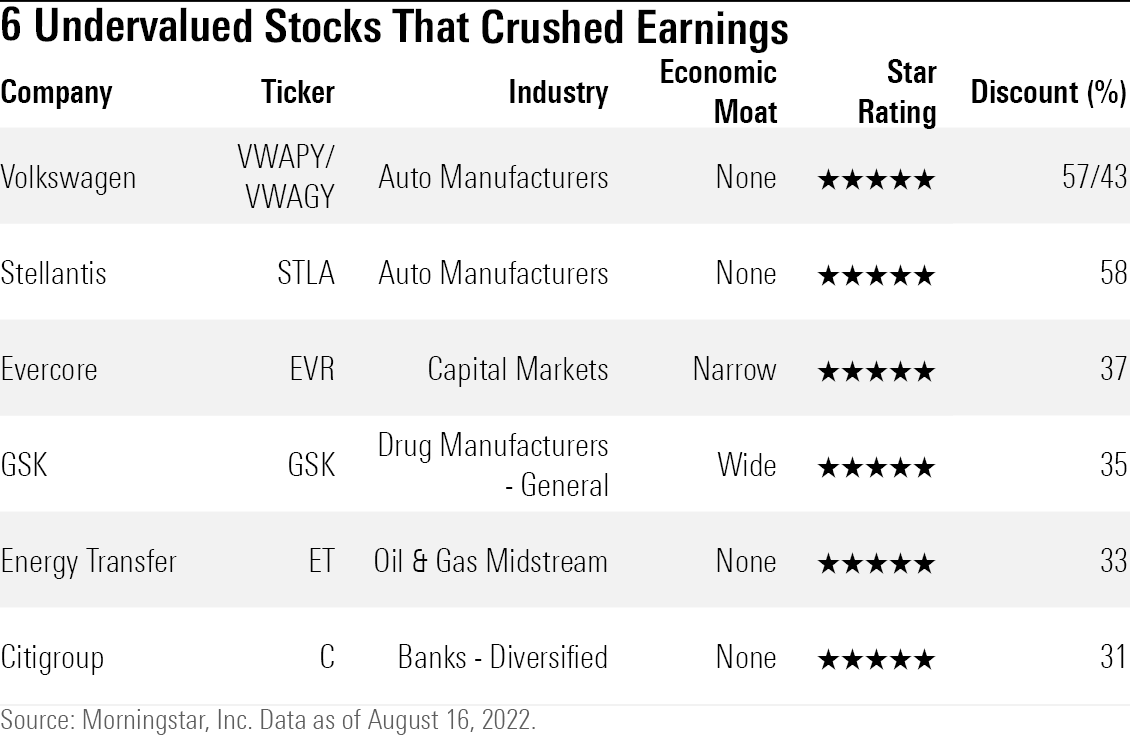

6 Undervalued Stocks That Crushed Earnings

Citigroup, Stellantis, and GSK are among those left undervalued even after earnings rallies on solid results.

Stocks have rallied more than 17% from bear-market lows thanks in part to earnings results that, while weak by historical standards, still managed to exceed or meet investors’ expectations.

Even with the rally, a wide swath of stocks followed by Morningstar analysts remain undervalued. Among the 854 U.S.-listed companies covered by Morningstar analysts, 46% are trading below their fair value estimates.

Those undervalued stocks, paired up with second-quarter earnings, offer investors an opportunity to screen for names that are both cheap and that turned in a better-than-expected earnings performance. Among those stocks:

