Federal Elections Won’t Materially Affect Utilities—but Local Regulations Will

Key regulatory proceedings are on tap for utilities this year.

Utilities’ wild rise and fall over the last two years has had a disappointing result for investors—but we think most of the pain is over, regardless of the outcome of this year’s federal election.

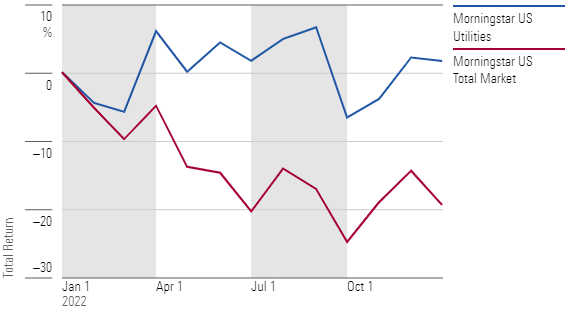

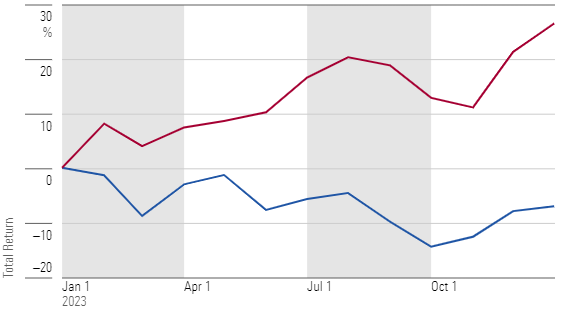

The Morningstar US Utilities Index is down 5.5% since 2021, trailing the U.S. market by 9 percentage points, including dividends. Only once since the 1980s have U.S. utilities both outperformed and underperformed the market by as much as they did in 2022 and 2023.

Utilities on a Wild Ride in 2022

And in 2023

Nonetheless, valuations have rightsized since peaking in early 2020 and fundamentals have improved:

- We think utilities are 9% undervalued.

- Growth outlooks and balance sheets are strong.

- Nearly every utility is rewarding investors with secure and growing dividends.

- Utilities’ 3.5% dividend yield remains attractive relative to other sectors.

The U.S. elections this November—a seemingly inevitable rematch between President Joe Biden and former President Donald Trump—will be a referendum on Democrats’ clean energy policies. But on the whole, we think utilities investors would do better to look to state elections for potential impacts on clean energy policymaking.

What a Trump Administration Could Mean for the Inflation Reduction Act

Politics and regulation will indeed be one of the utilities sector’s key drivers in 2024, though we expect coal plant retirements to continue and carbon emissions to fall regardless of the political party that controls the White House or Congress.

Still, the U.S. elections in November will serve as a referendum on clean energy policies, notably the 2022 Inflation Reduction Act, which has helped improve economics and provided favorable tax policy for renewable energy, particularly solar.

Should Trump win another term, he has promised to roll back renewable energy credits on day one. This would be difficult, as it would take an act of Congress in what likely will be a narrowly divided House and Senate. Congress also might be reluctant to roll back the renewable energy credits, as they have created more jobs and private investment.

A Trump administration might also seek to:

- Slow implementation of the IRA, but that is unlikely to slow renewable energy growth in the short-run. Long-dated projects such as hydrogen could be most at risk if IRA benefits are scaled back. We think both parties would continue grid infrastructure investments, such as transmission and smart grid technology.

- Make it more difficult to qualify for electric vehicle tax credits. We expect electricity demand from electric vehicles to increase 15-fold over the next decade. However, most of that growth is in the back half of our forecast, which limits the near-term impact on electricity demand if EV growth slows.

States Where We Expect Constructive and Challenging Rate Outcomes in 2024

That said, we expect state-level political and regulatory activity in 2024 to affect utilities more than federal policy.

