The Renewable Future

Utilities winners and losers as the U.S. goes green.

Renewable energy is still a small player in the U.S. energy ecosystem, accounting for just 10% of U.S. electricity sales and 7% of U.S. energy consumption, excluding hydropower. Oil, natural gas, nuclear, and even coal will keep us comfortable, charged, and on the go well into the next decade.

But we think renewable energy will grow faster than consensus forecasts. We expect U.S. renewable energy-- mostly wind and solar--to climb 8% annually during the next decade, reaching 22% of total electricity generation. Tech, consumer, and even oil and gas firms are rushing into renewable energy to establish sustainability cred, and politicians are greening up their resumes. Utilities that can harness this renewable energy growth will win big for investors; those that lack public support and struggle to execute will be left behind.

Renewable energy is also shifting the U.S. energy landscape. Natural gas is at risk. Coal and nuclear generation are reaching bottom, and energy demand is stagnant, creating a zero-sum game between renewable energy and gas. Gas has a near-term advantage, but renewable energy is gaining strength. Texas, California, and New England will be early battlegrounds.

Morningstar's 2030 U.S. Renewable Energy Forecast We forecast that U.S. renewable energy will surpass 1,000 terawatt-hours by 2030, or 22% of U.S. electricity generation, excluding hydro. The ramp-down in solar and wind tax credits during the next five years won't slow growth as much as others assume. State renewable energy portfolio standards and corporate purchases will fill the growth gaps. Our 8% compound annual growth rate for 2018-30 is higher than global growth rate forecasts and higher than the 5.6% forecast CAGR from the U.S. Energy Information Administration, which has a history of underestimating renewable energy growth.

Renewable Energy vs. Natural Gas The cost gap between renewable energy and gas generation has closed, and the technologies are fighting for new investment throughout the United States. Renewable energy has a policy advantage and will grow faster than gas during the next decade. We think gas will continue to grow, but only at a 2% annual rate, down from 5% during the last decade. Gas' demise is beyond our forecast period, but solar and wind will knock gas off its throne in many areas of the country by 2040, based on current technologies and policies.

Solar Growth Underestimated Solar is the key disrupter, and experts have consistently underestimated it. A 2012 government industry report suggested solar would struggle to reach 50 gigawatts and 11% of U.S. electricity demand by 2030. But solar already has 40 GW operating and 37.9 GW in construction or backed with signed contracts, according to Wood Mackenzie. Module shipments are exceeding 1 GW per month. With some 200 GW in U.S. grid operators' interconnection queues, solar could become the second-largest generation source behind natural gas in the next decade. Solar's load-matching profile makes it the biggest threat to natural gas, especially when paired with energy storage. In California, gas demand for power generation has fallen 30% since 2015, and the state's zero-carbon target could mean eliminating all gas use by 2045. The next big tests will be Florida and Texas, where gas generation dominates but solar has momentum.

Wind Growth Overestimated Wind growth estimates are too high. In 2009, the North American electric grid monitor forecast 256 GW of installed wind capacity by 2018, far above the 99 GW now in service. In 2015, the U.S. Department of Energy forecast that wind would hit 20% of U.S. electricity demand by 2030, well beyond what we think is possible. Wind bulls did not anticipate competing with natural gas for off-peak market share or solar for on-peak market share.

Gas has the reliability advantage; wind has the cost advantage. This war has whacked off-peak power prices in Texas, spurred offshore wind in the land-constrained, gas-short Northeast, and led utilities to flip-flop investment between gas and wind.

Cheap gas and reliability will vault gas generation to more than 40% U.S. market share by 2030. Cost-effective energy storage in development could boost wind and solar. We think offshore wind will be a financial, regulatory, and logistical albatross for early entrants.

Policy Sets Floor for Renewable Energy Growth We estimate that renewable energy will more than double by 2030 just to meet current government targets in 38 states and Washington, D.C. This represents most of our 10-year growth forecast after incorporating our state demand forecasts. We estimate that 32 states have not met their renewable portfolio standards. New York (70% by 2030) and California (60% by 2030) represent one third of our RPS-based renewable energy growth estimate during the next decade. Michigan, New Jersey, Illinois, and Pennsylvania also require big investments. Six states and Washington, D.C. (2032) are chasing 100% RPS. We believe the renewable energy policy floor will keep rising.

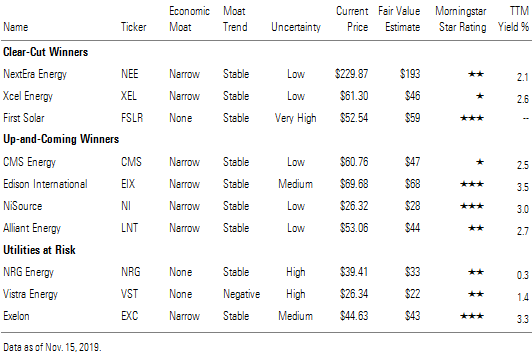

Clear-Cut Winners NextEra Energy NEE, Xcel Energy XEL, and First Solar FSLR should top any list of renewable energy winners our coverage. This in part explains why NextEra Energy and Xcel Energy trade at substantial premiums to our fair value estimates. First Solar trades at a slight discount to our fair value estimate.