- Volkswagen

- Stellantis

- Evercore

- GSK

- Energy Transfer

- Citigroup

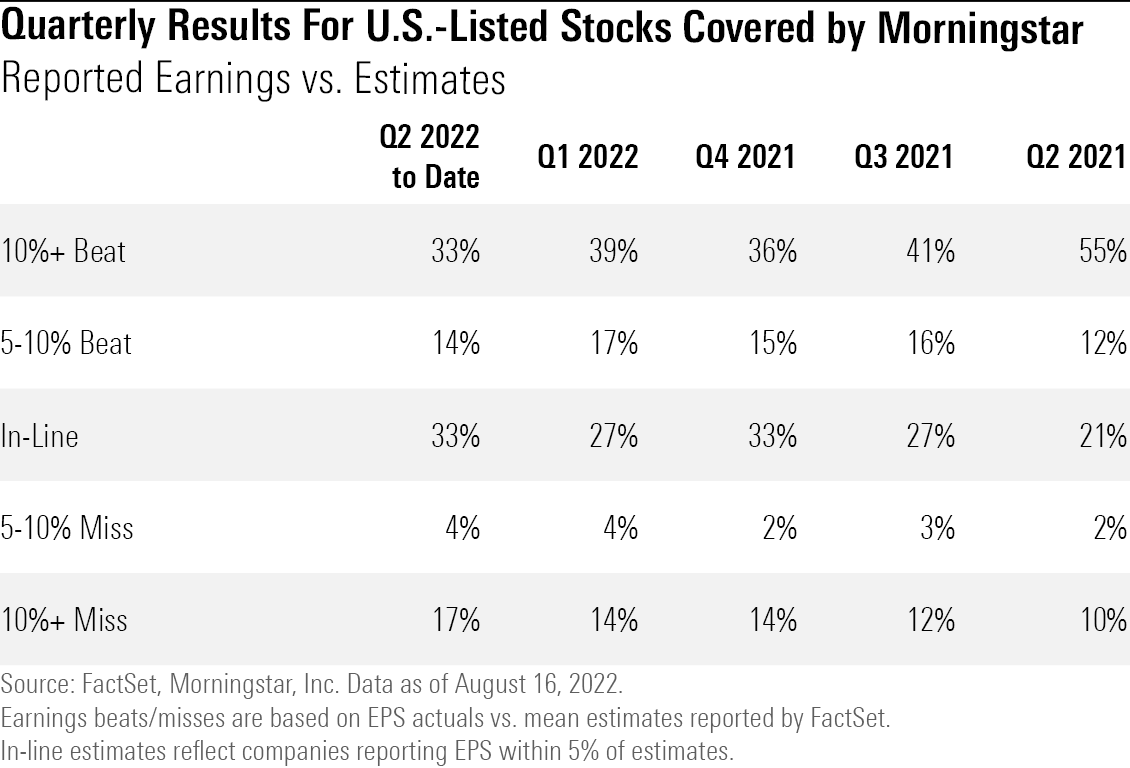

Just How Good Were Q2 Earnings?

Of the U.S.-listed companies covered by Morningstar analysts, 665 have reported second-quarter earnings as of Aug. 16. Out of those companies, 33% beat earnings estimates by 10% or more, the fewest for the previous four quarters.

The number of companies beating earnings estimates by a slimmer margin also declined, with only 14% of those that reported beating earnings per share, or EPS, estimates by 5% to 10%, the lowest since the second quarter of 2021, when 12% of companies beat estimates by that much.

Conversely, the number of companies that disappointed when it came to earnings increased, with 17% of those that have reported missing estimates by 10% or more, up from an average of 12% in the previous four earnings periods.

While Morningstar stock analysts pay close attention to earnings, they focus on long-term results and valuations. One quarter usually doesn’t lead to a change in the long-term assumptions behind the assessment of a stock’s fair value, unless a company also comes out with new, material information that affects the assumptions that opinion is based on. For example, new data on a drug that raises the probability of approval or pricing gains on a key product line could affect an analyst’s long-term thinking.

Still, looking at quarterly earnings against the valuation backdrop can help investors identify opportunities.

We screened for stocks that beat expectations but remained undervalued to help investors capitalize on new investment opportunities that arose during earnings season.

To keep the focus on those that had truly strong results and did not beat on earnings through accounting gimmicks or one-time factors, companies were also screened for revenue beats of 5% or more. Of that group, we filtered for stocks with a Morningstar Rating of 5 stars to highlight the most undervalued opportunities.

Of the 854 stocks that we screened, just six, less than 1%, made the cut.

Volkswagen VWAPY/VWAGY

- Earnings Per Share: $0.76 versus estimate of $0.43, from FactSet

- Revenue: $70 billion versus estimate of $66 billion

- Return Since Earnings: VWAPY up 14.4%, VWAGY up 10.4%

Morningstar senior equity analyst Richard Hilgert reduced his fair value estimate twice, settling at $36 per share after starting the quarter at $38, despite the earnings beat, as he sees high uncertainty for the company due to several headwinds.

“Second-quarter group operating profit of EUR 4.7 billion plunged 28% from EUR 6.5 billion a year ago while margin contracted 290 basis points to 6.8%. The group result was negatively affected by commodity and currency hedging losses of EUR 2.4 billion, production disruption from the Ukraine invasion, the chip crisis, and China lockdowns as well as inflationary cost pressures,” he says.

Despite this, Hilgert still sees the company’s stock as significantly undervalued, with preferred shares, which trade under the VWAPY ticker, at a 57% discount, and common stock shares, VWAGY, at a 43% discount.

Stellantis STLA

- Earnings Per Share: $1.32 vs. estimate of $1.22

- Revenue: $47 billion vs. estimate of $42 billion

- Return Since Earnings: 14.1%

Automaker Stellantis reported that second-quarter adjusted operating income, or AOI, margin expanded to 14.1% for the first half of 2022 compared with 11.4% last year, which beat Hilgert’s expectations.

“Despite lost volume, higher raw material costs, and other inflationary cost pressures, margin expansion was supported by price, content, mix, and merger cost synergies,” he says. Hilgert in turn raised his AOI margin estimates to 13% from 10% for 2022. AOI expectations were increased to 11.5% from 9.5% for 2023.

While pressures from the Ukraine crisis, a weakening U.S. economy, and some impacts from the chip shortage remain, Hilgert sees the company as significantly undervalued at a 58% discount.

