Climate Change Sharpens Investor Focus on Water Risks

As COP27 discussions start, expect asset managers to consider climate and water-related risks in tandem.

“This summer, we had the worst drought in 500 years in Europe, the worst drought in 1,000 years in the U.S., and the worst drought ever in China.”

I recently attended a talk by Alok Sharma, president of the COP26 Climate Conference that was held a year ago in Glasgow, Scotland. Sharma reflected on what was achieved by the agreement and what still needed to be done, as we head into COP27, which is taking place in Sharm-El Sheikh, Egypt, in early November.

The quote above is one of the key comments made by Sharma. COP26 was the first such conference to make an explicit link between efforts to prevent climate change and those to prevent nature loss. But it is clear—given the unprecedented heat and drought conditions seen across much of the world this year—that risks to water supply are becoming front-of-mind issues for businesses, investors, and policymakers.

“Global water use has increased by a factor of six over the past 100 years and continues to grow steadily at a rate of about 1% per year,” according to a 2020 study by the United Nations. It also states that “the world could face a 40% global water deficit by 2030 under a business-as-usual scenario.” In light of these risks, investors and asset managers are paying greater attention to water as a key theme.

Many are referring to COP27 as the “Implementation COP” as the focus moves away from the Glasgow negotiations toward the specific actions that governments need to take to combat climate change and other connected risks such as water supply. With the conference being held in Egypt—a part of the world with ever-present water-related risks—we expect that COP27 will set an important context for asset managers’ active ownership activities related to water in 2023 and beyond, in the same way that COP26 did for climate. It will also set an important foundation for the UN 2023 Water Conference due to be held in New York next March.

Water Emerges as a Key Active Ownership Theme

My colleague Jon Hale recently wrote about the emerging investment opportunities connected to the theme of water supply and sustainability. As our latest research paper explains, water is becoming a key active ownership theme for asset managers, too.

