What Does GameStop’s Stock Split Mean for Investors?

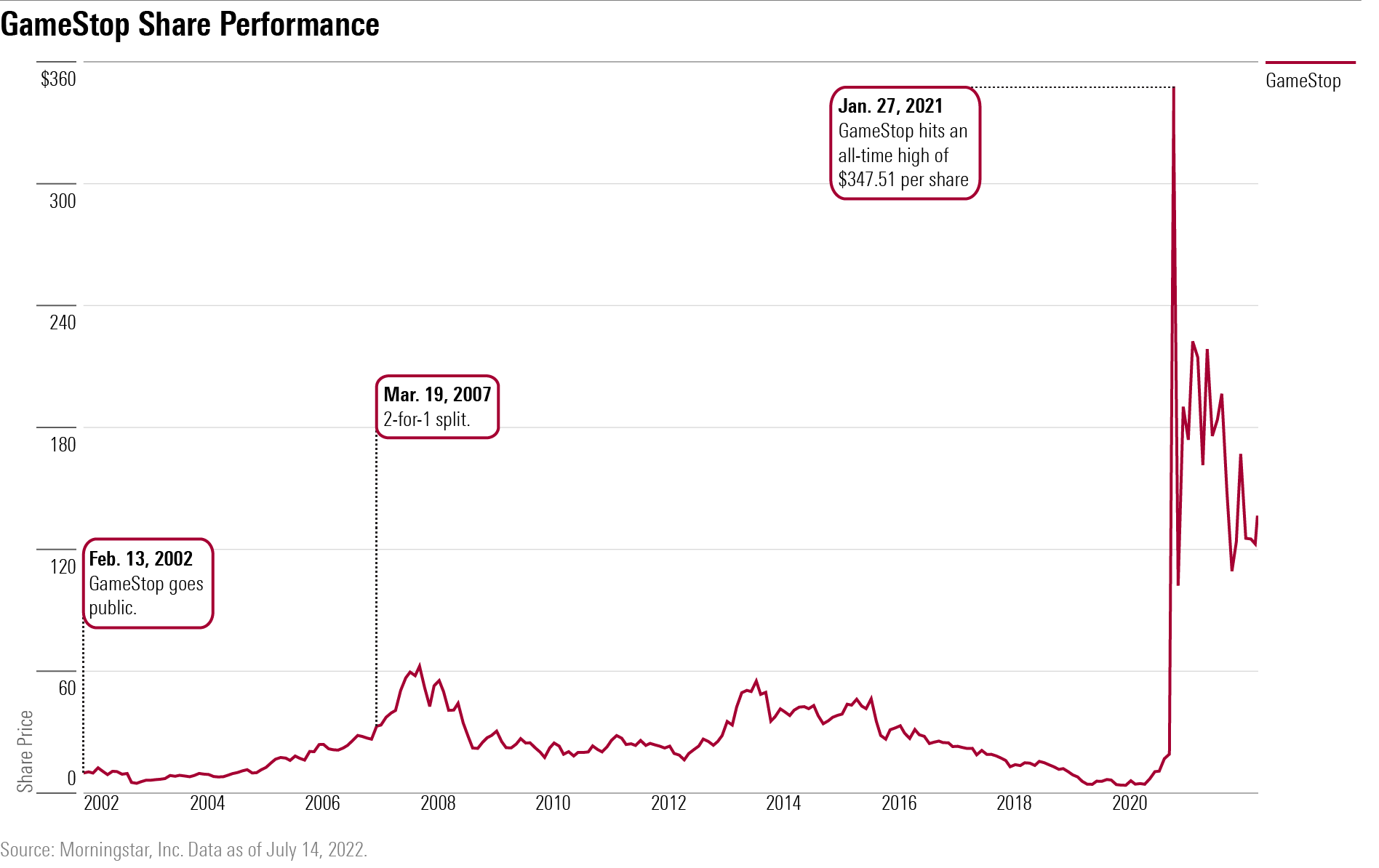

After a volatile comeback GameStop's stock will split for the first time in 15 years.

GameStop GME, the original meme stock, is getting ready to split its stock 4-for-1.

The 4-for-1 split means that GameStop investors will receive an additional three shares for each one they already own.

The stock split will be the video game retailer’s second split ever, its first being a 2-for-1 split that occurred in March 2007.

GameStop Stock Split Date

The stock split is set to take place after the market’s close on July 21.

GameStop’s Stock Split and What It Means

On its own, the stock split should not materially impact GameStop market value. Splits only directly affect the total number of a company’s shares, with the share price being adjusted to accommodate the change in the amount of shares available for purchase by investors.

The same goes for the company’s market capitalization. Following its 4-for-1 stock split GameStop’s market cap will not change, but its share count would multiply four-fold and each share’s price would decrease to a fourth of what it was prior to the split.

GameStop Stock Rating

GameStop is among the companies assigned a Morningstar Quantitative Star Rating, which is given to stocks that are not directly covered by an analyst. Quantitative equity ratings are denoted by a Q superscript.

The quantitative rating inputs at least 12 valuations metrics to arrive at a fair value estimate that mimics our analyst-driven estimates. The quantitative fair value estimate responds to price movements retroactively and updates nightly. In cases of highly volatile stocks, the quantitative estimate can shift in response to closing prices, but the exact estimate value may be unreliable. Nonetheless, we believe that our quantitative price to fair value ratio is directionally correct. If a stock's price to fair value ratio is greater than 1.00, we consider the stock overvalued. If less than 1.00, the stock is undervalued.

In the case of GameStop’s stock, our quantitative ratings assign a fair value estimate of $221.54 per share as of July 14. Following the split, this would be adjusted to roughly $55.39.

At recent prices, this leaves GameStop with a quantitative star rating of 3-stars, meaning the stock is considered fairly-valued. However, our quantitative uncertainty rating for GameStop is extreme, meaning that we consider the stock to be a highly risky investment for investors.

In deciding which stocks to cover, Morningstar’s equity research group strives to encompass a broad swath of names. Morningstar’s focus is on firms that have long-term sustainable competitive advantages, or an Economic Moat. But analysts will often also cover those within the same sector to leverage our expertise and draw valuation comparisons. The coverage list ranges from stocks of the largest companies in the world that trade on multiple global exchanges to small-cap stocks that only trade on U.S. exchanges.

Upcoming Stock Splits

GameStop is one of several tech and consumer companies that have set out to split their shares this year. E-commerce platforms Amazon AMZN and Shopify SHOP have already done so. Google’s parent company Alphabet GOOGL is set to split its shares on July 18. The next possible split Tesla TSLA, which plans to put a 3-for-1 split to a vote at its annual meeting on August 4. If passed it will be the electric vehicle maker’s second split in three years.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)