Consumer Behavior Changes Reshape Restaurant Industry

While we believe that most publicly traded restaurant companies will survive COVID-related disruptions, we still believe that the worst may be yet come for the broader industry.

There is little question that 2020 will go down as one of the most challenging years restaurant operators will ever face and will transform virtually every aspect of the restaurant experience. Before COVID-19, restaurant operators were already undergoing a period of change, including shifts in consumer attitudes regarding digital ordering, delivery, drive-thrus, health and wellness, and dining-in experience. Pandemic-related government-mandated operating restrictions have accelerated many of these trends and left many operators scrambling to catch up, or in many cases fighting for survival. We expect the restaurant industry will become a winners/losers situation after the pandemic, where companies that have invested in new technologies, digitally enabled restaurant formats, and more efficient operational procedures are poised gain market share at the expense of smaller independent players, many of which are unlikely to survive.

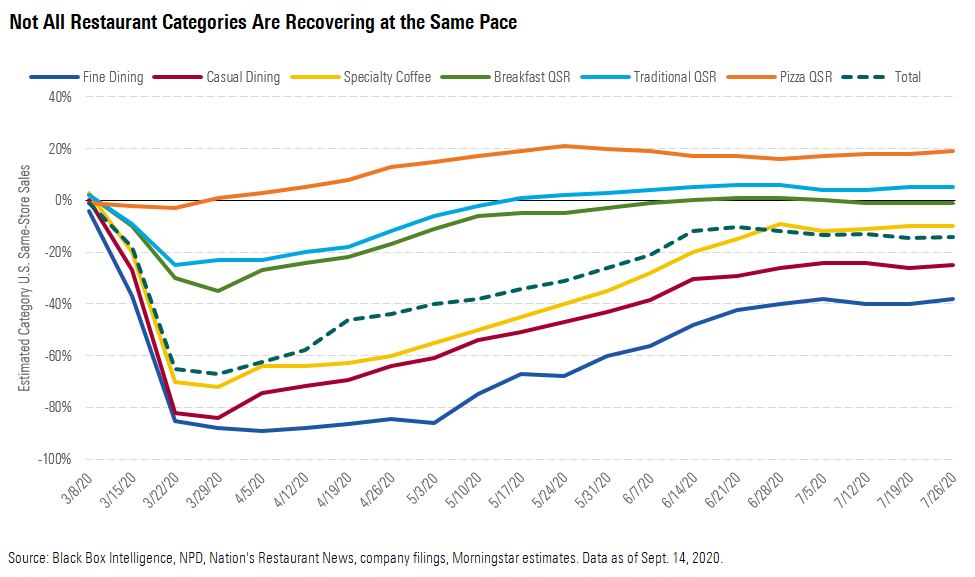

We believe we’re effectively seeing six different recoveries play out across the restaurant industry:

- Fine dining restaurants that may still be closed, operating under restricted guest counts, and/or do not offer delivery/to-go options remain most pressured. Many of these concepts continue to post same-store sales declines of 30%-40% and will probably see only a gradual improvement over the next several months as macro pressures start to replace COVID-19 concerns and consumers still navigate some apprehension about dine-in experiences.

- Casual dining remains well below industry averages, with same-store sales declines of 20%-30%, as operators struggle with in-restaurant dining restrictions in certain markets. However, many of these operators have taken their time to develop takeout and delivery options, with some now posting strong relative growth.

- Specialty coffee has been hit hard by the increase in work/school from home and its impact on morning commuters. Sales trends for specialty coffee chains have improved the past few months--with most chains posting mid- to high-teens declines--as these locations open up and employees return to workplaces. Nevertheless, we anticipate that specialty coffee will lag drive-thru and delivery-oriented concepts through early 2021.

- Breakfast quick-service restaurants are trending ahead of the specialty coffee category due to drive-thru capabilities but lag traditional QSR peers because of the decline in morning commuters. We expect this group to continue to lag the broader industry but with an acceleration across the back half of the year due to new value offerings.

- Traditional QSR and fast-casual concepts saw same-store sales growth bottom out in the negative low to mid-20s and now run in the positive low- to mid-single-digit range for many operators. For several players, drive-thru represents 60%-70% of transactions and recent investments in delivery and mobile ordering are paying off in improved engagement among newly acquired customers.

- Pizza QSR companies continue to take significant share in this environment, with many posting comparable sales growth in the high teens to low 20s. Consumers operating under social distancing and other quarantine measures have gravitated to pizza QSR chains because of developed digital ordering platforms, consistent delivery capabilities, and attractive value propositions.

