COVID-19 Sales Have No Major Impact on Drug and Vaccine Manufacturers We Cover

However, the biopharma industry's ability to adapt and innovate to treat disease reinforces our moat ratings.

After assessing the market for COVID-19 vaccines and treatments, we offer our company-specific outlooks.

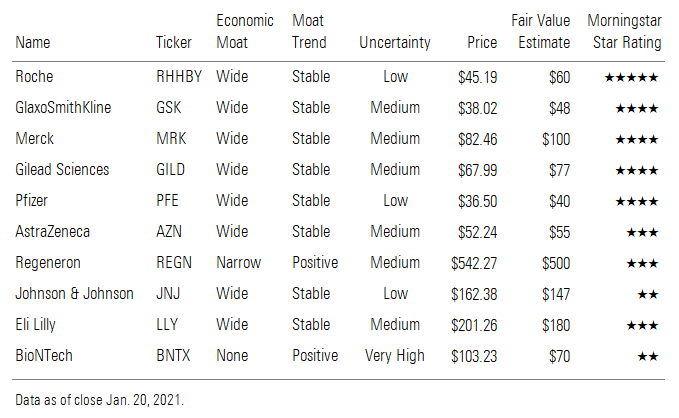

Despite significant COVID-19 vaccine and treatment sales potential in 2021, the uncertain market duration prevents significant impact on our discounted cash flow-based fair value estimates. That said, several biopharma companies with COVID-19 treatments (Gilead GILD, Roche RHHBY, Glaxo GSK, and Merck MRK) look undervalued on the basis of strong potential for their core businesses. COVID-19 vaccine companies generally appear fairly or overvalued, although AstraZeneca AZN and Pfizer PFE trade at slight discounts to our fair value estimates.

- We forecast a $39 billion COVID-19 vaccine market in 2021, as the most developed markets achieve herd immunity, and a $16 billion market in 2022, as less developed markets see vaccine distribution beginning in 2021 but extending into 2022-23.

- We forecast over $10 billion in global sales for newly authorized treatments, led by antibody treatments from Eli Lilly LLY, Regeneron/Roche REGN and GlaxoSmithKline/Vir VIR, for mild to moderate patients and Merck's CD24Fc, Lilly's Olumiant, and Gilead's Veklury for hospitalized patients.

- We do not include postpandemic (post-2023) sales for vaccines or treatments because of uncertainty around future transmission and competition.

- We expect $13.7 billion in global sales for Pfizer/BioNTech's BNTX Comirnaty in 2021 and significant profits through 2022, given premium pricing, strong supply, first-to-market status, and high efficacy.

- Despite its much lower vaccine manufacturing capacity, we expect Moderna MRNA to see $8 billion in 2021 revenue related to its COVID-19 vaccine mRNA-1273, driven by Operation Warp Speed in the first half of 2021 and sales to other developed markets in the second half.

- We see uncertainty around authorization of additional vaccines, but data from Johnson & Johnson JNJ, Novavax NVAX, and AstraZeneca in the first quarter will clarify how broadly capacity can stretch in 2021. We assume the United States will see sufficient supply to achieve herd immunity by mid-2021.

The majority of the larger biopharma companies we cover have wide economic moats. We believe their innovative power reinforces the strength of the group’s core pillar of competitive advantage that is sourced through intangible assets. Herd immunity is likely to cap COVID-19 vaccine and treatment sales over a much shorter period than is applicable to our decade-plus outlook for a moat, but the speed of the effective development shows how the industry can adapt and innovate to treat disease. We believe this partially reflects development strength that applies in more traditional disease settings where the sales cycle is much longer.

As we expect a relatively short period to achieve herd immunity, we don’t see a major impact from COVID-19 treatments and vaccines on the valuations of larger biopharma companies. Strong sales will be beneficial, but the steep drop-off means a relatively modest impact on our discounted cash flow valuation models. Nevertheless, we do expect the strong goodwill engendered with policymakers to begin to reduce the risk overhang on the group due to concerns about major drug pricing reforms, especially in the U.S., where aggressive drug pricing controls have been discussed but look less likely as the industry is solving the COVID-19 pandemic.

Pfizer/BioNTech Have First and Potential Best-in-Class Vaccine

- We assume $13.7 billion in global sales of BNT162b2 in 2021 and $1.8 billion in 2022.

- We forecast the vaccine to contribute 22% of Pfizer's top line and 17% of operating profit in 2021.