NextEra Energy As the largest wind power producer in the U.S., NextEra has proved itself to be a best-in-class renewable energy operator and developer. Management's continued execution on its Energy Resources development program leaves us confident that NextEra will deliver at the high end of its 11.5-18.5 GW development target in 2019-22. Declining wind and solar costs position Energy Resources favorably during the next decade. NextEra's early entry into battery storage will enhance its competitive positioning in the market. It has two first-of-its-kind wind-solar-battery projects in development: one in Oregon and one in Oklahoma.

NextEra’s regulated utilities in Florida also are moving into renewable energy with state support. By 2030, the utility aims to install 10 GW of new solar capacity, of which it earns near immediate returns upon completion. The program would increase solar energy in Florida Power & Light’s service territory to 20% from roughly 1% today. We forecast regulatory capital will increase 8% annually through 2023. On a consolidated basis, we forecast NextEra’s annual earnings growth will reach the top end of management’s 6%-8% range and annual dividend growth will average 14% through 2023.

Xcel Energy Xcel aims to be one of the industry's leading clean energy providers, with much of its $20 billion planned investment during the next five years going to renewable energy. This investment plan gives investors a transparent runway of 6% annual earnings and dividend growth potential. However, Xcel's investment plan creates more regulatory risk than peers. It must continue to receive political, regulatory, and customer support for its clean energy investments, particularly in its largest jurisdictions, Colorado and Minnesota, where it plans to invest $15 billion in 2019-23. Lower energy costs have helped keep customer bills mostly flat despite higher infrastructure charges. In the long run, we think Xcel's investment in renewable and clean energy could top $1 billion per year to meet management's net-zero carbon goal by 2050. Colorado and New Mexico are working on legislation that would require 100% carbon-free generation by 2050, supporting that long growth runway.

First Solar First Solar is the only pure-play solar company we cover and is winning big contracts with key U.S. developers. North America now represents two thirds of its potential booking opportunities. A surge in U.S. demand doesn't make First Solar a slam-dunk investment, however. Module makers like First Solar differentiate on cost and conversion rate--modules' ability to turn sun into electricity. First Solar's thin-film technology gives it a slight advantage in both but not enough to warrant an economic moat. Maintaining margins and staying ahead of the competition will require First Solar to invest in new technology and production capacity. This is risky for investors. Strong demand for its Series 6 modules released in 2017 and its smooth production capacity expansion is a win for investors so far. Bookings in 2018 and 2019 leave First Solar effectively sold out through 2021 at current capacity. Investors must watch if First Solar can stay ahead of the technology curve and expand production enough to offset lower margins in an increasingly competitive market.

Up-and-Coming Winners Most investor-owned utilities have yet to commit serious money to renewable energy. They own only 20% of U.S. wind projects and less of solar. The following utilities--CMS Energy CMS, Edison International EIX, NiSource NI, and Alliant Energy LNT--often don't make lists of renewable energy leaders, but we think they have the most renewable energy investment upside. The utilities that execute should reward investors with earnings growth and premium valuations.

CMS Energy Michigan's regulatory and political support gives CMS a transparent runway of earnings growth. CMS' electric integrated resource plan settlement in January and rate increases at its gas and electric businesses support our 7% annual earnings growth rate as long as regulators approve the bulk of CMS' proposed investments. The IRP supports CMS' five-year, $11 billion investment plan, and we think that investment total will go higher as CMS invests more in renewable energy. CMS' growth focuses on electric and gas distribution and renewable energy. These projects are positives for shareholders because they align with energy policy in Michigan and are likely to gain regulatory and political support. The planned Palisades nuclear plant retirement in 2022 and Michigan's 15% renewable portfolio standard by 2021 necessitate near-term investment. We think CMS can approach 25% renewables in the coming years with regulatory support.

Edison International Despite the California policy risk overhang, Edison has growth opportunities that would make most utilities jealous. With its plans for $5 billion of annual capital investment and good regulatory support, we think Edison can average 6% annual earnings growth on a normalized basis. Most of Edison's growth investment is not directly in renewable energy but in all of the infrastructure upgrades that will be needed to support California's quest for 100% renewable energy. Growth investments also will address California's aging core infrastructure and support for next-generation energy services, such as electric vehicles, distributed generation, and energy storage.

Regulators have approved much of Southern California Edison’s $10 billion capital investment plan in 2019-20. In September, Edison presented a plan that would continue $5 billion of annual investment through 2023. We think state policies and initiatives give Edison a good case to gain regulatory support for its investment plan. In the near term, Edison’s growth could be lumpy as regulatory delays, wildfire issues, and California energy policy changes lead to shifts in spending and cost recovery. Edison’s $2.4 billion contribution to the state wildfire insurance fund in 2019 will dilute earnings in 2019-20 before growth picks up. Dividend growth might lag earnings in the near term.