Not All Restaurant Categories Are Recovering at the Same Pace

Industry sales pressures have been largely the result of significant declines in guest counts. While the restaurant industry has been operating with low-single-digit comparable traffic declines for several years now, comparable traffic fell 10.8% in the first quarter of 2020 and nosedived 41.4% in the second quarter. Upticks in comparable ticket size have not been enough to offset these steep declines.

Despite current pressures, what can we expect going forward? For starters, we don’t expect the pizza QSR category to sustain 20%-plus comps over the balance of the year as nationwide lockdown measures ease, but we believe high-teens growth is a realistic expectation for the full year. Breakfast QSR concepts are likely to continue to lag other QSR concepts but should improve to positive territory in the back half of the year via value menu introductions and improved digital marketing efforts. We believe specially coffee will remain pressured through 2021. However, because this category is largely made up of small chains with five or fewer units, we believe there will be a significant shakeout as we head into next year, resulting in meaningful market share opportunities for the category’s survivors. Lastly, casual dining and fine dining concepts that lack to-go options, strong balance sheets, or access to funding will have a difficult time surviving with guest counts that are unlikely to return to peak levels over the foreseeable future coupled with several incremental safety, promotional, and operational expenses.

As sales trends have rebounded since mid-March, so have industry valuations. However, the valuation rebound has been disproportionate, with those players perceived as having sales growth potential over the next several years outperforming category peers and rewarded with valuations exceeding pre-COVID levels in many cases. In fact, a “FAANG”-like group of higher-growth names have separated themselves from the pack in recent months, including Chipotle CMG, Domino’s DPZ, Papa John’s PZZA, and Wingstop WING. We consider each of these names to have a leading delivery platform--which probably explains the relative valuation outperformance--and ample unit growth prospects in the years to come. However, we believe the market may be underestimating the longer-term potential of several other industry players.

The Worst May Be Yet to Come While we believe that most publicly traded restaurant companies will survive COVID-related disruptions, we still believe that the worst may be yet come for the broader industry. According to Yelp's second-quarter 2020 Economic Average Report, almost 16,000 U.S. restaurants have closed permanently since March 1, which represents about 2.5% of the 654,000 restaurants that existed at the end of 2019 (based on estimates from Euromonitor). A Sept. 14 report from the National Restaurant Association projects that at least 100,000 restaurants will close in 2020.

While our 2020 restaurant closure estimates are more conservative, we do expect closures to continue during the back half of the year and into 2021. With uncertainty regarding small-business and consumer stimulus efforts, elevated unemployment, and fewer opportunities for outdoor dining, we expect guest traffic to remain under pressure for the balance of the year for most restaurant categories (with pizza QSR and traditional QSR the notable exceptions). Coupled with reduced landlord concessions and incremental safety and operating expenses, we expect U.S. restaurant closures to continue into the third and fourth quarters of 2020, with 20,000-25,000 locations likely to close permanently by the end of the year.

We believe 2020 will be the first of multiple years of restaurant closures, with as much as 15% of restaurants in the U.S. presently at risk for permanent closure. Full-service restaurant chains are the obvious category at risk, but we also expect closures among smaller specialty coffee chains (chains under five units) and urban-focused fast-casual chains. Some of the vacated real estate will be replaced by surviving chains that have the financial flexibility to accelerate new openings as well as new restaurant formats like delivery hubs, ghost kitchens, and pickup or express formats. This suggests that it’s unlikely that reported gross restaurant closures will reach 15%, with mid- to high single digits likely to be the number of net closures reported when industry trends stabilize. In addition, some restaurant closures will be voluntary, as restaurants try to optimize and shift their store base to more suburban locations as consumers increasingly work from home.

We expect permanent restaurant closings to accelerate to around 30,000 net locations in 2021. We also expect net closures in 2022, but by this point, we expect those chains that have outlasted near-term headwinds will accelerate unit growth plans and open nontraditional locations.

After a nearly 10% decline in 2020, we expect the overall U.S. restaurant industry to resume growing in 2021 at a mid-single-digit clip and then a low-single-digit clip thereafter. As we project restaurant units continue to decline through 2022, our forecast implies that restaurants will post greater productivity out of existing locations in 2021 and 2022. We expect much of the productivity to come from changing consumer behavior, including digital ordering, improved delivery functionality, new to-go platforms for casual dining chains, and enhanced restaurant formats. Ultimately, we expect the industry to return to 2019 sales levels by 2023.

