Women Founders Get 2% of Venture Capital Funding in U.S.

Those paired with a male founder get 16.5%, PitchBook says.

The venture capital ecosystem is far from embracing gender equity. According to Pitchbook, in 2022, companies founded solely by women garnered just 2% of the total capital invested in VC-backed startups in the United States. In Europe, the percentage was even lower, at 0.9%.

Venture Capital Funding for Women Is Up—But Not Enough

But those numbers don’t tell the whole story. VC funding for companies founded or co-founded by women has been trending up in recent years, and 2021 saw the creation of several women-led funds, incubators for female founders, and more new companies.

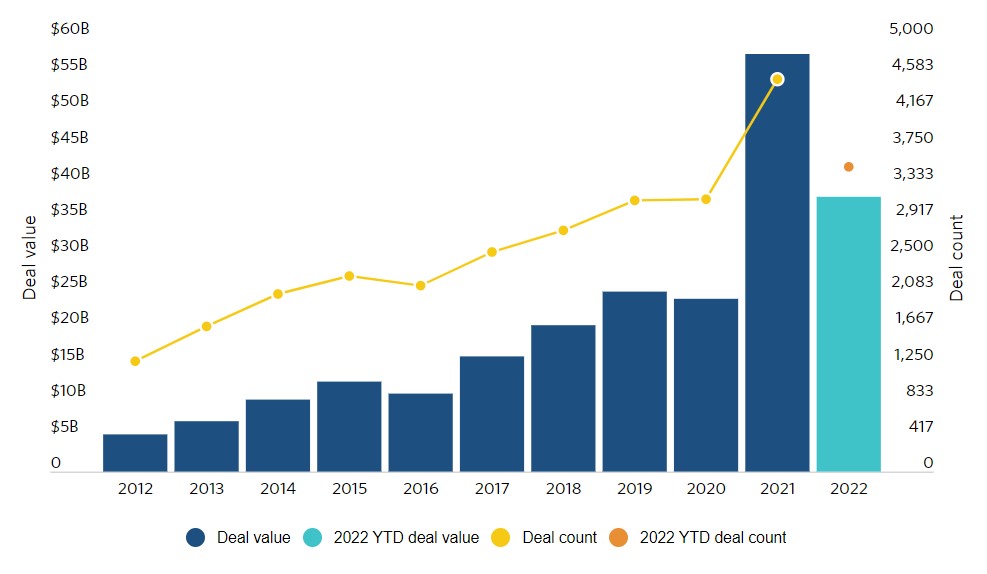

The year 2022 was a challenging one for VC markets in general. “After the lofty heights that VC-backed companies reached in 2021, it was perhaps only natural that they’d come back down to earth in 2022,” said Jordan Rubio, editor at Pitchbook. “As VC market conditions worsened throughout the year, female-founded companies in the U.S. experienced similar lulls in deal activity, according to PitchBook’s ‘All In: Female Founders in the US VC Ecosystem.’ However, female-founded companies appear to have not been disproportionately hurt by the decline in activity this year, unlike in previous slowdowns.”

U.S. Startups With Mixed Founders Raised More Money

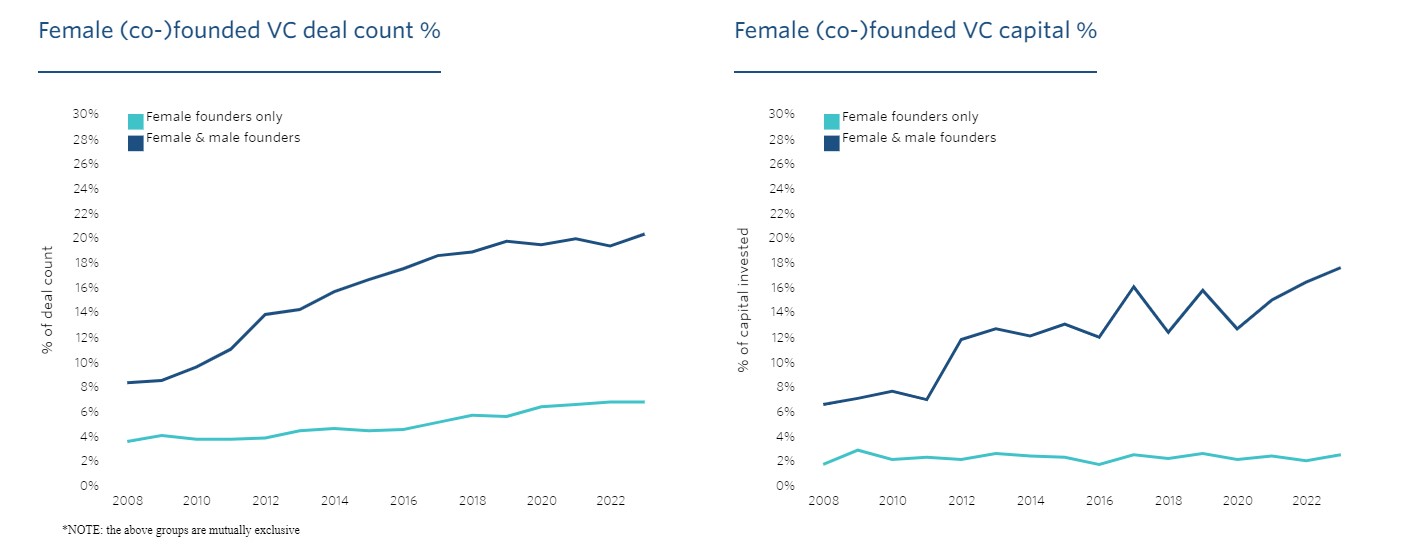

Looking into the data, it’s important to distinguish between companies with mixed founder teams (female and male) and startups with female founders only.

