held stock that was also present on the top 10 dividend-yielding stocks list this period was narrow-moat rated Cisco. Wide-moat rated Procter & Gamble PG, PepsiCo PEP, and Honeywell International HON were the most widely purchased top dividend-paying stocks this period.

Looking more closely at the list of top 10 widely held dividend-paying securities, there was a reasonable amount of overlap with our list of top 10 dividend-yielding stocks. Wide-moat rated Pfizer, Bank of New York Mellon, and narrow-moat rated Cisco Systems were present on both of our lists. Continuing a recurring theme, the majority of names on our list of top 10 widely held securities are held by seven or more funds. This period's list of widely held dividend-paying stocks was less undervalued than the top dividend-yielding stocks. Three of the 10 stocks were materially undervalued, averaging a price to fair value of approximately 86% compared with an average of 85% for our top 10 highest dividend-yielding stocks.

We continue to believe that the best way for investors to protect their capital is to invest in quality businesses that are trading at attractive prices. Our valuation shows that wide-moat rated Pfizer is trading at a significant discount to fair value, so we will focus on it in this piece. We also highlight narrow-moat rated Cisco Systems and wide-moat rated PepsiCo and BNY Mellon in this edition of Ultimate Stock-Pickers.

Pfizer Inc. PFE

Wide-moat rated Pfizer presents a compelling analysis as the healthcare system is highly scrutinized due to the race for a COVID-19 vaccine. The stock trades at a 15% discount to Morningstar analyst Damien Conover's fair value estimate of $42.50. Conover points out that even though strong antibody and T-cell responses in a variety of phase I COVID-19 vaccine studies are not indicative of guaranteed protection from sickness or severe infection, he's bullish on the prospects for late-stage trial vaccines receiving approval by the U.S. Food and Drug Administration (FDA), as they will likely reach the 50% risk reduction threshold requirement. He argues that of the three emergency use authorizations (EUA) that could be awarded before the end of the year, one could go to Pfizer/BioNTech's BNT162b2, with the vaccine hopefully contributing toward most U.S. adults receiving vaccinations in the first half of 2021. According to Conover, this is indicative of the innovation and clinical expertise at firms like Pfizer.

Conover argues that Pfizer maintains a solid foundation and strong cash flows reaped from a basket of drug products. Pfizer's vast scale accompanied by significant patent protections on its portfolio of drugs is indicative of strong competitive strengths that grant the company a wide moat. In fact, the firm's size has helped establish one of the largest economies of scale within the pharmaceutical industry. Drug development can be hit-or-miss, requiring several shots on goal to garner success. This requires significant financial investment that Pfizer has the scale and ability to make. This has helped lead to the firm's strong research pipeline for new drug development. In addition, after a few years of struggles in terms of creating new, important drugs, Pfizer is launching potential blockbusters in heart disease, cancer, and immunology.

Pfizer's salesforce is supported by its vast financial resources. The company's salespeople have a plethora of marketing data on hand as a result of its commitment to post-approval studies. In addition, Pfizer has leading salesforces in emerging economies that are rapidly becoming wealthier, including Russia, India, Turkey, China, and Brazil.

In spite of the company's position as an industry leader, Conover points out several near-term challenges, including the expiration of patent protection on several drugs (e.g. the loss of patent protection on neuroscience drug Lyrica in 2019) that will weigh on future results. Even so, Pfizer made the prudent decision to divest its off-patent division in the quest to create a new company along with Mylan, which should accelerate growth in Pfizer's remaining innovation pipeline. In addition, in spite of rising competition from generic drugs, Conover believes that the already existing diverse portfolio of drugs under Pfizer's control should protect it from any individual patent loss. Following Pfizer's merger with Wyeth, the company has newfound strength in the vaccine market with the addition of pneumococcal vaccine Prevnar-13, with vaccines being relatively resistant to generic competition as a result of manufacturing complexity and lower price points.

Cisco Systems CSCO

The shares of narrow-moat rated Cisco Systems are also currently trading at a discount to our fair value estimate. The stock appears on our list of top 10 dividend-yielding stocks and top 10 widely held dividend-paying stocks. Cisco Systems is the world's largest software and hardware supplier in the networking solutions sector. Morningstar analyst Mark Cash points to Cisco's strategic focus on growing recurring revenue via the sales of software and services to support its hardware equipment. While the software and services stream contributed to about 43% of revenue in fiscal 2017, Cash expects this figure to constitute about 55% of sales in fiscal 2020. Cash further argues that Cisco's increased focus on software, as well as on selling networking chips, can help the company maintain demand for its solutions in spite of some clients' increased reliance on generic hardware or cloud-based products. Cisco's shift will help support sustainable growth for the firm in a shifting technological landscape, and continued investments in organic growth and acquisition will help the company keep its position in today's networks.