Consumer Behavior Will Continue to Reshape the Industry Many of the changes in consumer behavior regarding restaurants over the past several months were already taking shape before the pandemic. However, we believe government-mandated quarantine measures and restaurant operating restrictions have accelerated the pace of these changes by a few years. In fact, we see similarities between the restaurant industry during coronavirus-containment efforts and what happened to the retail industry coming out of the Great Recession in 2008-09, where consumers were quick to gravitate to online retail and many traditional brick-and-mortar retailers were slow to adapt to the changing environment. In the case of restaurants, we believe accelerated adoption of new digital ordering, delivery, and drive-thru advances will likely continue after the pandemic and require several changes from restaurant operators. We think it would be a mistake to assume that dining-in trends ever fully return to prepandemic levels.

Delivery is making headlines, but drive-thru and takeaway changes are likely to be more significant. With restaurant dining rooms closed across the U.S. for much of the second quarter, there was an obvious hit to eat-in transactions as well as takeaway orders placed inside the restaurant. We believe delivery picked up much of this slack during the earliest days of COVID-19-related operating restrictions, with many public restaurant companies reporting high-double-digit and even triple-digit growth in delivery sales during the second quarter. However, more recently, drive-thrus have also become an increasingly important outlet for limited-service restaurants, and we expect this to continue. In fact, we believe operators that have spent time to improve the drive-thru process are well positioned to capitalize on these trends.

We think full-service operators are likely to see a much more pronounced shift in transaction type in 2020. Again, with dining rooms closed or operating at capacity constraints, delivery has picked up some of the slack for full-service restaurant operators. However, for full-service operators, we expect takeaway transactions to see increasing adoption. We believe to-go orders will remain elevated in the years to come, and those operators that have not implemented in-store to-go ordering capabilities will find themselves at a disadvantage.

Digital ordering is likely to surpass in-person ordering. Although consumers have continued to place orders at drive-thrus, having less access to physical restaurants has made digital ordering a much more convenient option for many consumers. We had already witnessed an uptick in digital orders the past several years as many of the pizza QSR and specialty coffee chains upgraded their mobile platforms, but many traditional QSR companies have made similar upgrades in recent years. We expect digital ordering to become one of the more permanent changes facing limited-service restaurants after the pandemic and remain at 20%-30% of transactions going forward (well above the single digits historically).

We’ve also seen a meaningful increase in digital ordering for full-service restaurants. As dining rooms reopen, we anticipate that the number of digital orders for the full-service restaurant industry will subside. However, we don’t expect this percentage to return to pre-COVID-19 levels, as many consumers will continue to embrace takeaway and delivery options. We also believe that ordering ahead will become a more pronounced trend for casual dining in the years to come.

Work-/school-from-home situations have affected restaurant daypart sales trends, but operators have started to adjust. One of the more debated questions regarding consumer behavior in a postpandemic environment is the future of the morning commute. Based on estimates from Morningstar's U.S. economics research team, work-from-home employees peaked at 45% of the workforce in 2020. This shift to work-/school-from-home situations has disrupted a number of breakfast-focused restaurant concepts and will likely continue through the back half of 2020. However, what does the morning commute look like after 2020? Employees have already started to return to the office (though not always through pre-COVID forms of transportation), but it's unlikely that the U.S. ever returns to the 9% of the workforce that worked from home before the pandemic. However, by the end of 2021, Morningstar's U.S. economics research team forecasts that work-from-home employees stabilize in the low double digits as a percentage of the overall workforce, which bodes well for the breakfast-oriented companies we cover, including McDonald's MCD, Starbucks SBUX, and Dunkin' Brands DNKN.

With the uptick in work-from-home employees, it’s not surprising that breakfast and lunch have been two of the hardest-hit dayparts. According to data from Black Box Intelligence, comparable sales trends for the breakfast daypart fell in the low 20s during early COVID-related restaurant restrictions in March and April, accelerated to the high 20s during May and June, and recovered to high-teens declines in July. Comparable sales for the lunch daypart dropped in the high 20s during March and April, accelerated to around 30% in May and June, and also improved to the high teens in July. Late-night daypart comparable sales have been affected by restaurant/bar operating restrictions, with comparable sales falling around 30% in March and April, almost 60% in May and June, and in the high 30s in July.

Even if we’re correct that the number of employees working from an office returns to somewhat normal levels by the end of 2021, we don’t necessarily think that consumer behavior will automatically return to pre-COVID levels with respect to different dayparts, given changes in commutes (staggered work schedules, office relocations), office operating restrictions, and family/group ordering trends. To this end, one daypart that has outperformed the past several months is the midafternoon, which we largely attribute to consumers shifting away from home coffee consumption from the morning daypart while also looking for ways to break up work-/school-from-home routines. While this has not been enough to offset lost morning daypart sales for most restaurant concepts, it does offer additional opportunities to connect with consumers at nontraditional times, and we expect additional menu innovation and marketing focus on this daypart over the near future.

