What the Hollywood Strikes Mean for Your Investment Portfolio

How actors picketing with writers could affect media stocks, human capital risk, and unionization.

The Writers Guild of America is in the third month of its strike, and affected studios are seeing production stoppages pile up. On May 2, 2023, Hollywood writers put down their pens and hoisted picket signs in hopes of securing an updated contract with the Alliance of Motion Picture and Television Producers. Among the WGA’s demands is an increase in residual bases, a major revenue source for writers in the streaming era.

On July 13, the union SAG-AFTRA, which represents 160,000 television and movie actors, voted to go on strike. The last big actors’ walkout was in 1980. Like the writers, the actors want increased payments from streaming services, among other things.

Large companies in the media and entertainment space face several challenges ahead with a strike that some are projecting could carry well into the summer. The last time the WGA went on strike was in 2007, and that one lasted for 100 days. This strike comes as shareholder and consumer support for unions stands at a decades-long high, broadcast television takes a back seat to streaming companies, and inflation remains stubbornly high.

What Do the Strikes Mean for Media Companies?

How will the two strikes affect your portfolio? The length of the strikes is key. If the strikes are short, it would mean media companies have some ground to make up, but the strike won’t have a detrimental impact on media-company results, says Neil Macker, senior analyst at Morningstar.

In the short term, networks like Disney DIS and Warner Bros. Discovery WBD have news, sports, and preproduced content available to sustain them as negotiations continue between the WGA and AMPTP. Meanwhile, streaming services like Netflix NFLX can lean on their stockpiled U.S. content as well as international programming to offset stoppage costs. Though it may be a while until we see the next seasons of Abbott Elementary or Stranger Things, media companies can withstand the pressure.

If the strikes drag well into the summer months, possibly to the end of summer, the consequences will be larger for production companies and, subsequently, the media companies that own them. Ad buyers are already asking for deal flexibility in anticipation of release delays.

Though the Directors Guild of America—the third of the Hollywood union trifecta—was able to avoid striking, if the WGA and SAG can put enough pressure on the AMPTP to negotiate, both unions may have greater success in achieving their demands, increasing studios’ expenses, says Macker. For studio companies, managing those expenses could mean passing on some of that cost to consumers or pulling less popular content from streaming platforms to avoid paying residuals.

What Do the Strikes Mean for the Market? Think Human Capital Issues

Entertainment and media companies account for just a small part of the market. They are 2.14% of the Morningstar US Market Index and 2.16% of the S&P 500. In an analysis of the Writers Guild strike, Moody’s wrote that a new agreement could pressure studios by raising costs, as companies are being asked to “show they can operate streaming platforms at a profit.” Indeed, Moody’s believes that if the standstill with writers lasts longer than three months, “weakly positioned media companies with limited financial flexibility could see their credit suffer.”

More broadly, the strikes also underline the importance of human capital issues in how companies are perceived today, as well as other environmental, social, and governance issues that affect shareholder value. “These companies’ success is driven by employees and the creativity of those employees,” says Jennifer Vieno, manager of technology, media, and telecommunications research at Morningstar Sustainalytics. “Without creatives doing the work, you could see stops in production. What’s the associated risk? Advertising dollars,” which could be affected as the strike drags on.

Shareholders are increasingly vocal about issues surrounding unions and freedom of association. Hollywood writers and actors are already represented by unions, and striking unions are at the peak of their collective bargaining powers, according to Jonas Kron, chief advocacy officer at Trillium Asset Management. For example, firms like Trillium are pushing companies like Starbucks SBUX to protect employees’ freedom of association. Trillium argues that shareholders and companies ought to support workers’ organizing rights in order to mitigate reputational risk and turnover and to boost employee productivity. A Gallup poll finds that as of August 2022, 71% of Americans approve of labor unions, just shy of the highest recorded approval rating of 72% in 1965.

The various ESG risks associated with the strikes—namely human capital risk—have been widely addressed throughout the most recent proxy season. Lindsey Stewart, director of investment stewardship at Morningstar, found that in 100 well-supported shareholder resolutions in S&P 100 companies over the past two years, 26 of those resolutions addressed workplace equity themes, including unionization and workers’ rights; diversity, equity, and inclusion reporting; and pay equity. The outcome of this writer’s strike and its effect on the media industry could raise the profile of human capital risk for companies.

Disney Remains Attractive in the Media Industry

The long-term effects of the strikes are yet to be seen, but in the next three to five years, the media industry is not at risk of losing talent, says Macker. The analyst expects more creatives will look to enter the industry, even once the WGA and AMPTP reach a resolution. Of the major studios affected by the strike, Disney is currently trading at a discount and remains the best-situated traditional media firm to navigate the transition to streaming, according to Macker.

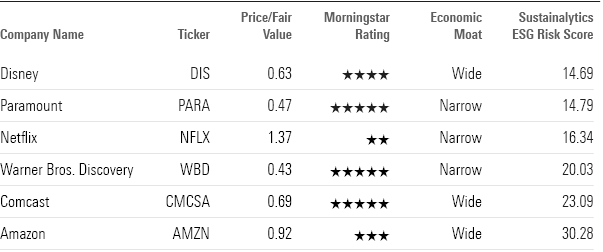

Disney on Top: Companies in the Media and Entertainment Space

Disney’s arsenal is well diversified to withstand market or industry downturns in the long term. It owns broadcast networks like ABC and Fox, has unscripted content coming from ESPN, and has a deep library of content available on Disney+. Heading into the summer season, Morningstar analysts expected that fans will continue to flock to the firm’s parks and resorts. Macker adds: “We expect a greater emphasis on revenue growth and cost controls over the next year with the return of CEO Bob Iger, but the firm’s flagship streaming service Disney+ should continue to build momentum with audiences around the world.”

Disney’s ESG risk is well managed compared with peers; its ESG risk score is the lowest of the companies shown in the nearby table. Of the three wide-moat companies in the table, it trades at the largest discount. In the long term, Morningstar analysts say undervalued firms with economic moats will outperform their peers that don’t have a durable competitive advantage. Disney is currently trading at a 38% discount to Morningstar’s fair value estimate. It has a 4-star Morningstar Rating. Writes Macker: “We expect average annual top-line growth of 6% through fiscal 2027.” Macker sees Disney’s operating margin rising to 21% in fiscal 2027 from 8% in fiscal 2022 on improvements in Disney’s direct-to-consumer operation.

Expect to See Greater Momentum Around Workers’ Issues

Over the last 10 years, the median writer-producer pay declined 23% after adjusting for inflation. The direct-to-consumer streaming model is pushing for a reevaluation of writer compensation. The precedent set by the WGA, combined with favorable shareholder sentiment toward unionization and freedom of association, suggests that investors can expect to see greater momentum around workers’ issues in proxy seasons moving forward.

This piece was originally published on June 22, 2023, and updated on July 14, 2023.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)