7 Undervalued Biotech Stocks

Even with biotech stocks performing well in the bear market, names including Moderna and Incyte are trading at a discount.

In an uncertain economic environment, biotechnology stocks have been outpacing the overall stock market. However, Morningstar analysts say there are still undervalued stocks in this innovative industry.

Among the biotech stocks trading at attractive prices are prominent names such as Moderna MRNA, which was in the spotlight for its COVID-19 vaccine, and up-and-comers such as CRISPR Therapeutics CRSP.

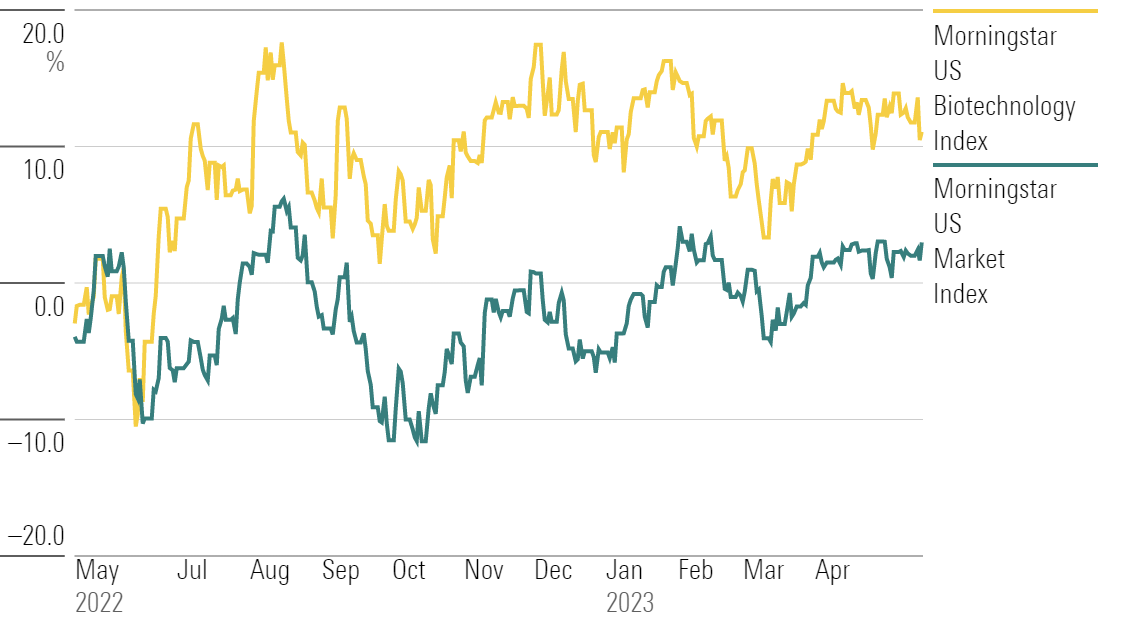

Over the trailing 12-month period ending May 17, 2023, the Morningstar US Biotechnology Index gained 11.0% while the overall stock market gained 2.9% for the same period, as measured by the Morningstar US Market Index.

This outperformance during the bear market came despite biotech’s reputation as a volatile area for investors. “Biotech is very speculative,” says Rachel Elfman, healthcare equity analyst at Morningstar. While successful drugs can bring in billions in revenue, that’s far from guaranteed. Profits can rise or fall based on the U.S. Food and Drug Administration’s regulatory verdict on a company’s major product.

The general defensive nature of healthcare stocks undergirds biotech outperforming the broader market. People need healthcare regardless of how the economy is doing. That’s also been part of the sector’s relative underperformance in 2023—the biotech index is flat so far this year, while the market is up roughly 8%.