The company is the prime supplier of products including routers, switches, cyber security, as well as complementary networking products. Cisco's products exhibit mission criticality in terms of security, stability, and network performance. Seeing nascent trends in software, analytics, wireless, and security, Cisco has increased proliferation in the space, and Cash sees the firm as a one-stop shop networking vendor. Cisco's unique position enables it to interconnect complementary requirements, such as security and networking, thus creating comprehensive solutions and products for clients.

In spite of a prime position in routers and switches, increasingly rapid shifts to the cloud by IT professionals means they are buying less data center hardware. In response, Cisco is moving toward subscription-based offerings, which Cash believes is the preferred consumption method for cloud-based resources. He is further encouraged by the establishment of this sales model in a variety of Cisco’s product offerings, which clients are purchasing as bundles with security and analytics. Cash posits that Cisco has identified key market trends and has rapidly evolved its portfolio of offerings to stay on par with/ahead of trends within the communications, cybersecurity management, switching, analytics, and software-defined wide-area networking spaces. Cisco should continue to locate and identify acquisitions in such segments to offset pressures in maturing parts of its business.

PepsiCo Inc. PEP

Narrow-moat rated PepsiCo currently trades at approximately a 3% discount to Morningstar analyst Nicholas Johnson's fair value estimate of $140. It is currently in the top 10 widely held dividend-paying stocks of our Ultimate Stock-Pickers. Johnson argues that even though previous missteps have hampered PepsiCo's performance in the past, benefits from Pepsi's integrated business model in confluence with improved execution will enable the firm to enjoy an acceleration in profitability growth.

When most customers first hear the term "Pepsi," they envision cola containers, soda cans, and curated advertisements, all exalting Pepsi's superiority to Coca-Cola KO. Although Pepsi remains a large player in the beverages space, it has extended its reach beyond this industry, with products from Frito-Lay and Quaker making up over half of all sales and profits. According to Johnson, maintaining a diversified portfolio across a variety of beverages and snacks is key to Pepsi maintaining its competitive advantages.

Pepsi faced years of lethargic growth and low levels of investment, but these are now issues of the past. The firm has responded and upped its commitment to expanding its top line, investing significantly in manufacturing capacity, improving product lines to match reformulated packaging demand, improving system capacity via optimizing routes and sales technology, and focusing on productivity via harmonization and automation. Johnson believes these prudent investments will enable the strengthening of key trademark products, such as Gatorade and Mountain Dew, and generate higher levels of cost savings that can be used for reinvestment to widen profits. The firm has also made some strategic pivots recently into the energy category that should further support growth and margins.

Johnson points out some risks in Pepsi's growth trajectory, with normative shifts in consumer behavior creating secular headwinds. Shifting go-to-market dynamics such as the advent of e-commerce enables real-time price comparisons, impeding Pepsi's retail distribution advantage and allowing for more aggressive competition. Even so, Johnson believes that structural benefits as a result of Pepsi's scale, brands, and portfolio of diverse product offerings should allow the company to maintain a wide moat and support its competitive advantage within its industry.

Bank of New York Mellon Corp. BK

The final stock we will highlight is wide-moat rated BNY Mellon, which was the sixth most widely held dividend-paying stock and sixth on the list of top dividend-yielding stocks, as well. BNY Mellon currently trades at approximately a 10% discount to Morningstar analyst Rajiv Bhatia's fair value estimate of $40. The bank has over $35 trillion in assets under custody/administration, essentially leaving it tied with State Street as the largest custodian by assets.

Although core custody can be a fairly undifferentiated offering, BNY Mellon's scale and client stickiness have enabled the firm to enjoy double-digit returns on tangible equity. The bank also provides a variety of other services via different businesses, including RIA custody and broker/dealer clearing through Pershing, an ADR issuer servicing solution, a mutual fund sub-accounting platform, and tri-party repo, which gives the firm a degree of differentiation from competitors, according to Bhatia.

Alongside investment servicing, the bank also has a $1.8 trillion investment management business that helps generate about one quarter of the bank's revenue. However, Bhatia points out that this segment has lower switching costs and thus a lower competitive edge compared with the investment servicing segment.

In the face of the Mellon merger, BNY Mellon dealt with criticism over its limited cost control and other failures in integration. Bhatia points out that even though some of the criticism may be justified, management has taken aggressive steps to control expenses and has consistently been able to generate 15%+ returns on tangible equity. Bhatia expects continued fee pressure and client concentration in the asset management space to translate into pricing pressure for BNY Mellon, though the bank will still be able to generate high returns as a result of share repurchases and sustained expense discipline.

Disclosure: Nupur Balain has no ownership interest in any of the securities mentioned here. Eric Compton has no ownership interest in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WFC7QPLI3Z7OFQIJYFW66JXOY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HYEFB6CPNRFUPDTOC2XUZFNV7I.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)