Consumer Defensive: Moaty Operators Should Win Amid Intensifying Competition

Despite trailing the broader market over the past year, the space isn’t flush with bargains.

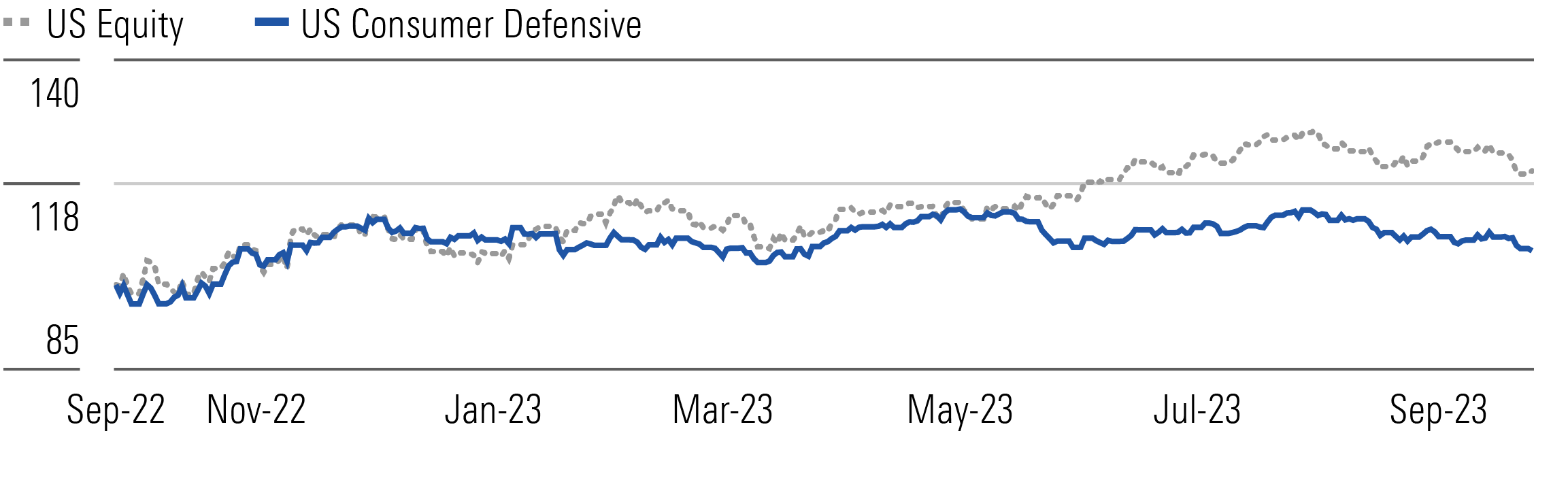

The Morningstar US Consumer Defensive Index significantly trailed the broader market over the past year, printing just a 6.1% gain versus the market’s 20.3% appreciation.

Consumer Defensive Stocks Lagged the Market’s Gain the Past Year

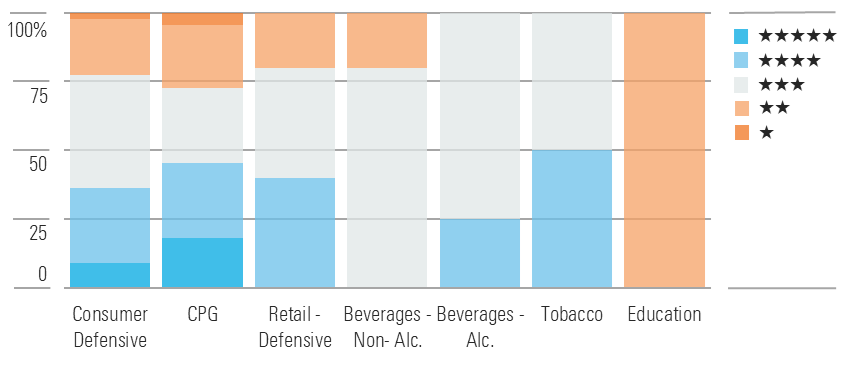

The space isn’t flush with bargains, however, as the median consumer defensive stock now trades at just a 9% discount to our fair value estimate. Nonetheless, we see compelling investment opportunities in the realm of consumer-packaged goods, or CPG, where roughly 36% of our coverage resides in 4- or 5-star territory. We suspect heightened competitive pressures and macro uncertainties have called into question whether operators will keep investing in their brands or favor near-term share and profit gains. We view this spending as key in supporting brand relevance and pricing power in the sector.