- Cold chain requirement and mRNA vaccine manufacturing difficulties could focus supply on the most developed markets.

- We expect a March biologics license application filing and progress in use with children.

We see the strongest sales in the second and third quarters of 2021 as supply ramps and sales are still focused heavily on the U.S. and other developed markets. We think BNT162b2’s ultracold chain requirement will make strong uptake in developing markets more difficult, particularly if other vaccine manufacturers in late-stage development are successful.

While the novelty of mRNA technology means that questions will remain around long-term safety, data for Pfizer/BioNTech’s BNT162b2 so far has been stellar, and we think mRNA technology has two key advantages over other manufacturing methods:

- BioNTech's mRNA technology is highly adaptable to any changes in the COVID-19 virus that may appear.

- There is no vector to interfere with boosting mRNA-based vaccines, which could not only improve efficacy during the pandemic, but also allow additional focused vaccination if the virus becomes endemic in certain geographic regions.

Ultracold chain storage is a unique challenge for Pfizer/BioNTech’s vaccine, as this creates special handling conditions that are not required for other vaccines. We think thermal shippers and dry ice supply should be sufficient to preserve vaccines during shipment and at vaccination sites, as we don’t expect vaccine to sit unused for weeks on end. For mRNA vaccines as a class, Pfizer specifically cited uncertainty around lipid supply and manufacturing of lipid nanoparticles; both raw materials and LNP manufacturing equipment is being scaled for the first time, so there could be issues with supply of raw materials.

Pfizer/BioNTech are innovating to improve the delivery and supply of their vaccine. The biopharma companies are working on a lyophilized formulation that could be refrigerated and reach the market in early 2022, as well as BNT162b3, a self-replicating version that would require much lower doses and could therefore protect more people. A potential combination flu vaccine could also be available in 2022, likely combined with the Pfizer/BioNTech program that formed the initial, pre-COVID collaboration between the two companies.

Moderna’s U.S. Vaccine Sales Should Parallel Pfizer’s in 2021

- Reported sales could easily exceed our $8 billion global sales forecast for mRNA-1273 in 2021, given Moderna's recent announcement of $11.7 billion in contracts for 2021. We expect $1.5 billion in sales in 2022.

- We assume 70% gross margins and operating margins around 50%.

- Similar efficacy and more flexible storage could give Moderna an edge, but vaccine manufacturing capacity in 2021 is less certain.

- We expect a March 2021 biologics license application filing and progress in use with children; half-dose potential is still unclear.

Moderna’s U.S. contract is sizable, and convenience is actually better than Pfizer’s vaccine thanks to standard freezer and refrigerator storage. However, Moderna’s vaccine manufacturing capacity should prevent it from seeing global sales ahead of Pfizer/BioNTech in 2021. We see the strongest global sales in the second and third quarters of 2021 as supply ramps. While efficacy looks similar to Pfizer/BioNTech’s vaccine, adverse reactions to the shot appear slightly worse, particularly at the grade 3 or higher level. Operation Warp Speed could test lower doses to see if it’s possible to maintain efficacy and improve tolerability (while also increasing supply).

Moderna’s vaccine is the second one authorized in the U.S. We think the mRNA technology this vaccine and Pfizer/BioNTech’s use has advantages over other vaccine technologies, despite its novelty. This technology is highly adaptable to any changes to the COVID-19 virus that may appear in the future, and can also be used as a booster, both as a second shot during the pandemic or an additional shot in the years to come, if the virus becomes endemic.

We imagine Moderna is facing the same potential vaccine manufacturing constraints as Pfizer. Moderna started development of a seasonal flu vaccine in September 2020, and we think the company could follow a similar strategy as Pfizer/BioNTech, potentially combining coronavirus and flu vaccines into a single seasonal shot as early as 2022.

AstraZeneca’s Global Sales Could Be Limited to International Markets

- We assume $2.9 billion in global sales of AZD1222 in 2021 and $2.6 billion in 2022; the vaccine is a single-digit portion of our 2021 overall sales forecast.

- Disappointing efficacy and trial stumbles could prevent U.S. approval and limit use to international markets, unless near-term U.S. phase 3 data shows significant improvement.

- A key U.S. phase 3 readout is expected in February.

