Real Estate Stocks: Underperformance Continues Due to Rising Interest Rates In Q1

Our top picks for this sector are Realty Income, Ventas, and Federal Realty.

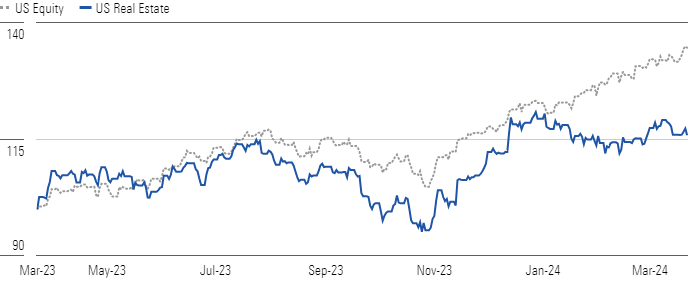

The Morningstar US Real Estate Index was only up 15.8% over the trailing 12 months, well below the 34.6% gain in the broader US equity market. The sector also underperformed in the first quarter of 2024, down 3% compared with a 9.7% gain by the broader market. Throughout the year, real estate’s performance has been driven by interest rates. While same-store net operating income growth is decelerating from the historic highs in 2022, most subsectors produced growth at or above the historical average in 2023.

Real Estate Underperformed Broader US Equities In 2023 and Q1 2024

However, guidance for most sectors indicates that revenue growth will continue decelerating in 2024 and operating expense growth will likely be above it, leading to flat or low same-store net operating income growth for most sectors.

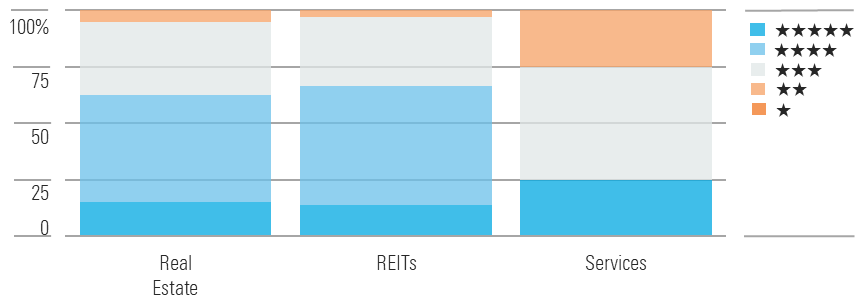

The Majority of Real Estate Companies Are Trading at a Discount to Their Fair Value

The average real estate stock currently trades below our fair value estimate. The median stock in our coverage is at a 16% discount, which is better than most other North American sectors. Currently, 15% of the sector is in the 5-star range, 47.5% is in the 4-star range, 32.5% is rated 3 stars, 5% is rated 2 stars, and no company is rated 1 star.

