How Supply Chain Troubles Snagged the Fashion Industry

Fashion retailers are still experiencing delayed deliveries amid increasing online shopping.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Supply chain woes have been well documented across industries like U.S. autos, industrials, and semiconductors. But one surprising industry that has been disrupted is fashion.

In a recent report, equity analysts Michael Field and David Whiston looked at how supply chains snapped under pressure and what this means for fashion manufacturers and retailers. Morningstar Direct clients can read the full version here.

In this article, we’ll look at what factors caused fashion to be slammed by supply chain disruptions and what fashion companies are poised to benefit.

Location of Manufacturers and Retailers Affects Supply Chains

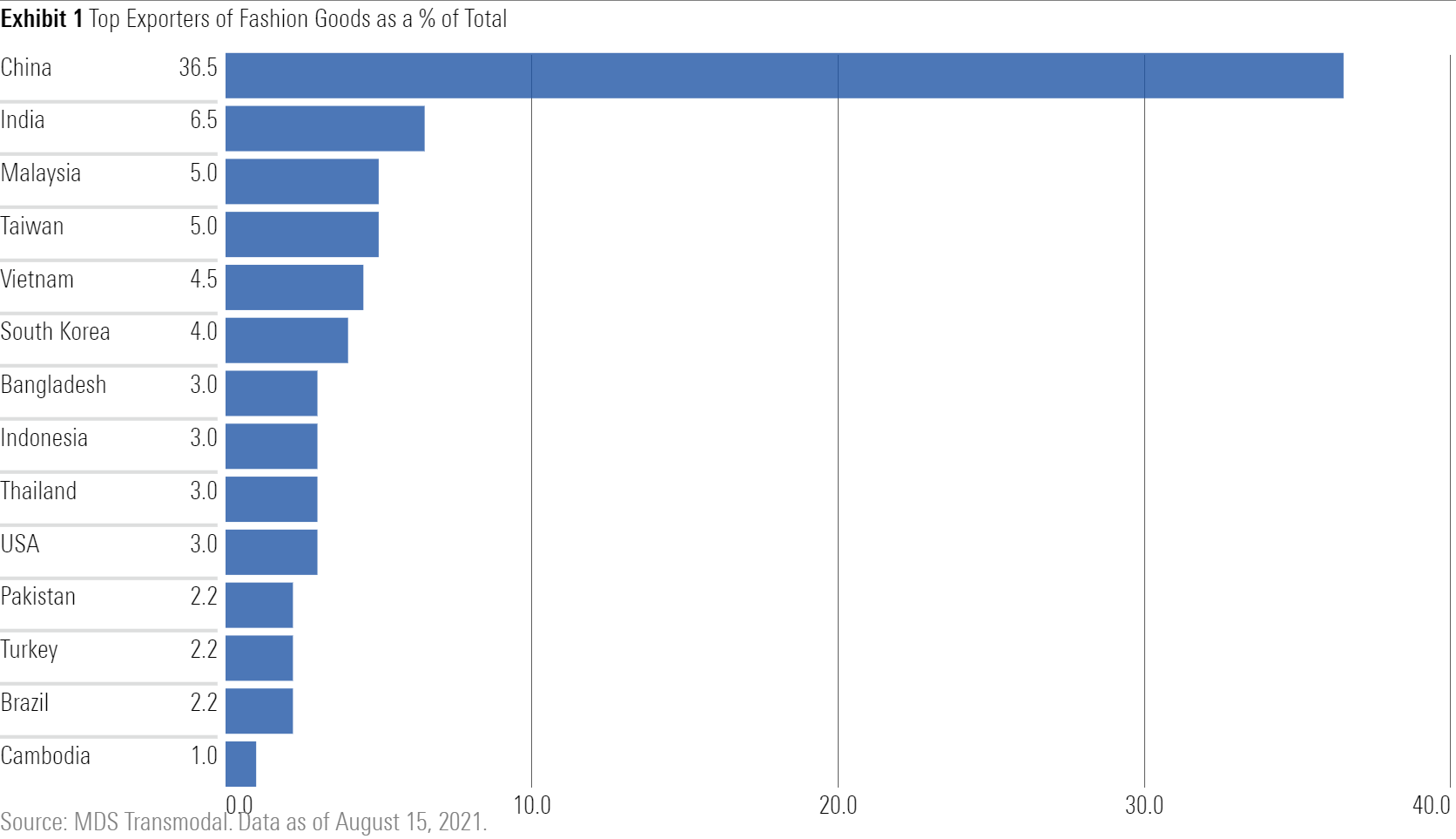

China is by far the largest fashion exporter. Exhibit 1 shows that China accounts for 36.5% of all fashion exports by a wide margin--with India coming in second at 6.5%.

So, when the coronavirus pandemic hit China the hardest in early 2020, manufacturing plants closed in order to stop the spread of COVID-19. This caused the initial wave of disruption to Western fashion retailers, Field and Whiston say, because the industry had become too reliant on China’s fashion exports.

Since China reopened its economy around April 2020, when many Western countries started lockdowns, disruptions were intensified. This stop-start production in China, along with unreliable shipping schedules, meant large fashion retailers didn’t have a reliable manufacturing pipeline.

This helped fast-fashion players like Inditex ITX, the owner of Zara, which manufacture goods closer to their retail end markets, Field and Whiston explain. Realizing the fragility of these supply chains will force retailers to diversify their manufacturing supply chains--though it will come at a cost.