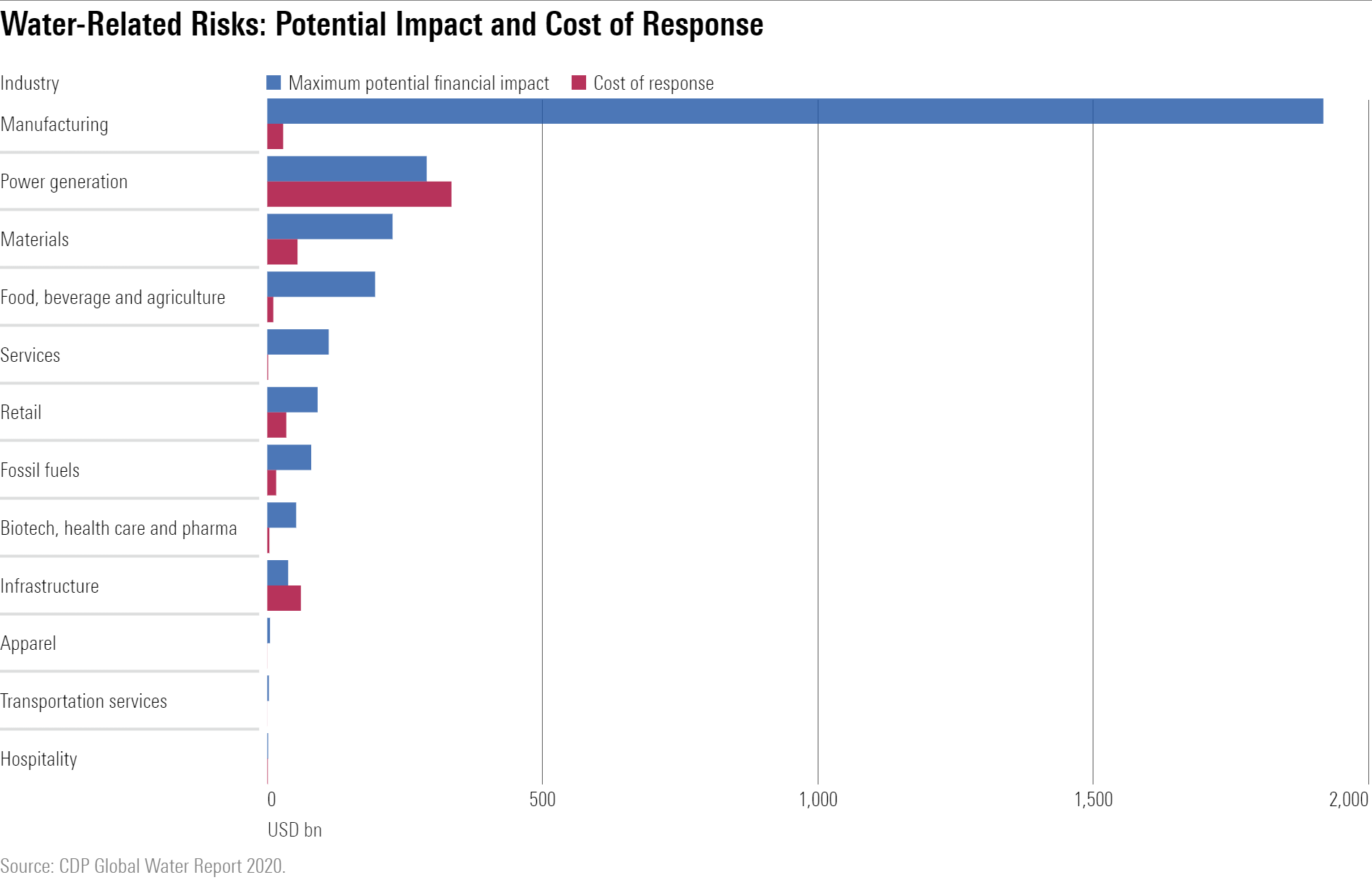

Data from environment reporting specialist CDP, shown on the chart below, illustrates that many key industries—particularly manufacturing—are exposed to high potential financial impacts from water-related risks that are many times the cost of mitigating them.

Conscious of this emerging risk, asset owners and asset managers launched the Valuing Water Finance Initiative in August this year, seeking to tackle some of the key issues. The VWFI aims to address water-related risks in investing by “engaging companies with a high water footprint to value and act on water as a financial risk and drive the necessary large-scale change to better protect water systems.” Its 64 signatories—including 26 asset managers—have almost $10 trillion of assets under management. The VWFI is currently targeting 72 companies for engagement, most of which are in the food and beverage, apparel, and technology industries.

Investor Policies on Water Begin to Get Specific

Further to this collaborative effort, we’re seeing signs that some asset managers are getting more specific about the kind of reporting and behavior they expect from companies on responsible water use. We see evidence of this in their policies for voting at shareholder meetings and engagement with companies on sustainability issues.

The “big three” index managers—BlackRock, State Street, and Vanguard—have yet to form detailed policies on this issue; although BlackRock does mention it as part of its broader policy on natural capital:

“We look to companies to disclose detailed information on their approach to managing material natural capital-related business risks and opportunities, including how their business models are consistent with the sustainable use and management of natural resources such as air, water, land, minerals and forests. To support investors’ assessments, it is helpful for companies with material dependencies or impacts on natural habitats to disclose how they measure their progress on key issues such as water conservation.”

Among the 25 managers Morningstar has assigned with ESG Commitment Level ratings of Leader or Advanced—the highest two ratings—we found substantive comments on water-related sustainability expectations by eight managers: AllianceBernstein, BNP Paribas, Boston Trust Walden, Calvert, LGIM, Robeco, Schroders, and UBS.

These managers’ policies cover three key areas, which we explore in our paper:

- Focus on water as part of a holistic environmental approach

- Encouragement of better corporate reporting and clearer policies

- Support for shareholder resolutions addressing water-related risks

These managers emphasize the financially material nature of water-related risks for many companies. As Calvert puts it, “As investors, we also believe that over the long-term stable ecosystems are necessary to sustain capital markets and economic growth.”

Given the crucial importance of water to life and to business, we can expect that managers’ thinking on these issues will develop further post-COP 27 and be reflected in managers’ policy updates for 2023.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)