Evercore EVR

- Earnings Per Share: $2.46 vs. estimate of $1.39

- Revenue: $635 million vs. estimate of $444 million

- Return Since Earnings: 11.7%

Investment bank Evercore beat estimates by a significant margin, says Morningstar’s director of equity research for financials, Michael Wong. The company is expected to face headwinds in the following quarters, says Wong, who sees increased economic uncertainty as a major issue for Evercore.

“Even if economies don’t fall into a technical recession, forecast economic growth is lower and uncertainty stalls merger and acquisition deals that are the bulk of Evercore’s revenue with advisory fees around 80% of the company’s net revenue,” he says.

However, Evercore’s future is not bleak, says Wong. “One medium- to long-term bright spot is that Evercore’s advisory, senior managing director headcount increased to 134 from 114 at the beginning of the year. This could increase compensation costs in the near term but increase long-run revenue potential.”

Furthermore, at recent prices, Wong sees the stock as undervalued. He pegs the company’s fair value estimate at $168 per share. While Wong cautions that the company’s fair value uncertainty rating is high, the company does have a substantial margin of safety, with shares at a 37% discount to their fair value estimate.

GSK GSK

- Earnings Per Share: $0.83 vs. estimate of $0.64

- Revenue: $8.3 billion vs. estimate of $7.8 billion

- Return Since Earnings: Down 17.1%

Pharmaceutical company GSK, formerly known as GlaxoSmithKline, reported solid results, according to Morningstar’s director of equity research for healthcare stocks, Damien Conover. Despite that, Conover did not make any adjustments to his fair value estimate of $54 per share for GSK but still sees value in the stock.

“We continue to view the stock as undervalued, with the market not fully appreciating GSK’s growth potential and pipeline advancements that support the firm’s wide moat,” he says. He also points out that now that Haleon, a consumer health company, has completed its spinoff from GSK, investors can expect faster growth from GSK, as the firm can now focus on its biopharmaceutical and vaccine businesses.

“On the pipeline, GSK is making solid progress to help offset the firm’s key patent losses in 2027-31. We remain most bullish on GSK’s RSV vaccine that posted strong top-line data earlier in the year, (with) more details to be presented later in 2022,” says Conover. Other wild-card drugs that hold major upside potential include the anemia drug daprodustat, which is expected to receive approval in early 2023, and rheumatoid arthritis drug otilimab, which will post phase 3 data later this year.

Shares are 35% undervalued at current prices.

Energy Transfer ET

- EPS $0.39 vs. estimate of $0.35

- Revenue: $25.9 billion vs. estimate of $20.4 billion

- Return Since Earnings: 7.1%

Oil and gas transport giant Energy Transfer benefited from the volatility in prices, prompting management to increase its 2022 full-year earnings before income, taxes, depreciation and amortization guidance to $12.7 billion from $12.4 billion during the first quarter.

“More so than any other U.S. and Canadian midstream entity we cover, Energy Transfer leans into profiting from volatility in the energy market, so this is an ideal environment," says Stephen Ellis, Morningstar energy sector strategist. "Management confirmed this by stating on the conference call that the revised guidance could be exceeded if oil and gas prices and spreads remain strong for the rest of the year."

Ellis left his fair value estimate unchanged following Energy Transfer’s latest earnings results. His view on how the company has been investing its cash windfall is mixed, however, as he is skeptical of the firm’s efforts to seek merger and acquisition opportunities in the petrochemicals industry given the strong environment. On the other hand, he views Energy Transfer’s investments in projects for its Lake Charles facility and Gulf Run and Warrior pipelines as attractive.

Ellis values Energy Transfer’s stock at $17.50 per share, leaving it at a 33% discount.

Citigroup C

- EPS: $2.19 versus estimate of $1.68

- Revenue: $19.6 billion versus estimate of $18.4 billion

- Return Since Earnings: 24.0%

Morningstar financial-services strategist Eric Compton saw Citigroup’s second-quarter results as excellent. However, Compton expects Citi’s results to be messy for some time given the bank’s recent efforts to sell consumer units in Asia and consumer operations in Mexico.

Compton notes that it’s important to ignore the noise from those actions and focus on the firm’s core operations. “On this basis, results excluding legacy franchises were ahead of our expectations for net interest income, or NII, and fees, and roughly in line with our expense expectations,” he says.

Despite Citi’s solid results, Compton does not see a reason to adjust his $78 per share fair value estimate.

“Signs of growth for card balances and signs of fee growth within treasury and trade solutions and personal banking and wealth management will be key metrics to watch as expected pressure within investment banking plays out,” Compton says. “The bank won’t be a top performer operationally compared with peers, but it is simply too cheap.”

Among the U.S. bank stocks covered by Morningstar analysts, Citigroup remains the most undervalued, trading at a 31% discount.

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_99626deb19c94bd4a5c406e19350f0ee_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U4OLR5WQ3JFYDHD76KVW6URKTU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOFK3IUSBRF5XHSFKBZHOG4J5A.jpg)