We expect that supply to less developed markets will dominate for Astra, and despite the lower price point in these markets, we expect this will also be the dominant part of AZD1222 global sales. AZD1222 benefits from significant global vaccine manufacturing capacity and refrigerated storage and distribution temperatures. However, mixed data from international phase 3 studies and U.S. phase 3 data still to come adds uncertainty around this product, with significant remaining questions on the best dosing strategy and safety. We assume that the U.S. will not approve AZD1222 based on existing phase 3 trials, but we still see a 90% probability of approval in other key markets like the European Union. That said, AstraZeneca entered this space with a not-for-profit strategy, so our analysis here has little to no impact on our fair value estimate.

While AstraZeneca is not historically known as a vaccine manufacturer, its partnership with Oxford allowed it to jump to the lead of the COVID-19 vaccine pipeline with AZD1222. The vaccine’s adenoviral vector technology allows for rapid design and affordable manufacturing scale-up; vaccine manufacturing only requires a limited number of bioreactors of cells to churn out large quantities of the viral vector. We expect this technology is also highly adaptable to any future changes to the COVID-19 virus. We think this technology has advantages in the scale and cost of production but could have disadvantages if those immunized form immune responses to the vector and are less responsive to boosters or potential future doses if the virus becomes endemic.

After the pandemic, AstraZeneca could actually be more focused on the long-acting passive antibody program, AZD7442, which could be an alternative form of prevention for those who are not good candidates for vaccination. This could still be a good fit for the company, given AstraZeneca’s experience with antibodies in infectious disease with RSV antibody Synagis and pipeline drug nirsevimab. However, the challenge with AstraZeneca’s antibody program is timing, with data not expected until early 2022 for the key phase 3 studies. By 2022, we expect a much smaller market for antibodies and a fairly strong entrenchment of competitive antibodies from Eli Lilly and Regeneron/Roche.

Johnson & Johnson’s Global Sales Concentrated in Developing Markets

- We assume $2.4 billion in global sales of J&J's adenoviral vector vaccine in 2021 and $2.5 billion in 2022; the vaccine is a single-digit portion of our 2021 sales forecast.

- If near-term phase 3 data is positive, this single-dose, refrigerated vaccine could become foundational to the global recovery.

- A key U.S. phase 3 readout is expected in January, with data for the two-dose regimen likely in the second quarter.

As with AstraZeneca, we expect that supply to less developed markets will dominate for Johnson & Johnson. J&J’s vaccine is stable at refrigerated temperatures for three months, making distribution similar to standard practice for other vaccines and easier than for already authorized mRNA vaccines from Pfizer/BioNTech and Moderna. The company’s potential ability to supply over 1 billion COVID-19 vaccine doses in 2021 could allow it to serve as a solution in multiple markets.

We have relatively minimal data so far, and we’re concerned that efficacy may not approach that of the Pfizer/BioNTech and Moderna vaccines. We therefore assume a 50% probability of approval, which cuts our potential global sales estimates in half. Johnson & Johnson also began testing a two-dose regimen of its vaccine in a phase 3 trial in November 2020 to examine any potential benefits for duration of protection, although it is unclear how well two-dose adenoviral vector vaccines will perform in practice. Johnson & Johnson is planning to enter this space with a not-for-profit strategy, so our analysis here has little to no impact on our fair value estimate.

Novavax Benefits From Significant Global Vaccine Manufacturing Capacity

- We assume $2 billion in sales of Novavax's antigen-based vaccine in 2021 and $1 billion in 2022.

- Promising phase 1 data and high vaccine manufacturing capacity point to a potential global benefit but may require a U.S. trial for authorization.

- International data could support a U.S. emergency use authorization early in the second quarter.

Novavax is a development-stage vaccine manufacturer that had a key focus on influenza prior to COVID-19. The company uses an established antigen technology that is combined with its Matrix-M adjuvant to allow for low doses (and therefore higher supply). We expect that U.S. and other developed-market sales will be the dominant source of sales for Novavax, although lower-priced, less developed markets should dominate on a volume basis. NVX-CoV2373 benefits from significant global vaccine manufacturing capacity and refrigerated storage and distribution temperatures. We think strong phase 1 data and established antigen technology bode well for the efficacy and safety of the Novavax program.

However, with phase 3 data from a U.K. study due in the first quarter and a phase 3 U.S. study that began at the end of December, the timing of availability is less certain than other leading programs. We therefore assume a 60% probability of approval.

CureVac’s Efficacy Bar Is Still High

- We assume $900 million in global sales of CVnCoV in 2021 and $500 million in 2022.

- The vaccine's self-amplifying technology could be differentiating.

- We expect phase 3 data in February and authorization in the second quarter.

