Structured Products and Tesla: A Match Made Somewhere Other Than Heaven

Structured products are designed to eliminate downside risk, but are they really working for Tesla investors?

To eliminate downside risk and earn income off their holdings, investors have increasingly turned to a type of investment known as a structured product. Structured products come in many different flavors but typically work best when they’re hedging against holdings that have limited upside potential.

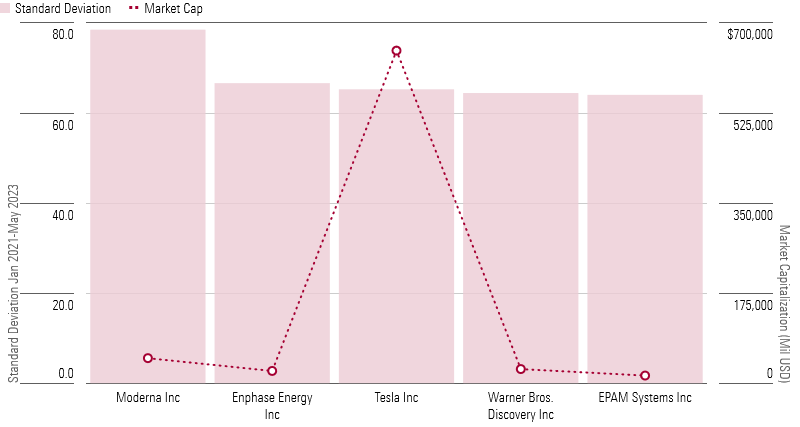

In our latest paper on the topic, we discovered that Tesla TSLA is the most popular subject for single-stock structured products. That’s not a particularly surprising finding: Investors in Tesla have had one of the rockiest rides of any large-cap stock over the past few years. Tesla’s volatility ranks third highest among the current companies in the S&P 500 since it was added in December 2020, behind only Moderna MRNA and Enphase Energy ENPH.

Telsa Has Been the Third-Most Volatile Stock in the S&P 500 Since Its Inclusion

Given how volatile Tesla is, it makes sense that investors in the stock would use these products to protect against downside risk. After all, structured notes could help shield investors from Tesla’s volatility, right?

Not necessarily. Volatility and downside risk are not the same thing. Volatility measures price variability, while downside risk measures movement in one direction. Structured products generally protect against the latter, not necessarily the former. That’s why they work best on stocks that are overvalued.

For a potential investor, timing is key. The question at the heart of the matter is: Is the stock I’m trying to hedge against overvalued right now? Or could it rally somewhere down the line and nullify my contract?

How can an investor determine if a stock is overvalued, though? Luckily enough, we can measure that.

Overgrown Hedges

In April 2023, I created a framework for measuring how structured products align with the price of the underlying stock when they’re issued. I created three tags: “excessive coverage,” “appropriate coverage,” and “breach risk.”

These tags will make more sense with an illustration.

Let’s take “excessive coverage” first. If a note has excessive coverage, that means that when the note was issued, Morningstar’s equity analysts (not me) believed that Tesla’s stock was worth more than the price it traded at. When this is the case, a note is at risk of getting called away if the stock converges with our fair value estimate.

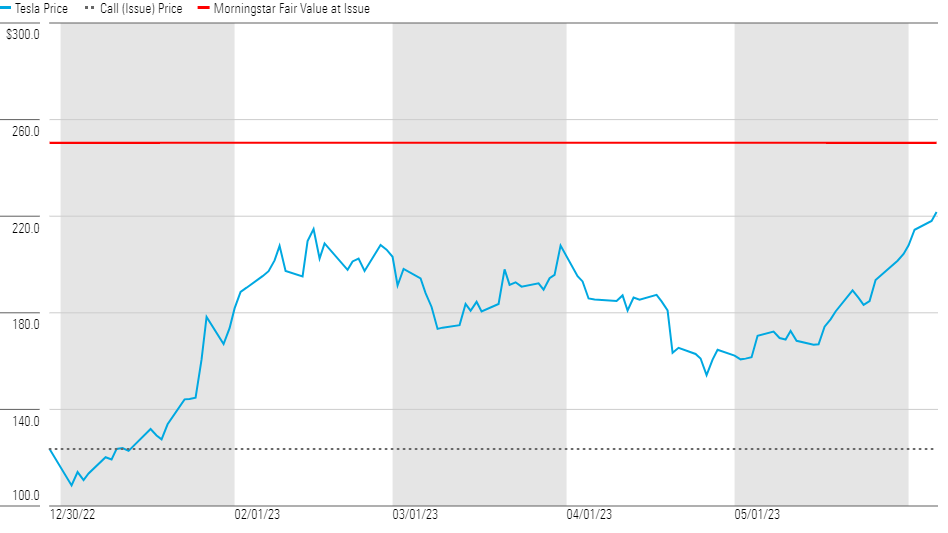

BMO offers such a note, trading under the name “Autocallable Barrier Notes with Contingent Coupons due December 31, 2025.” Quite the mouthful!