NiSource Even though just one third of NiSource's earnings come from its electric business, it is at the center of the struggle between renewable energy and natural gas generation in Indiana. Indiana regulators are assessing NiSource's long-term resource plan for retiring 80% of its coal generation by 2023 and all of it by 2028. NiSource plans to replace this with a combination of wind, solar, and battery storage, all at lower costs than fossil fuel options. Its seven-year, $1.2 billion investment program at its electric utility helps support this surge in renewable energy. On Oct. 1, NiSource's Indiana electric utility, Nipsco, requested proposals for 2.3 GW of solar and energy storage and expects to sign contracts in 2020.

Companywide, NiSource plans to invest about $30 billion in infrastructure improvements during the next 20 years, more than half of which are modernization programs for replacing steel and cast iron pipe with plastic at its natural gas distribution utilities. Special rate treatment for most of these investments helps ensure NiSource earns its allowed returns. Across its entire system, NiSource has rate trackers for roughly 75% of planned capital expenditures, providing recovery of investments in less than 12 months. As a result of the favorable regulation, NiSource has stepped up its capital expenditures to almost $2 billion per year over the next five years, almost double its annual investment the last five years.

Alliant Energy The Upper Midwest utility is planning $7 billion of investment during the next five years and is eyeing another $5.7 billion beyond 2023. Much of that is going to renewable energy, and regulators are pushing in that direction. Interstate Power and Light in Iowa received approval for 1,000 megawatts of wind generation with an 11% allowed return, almost 200 basis points higher than most U.S. utilities earn. IPL has placed into service 470 MW and is on track to install the remaining 530 MW by the end of 2020. The wind generation will help offset the planned power purchase agreement retirement of the Duane Arnold Energy Center. At Wisconsin Power and Light, management has identified 200 MW of new wind projects. Alliant benefits from operating in what we consider two of the most favorable regulatory jurisdictions. To maintain earned returns near allowed returns during this period of high investment, management has reduced regulatory lag by working with regulators on unique rate structures.

Utilities at Risk Any company that owns coal, nuclear, or gas generation outside of a cost-of-service rate framework is at risk of losing market share and earnings. Most large utilities have exited the merchant generation business during the last half-decade. The three remaining utilities with substantial exposure to fossil fuel and nuclear generation are NRG Energy NRG, Vistra Energy VST, and Exelon EXC.

NRG Energy The renewable energy build-out in the Eastern U.S.--especially solar--is going to shrink margins for NRG's legacy coal, nuclear, and gas generation. In the Mid-Atlantic and Northeast, nuclear subsidies also hurt NRG's competitive position. In Texas, we expect wind and solar to start stealing share from NRG's legacy coal, nuclear and gas generation. Our forecast for 1.4% annual demand growth in Texas during the next decade won't be enough to offset 38% renewable energy growth on a capacity-weighted basis in the next three years, according to the most recent grid operator's report. NRG's growing retail business will help offset the weak outlook for its generation business. Retail earnings could surpass generation earnings as soon as 2020 based on recent retail acquisitions and weak energy prices. Falling renewable energy costs and more retail demand for renewable energy could boost retail margins, but we don't think it will be enough to offset the drop in generation margins.

Vistra Energy Vistra became one of the largest fossil fuel generators in the country, with 41 GW of nuclear, coal, and natural gas generation after acquiring Dynegy in 2018. But as with NRG, falling renewable energy costs in its core Texas, Northeast, and Mid-Atlantic markets are a big long-term risk. One early sign: Vistra retired three coal plants in Texas in 2018 and plans to retire five coal plants in Illinois. Texas leads the U.S. in wind energy, and Illinois ranks sixth. Vistra has offset some of its wholesale energy market exposure by expanding its retail energy business. Its 2019 acquisitions of Crius Energy ($436 million) and Ambit Energy ($475 million) will boost retail earnings to about one third of consolidated earnings. This could result in more-stable cash flows and more share buybacks. Vistra is eyeing renewable energy and battery storage opportunities, but earnings from those projects are many years out.

Exelon The largest nuclear operator has protected most of its earnings downside with state subsidies covering most of its generation. If wind and solar continue to exceed growth expectations in Illinois and New York, state subsidies might not be enough to save nuclear in the next decade. Huge sunk costs, low variable costs, and high reliability factors give nuclear an advantage. But maintenance investment is a big risk. Any large capital outlays could lead to plant shutdowns. Carbon caps would be a near-term lifeline, but they also would boost renewable energy economics. As Exelon directs more investment to its regulated distribution businesses and even renewable energy, its nuclear fleet share of earnings will continue to fall. We expect its regulated utilities to produce all the earnings growth for the foreseeable future and surpass generation earnings within the next two years.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)