After Earnings, Is Target Stock a Buy, a Sell, or Fairly Valued?

With favorable margin improvements in Q4, here’s what we think of Target’s stock.

Target TGT released its fourth-quarter earnings report on March 5. Here’s Morningstar’s take on Target’s earnings and the outlook for its stock.

Key Morningstar Metrics for Target

- Fair Value Estimate: $132.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

What We Thought of Target’s Q4 Earnings

We were impressed by Target’s robust margin recovery during its fiscal 2023 fourth quarter, though we are concerned by continued softness in its top-line results. The retailer’s 5.8% operating margin (210 basis points ahead of last year) easily outpaced our 4.4% estimate, driven by a nearly 300-basis-point expansion in gross margin to 25.6%, as normalized inventory levels reduced the need for the inordinate promotional destocking that was pervasive across the retail landscape last year. Due to this margin strength, Target posted $2.98 in earnings per share, outpacing our $2.11 forecast.

While we plan to modestly raise our $132 fair value estimate in light of this stronger-than-expected near-term recovery, we still think the firm lacks a defensible edge in an intensely competitive retail landscape. Thus, we are keeping our 6.5% midcycle operating margin forecast intact. Management said it’s striving for a long-term operating margin of at least 6%, up from 5.3% in fiscal 2023. As expected, this is well below the 8% goal cited in early 2022.

We caution investors against taking an overzealous view of the report, due to continued top-line pressure. Target’s 4.4% drop in comparable sales (transactions and tickets declined 1.7% and 2.8%, respectively) marks the third consecutive quarter of declines, and it contrasts starkly with Walmart’s WMT 4% gain. While management expects comparable sales to modestly recover in fiscal 2024 (guidance was flat to up 2%), we think the top line is at risk of being further constrained in the near term—as value-conscious consumers may peruse lower-priced competitors—before returning to a low-single-digit percentage growth trajectory in the long term.

Target (US) Stock Price

Fair Value Estimate for Target

With its 2-star rating, we believe Target’s stock is overvalued compared with our long-term fair value estimate of $132. Our estimate accounts for a more gradual recovery in the firm’s operating margin and a more subdued midcycle margin forecast of 6.5%, down from 7.0%. In the near term, we expect competitive angst among retailers to intensify as demand wanes for higher-margin discretionary categories, keeping margins constrained. Our fair value estimate implies a forward 2024 adjusted price/earnings ratio of 15.6 times and enterprise value/adjusted EBITDA of 8.8 times.

We expect fiscal 2023 and 2024 to be choppy as economic uncertainty and persistent inflationary headwinds pinch consumer wallets. Target grew rapidly across its product categories over the past three years, with sales increasing nearly 40% amid unprecedented consumer demand and abundant disposable income. However, as consumers worked down excess savings and costs remained elevated, there were signs of an imminent pullback in demand, prompting retailers to take a cautious approach in the second half of 2023.

In the near term, we expect Target’s top line to face pressure as consumers trade down to lower-priced retailers like Walmart, and for operating margins to remain compressed as the retailer’s sales skew more toward lower-margin items in food, beverage, and household essentials. Management indicated in early 2023 that the firm could return to a 6% operating margin by 2024, though we are incorporating a more conservative view into our forecast, as we don’t think it will hit that mark until 2026.

Read more about Target’s fair value estimate.

