Utility Stocks: When Will the Market Give the Sector Some Respect?

Our top utility picks are NiSource, Duke Energy, and Entergy.

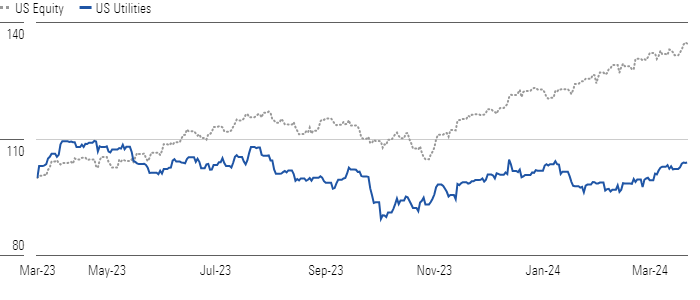

The fundamentals for utility stocks have rarely looked better, but the market doesn’t seem to care. Despite impressive 2023 earnings, larger long-term growth investment plans, and dividend increases sector-wide, these stocks have barely moved. The Morningstar US Utilities Index was mostly flat in the first quarter of 2024 and down 6% since March 2023. Only utility dividends have saved investors from losing money during the last three years, even as the US market has rocketed up 30%.

Utilities Treading Water While Market Soars

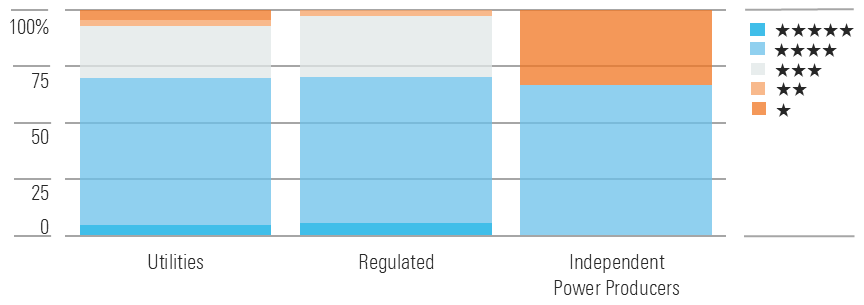

We think the combination of stagnant stock prices and growing earnings and dividends offers an attractive buying opportunity. Utilities’ valuations and dividend yields are back to 2019 levels despite what we think is a brighter long-term growth outlook. Utilities trade at a median 10% discount to our fair value estimates as of late March. This continues the longest stretch of utilities being undervalued since before 2009.

Most Regulated Utilities Trading at or Below Fair Value

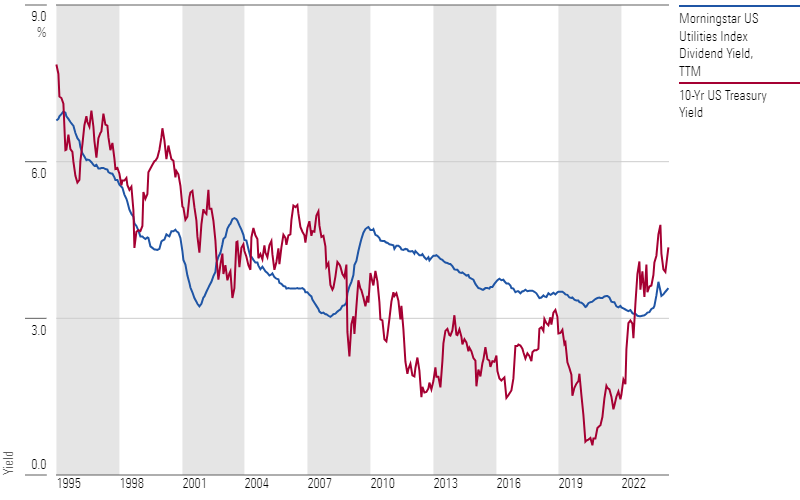

The emerging tailwind from energy demand growth—particularly new data centers—should ease concerns about customer bill increases and interest rates. Regulators continue to sign off on growth investments in renewable energy, reliability, resiliency, and safety. We think most utilities can grow earnings and dividends by at least 6% annually through the end of the decade. That growth, paired with dividend yields near 4%, offers an attractive return that the market is ignoring.

Utilities’ Dividend Yields Are Near Decade Highs, but So Are Interest Rates

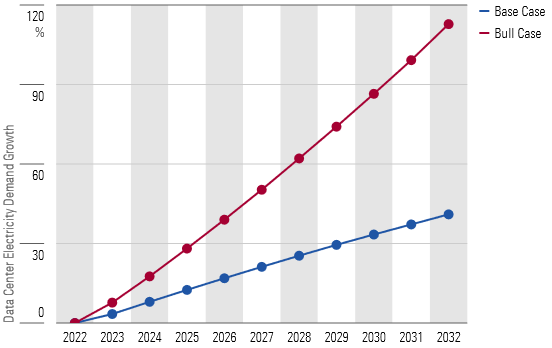

With utilities’ dividend yields nearly in line with long-term interest rates, we think investors should switch focus to their growth potential. We don’t think the market is giving utilities credit for the accelerating growth we anticipate ahead. The big needle mover is the electricity demand for data centers, which we estimate could grow twice as fast as the total US electricity demand over the next 10 years. This will require billions of dollars of clean energy and grid investment, supporting at least 6% earnings growth for most utilities.

Data Center Electricity Demand Could Double by 2030

Top Utility Sector Picks

NiSource

- Fair Value Estimate: $33.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

Though NiSource NI trades at a similar valuation to its peers, we think it has a superior growth runway and deserves to trade at a premium. The firm’s transition from fossil fuels to clean energy in the Midwest supports at least a decade of faster growth than the sector average. We expect NiSource to invest $17 billion over the next five years and as much as $30 billion over the next 10, leading to 7% earnings growth and similar dividend growth. Its electric utility plans to close its last coal-fired power plant in 2028 and replace the generation with wind, solar, and energy storage. Its six gas utilities have ample near-term investment and regulatory support in regions unlikely to abandon gas.

Entergy

- Fair Value Estimate: $123.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

Entergy ETR offers one of the most attractive combinations of yield, growth, and value in the sector, with a dividend yield above 4% and the potential for 7% annual earnings growth. Above-average electricity demand growth, clean energy investments, and reliability/resiliency grid investments are core growth drivers. Entergy also should benefit from industrial carbon emissions cuts, global energy demand, and green hydrogen development. We expect the firm’s valuation discount to disappear as the market becomes comfortable with its decadelong transformation away from commodity-sensitive businesses.

Duke Energy

- Fair Value Estimate: $112.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

After divesting its unregulated renewable energy business, Duke DUK has a clear pathway to achieving the high end of management’s 5%-7% annual earnings growth target. The company’s $73 billion capital investment plan for 2024-28 is focused on clean energy and infrastructure upgrades to reduce carbon emissions. New legislation in North Carolina supports Duke’s ability to invest in the clean energy transition through its regulated subsidiaries. Florida offers opportunities for solar growth. Duke’s 4.3% yield is among the highest in the sector, but dividend growth will lag behind earnings growth until the company’s payout ratio comes down.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YTLLJ3VT4NFZTCTDNZPCUR27D4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)