“Companies with at least one female founder have raised about $38 billion in venture funding over 3,503 deals in 2022, while startups with only female founders have garnered $4.3 billion over 926 deals, according to PitchBook data as of Nov. 30. These both represent sharp declines from 2021, although they are still the second-highest annual totals on record,” said Rubio.

Source: Pitchbook 2022 Female Founders Year in Review. Data as of Nov. 30, 2022.

Women Garner More Venture Capital Funding—If They’re With Men

While funding for female founded companies has declined year-over-year, the share of female co-founded VC capital ticked up to 16.5% of total U.S. VC funding in 2022, the highest it’s been since 2017. For female-only founded startups, however, that number is 2%, the lowest it has been since 2016.

It seems that 2023 started in a good shape. In January, U.S. VC funding for female founded or co-founded companies trended up to 17.6% and 2.5%, respectively, of total U.S. VC funding.

Source: Pitchbook US VC Female Founders Dashboard. Data as of Jan. 31, 2023.

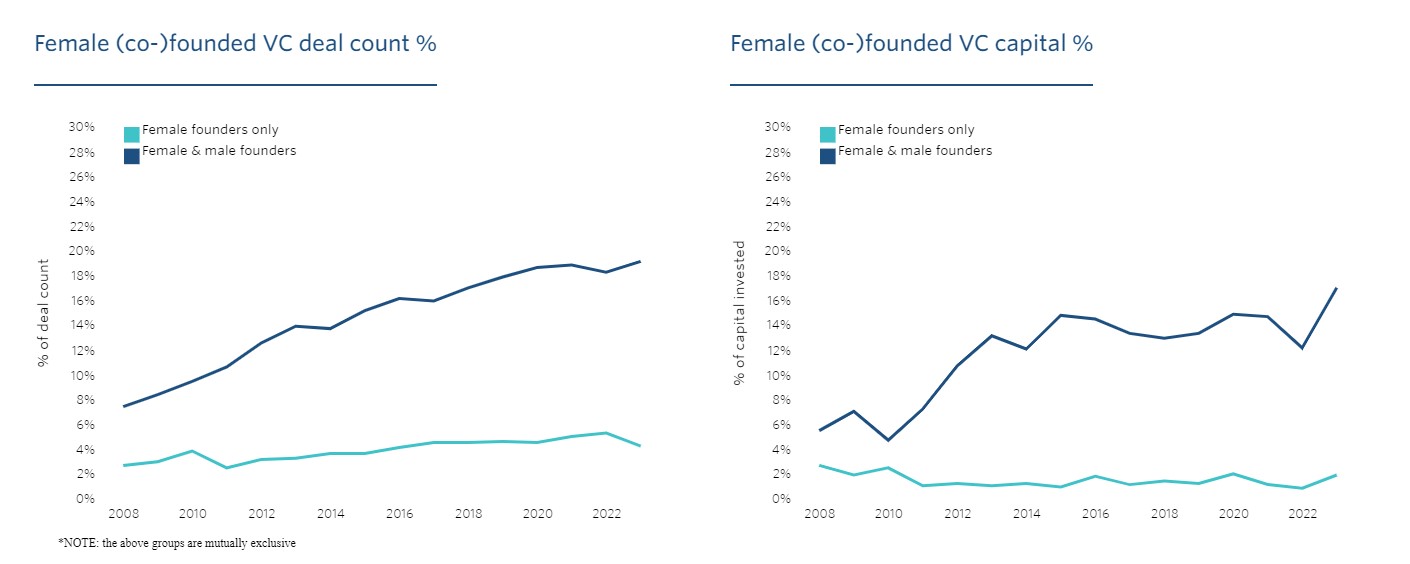

European Women Have a Harder Time Raising Money

In Europe, the numbers are lower. Capital invested in female co-founded companies amounted to EUR 17.7 billion in 2022 across 2,531 deals. Funding for female founded companies declined from 2021, but it was higher than previous years.

In Europe, VC funding for female co-founded companies declined to 12.2% of total European VC funding in 2022 from 14.7% in 2021. It was the lowest level since 2014. The funding for female-only founded startups was 0.9% of the total capital invested, the same as 2015. The situation improved in January 2023, with a recovery in deals and funding.

GRAPHIC: Source: Pitchbook European VC Female Founders Dashboard. Data as of Jan. 31, 2023.

Tech Is the Largest Industry for Female Founders

Technology is one of the most popular VC industries and by far the largest industry for female founders by deal value. According to Pitchbook data, U.S. female founders in tech closed $26.8 billion in the first three quarters of 2022, just shy of the amount closed by the third quarter of 2021 and 54.3% higher than the amount raised in 2020. Also in Europe, tech is the largest industry for female founders by deal value, and software is the biggest segment with EUR 4.1 billion invested (as of end January). Healthcare is another large industry both in the U.S. and Europe.

Venture Capital Funding for Women Founders Is Heading in the Right Direction

“Over the past few years, the number of women-led funds has started to rise, making a dent in a landscape long dominated by men. And while the numbers are still low, we’re heading in the right direction,” said two long-standing experts of the VC ecosystem, Pamela Aldsworth and Katie Taormino of J.P. Morgan, in PitchBook’s “All In: Female Founders in the US VC Ecosystem” report.

Data from 2022 shows that female founding teams are weathering the current macroeconomic storm relatively well, but there is a long way to go to close the gap between women and men in the VC ecosystem, as well as in the public financial markets.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BL6WGG72URAJJJCPC4376SZKX4.png)