Energy: Stocks Are Weaker In Wake of Israel-Hamas War Amid Oil Demand Concerns

We currently like the prospects for ExxonMobil, APA, and Equitrans Midstream.

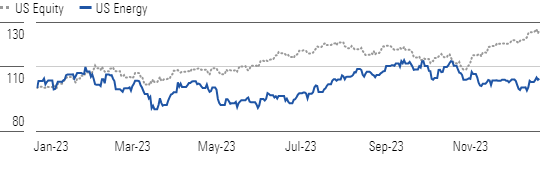

After the energy sector’s strong performance in the third quarter, we were not surprised to see it flatline in the fourth and underperform the broader market. The market is very much in wait-and-see mode, with 2024 budgets and initial guidance from management teams arriving soon.

Our top picks among energy stocks are:

Real Estate Sector Underperforming Broader U.S. Equities In 2023

Concerns over OPEC+ output cuts by Russia and Saudi Arabia tightening the market have been diminished in the wake of ongoing oil demand weakness. These factors account for the decline in oil prices following the initial spike in the wake of the outbreak of war between Israel and Hamas, and have no doubt played a major factor in the new 2.2 million bbl/d of OPEC+ cuts in the first quarter of 2024.

Only about 896,000 bbl/d are incremental to existing voluntary cuts, which we expected to be extended. All these cuts are voluntary instead of official OPEC adjustments, meaning it is harder for OPEC+ to police and enforce compliance. The cuts include an extension of the Saudi Arabian “lollipop” of 1 million bbl/d first announced in June 2023. Russia will increase its voluntary cut to 500,000 bbl/d from the 300,000 bbl/d announced earlier this year, consisting of 300,000 bbl/d of crude oil and 200,000 bbl/d of refined products.

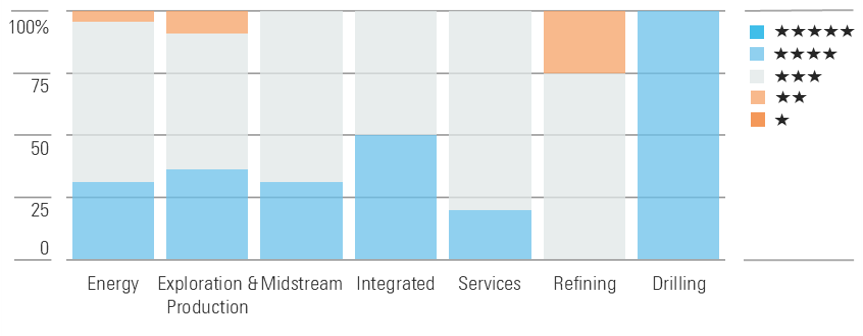

More Bargains Are Showing Up In the Energy Sector

Like last quarter, we continue to believe the market remains laser-focused on potential gas supply disruptions, including Australian liquefied natural gas strikes, a cold European Union winter, and any potential disruptions from the Israel-Hamas conflict. We anticipate the market will be volatile until late 2024, when new U.S. liquid natural gas export capacity is added, acting as a market-relief valve.

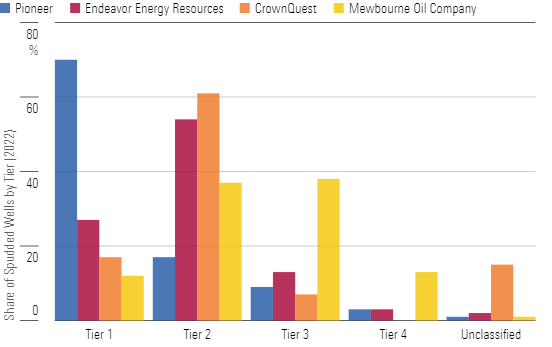

Permian M&A Is Red-Hot; With Pioneer and CrownRock Acquired, Endeavor Next?

After ExxonMobil’s deal to acquire Pioneer, we believe acquirers will have to accept a large step down in acreage quality for the Permian Basin. Speculation has focused on three major private operators due to potential valuation discounts compared with public operators, as well as capital constraints given higher interest rates. With CrownRock (owned by CrownQuest) just acquired by Occidental Petroleum OXY, the focus now shifts to a potential Endeavor sale. We think U.S. gas inventories continue to look ugly. We would not be surprised to see inventory levels exceed five-year averages by more than 20% sometime this winter. We would not expect to see sustained drawdowns until new U.S. LNG capacity is added in late 2024.

Top Energy Sector Picks

ExxonMobil

- Fair Value Estimate: $123.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

ExxonMobil plans to double earnings and cash flow from 2019 levels by 2027 on a combination of structural operating cost reductions, portfolio improvement, and growth across its upstream, downstream, and chemical segments. Exxon estimates that under the current plan, it will generate about $100 billion in surplus cash (after funding investments and paying the dividend) during the next five years. Combined with current higher-than-expected commodity prices, its repurchase program of $35 billion through 2024 is likely just the beginning.

APA

- Fair Value Estimate: $56.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

APA is hoping for a game-changer with its exploration assets in Suriname. The firm has announced a string of promising discoveries, and it may have a final investment decision in 2024. We think the project will move forward and the market isn’t giving the company enough credit. Our fair value estimate assumes three production vehicles with 180 mb/d capacity. That pegs Suriname at a sizable percentage of APA’s equity, so we like the upside as a catalyst-driven name that might outperform in a challenging oil and gas price environment.

Equitrans Midstream

- Fair Value Estimate: $15.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

With the path forward now clear for the Mountain Valley Pipeline, we continue to think the stock is undervalued, as investors are no longer pricing in an MVP cancellation but are not fully reflecting its contributions either. We think Equitrans Midstream will likely bring the related projects Hammerhead and MVP Southgate online. When combined with other MVP-related opportunities, including expanding the MVP to 500 million cubic feet per day, EBITDA should increase about 40% from 2023 levels.

Top Energy Sector Picks Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)