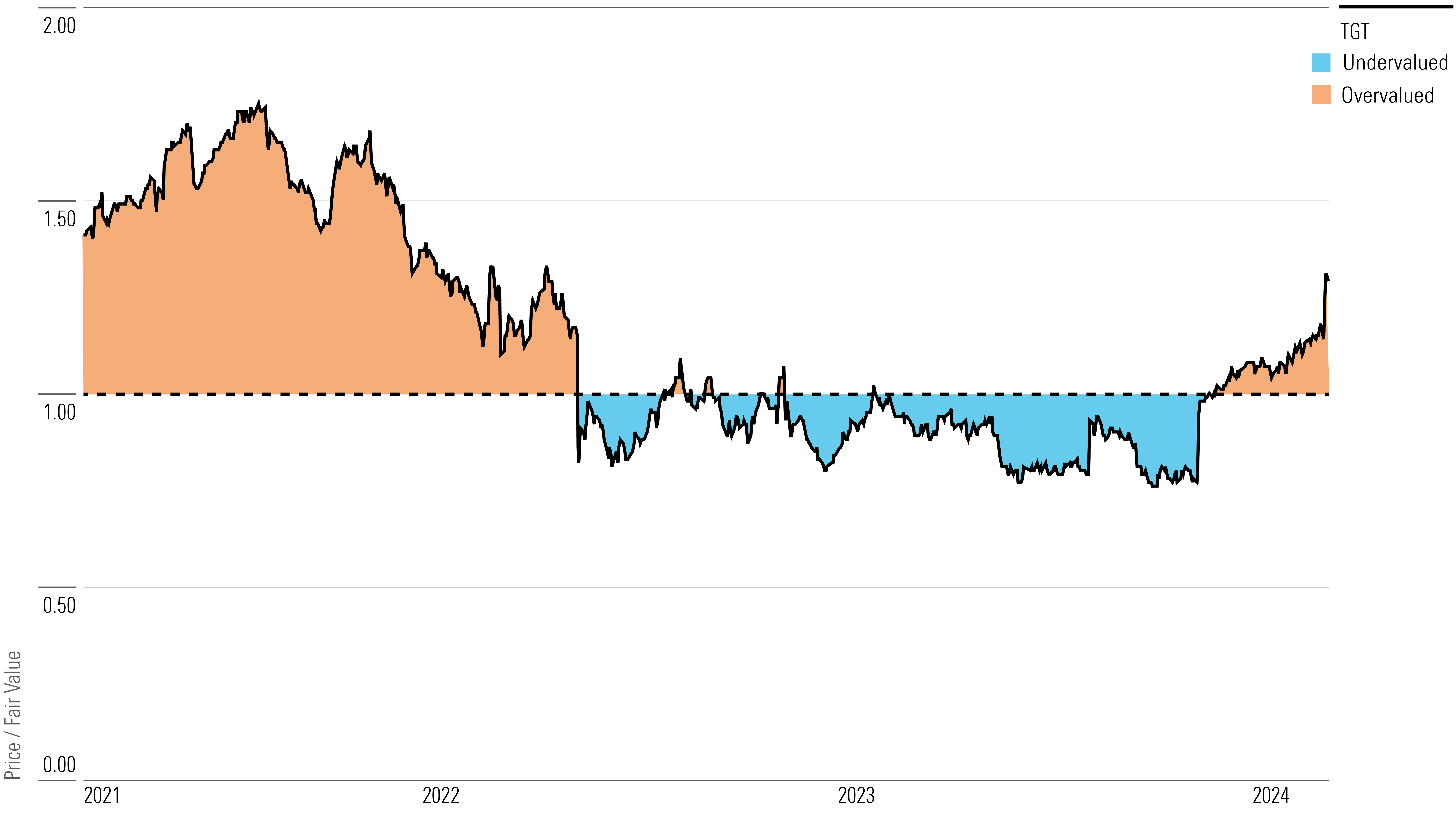

Target Historical Price/Fair Value Ratio

Economic Moat Rating

We do not believe Target has a moat. Despite its iconic and trendy brand, we view its position in the hyper-competitive retail environment as rather ambiguous, which dilutes our confidence in its ability to drive consistent store traffic. Furthermore, we don’t see sufficient evidence to award Target a cost advantage. Although it is the nation’s sixth-largest retailer, we do not believe the firm exhibits an irreplicable scale across its individual product categories that would suggest it has amassed negotiating prowess over its supplier partners.

In our view, Target’s position makes it susceptible to changing consumer preferences and online competition. We believe the retailer is at a crossroads, trying to balance an undifferentiated low-cost grocery portfolio that drives recurring traffic but doesn’t dilute the firm’s reasonably priced upscale, trendy product offerings in apparel and home goods. While we acknowledge its wide array of product offerings (according to Reuters, Target boasted about 80,000 stock-keeping units per store in the early 2010s), we believe the firm’s goal of being a “cheap trick” retailer pressures the management team to balance its brand perception.

This dynamic could be seen after the retirement of CEO Bob Ulrich in 2008. He successfully built Target into a leading retailer during his 14 years at the helm, but it seems that immediately following his exit, a bureaucratic culture developed. This prompted years of underinvestment in stores, an unclear position in grocery, and costly strategic missteps (such as its abysmal foray into Canada) that led to anemic trends in transaction volume. We note that comparable sales growth averaged a mere 1.5% from 2010 to 2016 (compared with growth in retail sales at warehouse clubs and superstores of 3.7%) while transaction volume was roughly flat.

Read more about Target’s economic moat.

Risk and Uncertainty

We assign Target a Medium Uncertainty Rating. Increasing digital penetration in retail is a formidable threat to the company’s traditional brick-and-mortar model. Price shopping has become seamless as consumers increasingly begin product searches on digital channels, making Target susceptible to price competition in an industry with virtually no switching costs. Retail leaders like Walmart and Amazon AMZN boast unrivaled scale and an impressive ability to invest in supply chain automation to mitigate costs. We expect Walmart and Amazon to serve as disinflationary forces for years to come, putting pressure on retailers that lack a differentiated product offering, vast scale, or a concentrated geographic focus (we believe Target falls into all three categories). As such, we think gross margins may be pressured over the following decade.

Target’s business model also faces uncertainty due to its high mix of general merchandise such as apparel, electronics, and home furnishings, which we believe is most susceptible to digital competition. The company also lacks a clear positioning in grocery, in our view. We surmise that its food and beverage products add a nice element of convenience, which helps drive recurring foot traffic, letting the firm serve as a one-stop shop, but this also offers minimal differentiation. While we are encouraged by the firm’s improvements in its higher-turnover product categories (sales of the firm’s food and beverage and beauty and household essentials categories are up 52% and 43% since 2019, respectively), we note that these categories still pale in comparison to larger peers. Target’s food and beverage and beauty and household essentials categories combine to be about one-fifth the size of Walmart’s domestic grocery category (excluding Sam’s Club) and a mere 40% of Kroger’s total sales, excluding fuel.

Read more about Target’s risk and uncertainty.

TGT Bulls Say

- Given its iconic brand that attracts consumers due to its promise of a more gratifying customer experience than what other low-cost retailers offer, we are confident in Target’s ability to drive recurring foot traffic.

- Based on its performance during the pandemic, we view Target as a formidable online retailer, putting to rest many concerns about its ability to compete in a digital retail environment.

- Target is poised to benefit from the continued decline of mall-based competition and department stores, which will drive strong growth in comparable sales.

TGT Bears Say

- Target lacks the scale and differentiation to drive significant market share across its product categories since these offerings lack a clear value proposition.

- Despite being the nation’s sixth-largest retailer, Target must constantly invest in cost-saving initiatives, product innovation, and store renovations to keep up with behemoths Walmart and Amazon.

- Target’s higher-margin discretionary product categories, such as apparel and home furnishings, are susceptible to losing market share via digital retail penetration, which could weaken the firm’s margins.

This article was compiled by Quinn Rennell.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)