Going Into Earnings, Is Bank of America Stock a Buy, a Sell, or Fairly Valued?

We’ll be closely watching net interest income for clues on the profitability outlook.

Bank of America BAC is set to release its third-quarter earnings report on Oct. 17, before the market open. Here’s Morningstar’s take on what to look for in Bank of America’s earnings and stock.

Key Morningstar Metrics for Bank of America

- Fair Value Estimate: $35.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

What to Watch for In Bank of America’s Q3 Earnings

Net Interest Income Outlook for 2023: This is very important. Last quarter was about stopping deposit outflows, and we think this quarter will be about stopping the deterioration of the future profitability outlook.

Updates in mid-September were generally good, with Bank of America maintaining the previous outlook. We’re hoping the third quarter is the first period in which outlooks for net interest income, or NII, don’t deteriorate further. For Bank of America, that means maintaining the current full-year outlook of just above $57 billion on a fully taxable equivalent basis.

Net Interest Income Outlook Beyond 2023: We will also be paying attention to commentary around when net interest margins and NII will stabilize. Is it a third-quarter or fourth-quarter event? Or is it pushed to 2024, and how does an additional rate hike affect that outlook? This will affect how we think about 2024 NII and through-the-cycle NII, which in turn will affect our longer-term NII forecasts. This is an important variable, making up the majority of revenue. Investors are trying to get a feel for when the current earnings pressure from higher rates will stop, and this is a key part of that equation.

This is particularly important for Bank of America because it has a disproportionate amount of longer-dated, fixed-rate securities on its balance sheet. This means the earnings pressure from higher rates is worse than it is for some peers, such as JPMorgan Chase JPM.

Change In Unrealized Losses On Securities: Interest rates have kept going higher, especially over the last month. As a result, another key data point will be where unrealized losses finished for the quarter, along with any additional commentary around how hedged Bank of America is, in case rates keep moving up. This affects how we think about capital buildup needs in the current environment.

Reserves/Credit/Economic Outlooks: This will continue to be a topic of discussion. While not currently quite as important as the rate/profitability discussion, these outlooks are still on investors’ minds. We think reserves are still mostly stable, with some potential additional deterioration in commercial real estate portfolios, and that consumers/businesses are still mostly fine.

It remains a big question when and where higher interest rates will really start to appear. Where will we first see cracks in credit, especially beyond the typical CRE exposures?

Bank of America Stock Price

Fair Value Estimate for Bank of America

With its 4-star rating, we believe Bank of America’s stock is undervalued compared with our long-term fair value estimate.

After incorporating the latest quarterly results, we are decreasing our fair value estimate to $35.00 per share from $37.00, primarily due to lower NII assumptions. Our fair value estimate is about 1.5 times the reported tangible book value per share as of March (1.4 times excluding accumulated other comprehensive income).

Bank of America has been one of the more rate-sensitive banks under our coverage, and with rates starting to peak, its path forward is changing. We anticipate the fourth quarter of 2022 will have been the bank’s peak for NII. We still expect annual growth of 6% for 2023 (down from 8%), but that the quarterly path will be down from here.

With rate cuts projected toward the end of 2023 and into 2024, we expect NII to decline 4% in 2024 and barely grow in 2025. This is the flip side of the 22% growth the bank saw in 2022 as rates rose.

A lot of near-term uncertainty remains, but we currently expect some combination of deposit runoff and higher funding costs could lead to a miss for NII versus consensus in 2023, while rate cuts in 2024 will lead to another miss. This, combined with our above-consensus expense outlook in 2024, leads us to be cautious about the near-term earnings per share outlook. Still, we see the shares as modestly undervalued even if near-term earnings are set to face some pressure, although the timing of any revaluation is difficult to predict.

Read more about Bank of America’s fair value estimate.