Demand Shock Created a Ripple Effect in Supply Chain

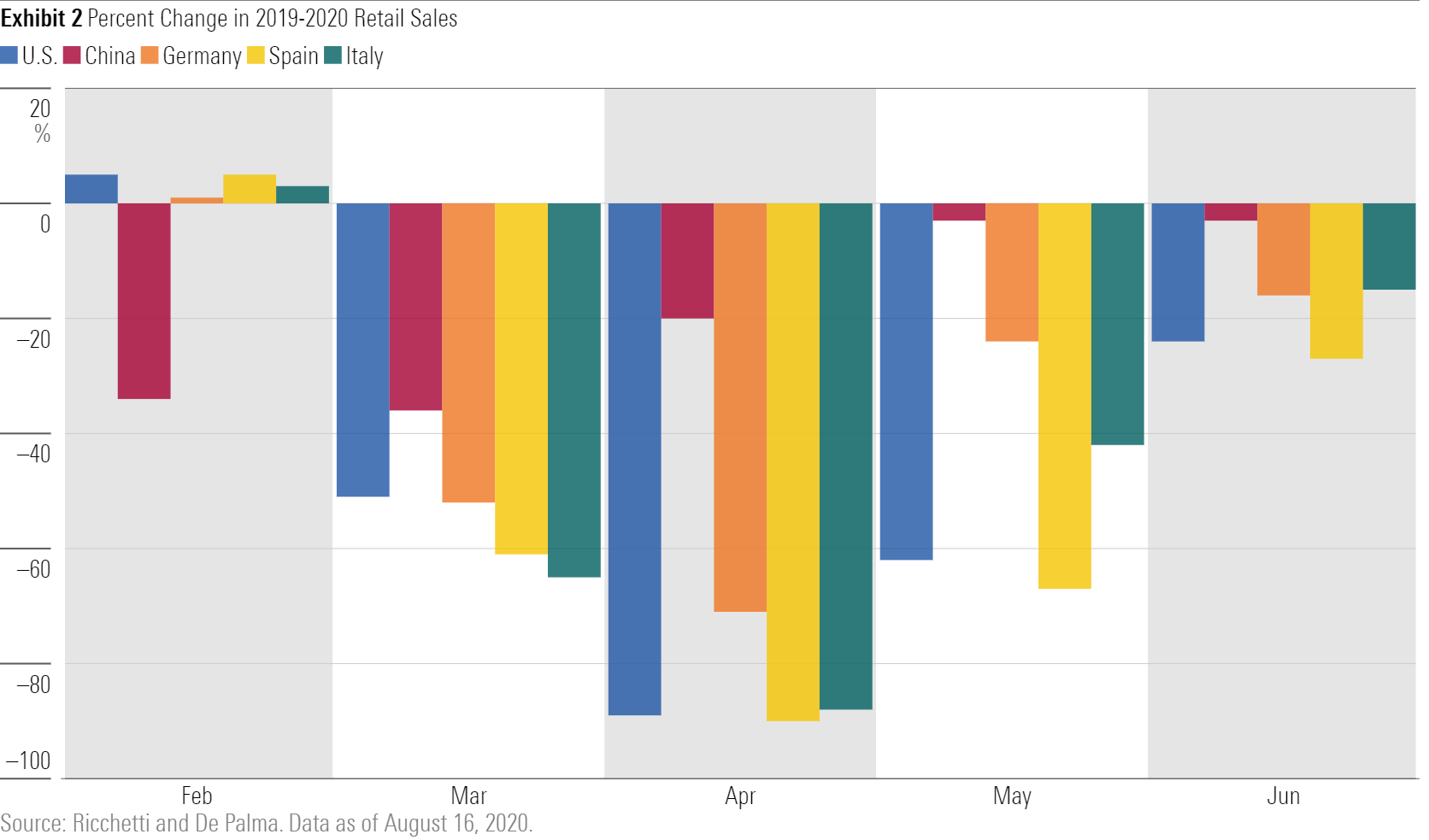

Lockdowns across Europe and the United States led to an initial slump in fashion demand as many consumers couldn’t physically shop in stores. Others considered these lockdowns as short-term measures and postponed new purchases.

This demand shock hit fashion sales hard in March and April 2020--falling by as much as 90% in some regions. Exhibit 2 shows the percentage change in 2020 fashion sales compared with 2019 across the U.S., China, and a few European countries.

The initial demand shock caused many fashion retailers to cancel orders for new clothes and accessories. This caught the fashion manufacturers by surprise and forced them to stop production--like the auto microchip shortage.

Halting production meant raw materials went unused and current production didn’t have any buyers. This left many manufacturers vulnerable because they had to pay for the costs of existing orders, Field and Whiston say.

In fact, 72% of retailers didn't pay for raw material costs, and 91% didn't pay for production costs, according to the Center for Global Workers' Rights.

Surge in Online Ordering and Home Delivery

The lockdown period saw a surge in demand for online ordering and home delivery. U.K. clothing giant Next NXGPF saw online sales comprise 45% of total sales in 2019--that figure jumped to more than 70% in 2020.