Some state regulators continue to approve customer rate increases to fund utilities’ aggressive capital investment plans, particularly related to clean energy. Other regulators have taken a tougher approach.

Overall, we believe more regulators are making constructive decisions that support utilities’ earnings growth outlooks.

States in which we’re seeing constructive rate outcomes include:

- California. Despite some of the highest electric rates in the country, regulators have embraced the idea that utilities must be compensated for investing in infrastructure to support the state’s clean energy policies. California regulators in late December approved an increase in allowed returns on equity for all four subsidiaries of the state’s three investor-owned utilities: PG&E PCG, Edison International’s Southern California Edison EIX, and Sempra SRE.

- Michigan. In November, Michigan Gov. Gretchen Whitmer signed legislation that raised the state’s 2035 renewable portfolio standard to 60% from 15% and introduced a 100% clean energy requirement by 2040. We expect this will result in a boost to Michigan-based CMS Energy CMS and DTE Energy’s DTE capital investment plans and solid increases in their annual earnings growth outlook.

- Indiana. We rank Indiana as one of the top five states with the most constructive utility regulation. NiSource’s NI base electric rate settlement in March supports our 7% annual earnings growth outlook through 2027.

- New York. Despite already-high energy costs, New York has regulators who appear willing to increase customer rates for investments in clean energy, efficiency, and safety. In 2023, New York regulators approved a settlement at Consolidated Edison’s ED New York City utility, CECONY, that supports the company’s $15 billion capital investment plan in 2023-25 and lifted CECONY’s allowed return on equity to 9.25% from 8.8%.

- North Carolina. The state has become one of the most constructive regulatory environments for utilities. Regulation allows for multiyear rate plans, performance incentive mechanisms, and decoupled revenue for residential customers.

On the other side of the coin, utilities in these states face more-challenging rate regulation:

- Illinois. The state’s utilities still face a difficult pathway, as the allowed returns of equity for both Ameren’s AEE Illinois subsidiary and Exelon EXC were well below the companies’ recommendations. Regulators also questioned both utilities’ capital investment plans, which we viewed as appropriate and supporting the state’s policy objectives, though this reduced our fair value $8 per share for Ameren and $4 per share for Exelon.

- Connecticut. The state continues to be a difficult operating environment for utilities. At Avangrid’s AGR United Illuminating Company subsidiary, regulators ignored past precedent in historical ratemaking and awarded among the lowest allowed return on equity in the sector. We expect Avangrid will dial back investment in the state and allocate capital for growth at other units.

We’re continuing to monitor:

- New Jersey. Public Service Enterprise Group PEG has requested a $462 million electric rate increase and a $364 million gas rate increase. How regulators respond to the gas rate request could offer some insights into how regulators and others are thinking about the long-term future of retail gas service in the state.

- South Carolina. While the state only represents 7% of rate base for Duke Energy DUK, it is the last state in which Duke operates that we consider as having a less-constructive regulatory environment. Duke recently filed its first rate case since 2018, and while we don’t think Duke will be awarded the full increase, a positive outcome could be one of the last steps on Duke’s pathway to receiving a premium market valuation.

3 Key Themes for Utilities in 2024

Other themes that will influence utilities in 2024:

- Renewable energy. In 2024, we expect U.S. solar and wind generation combined will overtake coal and possibly nuclear generation for the first time in history in 2024. Gas remains the leading fuel source for now, but utilities’ investments in renewable energy are growing rapidly, and we think renewable energy will approach gas as the leading power generation source by 2030.

- Interest rates. The market’s “higher-for-longer” interest-rate outlook sunk utilities in 2023. Now, possible Fed rate cuts represent upside optionality. Higher interest rates will start to pressure earnings growth, making regulatory outcomes even more important.

- Energy demand. Higher operating, financing, and capital costs are leading to utility bill increases nationwide. This could weigh on energy demand and, ultimately, utilities’ long-term earnings growth. Data center growth is a key positive for energy demand.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)