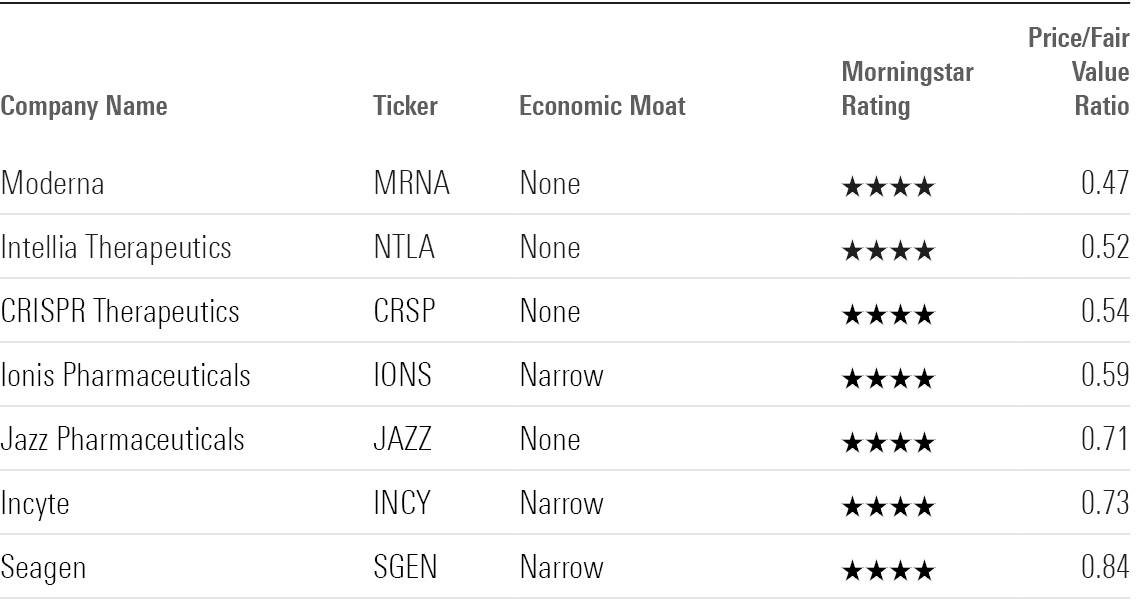

To find undervalued biotech stocks, we turned to the Morningstar US Biotechnology Index. Of the 48 biotech stocks in the index, seven were undervalued with 4- or 5-star ratings as of May 17, 2023.

Morningstar US Biotechnology Index

What Is a Biotech Stock?

The Morningstar US Biotechnology Index comprises stocks from companies involved in the research, discovery, development, and production of innovative drug and drug-related technologies. Genetic and mRNA technologies and vaccines are central to many of these companies, which depend on innovation and the opportunity for growth. Regeneron Pharmaceuticals REGN, Vertex Pharmaceuticals VRTX, and Alnylam Pharmaceuticals ALNY are among the largest companies in this index.

Biotech Stocks to Buy Now

We looked for the most undervalued stocks in the index that currently have a Morningstar Rating of 4 or 5 stars.

For long-term investors, companies with wide or narrow Morningstar Economic Moat Ratings have historically had better odds of outperforming. But for this screen, we included companies without moat ratings. This is because moat designations are rarely found in the innovative, research-heavy biotech industry; Morningstar analysts often withhold such judgments until clinical trials or acquisitions are completed.

These were the seven most undervalued biotech stocks in the Morningstar US Biotechnology Index as of May 17:

- Moderna

- Intellia Therapeutics NTLA

- CRISPR Therapeutics

- Ionis Pharmaceuticals IONS

- Jazz Pharmaceuticals JAZZ

- Incyte INCY

- Seagen SGEN

The most undervalued stock on the list is Moderna, trading at a 53% discount to the fair value estimate set by Morningstar analysts. The least undervalued stock is Seagen, trading at a 16% discount.

Undervalued Biotech Stocks

Moderna

- Stock Price: $125.57

- Fair Value Estimate: $266.00

- Morningstar Economic Moat Rating: None

“In a record-breaking span of just 11 months, Moderna created, developed, manufactured, and got regulatory authorization for mRNA-1273, a two-dose COVID-19 vaccine that is one of the first two mRNA vaccines ever authorized. The pandemic accelerated Moderna’s evolution into a commercial-stage biotech company, and we expect that the firm’s ramp-up in manufacturing and clinical know-how will pave the way for faster timelines for additional programs. Moderna’s mRNA platform, involving rapid design and similar manufacturing across programs, allows the company to pursue multiple programs in parallel.

“Moderna’s mRNA technology has gained rapid validation as sales of its COVID-19 vaccine soared in 2021, but we think the firm has yet to secure a narrow economic moat around its business, largely due to uncertainties tied to an evolving virus and the changing competitive landscape for innovative vaccines.”

