How to Find Gun Stocks in Your Fund Portfolios

Steps you can take to analyze your exposure to gun manufacturers and retailers.

Editor’s Note: The first version of this article ran on March 1, 2018. It was updated on Aug. 8, 2019, on March 31, 2021, and again on May 26, 2022, each time in the aftermath of a mass shooting in the United States.

Chances are, you may have some exposure to guns in your fund portfolios. For most of you, however, that exposure is almost sure to be minimal.

Nonetheless, investors have a right to decide what companies to invest in. If you are one of those concerned about your exposure to gun stocks in your portfolio, here are some steps you can take to analyze your exposure and take action to mitigate it or eliminate it altogether.

Which Public Companies in the U.S. Manufacture Guns?

While most guns in the United States are manufactured by private companies, the two publicly traded gunmakers are responsible for more than one third of guns manufactured here. Sturm Ruger RGR and Smith & Wesson Brands SWBI generate virtually all their revenue from gun manufacturing. Both make semiautomatic assault-style weapons.

Not long ago there was a third publicly traded gunmaker, Vista Outdoor VSTO. Vista sold off its Savage Arms gun manufacturing division to private buyers in 2018, although it remains in the ammunition manufacturing business, which generates an estimated 20% of revenue, according to Morningstar Sustainalytics.

With a market capitalization of $959 million, Sturm Ruger is included in the Russell 2000 Index at a weighting of 0.05%. Smith & Wesson’s $473 million market cap merits a 0.04% weighting in the same index. Vista Outdoor, with a market cap of $1.6 billion, is weighted at 0.06% in the Russell 2000 Index.

Which Public Companies in the U.S. Sell Guns?

Five publicly traded retailers sell guns, although the two largest, Walmart WMT and Dick’s Sporting Goods DKS, have sharply curtailed their gun sales in the aftermath of mass shootings. Neither sells semiautomatic assault-style weapons any longer.

The nation’s largest retailer, Walmart, still sells guns, but since the mass shooting at a Walmart store in El Paso, Texas, in 2019, the company now only sells firearms and ammunition used for hunting. It has stopped selling handguns and has not sold assault-style rifles since 2015. Walmart also raised the age limit to purchase a firearm or ammunition to 21 and requires more-aggressive background checks than required by law. Guns make up only an estimated 1% of Walmart’s revenue. With a market cap of $385 billion, Walmart is a top-30 holding in the S&P 500 at a weighting of about 0.62%.

Another prominent retailer, Dick’s Sporting Goods, also sells guns but no longer sells assault-style weapons. After the mass shooting at Marjory Stoneman Douglas High School in Parkland, Florida, in 2018, the company stopped selling assault-style weapons and high-capacity magazines, and it stopped selling any guns and ammo to anyone under 21 years of age. With a $10.4 billion market cap, Dick’s Sporting Goods stock is held in the S&P MidCap 400 Index at a weighting of about 0.32%.

Three smaller retailers that are publicly traded continue to include semiautomatic assault-style weapons. At Academy Sports and Outdoors ASO, guns, including semiautomatic assault-style weapons, generate about 6% of sales. The stock has a market cap of $4.3 billion, which translates to a 0.18% position in the Russell 2000 Index.

At Sportsman’s Warehouse SPWH, gun sales represent an estimated 24% of the revenue. Included in that are sales of semiautomatic assault-style weapons. With a market cap of $345 million, its weighting in the Russell 2000 Index is 0.02%.

Big 5 Sporting Goods BGFV ($215 million market cap) also sells semiautomatic assault-style weapons, but guns only account for an estimated 1% of its revenue. The stock has a 0.01% weight in the Russell 2000 Index.

Do You Own Gun Stocks in Your Fund Portfolios?

If you are an index-fund investor, you almost certainly have exposure to some or all of these gunmakers and gun retailers, depending on the type of index funds you own.

In your 401(k) plan, if you own a target-date fund that uses underlying index funds, chances are you have exposure to gun stocks.

Among actively managed funds, many large-cap funds own Walmart, and some mid-cap funds hold Dick’s Sporting Goods.

However, if you own an actively managed small-cap fund, you are less likely to have exposure to the two gunmakers or the three small-cap retailers that sell semiautomatic assault-style weapons. Based on Morningstar’s fund portfolio holdings data, only a few of the 450 or so actively managed small-cap funds own any of these stocks.

To quickly find out any fund’s exposure to guns, you can consult the ESG Screener on Morningstar.com, located by clicking the Sustainable Investing tab. Here is an explainer on how to use it. You can also consult a website called Gun Free Funds, maintained by As You Sow, a nonprofit shareholder advocacy group, and partially powered by Morningstar. Simply input a fund name and get the fund’s exposure to gun manufacturers and major gun retailers, along with replacement recommendations for those funds that have exposure to guns.