Companies that have online operations to accompany their brick-and-mortar stores face significant pressure from other companies that have championed developments in e-commerce. These developments include demand for next-day delivery and return periods.

A recent survey from GXO GXO found that 35% of all goods bought online were returned.

The pandemic has been mildly positive for the strongest players in fashion, Field and Whiston explain. These companies managed to significantly grow online sales, allowing them to close brick-and-mortar stores and invest in more cutting-edge e-commerce technology.

Even Nike NKE cannot keep up with demand, equity analyst David Swartz says. The company, which has a Morningstar Economic Moat Rating of wide, anticipates several virus-related closures in Vietnam, home to 50% of the firm's iconic footwear production under normal circumstances.

Staying Stylish Amid Supply Chain Disruptions

The pandemic has given many fashion retailers more questions than answers, higher costs, and customers with greater expectations. But a healthy market has boosted valuations for many of the fashion stocks Morningstar analysts cover, leaving only a few names attractive.

One stylish name is Hanesbrands HBI. The activewear and basic-apparel producer is expected to return to 2019 sales and profitability by 2022, Field and Whiston say. They forecast Hanes’ popular "athleisure" brand Champion will increase sales to $3 billion in 2024 from $2 billion in 2021.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-03-2024/t_8ba91080cb4d43acae9d9119875abede_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)