5 Wide-Moat European Firms With Strong Gender Policies

Novo Nordisk, Novartis, and Nestlé are among the high-quality stocks with commitments to gender equity and inclusion.

When stock investors are looking for companies that are more likely to outperform over the long term, it’s recommended that they consider strong diversity as a factor. That often means going to Europe, since research shows companies there have done a better job of closing the gender gap than those in the United States.

For this article, we looked for champions of diversity, equity, and inclusion champions that Morningstar analysts have assigned wide moats, meaning they have durable competitive advantages. We’re highlighting five stocks:

Of these, Morningstar analysts believe three are undervalued: Nestlé, AstraZeneca, and Roche. Undervalued stocks with moats have a long track record of outperformance.

Europe’s Strength In Gender Parity

According to the World Economic Forum’s Global Gender Gap report, Europe’s gender parity metrics surpassed North America’s in 2023, ranking it first among eight geographic regions. The report tracks “progress toward gender parity and compares countries’ gender gaps across four dimensions: economic opportunities, education, health, and political leadership.”

A third of the countries in Europe featured in the report’s top 20, while 20 out of 36 European countries have parity scores of at least 75%. Top performers both regionally and worldwide include Iceland, Norway, and Finland. Meanwhile, Hungary, the Czech Republic, and Cyprus are ranked the lowest. The report says that at their current rates, Europe is projected to attain gender parity in 67 years, and North America in 95 years.

Looking at economic participation and opportunities, the World Economic Forum found that Europe came in third among the regions in 2023, behind North America and East Asia and the Pacific. The European countries with the highest parity scores here are Norway, Iceland, and Sweden. Those with the lowest are Italy, North Macedonia, and Bosnia and Herzegovina. According to the report, compared with 2022, “13 countries (including France and Germany) have declined by at least 1% and 8 countries have improved by at least 1%.” In addition, senior officer positions held by women fell in 17 countries out of 35.

The landscape of the Eurozone is expected to change rapidly thanks to the European Union’s “Woman on Boards” directive, which took effect in 2022. All large stocks in EU-regulated markets must take measures to increase the presence of women in their leadership by June 30, 2026.

Investing In Stocks With Strong Gender Policies

According to several studies, companies committed to robust gender diversity policies and practices can achieve superior financial results. In a 2023 report on diversity, McKinsey found that “creating an internal culture of transparency and inclusion” was not incompatible with “maintain[ing] financial performance while navigating a rapidly changing business landscape … On the contrary, our research suggests a strong, positive relationship between them. And in an increasingly complex and uncertain competitive landscape, diversity matters even more.”

Gender diversity indexes emphasize companies that demonstrate a commitment to gender inclusion and equity. They consider aspects like the gender balances within a company’s workforce, executive ranks, and board of directors. Is the pay gap between male and female employees disclosed and mitigated? Does the company offer parental leave and flexible work policies?