If You Do Have Exposure to Guns, Is It Material to Your Investment Returns?

Not very. Even if you hold an actively managed fund that is overweighting one of these stocks, the effect on returns is likely to be small.

And if you hold these stocks in an index fund, the effect on returns may be barely detectable. Walmart, for example, is weighted at 0.62% in S&P 500 index funds. Last year, Walmart posted a modest 0.5% loss, holding up much better than the S&P 500, which lost 18.1%. But that outperformance only added about 0.03% to the index’s returns.

Dick’s Sporting Goods is weighted at 0.32% in the S&P MidCap 400 Index. Last year, the retailer posted a 6.3% gain, much better than the index’s 14.5% loss. That outperformance added about 0.02% to the index’s returns.

The remaining gun stocks fall into small-cap territory. Their combined weighting in the small-cap Russell 2000 Index is approximately 0.36%. Four of the stocks lost more than the Russell 2000’s 19.1% loss in 2022, and two outperformed the index. Collectively, gun stocks detracted about 0.03% from the Russell 2000 Index’s return.

Given the “de minimis” impact on investment returns, most index investors can rest easy knowing they are not invested in guns to a degree that affects their investment return.

With So Little Exposure to Guns in My Portfolio, Is It Worth It to Take Steps to Exclude Guns Altogether?

That’s a question for each investor to answer. It may be enough to know that an exceedingly small portion of your investment return comes from your indirect investment in gunmakers via funds. On the other hand, avoiding gun stocks altogether is not likely to cost you, other than switching costs, and you can rest easy knowing that you are not earning returns from guns.

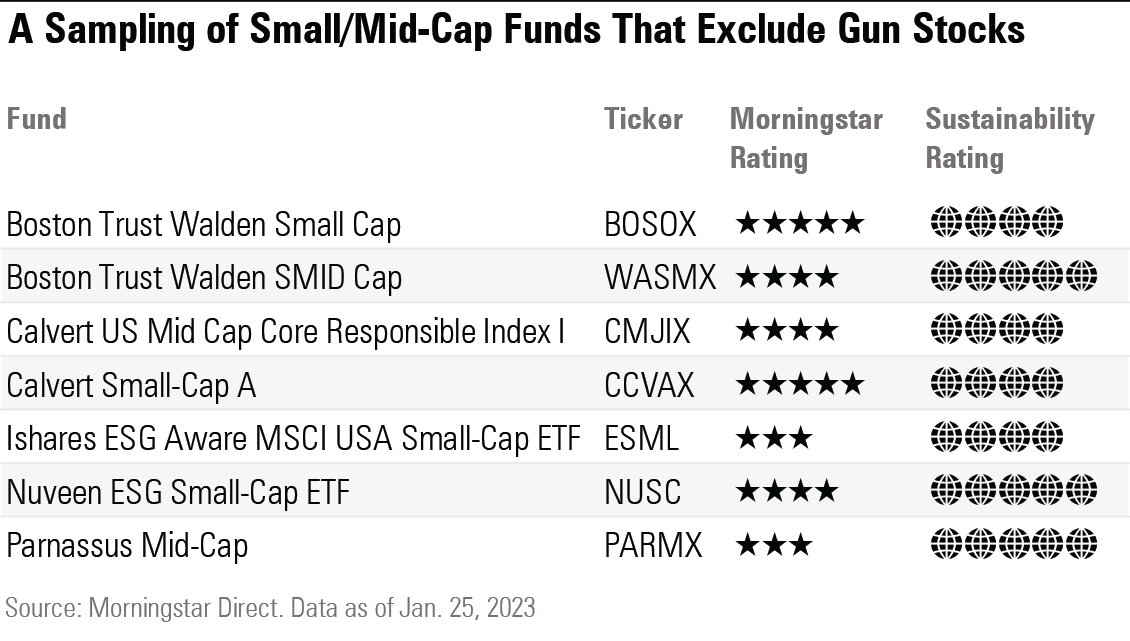

If you want to avoid guns completely, on principle, it’s not hard to invest that way. You can do this by investing in a fund that avoids guns as a matter of investment policy. Using Morningstar Direct, I found 386 such funds, which come in all shapes and sizes.

Most funds that exclude guns by investment policy are sustainable funds, which consider a broader list of environmental, social, and governance risk factors as part of their investment process. I’ve listed several of these in the following table:

For example, investors might consider iShares ESG Aware MSCI USA Small-Cap ETF ESML. Launched in the aftermath of the 2018 Parkland mass shooting, this passive fund avoids guns, controversial weapons, and tobacco. It optimizes the rest of the portfolio to maximize exposure to companies with higher ESG ratings, while broadly maintaining the risk and return characteristics of a conventional small-cap index. It has a competitive expense ratio of 0.17%.

