Chain Disruptions, Labor Shortages Hampered Industrials Stocks in 2021

The sector looks overpriced to us today, but there are a few bargains to be had.

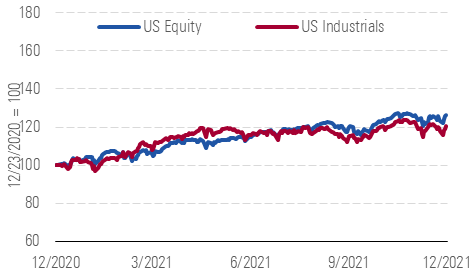

The Morningstar US Industrials Index underperformed the broader market over the trailing 12 months driven by investor angst surrounding supply chain disruptions and inflation, as well as concerns that the emerging omicron variant could derail an aerospace recovery. Indeed, aerospace and defense and airline stocks have been laggards, held back by the likes of

Industrials Have Underperformed Overall U.S. Equities

Source: Morningstar analysts

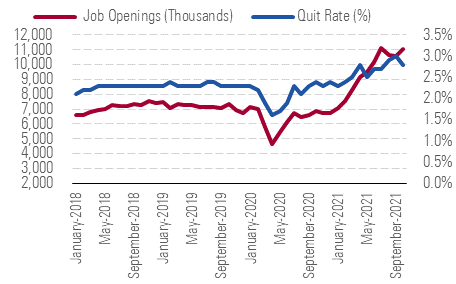

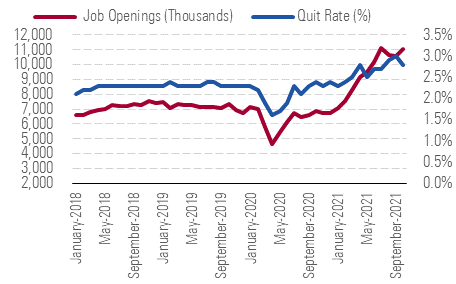

While a handful of firms have defended profit margins in the inflationary environment, most have been unable to increase prices fast enough to outpace inflation and offset additional costs associated with raw material shortages. Many companies have also endured labor shortages, further contributing to lower manufacturing throughput and higher operating costs. Quit rates and job openings have rapidly increased as workers leave their current positions and take their time committing to new ones. Firms in the industrials segment tend to operate with large employee head counts, increasing pressure to hire and retain qualified employees in a tight labor market. Many companies must pay up to get employees in the door and keep them in their current positions.

Most Industrial Stocks Overvalued, Some Opportunities Remain

Source: Morningstar analysts

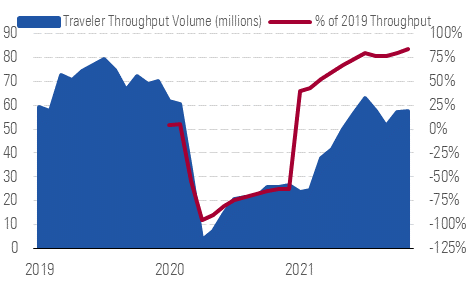

While we expect some of these supply chain challenges will ease in 2022, recent spikes in COVID-19 cases and threats of future variants could hamper recovery in some industries, especially aerospace. That said, based on recent U.S. passenger throughput data from the Transportation Security Administration, air travel demand seems to be holding up quite well.

Quit Rates Contribute to Tight Labor Markets

Source: Morningstar analysts

Many industrials stocks appear somewhat overvalued to us, with the sector trading at a 1.10 median price/fair value ratio. Nonetheless, we believe there are still appealing stock ideas in the sector. For example,

Air Travel Has Held Up Despite Omicron

Source: Morningstar analysts

Top Picks

Delta Air Lines

DAL

Star Rating: ★★★★

Economic Moat Rating: None

Fair Value Estimate: $54.50

Fair Value Uncertainty: Very High

We think Delta is the highest-quality legacy carrier because it has been able to attract high-yielding business travelers through its product segmentation and credit card partnerships, primarily with American Express. In the third quarter, the firm's co-branded card spends recovered to 115% of 2019 levels, showing strong recovery for the firms highest-margin revenue stream. While the omicron variant posts a new threat to business and leisure travel demand, we maintain our view that the firm can reach its 2019 capacity levels by 2023.

EMR

Star Rating: ★★★★

Economic Moat Rating: Wide

Fair Value Estimate: $107

Fair Value Uncertainty: Medium

Wide-moat Emerson is an industrial conglomerate that operates under two business platforms: automation and commercial and residential solutions. Emerson is a powerhouse in process manufacturing and holds strong market share positions in many sizable but fragmented markets. With this runway, we expect several years of positive organic growth following a slow recovery in 2021. We concur with management that Emerson can deliver sustainable 30% incremental margins (with some better years during our forecast), and we like that management cited improving automation markets amid modernization efforts, among other long-term growth drivers.

GE

Star Rating: ★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $131

Fair Value Uncertainty: High

GE announced it will be separating the firm into three public companies: GE Aviation, GE Healthcare, and a combination of GE Renewable Energy, GE Power, and GE Digital. While we are encouraged by this announcement, as it could be a catalyst to help close the persistent price/value gap of the stock, GE still needs to hit its ambitious long-term targets. This includes the firm's high-single-digit free cash flow margin and its high-single-digit operating margin for the power segment. That said, investors will now be able to own their preferred part of the company without having to hold on to GE's more challenged businesses.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)