Utilities: Will the Sector Reset or Repeat In 2024?

Our top picks in this sector are NiSource, Entergy, and WEC Energy Group.

Utilities have been caught in a rinse-and-repeat cycle over the past two years. In both 2022 and 2023, utilities’ stock prices slowly rolled downhill before rallying in the fourth quarter to trim the losses. Since 2021, only dividends have kept investors here afloat. We think utilities are better positioned going into 2024 to produce the steadier positive returns that investors expect.

Our top picks among utility stocks are:

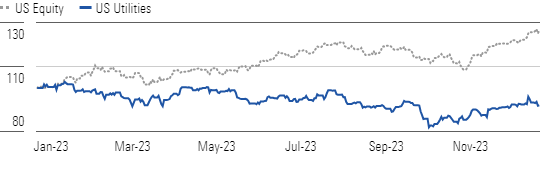

Utilities' Fourth-Quarter Rally Recouped Some Losses In 2023

Earnings and dividend growth throughout 2022 and 2023 have rinsed out what we considered absurdly high valuations in 2019-20, while stock prices treaded water. Valuations across the sector have converged as fundamentals improved. Most utilities enter 2024 trading near their long-term historical market valuations and within 10% of our fair value estimates.

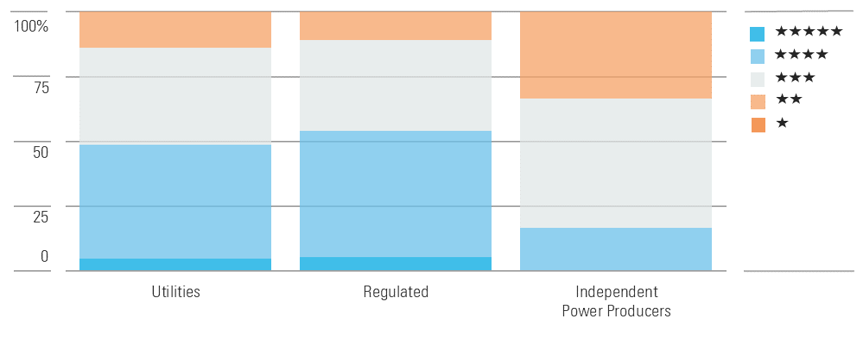

Still-Attractive Values Among Utilities After Hitting Low In October

We think strong balance sheets, secure dividends, and robust long-term growth opportunities should support premium valuations for many utilities. However, some headwinds could stunt that growth. Regulators are closely watching customer bills, and customer rate increases will be difficult to justify. Higher interest rates could pressure high-growth utilities that need to raise new debt to fund their growth investments.

We think the best-positioned utilities are those in regions with strong energy demand growth and widespread support for clean energy investments. Parts of the Southeast and Midwest check those boxes for now.

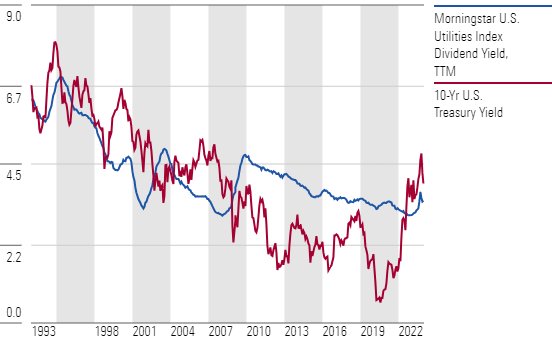

Utilities' Dividend Yields Are Near Decade Highs, but So Are Interest Rates

Utilities have been fighting the market’s inconsistent outlook on the interest rate for the past two years. Rising interest rates have compressed valuations and made utilities’ dividends less attractive on a relative basis. Ultimately, we think the sector can mitigate some of that sensitivity as firms execute their growth plans, including huge investments in clean energy over the next decade. That could help investors focus on fundamentals rather than short-term swings in interest rates.

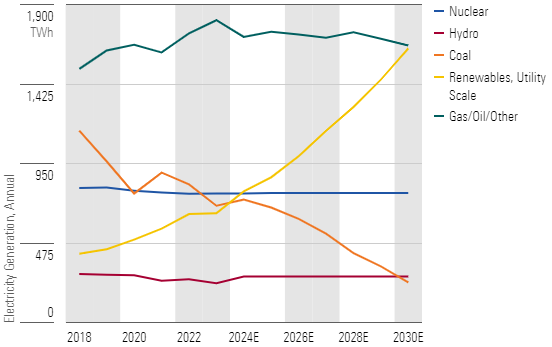

Clean Energy Investment Is Surging; Renewables Set to Top Coal In 2024

Top Utilities Sector Picks

NiSource

- Fair Value Estimate: $33.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

Though NiSource trades at a similar valuation as its peers, we think it has a superior runway of growth and deserves to trade at a premium. NiSource’s transition from fossil fuels to clean energy in the Midwest supports at least a decade of faster growth than the sector average. We expect NiSource to invest $15 billion over the next five years and as much as $30 billion during the next 10 years, leading to 7% earnings growth and similar dividend growth. Its electric utility plans to close its last coal-fired power plant in 2028 and replace the generation with wind, solar, and energy storage. Its six gas utilities have ample near-term investment and regulatory support in regions that are unlikely to abandon gas.

Entergy

- Fair Value Estimate: $120.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

Entergy offers one of the most attractive combinations of yield, growth, and value in the utilities sector, with a dividend yield above 4% and the potential for 7% annual earnings growth. Above-average electricity demand growth, clean energy investments, and reliability/resiliency network investments are core growth drivers. Entergy also should benefit from industrial carbon emissions cuts, global energy demand, and green hydrogen development. We expect Entergy’s valuation discount to disappear as the market becomes comfortable with Entergy’s decadelong business transformation away from commodity-sensitive businesses.

WEC Energy Group

- Fair Value Estimate: $96.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

WEC combines best-in-class management and above-average growth opportunities supported by constructive regulation across most of its jurisdictions. The company increased and updated its capital plans, anticipating spending of $23.4 billion, a $3.3 billion increase from its prior program. WEC will increase investments in renewable generation, natural gas generation, and transmission due to significant economic development in southeastern Wisconsin. This supports our 7.0% growth estimate, at the high end of management’s 6.5%-7.0% guidance range.

Top Utilities Sector Picks Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YTLLJ3VT4NFZTCTDNZPCUR27D4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)