CPG Operators Largely Remain In the Bargain Bin

Consumers are facing pressures on their pocketbooks (like higher interest rates, increased gas prices, and the resumption of student loan repayments), which may prompt increased trade down to lower-priced private label fare and/or a shift in spending to more value-oriented discount stores. Against this backdrop, we surmise CPG volumes could remain depressed, even after lapping several rounds of pricing in recent years. We posit that stepped-up promotional spending (which has lain idle in light of massive supply/demand imbalances) could be utilized to thwart declining unit sales and market share losses. While this could shake the near-term competitive landscape, we still believe leading competitively advantaged branded operators will prioritize brand investments in the longer term to bolster their standing with retailers and end consumers.

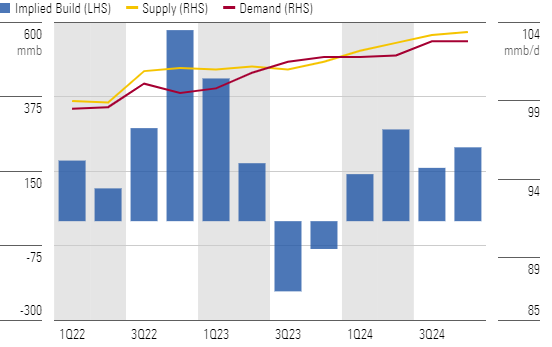

The Oil Market Will Be Short of Supply for the Rest of 2023

To combat stagnating CPG growth, acquisition deals have surged after lying dormant for the past few years. This has come despite rising interest rates, which make such purchases more expensive. We see the strategic merits of tie-ups that open the door to more attractive categories and geographies (that is, those that boast a more robust growth profile) and/or complement the acquirer’s existing product portfolio. However, we don’t believe buying growth necessarily stands to buoy the competitive standing of operators across the sector, and paying too much could challenge the ability to unlock any potential benefits of the transaction.

Top Consumer Defensive Sector Picks

Estée Lauder Companies

- Fair Value Estimate: $249.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

We believe Estée Lauder’s EL shares are attractive, trading at a 41% discount to our fair value estimate. While a slow travel retail recovery in China has been impairing demand and margins, we don’t think this will affect the firm’s long-term prospects. We believe the company’s stepped-up brand investments and solid execution will help bring its margins back to historical levels while ensuring the firm’s standing (underpinned by category-leading brands and preferred vendor status) remains in place. With this and the premiumization trends, we think the firm’s stock will gravitate to our valuation over time.

The Kraft Heinz Company

- Fair Value Estimate: $53.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Kraft Heinz KHC trades at a 36% discount to our fair value estimate while boasting a 4% dividend yield. We suspect investors are skeptical about the firm’s ability to lean on price increases without a material volume contraction in a challenging economic and competitive environment. However, we have a favorable view of the company’s efforts to unearth cost savings and extract inefficiencies to support brand investments, which should help support its volume in the long term.

Anheuser-Busch

- Fair Value Estimate: $90.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

Shares of Anheuser-Busch BUD are trading at a 37% discount to our valuation. While we sense investor concerns about the firm’s near-term financial risk, we think the favorable effects of a weaker U.S. dollar against some major currencies should provide a tailwind over the next 12 months. Further, if the firm continues to grow EBIT as inflation slows, this should help accelerate the reduction of the net debt/EBITDA ratio. In the long term, we believe the company will benefit from its dominant position in developing countries in Africa and Latin America, given those markets’ structurally higher growth prospects.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)