Investing Opportunities for Oil and Gas E&P Stocks During the Energy Transition

Cost advantage is key for E&P firms to achieve a moat.

Exploration and production firms, which produce oil and natural gas for energy and transport, are facing near-term uncertainty, but we think they have positioned themselves well for changes in the industry environment.

We expect three key themes to drive the E&P industry:

- The energy transition and global oil demand.

- Producer capital discipline.

- The global thirst for U.S. natural gas.

We outline our expectations for the industry through the lens of these themes and how companies in this space are positioning themselves to succeed in lower-price environments.

3 Key Themes for the E&P Industry

Our outlook for the E&P industry is centered on three key industry themes:

- The energy transition and global oil demand. We think oil demand will peak around 2030 and the subsequent decline will be mild. Electric vehicle adoption will accelerate quickly for private and commercial uses, but the vehicle stock will shift more slowly because internal combustion engines have long lives. For aviation, shipping, and petrochemicals, the substitutes are far from ideal, even with generous allowances for technological improvements. This does not necessarily signal climate disaster, though; emissions will decline faster as the share of noncombustible uses rises.

- Producer capital discipline. E&Ps were long demonized by investors for overspending and growing recklessly. This continued after the 2015 collapse in crude prices; when prices recovered, activity bounced right back as well. Such behavior exacerbated commodity price booms and busts. But firms eventually realized that investors want disciplined investing, with surplus cash returned to shareholders rather than plowed back into drilling. So far, the evidence shows firms are committed to this new philosophy: U.S. rig activity decoupled from spiraling prices in 2021-22.

- The global thirst for U.S. natural gas. Natural gas is more climate-friendly than coal and a better complement for renewables in power generation. So consumption is growing rapidly in Europe and Asia, spurring a surge in U.S. exports. This benefits U.S. producers to an extent, but infrastructure constraints cap the potential for growth. Despite rising energy costs, many politicians are reluctant to compromise their climate credentials by supporting pipeline or export terminal approvals.

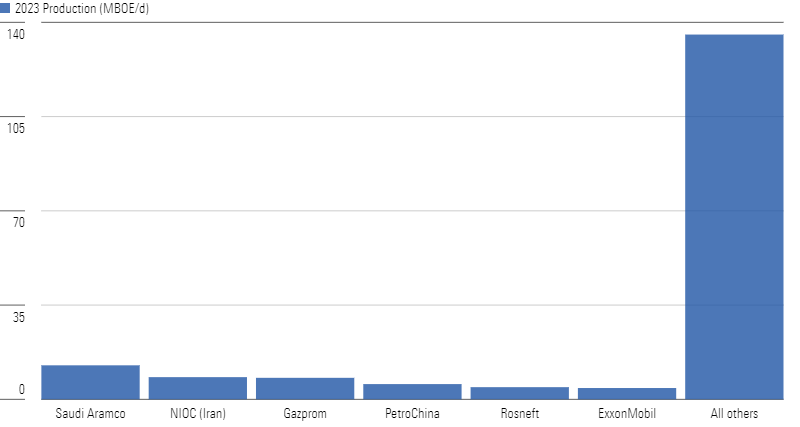

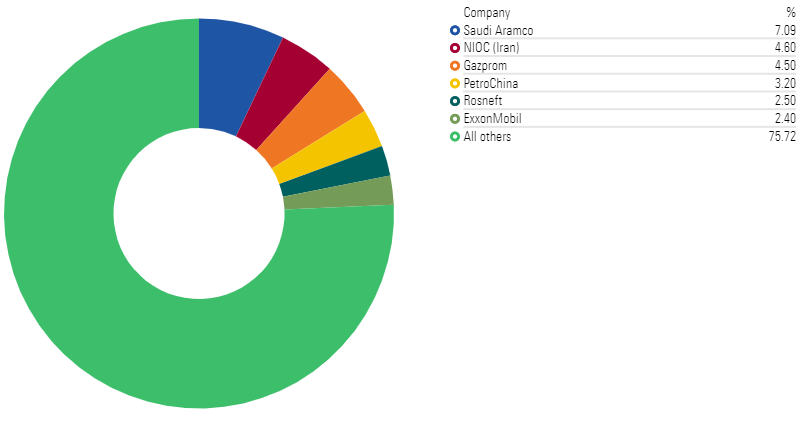

Market Share of Key Players in the E&P Industry

The oil and gas E&P industry is extremely fragmented, befitting the fact that its product is fungible and a global commodity.