Due to its position as a later entrant, as well as potential constraints on supply and a sizable European contract, we don’t model U.S. sales for CVnCoV. CureVac’s technology could makes its vaccine a preferred mRNA vaccine in the long run, thanks to its self-amplifying technology that reduces dosing and its convenient refrigerator storage. However, with less certainty surrounding data and vaccine manufacturing scale-up, we assign a 40% probability to our global sales estimates for CVnCoV. Bayer signed on as CureVac’s collaboration partner in January 2021, which we expect will provide CureVac with important regulatory and commercialization expertise as well as better positioning to enter markets outside Europe in the long run.

CureVac could be the third mRNA vaccine to reach the market, although its development is significantly behind leaders Pfizer/BioNTech and Moderna. CVnCoV’s self-amplifying technology significantly lowers dosage, although vaccination still requires two doses. Its potency also allows its manufacturing capacity to be stretched across more people. CureVac’s clinical-stage pipeline isn’t nearly the size of its peers, but previous work on rabies vaccine CV7202 provides some validation of its technology.

CVnCoV only requires refrigeration, which would allow it to travel the standard cold chain for supply of vaccines globally and making it potentially the most convenient mRNA vaccine. However, if phase 1 data is any indication, CureVac could struggle to match Pfizer/BioNTech and Moderna on efficacy. CureVac’s is likely the last mRNA vaccine to be capable of significant use in 2021.

Sanofi’s Disappointing Early Data Likely Pushes Vaccine to International Markets in Late 2021

- Overall, we assume $200 million in global sales of Sanofi's antigen-based vaccine in 2021 and $300 million in 2022; the overall financial impact is not material.

- The technology is established, but disappointing phase 1 data adds uncertainty.

- Phase 2b will start in February, and phase 3 in the second quarter.

Sanofi has two programs: an antigen vaccine using an adjuvant from Glaxo, and a novel mRNA vaccine via a collaboration with Translate TBIO. Sanofi based the vaccine manufacturing process for its antigen vaccine on its influenza Flublok technology, allowing it to use the same facilities, and mRNA vaccines require smaller investment and a smaller footprint for manufacturing. However, Sanofi’s lead program, the antigen vaccine, had disappointing top-line phase 1/2 data in December 2020. We expect that other developed-market sales will be the dominant source of sales for Sanofi, although lower-priced, less-developed markets should dominate on a volume basis.

Sanofi benefits from significant global vaccine manufacturing capacity and refrigerated storage and distribution temperatures. However, Sanofi had disappointing early-stage data, and late-stage development has been delayed as the company tweaks its formulation. We therefore assume only a 30% probability of approval.

Merck Has Established Technology, but Lack of Data Adds Uncertainty

- We assume roughly $200 million in annual global sales of Merck's replicating viral vector vaccines in 2021 and 2022, with no significant financial impact.

- Merck's COVID-19 treatments look more promising in the near term.

- Two vaccines are poised to enter phase 3 in 2021, including a potential one-dose oral.

Merck has two vaccines in phase 1 studies, so it is still determining the best dosing regimens and formulations. Merck is using established platforms that should allow for the production of hundreds of millions of doses if the vaccines are approved, particularly as the viral vectors are replicating and could require lower doses. The biggest potential innovation from Merck could be an oral formulation for V590, which would give the company a significant advantage for distribution (particularly in developing markets, which would still have very high unmet need when Merck’s vaccines are cleared for use) and could also be an appealing option for vaccine boosters beyond the pandemic. Both vaccines could require a single dose, which would improve convenience and also contribute to uptake in developing markets. However, given the lack of data and established competition, we assume a 20% probability of approval.

While Merck’s development efforts are lagging competing COVID-19 vaccines and drugs, the company is catching up quickly in the treatment space with CD24Fc and molnupiravir, which it's developing with Ridgeback Biotherapeutics. Overall, we project $1 billion in CD24Fc treatment sales in 2021, followed by a sharp decline in 2022 as vaccines drive herd immunity in most developed countries. While CD24Fc is a fusion protein that is more complicated to manufacture than a small molecule, we still project gross margins of close to 95%.

Oral antiviral molnupiravir holds potential in both nonhospitalized and hospitalized patients, with key data expected in May, following a smaller study readout in February. With only limited data available for molnupiravir, we project a 50% chance the drug reaches the market, generating close to $250 million in 2021.