BMO issued the note on Dec. 30, 2022, shortly after Elon Musk completed his acquisition of Twitter, when Tesla’s stock was trading at $123. Our fair value estimate was $250 per share at the time, which means the shares were undervalued by more than 50%. Tesla’s stock was trading at a price of $244 as of June 9, 2023.

Tesla's Rally Since Year-End Places It at Risk of Redemption

Why does that matter? It matters because this structured product, like most, can be redeemed.

Redemption works through one of two mechanisms known as an issuer call or an autocall. These terms are operationally different from one another but have similar implications: If a structured product has this feature, the note gets recalled by the issuer if the price of the stock is higher on predefined measurement dates than it was on the date the note was issued.

The note’s next call date is July 27. Tesla’s current stock price is above the call price (also known as the issue price) of $205 and still below our fair value estimate of $250 at the time of the note’s issue. As a result, this note is in jeopardy of getting redeemed by BMO—putting investors at risk of losing all or part of the note’s promised coupons.

Oh, and One More Thing

Now, we’ve talked about how structured products protect investors from losses, and that’s somewhat true, but it’s also an oversimplification. That principal protection has limits.

Structured notes commonly set a boundary on the hedge they’ll provide for an investor, called a barrier. Below that barrier, the investor is liable for all of the downside in the stock.

“Breach risks” describe a situation where a stock was so overvalued when it was issued that the issuer set the barrier limit above where Morningstar analysts expect the stock to go. As a result, a structured product’s downside protection may not be sufficient, and investors may be exposed to the entire loss.

Tesla’s trajectory since its November 2021 peak places many notes in this category, including the “Callable Contingent Coupon Note due November 24, 2023” issued by Barclays. At the time it was issued, the note had a trigger price of $260—70% of the stock’s price at issuance. (The stock was trading at $372 on the day that the note was priced.)

At the time, Morningstar had a fair value estimate on Tesla of $227, far lower than the stock’s $372 price tag and well below the trigger price of $260.

Meanwhile, Poor Timing Places Other Notes at Risk of Breaching Limits of Downside Protection

(Interestingly, investors in this note aren’t at risk of breach anymore. Instead, they met an entirely different fate. Last summer, Barclays announced that it had neglected to keep track of how many structured products it had issued. As a result, it issued too many structured products without getting permission from the SEC, and Barclays was forced to recall the note.)

Are Structured Products a Good Choice for Volatile Stock?

Structured products are a little bit like Goldilocks. The performance profile of the underlying stock has to be just right.

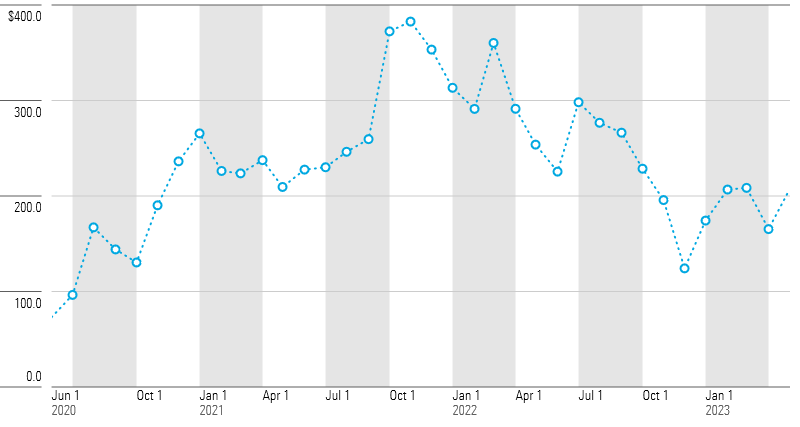

The problem is that Tesla’s stock is all wrong. It’s profoundly volatile in both directions and flouts many of the borders set by structured products. The company courts a high degree of headline risk courtesy of CEO Elon Musk, and Tesla’s business model has continued to trounce expectations. Looking at the chart below, it can be hard to believe that the stock has rallied by 54% in the past three years through May 2023.

It's Been a Bumpy Road for Tesla Investors

It’s a heads-I-lose, tails-you-win situation. If you think the stock is overvalued and want to mitigate the downside risks, there’s a chance that you could be too right and the stock breaches the barrier. On the other side of the coin, there’s barely any margin for error: If you’re just the slightest bit off on your timing and Tesla rallies at all, the structured product written on top of it could be nullified.

For most Tesla investors, a structured product just isn’t worth the hassle.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)