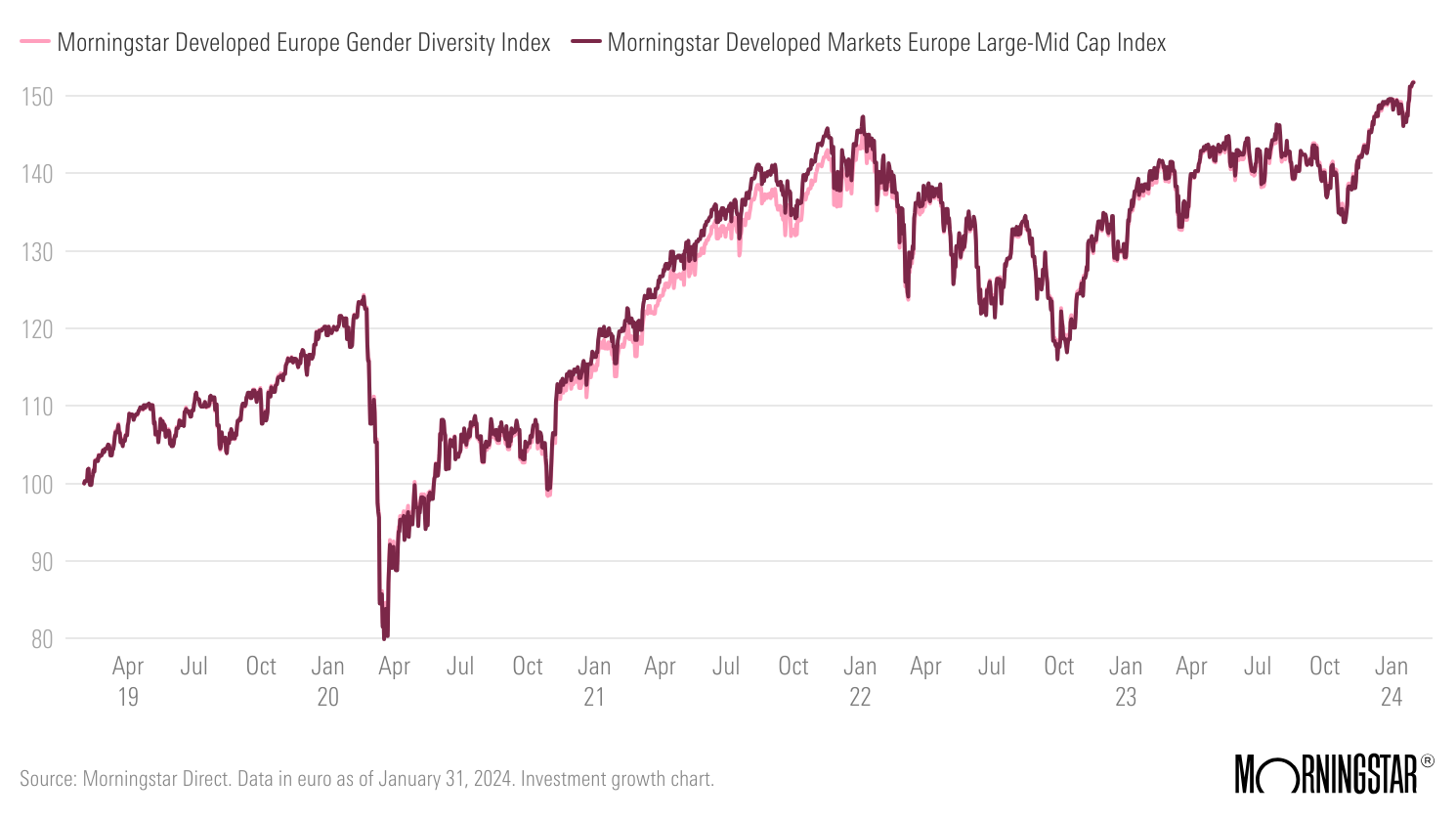

Over the past five years, gender diversity indexes performed similarly to the broader equity market—and in some cases, like 2022, they outperformed. The Developed Europe Gender Diversity Index posted a five-year annualized return of 8.7% (in euro as of the end of January 2024), the same as the Developed Markets Europe Large-Mid Cap Index, but with lower volatility. In 2023, both indexes gained around 15.8%.

Developed Europe Gender Diversity Index vs. Developed Markets Europe Large-Mid Cap Index

The Top 5 Wide-Moat Stocks In the Gender Index

Novo Nordisk

- Fair Value Estimate: $80.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

With roughly one-third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes care products in the world. Based in Denmark, the company manufactures and markets injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders. “In November, Morningstar raised its fair value estimate of Novo after significantly raising our assumptions for uptake of GLP-1 therapies in diabetes and obesity, as well as adding sales for overweight patients,” says Morningstar strategist Karen Andersen.

Nestlé

- Fair Value Estimate: $124.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Low

With a 150-year-plus history, Nestlé is the largest food and beverage manufacturer in the world by sales. Its diverse product portfolio includes brands such as Nestle, Nescafe, Perrier, Pure Life, and Purina. Nestle also owns just over 20% of French cosmetics firm L’Oreal. “We expect structurally higher inflation in the midterm to be a net positive for Nestlé, due to the group’s strong exposure across price points and evident pricing power in key high-growth product categories. Our estimates call for about 5.5% organic growth over the next three years,” says Ioannis Pontikis, senior equity analyst at Morningstar.

Novartis

- Fair Value Estimate: $98.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

Novartis develops and manufactures drugs, with key areas including oncology, rare diseases, neuroscience, immunology, respiratory, cardio-metabolic, and established medicines. The company sells its products globally, with the US representing close to one-third of total revenue. “We are not making any changes to our fair value estimate following the announced acquisition of MorphoSys by Novartis for close to $3 billion. We believe pelabresib represents the key driver in the deal. Since pelabresib has been successfully studied in combination with Novartis’ Jakafi (US rights reside with Incyte), we believe Novartis can leverage its strong entrenchment in the myelofibrosis community to launch pelabresib efficiently. Further, the new drug helps build out Novartis’ innovative drug pipeline, a core element in the firm’s wide moat,” writes Morningstar sector director Damien Conover.

AstraZeneca

- Fair Value Estimate: $78.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

AstraZeneca sells branded drugs across several major therapeutic classes, including gastrointestinal, diabetes, cardiovascular, respiratory, cancer, immunology and rare diseases. The majority of sales come from international markets, with the US representing close to one-third of its revenue. “We believe the market is increasingly concerned about several drugs maturing and posting slowing growth and worried about lack of significant margin expansion. While we do expect some deceleration in key products, we expect several recently launched drugs to help propel top-tier industry growth for the company over the next four years,” writes Conover.

Roche

- Fair Value Estimate: $55.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Low

Roche is a Swiss biopharmaceutical and diagnostic company. The firm’s best-selling pharmaceutical products include a variety of oncology therapies from acquired partner Genentech, and its diagnostics group was bolstered by the acquisition of Ventana in 2008. Oncology products account for 50% of pharmaceutical sales, and centralized and point-of-care diagnostics account for more than half of diagnostic-related sales. “Roche is facing relentless pressure due to the strength of the Swiss franc against other major currencies, so although the firm produced 1% constant-currency sales growth in 2023 despite pressure from covid diagnostic and treatment declines (and above the low-single-digit decline guidance), this resulted in a 7% sales decline,” according to Andersen.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)