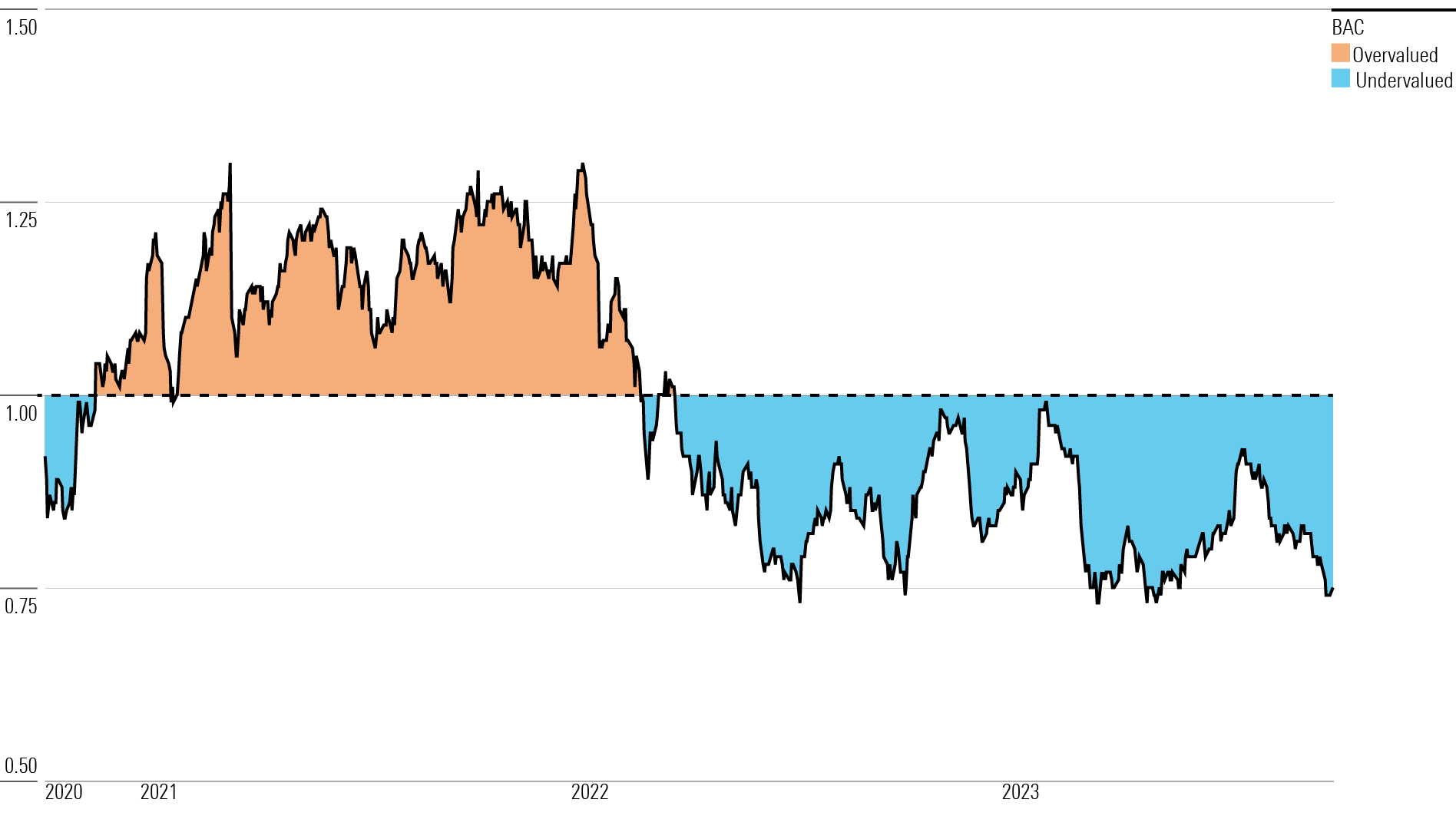

Bank of America Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Bank of America a wide moat based on its cost advantages and switching costs.

Bank of America is the second-largest U.S. money center bank by assets, and it tends to have leading share and operations in many of the areas where it competes. It is one of the top deposit gatherers in the United States, and it also has one of the country’s top retail-lending footprints and top corporate franchises. The bank also has one of the largest online retail brokerages in Merrill Edge, and one of the largest advisor forces through Merrill Lynch Wealth Management.

The bank is a top-five global investment bank, one of the largest U.S. issuers of credit and debit cards, one of the top four U.S.-based merchant acquirers, and a top-five fee earner from fixed-income, currencies, and commodities products globally. Given the bank’s higher capital levels since the financial crisis, the increasing importance of scale and scope with changes in technology, and robust fee income, we believe Bank of America will consistently earn returns that exceed its 9.5% cost of equity through the cycle.

On the consumer side, Bank of America is able to cross-sell multiple products, providing advantaged pricing to key customer segments (such as through its Preferred Rewards banking program), and spread the overall costs of customer acquisition across more revenue streams. On the commercial side, similar dynamics apply. The bank is able to offer a complete package with a global scale few can compete with while sending out armies of bankers to both existing and new markets to win new business.

A final point relates to the switching costs created and the advantages that come from lowering customer acquisition costs. In banking, where many of the products are commodified to a large degree, getting potential clients into your platform (having more products in more places helps with this) and then keeping them there (more products and therefore higher switching costs help with this) matters a lot. We see Bank of America being able to pull this off.

Read more about Bank of America’s moat rating.

Risk and Uncertainty

We assign Bank of America a Medium Morningstar Uncertainty Rating.

An investment in Bank of America entails a large amount of regulatory and macroeconomic risk. Costs of compliance are high, the bank is large and complex, and it is clearly a prime target of regulators seeking fines and litigants seeking compensation for alleged misdeeds. From a macroeconomic perspective, the bank’s profitability will be affected by the interest-rate cycle and the effects of credit and debt cycles, all of which are not under management’s control. Most lines of business at Bank of America are economically sensitive.

Another risk is business disruption. The banking industry is arguably going through more technological change than ever before. Bank branches are declining in importance as more transactions take place digitally, and it is still uncertain how this dynamic will ultimately play out. Though scale and regulatory expertise create barriers to entry, new or existing competitors could take share as the banking industry digitizes and becomes increasingly focused on technology.

Read more about Bank of America’s risk and uncertainty.

BAC Bulls Say

- Bank of America is poised to succeed on a nationwide scale, and there seems to be no structural reason it can’t be one of the strongest bank franchises going forward.

- As a global systemically important bank, Bank of America should not have to worry about deposit flight, and its valuation has recently become less demanding, potentially increasing future upside.

- Bank of America is seeing exceptional digital adoption, and there still seems to be something left in the tank for expense savings, potentially helping the bank better absorb inflationary expense pressure.

BAC Bears Say

- Rate sensitivity is a double-edged sword, as is leverage to the state of the economy. If the economy ever falters and rates are cut, watch out for the downside.

- Easy expense cuts are probably over for Bank of America, and with expenses starting to creep up again, it may be difficult for the bank to fight back.

- There are few positive catalysts left for banks. Funding costs are running higher, NII has probably peaked, higher regulatory scrutiny is likely, and a recession may be around the corner.

This article was compiled by Brendan Donahue.

Earnings Season: What to Expect

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)