ESML outperformed the Russell 2000 index in 2022, and its 5.8% annualized return over the trailing three years, trails the index, but lands in the top half of the small-blend Morningstar Category.

Bottom line: It is easier than ever to align your portfolio with your values. When a lot of investors do so, it sends a broader message to asset managers and public companies. It also ties you more closely to your investments, making it more likely that you will stay the course during bad markets and focus on the long term.

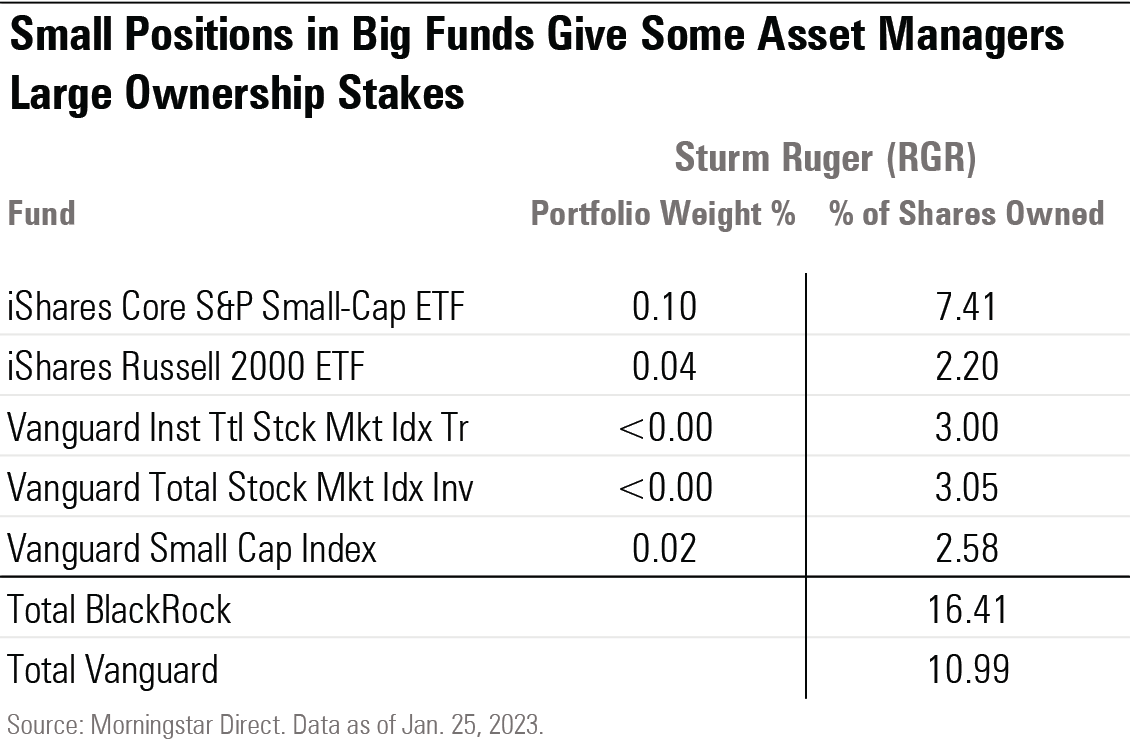

Small Positions in Large Funds Equal Major Ownership Stakes for Asset Managers

Because index funds have so many assets under management, even though they hold very small positions in the two gun manufacturers, their tiny positions equate to the fund company holding a lot of the firms’ outstanding shares. The next table shows the index funds that hold the largest number of shares in Sturm Ruger. Even though Sturm Ruger is only a 0.10% position in iShares Core S&P Small-Cap ETF IJR, the fund holds 7.4% of Sturm Ruger’s outstanding stock.

Is My Asset Manager Engaging With Gunmakers and Other Companies It Owns?

If you own a fund from Vanguard or BlackRock BLK (the parent of iShares), or any large fund company, regardless of whether they limit investment in guns, you should expect them to be actively meeting with many of the companies they own to discuss issues that may affect long-term shareholder value. This is a process called engagement, which is aimed at helping companies understand the issues that are important to their investors.

The giant asset managers that manage index funds, like BlackRock and Vanguard, not only are among the largest shareholders of most public companies, but as long-term permanent investors, they also have a stake in maintaining and strengthening the broader social systems within which they invest.

Over the long run, their investors stand to benefit because healthy systems create the conditions for better investment returns. Thus, their engagement activities should include systemic issues that affect subject companies materially and that the companies can play a role in helping address more broadly. The misuse of guns has spillover costs on many other companies that asset managers hold in their portfolios, as well as on society at large.

Significant engagement with gunmakers, gun retailers, and the banks and credit card companies that finance gun purchases at this point should be an obligation.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)