Real Estate: Sector Underperforms Over the Past 12 Months but Outperforms In the Quarter

Our favored real estate stocks include Realty Income, Ventas, and Federal Realty Investment Trust.

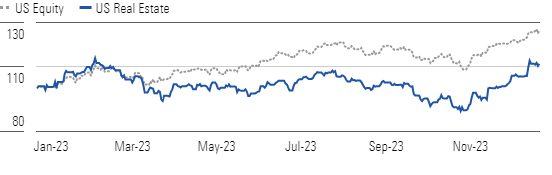

The Morningstar US Real Estate Index is up 11.1% over the trailing 12 months, well below the 26.4% gain seen by the broader U.S. equity market over the same period. However, the real estate sector was up 16.7% in the fourth quarter of 2023, outperforming the 11.5% seen by the broader U.S. equities market. This performance has been driven by interest rate movements throughout the year. While same-store net operating income growth is decelerating from the historic highs seen in 2022 for most real estate subsectors, most are still growing at or above their historical averages. We anticipate this trend continuing into 2024.

Our top picks among real estate stocks are:

Real Estate Sector Underperforming Broader U.S. Equities in 2023

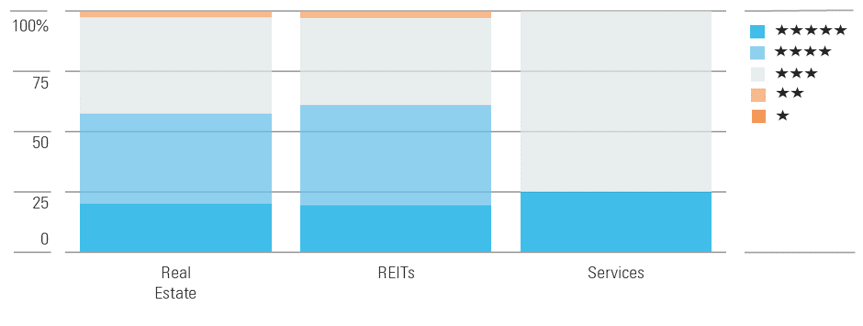

Most real estate companies are trading below our fair value estimates. The median company in the sector under our coverage currently trades at a 13% discount to its fair value estimate, which is in line with or better than most other North American sectors. Currently, 20% of the sector is trading in the 5-star range, 38% is in the 4-star range, 40% is in the 3-star range, and only 2% is in the 2-star range. No company is currently trading in the 1-star range.

Majority of Real Estate Companies Trading at Discount to Fair Value

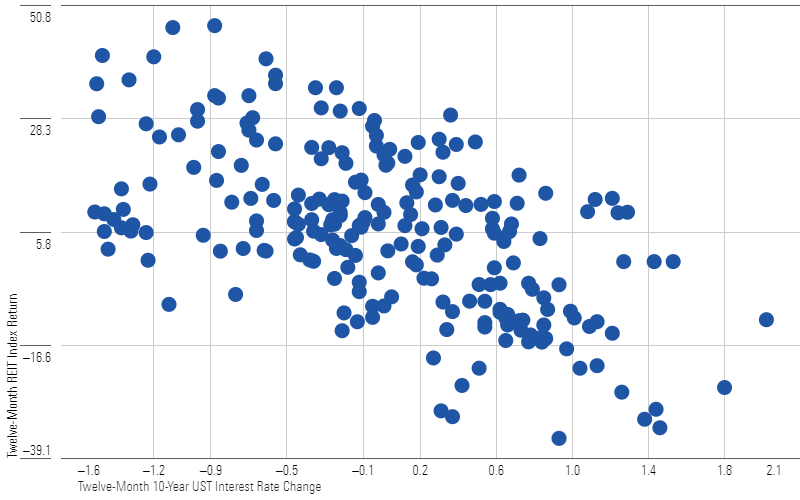

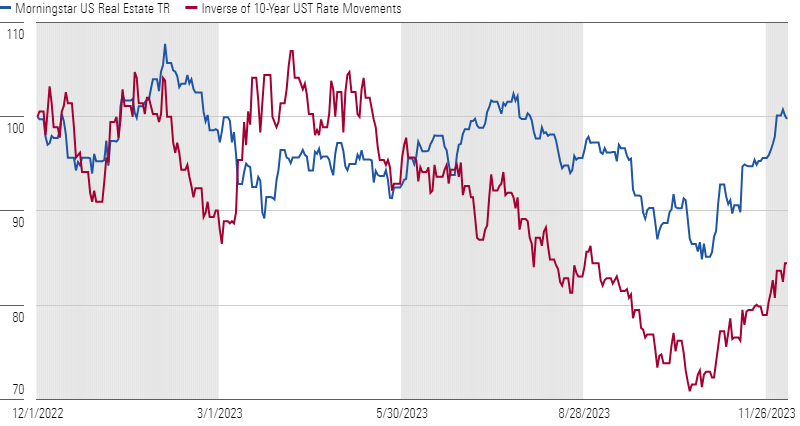

Much of the sector’s underperformance in 2023 is due to rising interest rates. Between July and October, rates on the 10-year U.S. Treasury climbed from 3.75% to almost 5.00%, and the sector saw a 15% decline in share prices over that time. However, since mid-October, 10-year Treasury rates have fallen to around 4.2%, while real estate shares have rallied 15%. The Federal Reserve did not lower interest rates at its most recent meeting, but it indicated it may consider cuts in 2024. Given that we expect rental rate, revenue, and net operating income growth to be at or above the historical average in 2024, we find the sector to be attractively valued.

Relative Performance of REIT Sector Negatively Correlated With Interest Rates

Since July, Real Estate Index Has Mirrored Inverse of Interest Rate Movements

Top Real Estate Sector Picks

Realty Income

- Fair Value Estimate: $76.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Low

Realty Income’s portfolio should provide stable rental payments in nearly any economic environment. The company’s assets are mostly leased to defensive retail tenants like pharmacies and gas stations, which generally produce stable sales even in economic recessions. Additionally, the company’s high coverage ratio further helps the tenants maintain rent payments even if it does experience a slowdown in sales. The company has sold off as it is one of the most sensitive names to rising interest rates given its high dividend payments and reliance on acquisitions for growth. However, we believe that the current market-implied cap rate undervalues the company’s portfolio of stable assets.

Ventas

- Fair Value Estimate: $72.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Ventas owns high-quality assets in the senior housing, medical office, and life science fields. While the company’s medical office and life science portfolios were unaffected by either the pandemic or an economic recession, the senior housing portfolio saw a large drop in occupancy in the first year of the pandemic. However, occupancies have steadily recovered since the start of 2021 with the company reporting double-digit net operating income growth. Long-term, the industry should continue to see strong demand growth from the coming demographic wave of baby boomers aging into senior housing facilities, which will produce high occupancy levels and rate growth.

Federal Realty Investment Trust

- Fair Value Estimate: $142.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Federal Realty owns and operates high-quality shopping centers and mixed-use assets in eight of the largest metropolitan areas, and the average population density and average median household income around its portfolio is higher than with any other retail REIT. Occupancy in Federal Realty’s portfolio has stabilized at 94%, and the company reported nearly double-digit re-leasing spreads on all leases for the past 12 months. The company has a large development pipeline of mixed-use assets, which should provide significant growth as the projects stabilize over the next few years.

Top Real Estate Sector Picks Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YTLLJ3VT4NFZTCTDNZPCUR27D4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)