—Karen Andersen, sector strategist

Intellia Therapeutics

- Stock Price: $43.80

- Fair Value Estimate: $85.00

- Morningstar Economic Moat Rating: None

“Intellia Therapeutics is a gene editing company focused on the development of clustered regularly interspaced short palindromic repeats, or CRISPR/Cas9. This tool precisely cuts DNA to disrupt, delete, correct, and insert genes to treat genetically defined diseases. CRISPR/Cas9 has created a new class of medicines that are suited for targeting rare diseases or other disorders caused by genetic mutations.

“CRISPR/Cas9 works by having CRISPR (pieces of DNA sequences) guide Cas9 (an enzyme that can cut and edit DNA) to edit, alter, or repair genes. Intellia is utilizing this gene knockout approach to remove unwanted proteins using its proprietary lipid nanoparticle delivery system. The company has leveraged its expertise in CRISPR/Cas9 gene editing to advance a pipeline of in vivo and ex vivo therapies for diseases with high unmet medical needs.

“We believe the company’s proprietary technology has the potential to build blockbusters in rare diseases with limited treatment options available. Intellia currently has no approved drugs and its pipeline is largely in its early stage, so we refrain from awarding the company an economic moat rating.”

—Rachel Elfman, equity analyst

CRISPR Therapeutics

- Stock Price: $64.41

- Fair Value Estimate: $119.00

- Morningstar Economic Moat Rating: None

“CRISPR Therapeutics is a clinical-stage gene editing company focused on the development of CRISPR/Cas9-based therapeutics. We think the company’s proprietary technology has the potential to build blockbusters in rare diseases, such as exa-cel for the treatment of sickle cell disease, or SCD, and transfusion-dependent beta-thalassemia, or TDT. Although the company currently operates without an economic moat, we believe potential success through regulatory approvals for its therapies could push us to consider a narrow moat rating in the future.

“While CRISPR Therapeutics’ products are still unproven, we recognize that if successful, multiple targeted treatment areas are potentially moatworthy businesses. For example, TDT and SCD are two areas of high and critical need, and the company’s genetic therapies could have high efficacy, commanding strong pricing power.”

—Rachel Elfman, equity analyst

Ionis Pharmaceuticals

- Stock Price: $36.30

- Fair Value Estimate: $62.00

- Morningstar Economic Moat Rating: Narrow

“Ionis is a leader in RNA-based therapies. Its spinal muscular atrophy drug Spinraza, marketed by partner Biogen BIIB, is the first RNA-based therapy to achieve blockbuster status. The firm’s antisense oligonucleotide technology faces strong competition from RNA interference technology emerging from Alnylam, Arrowhead ARWR, and Dicerna, as well as gene editing and gene therapy pipelines at multiple firms. However, Ionis has built a massive pipeline of promising new drugs that are rapidly moving toward the market, securing a narrow moat.

“Ionis’ therapies alter the production of a given protein in the body, typically reducing the production of a toxic, mutant version. Ionis can therefore tackle diseases that are difficult to treat effectively with other methods, as its therapies are targeted (avoiding safety issues with off-target effects of small-molecule drugs), can act inside the cell (unlike antibody therapies), and are reversible (unlike gene therapy). Ionis has a broad pipeline and strong collaboration partners to help usher to market drugs for large indications, requiring large clinical trials and salesforces. Ionis spun out cardiovascular-focused Akcea in 2017 but reacquired full ownership in 2020, given the advancement and increasing attractiveness of Akcea’s late-stage cardiology pipeline.

“Beyond these programs, several other drug candidates could continue to validate Ionis’ pipeline potential. Ionis has several wholly owned neurology and rare-disease programs, and partnered programs in neurology (with Biogen) and cardiology (with Novartis NVS and Pfizer PFE) are in late-stage development, putting Ionis in a position to see key phase 3 data in 2023-25.”

—Karen Andersen, sector strategist

Jazz Pharmaceuticals

- Stock Price: $132.16

- Fair Value Estimate: $187.00

- Morningstar Economic Moat Rating: None

“Jazz Pharmaceuticals added its leading drug, Xyrem, to its portfolio in 2005 with the acquisition of Orphan Medical. At that point, Xyrem was the only approved treatment for cataplexy (sudden muscle weakness or paralysis) in narcolepsy; it has since garnered additional approvals for excessive daytime sleepiness in patients with narcolepsy. Its strong efficacy has propelled its success in the difficult-to-treat sleep indication, but generic entry is on the horizon, leaving a cloud of uncertainty for the company. Jazz reached a settlement in 2017 with Hikma Pharmaceuticals HIK to not allow generics on the market until January 2023. While Jazz will retain some economic profit from royalties on generic sales and a shared distribution program, we expect its returns to decline following Xyrem’s generic entry.