The largest producers tend to be national oil companies backed by governments and include Saudi Aramco, Gazprom, and PetroChina. The extreme fragmentation of the industry typically results in intense competition, giving rise to OPEC, which attempts to exert a level of control over the market and oil prices.

National Oil Companies Occupy the Top Spots...

But They Don’t Hold Control

Are There Any Moats to Be Found?

Moats are relatively rare in the oil and gas E&P industry. More than half of companies in our E&P coverage—68%—have a Morningstar Economic Moat Rating of none, compared with the cross-sector average of 42%.

We assign no wide moat ratings in the E&P space, as the uncertainty regarding long-term oil and gas prices is simply too high. But low-cost producers can earn narrow moats: We assign narrow moat ratings to 32% of our coverage, compared with the cross-sector average of 41%.

The largest oil and gas E&P companies with narrow moats are:

- Devon Energy

- Diamondback Energy

- EOG Resources

- Hess

- Pioneer Natural Resources

- ConocoPhillips

| Stock | Ticker | Morningstar Rating | Fair Value Estimate (as of Feb. 14, 2024) | Price/Fair Value Estimate (as of Feb. 14, 2024) | Uncertainty Rating |

|---|---|---|---|---|---|

| Devon Energy | DVN | 4 stars | $60 | 0.70 | High |

| Diamondback Energy | FANG | 3 stars | $169 | 0.98 | High |

| EOG Resources | EOG | 4 stars | $129 | 0.86 | Medium |

| Hess | HES | 4 stars | $176 | 0.81 | High |

| Pioneer Natural Resources | PXD | 4 stars | $274 | 0.83 | Medium |

| ConocoPhillips | COP | 3 stars | $101 | 1.09 | High |

All E&P moats are predicated on the cost advantage moat source. Maintaining production costs well below the long-run industry marginal cost is the only real way to generate excess returns on invested capital. Oil and gas companies produce undifferentiated commodities, often widely fungible. Therefore, other moat sources—like switching costs, network effect, brands or patents, and efficient scale—aren’t available.

Disciplined capital allocation, efficient operations, and leading-edge technology do help lower unit costs, but these characteristics are theoretically replicable and do not guarantee a durable competitive advantage.

Instead, moats are determined by access to resources with intrinsically low extraction costs. This is determined by geological characteristics, such as product mix, reservoir quality, formation thickness, and depth. We also consider processing needs, transportation distances, infrastructure, and the runway of potential drilling opportunities (since geological deposits are finite and eventually deplete).

Industry Outlooks: Crude Oil and Natural Gas

We believe reports of oil demand’s death have been greatly exaggerated.

We expect oil demand to drop by 11% through 2050, down to 88 million barrels per day in 2050 from 99 mmb/d in 2019. That’s less of a decline than some may expect. We’re optimistic on EV adoption, which will slash road fuel demand, but not every component of oil demand can be electrified.

- Light-duty vehicles. Our bullish views on electric vehicles drag our gasoline consumption forecast below the consensus business-as-usual case. We think EVs will account for 57% of the vehicle fleet by 2050. We’re still above the consensus bear average because we’re more pessimistic on efficiency gains for internal combustion engines.

- Road freight. Freight trucking (including, eventually, long haul) is an ideal candidate for electrification, though conventional wisdom is surprisingly pessimistic.

- Ships and planes. Even the consensus business-as-usual average incorporates rosy assumptions on efficiency gains as well as unduly pessimistic views on air travel and marine freight volume. For planes, substitute fuels are exorbitantly expensive. For ships, we think displacement of oil by green ammonia will be modest.

- Petrochemical feedstock. We’re way above the business-as-usual average despite incorporating optimistic assumptions for recycling uptake (which will reduce demand for virgin plastics). The consensus forecasts seem to imply plastics demand far below historical trends, along with unrealistic assumptions for recycling.

On the natural gas side, we believe that global liquefied natural gas demand is the most important growth driver for the U.S. gas market.

Since 2010, global LNG demand has increased about 5% annually. We expect that pace to accelerate to 7% annually between 2022 and 2027.

We build our forecast on a country-by-country basis, considering gross domestic product growth rates, electricity growth and gas power sector demand, renewables growth, and domestic production, and we factor in GDP/electricity intensity changes over time, among other assumptions. China will be the main engine for this expansion.

While growth will be lower than historical levels, there’s still scope for further expansion, and that should drive up natural gas consumption in the industrial and power generation sectors, with natural gas taking a larger slice of the electricity mix going forward.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)