Subtle changes in daypart preferences will likely also influence restaurant real estate decisions. Suburban locations have outperformed urban locations as consumers continue to work/school from home, and it’s unlikely that these trends will reverse in the near future. With so many restaurant operators exiting the market, we see an opportunity for many operators to adjust their store base assets, both from a geographic and physical format perspective.

Restaurant formats will look different after the pandemic. With changing consumer behavior regarding digital ordering, drive-thrus, delivery, and daypart, it's not surprising that several restaurant chains have introduced new restaurant formats. These new format prototypes share several features, including smaller dining rooms, multiple drive-thru lanes or pickup windows (some reserved for mobile orders), as well as parking spaces reserved for third-party delivery.

While these new restaurant formats will require up-front capital from operators and franchisees, we think they are ultimately aligned with evolving consumer preferences. We expect fewer restaurant patrons to dine in in the years to come, so having a restaurant format that can better accommodate drive-thru and delivery orders will be key to comparable-store sales growth over the next five years. Ultimately, we believe these restaurant formats may end up being more capital-efficient than legacy locations--our discussions with franchisees suggests that these new formats may require 10%-20% less capital than traditional formats, depending on the market--improving franchisee returns. This could also help to enhance the franchisee intangible asset that underpins the economic moats of many of the QSR companies we cover.

Rivalry with online grocers is likely to intensify, but there is still room for restaurants to compete. Another changing consumer behavior for restaurant investors to monitor is the adoption of online grocery platforms. In January, we laid out our case for 2020 being an inflection point year for online grocery growth. While we clearly didn't anticipate COVID-19 as a significant catalyst heading into the year, we think many of the reasons that we expected an uptick in online grocery remain valid (namely the removal of monthly service fees and the introduction of one- and two-hour delivery window options for many leading services like Amazon Fresh AMZN).

With many restaurant dining rooms closed from March through early June, it’s not surprising that traditional and online grocery took market share from restaurants. Using data from Black Box Intelligence for limited-service restaurants and full-service restaurants, and our estimates for online grocery (purchases through online order and delivery grocer websites), packaged foods, and beverages sold directly to consumers by manufacturers and traditional grocers, we believe that online food sales (online grocery plus direct to consumer) moved from approximately 4.8% of total food expenditures before the pandemic to 6.1% at the height of COVID-19 prevention measures from mid-March through April. While these numbers have retrenched since May as restaurants have reopened, we don’t expect them to return to prepandemic levels, given increased online order frequency and the reduction in total restaurants.

Online grocers and manufacturers selling consumer packaged goods directly to consumers will loom as a competitive threat, but we believe the same characteristics that have spurred greater online grocery adoption will ultimately benefit restaurants as well. This includes reduced delivery fees (including delivery fee caps in many major markets), more reliable delivery windows (partly a byproduct of new restaurant formats that are more conducive to delivery and takeaway orders), and better integration between restaurants and delivery platforms. While we believe changes to a restaurant’s drive-thru and takeaway functionality will be more critical to most restaurant operators’ growth prospects, a streamlined delivery platform can be complementary to other sales channels while offering additional customer acquisition/retention benefits.

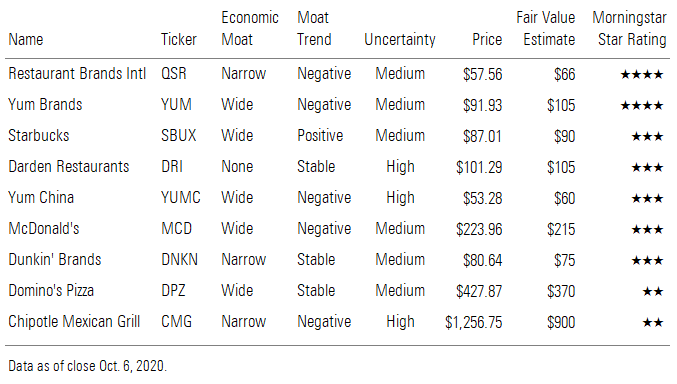

Attractive Opportunities Still Exist We share the market's enthusiasm for the growth prospects of chains like Chipotle and Domino's and don't see many near-term downside catalysts for these names, but we believe there are more attractive valuations elsewhere in the industry. While they face near-term issues, Restaurant Brands International QSR, Yum Brands YUM, Starbucks, and Darden DRI are all trading below our fair value estimates and should see growth accelerate in 2021.

Restaurant Brands Intl, Yum Brands, Starbucks, Darden Restaurants, Yum China, etc.

/s3.amazonaws.com/arc-authors/morningstar/d989732f-19b3-4049-b5fe-f59c1fcfa828.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d989732f-19b3-4049-b5fe-f59c1fcfa828.jpg)