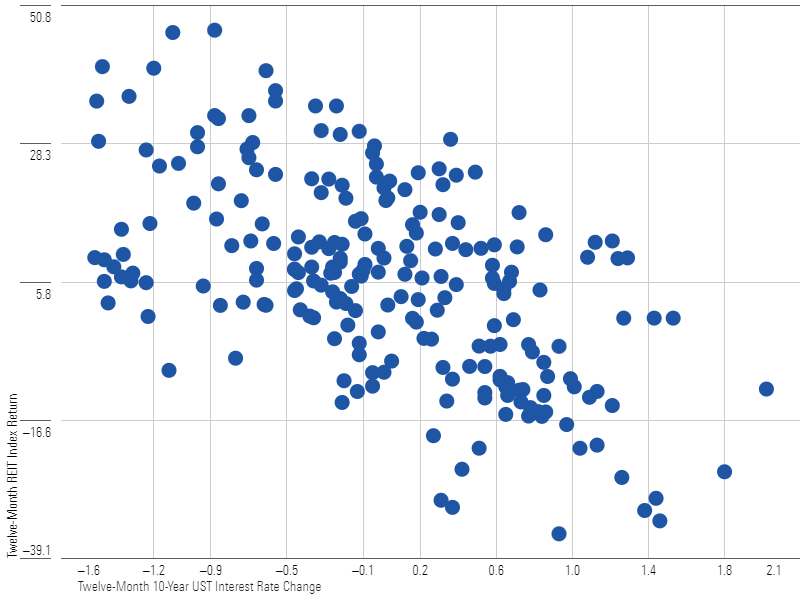

Relative Performance of REIT Sector Negatively Correlated With Interest Rates

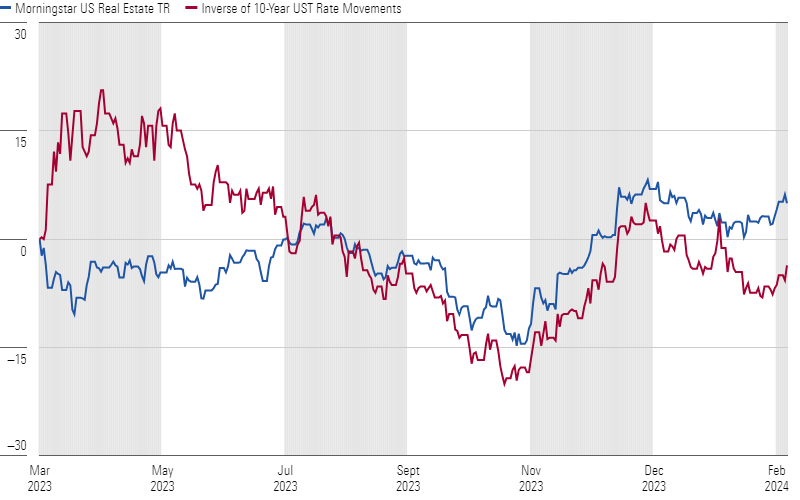

Much of the underperformance over the past 12 months is due to rising interest rates. Between July and October, rates on 10-year US Treasury bonds climbed from 3.75% to almost 5%, while real estate saw a 15% decline in share prices. The 10-year Treasury rates fell between mid-October and the end of December but are up slightly in the first quarter, leading to the sector’s underperformance. However, since we expect rental rates, revenue, and net operating income growth to remain positive in 2024 and believe interest rates will stabilize or even be cut over the next year, we find the sector attractively valued.

Since July, Real Estate Index Mirrored Inverse of Interest Rate Movements

Top Real Estate Sector Picks

Realty Income

- Fair Value Estimate: $76.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Low

Realty Income’s O portfolio should provide stable rental payments in nearly any economic environment. The company’s assets are mostly leased to defensive retail tenants like pharmacies and gas stations, which generally produce stable sales even in recessions. Additionally, the company’s high coverage ratio helps tenants maintain rent payments even if they experience a slowdown in sales. We believe the current market-implied cap rate undervalues the company’s portfolio of stable assets.

Ventas

- Fair Value Estimate: $70.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Ventas’ VTR portfolio of senior housing assets should produce double-digit net operating income growth for the next several years, given strong demand growth combined with limited supply growth. The company’s medical office and life science portfolios should provide recession-resistant revenue. Ventas’ development pipeline should also produce yields above its cost of capital even in a higher interest rate environment, producing more cash flow growth for shareholders. Ventas sold off due to rising interest rates, but we believe this provides an attractive entry point for shareholders looking for a REIT with a strong growth story.

Federal Realty Investment Trust

- Fair Value Estimate: $142.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

High-quality retail centers should outperform the brick-and-mortar average. Federal Realty’s FRT portfolio has the highest average population density and per capita income among all shopping center REITs, which are highly correlated with strong store sales productivity. As retailers are looking to slim store counts, they tend to choose their highest-productivity locations, so occupancy should remain high even in periods of retail weakness. The company’s strong internal and external growth prospects should also let it continue to support a high and growing dividend yield.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)