“Management has been focused on diversifying its portfolio, with new drug approvals of Zepzelca (for metastatic small cell lung cancer), Rylaze (for acute lymphoblastic leukemia), and Xywav (for the treatment of cataplexy, EDS, and idiopathic hypersomnia). Strong launches and commercialization efforts for these drugs will be crucial for Jazz to diversify its portfolio.

“Acquiring recently launched drugs has been part of Jazz’s portfolio diversification strategy. In May 2021, Jazz acquired GW Pharmaceuticals for the hefty price of $7.2 billion. GW contributed greatly to Jazz’s overall 2022 revenue, largely driven by its leading product, Epidiolex. This drug is a cannabidiol for the treatment of severe, rare forms of epilepsy.”

—Rachel Elfman, equity analyst

Incyte

- Stock Price: $64.55

- Fair Value Estimate: $88.00

- Morningstar Economic Moat Rating: Narrow

“Incyte has built a solid foundation over the past decade with its hematology drug Jakafi, and the approval of the same active ingredient as oral dermatology drug Opzelura is expanding the firm’s focus to new therapeutic areas. We think the firm’s strategy to find more effective combination therapies in hematology and build a larger oncology and dermatology portfolio is solid, although we’re waiting for key data before assuming the firm can grow through Jakafi’s patent expiration in 2028.

“Jakafi initially gained traction in 2011 as the only drug approved for severe myelofibrosis, a rare blood disorder. Jakafi’s stronghold in the MF market is likely to continue, although new drugs are entering the market for subsets of the population. Incyte expanding Jakafi’s label to polycythemia vera (2014), steroid-refractory acute graft versus host disease (2019), and chronic GvHD (2021) should together increase peak U.S. sales. Incyte’s ALK2 and BET-targeted drugs are being combined with Jakafi in myelofibrosis, which could lead to a fixed-dose combination regimen that refreshes this franchise beyond Jakafi’s patent expiration.

“We think the firm’s Jakafi products and new launches like Opzelura secure Incyte a narrow moat. Due to Incyte’s steady Jakafi sales growth, as well as the firm’s recent diversification into immunology as Opzelura gains traction in atopic dermatitis and vitiligo, we’re lowering our Uncertainty Rating from High to Medium.”

—Karen Andersen, sector strategist

Seagen

- Stock Price: $193.05

- Fair Value Estimate: $229.00

- Morningstar Economic Moat Rating: Narrow

“We think Seagen is well positioned with its robust portfolio of internally developed antibody-drug conjugates, and we expect label expansions for its three approved drugs will push the firm into profitability in the next couple of years.

“Its leading ADC technology has allowed Seagen to develop an internal pipeline of innovative cancer treatments and become the partner of choice for leading oncology players. The technology improves the potency and safety of cancer-targeting monoclonal antibodies by linking them to potent cell-killing drugs (chemotherapies), enhancing antitumor activity while reducing potential toxicity. This approach has yielded remarkable results. In addition to strong results from Adcetris (approved for Hodgkin and some types of non-Hodgkin lymphoma) and Padcev (approved for previously treated bladder cancer), the company’s leading pipeline candidates have exhibited promising efficacy in various cancer indications.

“Adcetris was approved by the Food and Drug Administration in 2011 and is commercially available in more than 75 countries. Due to its efficacy, we think Adcetris will hold its strong position in Hodgkin lymphoma, and we see ample room to grow in non-Hodgkin lymphoma over the next several years. We also think trials of Adcetris in combination with checkpoint inhibitors, such as Bristol’s BMY Opdivo, offer further runway for growth.”

—Rachel Elfman, equity analyst

Correction: May 26, 2023: A previous version of this article included incorrect index performance information. Over the trailing 12-month period ending May 17, 2023, the Morningstar US Biotechnology Index gained 11.0%, not 20.7%, and in that same time the overall stock market gained 2.9%, not 8.6%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)