Eli Lilly Is Creating Viable COVID-19 Treatment Options Quickly

- COVID-19 use could add $1 billion in incremental global sales for repurposed Olumiant in 2021.

With very few treatment options available for COVID-19 patients, we believe Lilly has brought forward two viable treatment options: bamlanivimab for mild to moderate patients and Olumiant (baricitinib) for hospitalized patients. Bamlanivimab looks well positioned to help reduce the strain on hospitals dealing with COVID-19, as data shows only 1.6% of patients receiving the antibody needing hospitalization versus 6.3% of those on placebo.

We expect an increase in utilization with government efforts. The U.S. government has committed over $1.1 billion to Eli Lilly for bamlanivimab, and we project the company will be able to ramp supply to almost 3 million doses in 2021. We expect these will be fully purchased, given our estimate of over 30 million COVID-19 patients to be diagnosed in developed markets in 2021.

Bamlanivimab’s dosage and likely global pricing imply gross margins close to 85% for the drug. Also, we expect the addition of Lilly antibody etesevimab to bamlanivimab in early 2021 based on better efficacy data than bamlanivimab alone. However, given the likely dose for etesevimab, we expect the gross margin to fall closer to 60% for the combination treatment.

Regeneron/Roche Have Well-Positioned COVID-19 Antibodies

- We expect $3.4 billion in global sales in 2021 for the antibody cocktail.

- We believe the gross margin on the treatment is close to 70%.

Regeneron/Roche’s antibody cocktail REGN-COV2 (casirivimab and imdevimab) is targeted at COVID-19 patients who are not yet hospitalized but are considered high risk. Regeneron’s data has shown a promising ability to lower viral loads and reduce rates of hospitalization.

Combined with the manufacturing strength of Roche, we expect the companies can produce close to 3 million doses of the drug cocktail in 2021. We expect costs on the selling front to help the physician community adapt to the challenges of IV infusion, but we still project overall operating margins over 50%. According to the terms of the collaboration, Regeneron will see roughly 50%-60% of gross profits, and Roche 40%-50%. We therefore split our $3.4 billion global sales forecast for REGN-COV2 in 2021 equally, assigning $1.7 billion in sales to each company.

Gilead Owns First-to-Market COVID-19 Treatment

- We expect $2.9 billion in Veklury sales in 2020 (not far from Gilead's recent guidance of $2.8 billion-$2.825 billion), followed by $2.1 billion in 2021.

Veklury gained full Food and Drug Administration approval in October 2020 following an emergency use authorization in the U.S. in May as a treatment for severely ill, hospitalized patients with COVID-19. The Infectious Diseases Society of America recommends Veklury based on the drug’s ability to reduce recovery time in hospitals, which is important given the strains on the hospital system. However, the World Health Organization recommended against the use of the drug in November, based partly on a large controlled WHO study showing no mortality benefit.

Our global sales forecast attempts to balance the mixed data with potential high demand as one of the only treatment options for severe COVID-19. Beyond the negative stance taken by WHO, we think disappointing data from the Solidarity study could have negative implications for global uptake of the drug in the fourth quarter of 2020 and into 2021. However, the recent full FDA approval in hospitalized patients and Gilead’s comment that the drug is used in roughly 40%-50% of U.S. hospitalized COVID-19 patients likely means demand will remain.

We don’t assume any benefit to Veklury sales from new indications or formulations. Data that could expand Veklury’s use outside the hospital--including a trial with an inhaled formulation of the drug--is coming in the first quarter of 2021, but newer competition will likely slow Veklury demand.

GlaxoSmithKline: Third-to-Market Antibody Still Holds $1 Billion Potential

- We project close to $1 billion in VIR-7831 global sales in 2021.

While Glaxo and partner Vir will likely reach the antibody treatment market third, following the already authorized drugs from Lilly and Regeneron/Roche, we expect the entrenched competition will not be able to produce enough supply to meet the demand. With 30 million people in key developed markets likely to be infected with COVID-19 in 2021 and potential for only 6 million doses of competing antibodies from Lilly and Regeneron/Roche, we believe a large market opportunity still exists for Glaxo/Vir’s VIR-7831.

With key data likely in early 2021, the drug will likely still be available during the peak of the pandemic, driving substantial sales. Based on the proven mechanism of action by Lilly and Regeneron/Roche and some limited data, we project a 75% probability VIR-7831 gains emergency use authorization in the first quarter. Supply is uncertain, especially since Glaxo’s existing product portfolio is not focused on antibodies.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)