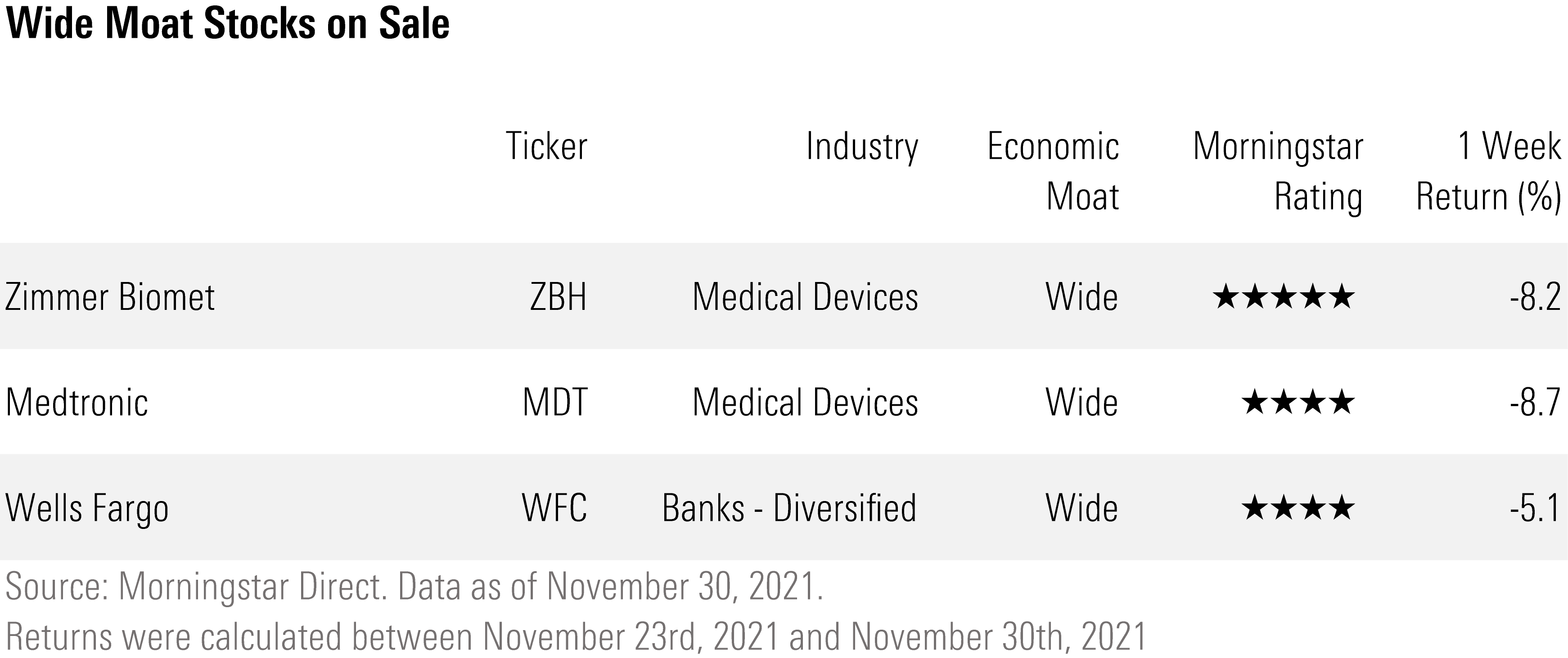

3 Wide-Moat Stocks on Sale After the Omicron Sell-Off

These high-quality names were caught up the market downdraft.

The emergence of the Omicron coronavirus variant sent the stock market stumbling back from record highs, but in the process it also left some stocks trading at bargain prices based on Morningstar’s estimates.

To find stocks that were sent into undervalued territory during the recent market retreat, we tracked changes in Morningstar Ratings for the 850 U.S.-listed stocks covered by Morningstar analysts. The Morningstar Rating ranks stocks between 1 and 5 stars, with 5 stars indicating a stock is viewed as undervalued and 1 star overvalued.

Looking back from Nov. 23 through Nov. 30, 41 stocks became more attractive with newly minted 5- or 4-star ratings.

Of those 41 names, five stocks joined the ranks of our 5-star rated stocks, while 36 stocks--mainly those in the communication services, consumer cyclical, and healthcare sectors--became 4-star stocks.

To narrow down the list of the stocks, we added a filter based on Morningstar’s Economic Moat Ratings. In this case, we excluded all but stocks with wide moat ratings, a designation signifying our analysts believe the company holds lasting competitive advantages.

The result led us to three wide-moat stocks that have just gone on sale.

Two of the stocks are in the medical devices industry. Zimmer Biomet ZBH fell into 5-star stock territory from 4-stars in the last week. Zimmer trades at a 38% discount to its fair value estimate at the time of writing. Medtronic MDT is now a 4-star stock and trades at a 17% discount. Both medical device companies fell more than 8% in the last week. Analyst Debbie Wang attributes the market’s reaction to concerns that nonpandemic procedures won’t resume to normal levels because of the emerging Omicron variant, slowing vaccination rates, and hospital labor constraints.

Wells Fargo WFC also landed in the more-attractive 4-star space from 3-stars a week ago. The stock fell 5.1% in the past week and trades at a 13% discount to its fair value estimate.

Here are the Morningstar analysts’ takes on the three stocks:

Zimmer Biomet

"With the addition of smaller competitor Biomet, Zimmer is the undisputed king of large joint reconstruction, by far. We expect favorable demographics, which include aging baby boomers and rising obesity, to fuel solid demand for large-joint replacement that should offset price declines. However, Zimmer stumbled into a series of pitfalls in 2016-17, including integration issues, supply and inventory challenges, and quality concerns that have caught the attention of the U.S. Food and Drug Administration. But new management has tackled these issues, and the firm is poised to ramp up its growth." - Debbie S. Wang, senior equity analyst

Medtronic

"Medtronic's standing as the largest pure-play medical device maker remains a force to be reckoned with in the med-tech landscape. Pairing Medtronic's diversified product portfolio aimed at a wide range of chronic diseases with its expansive selection of products for acute care in hospitals has bolstered Medtronic's position as a key partner for its hospital customers. Medtronic is one of the few relatively undervalued firms in our medical device coverage. Though Medtronic's near-term prospects are likely to be buffeted by where COVID-19 goes next, we remain confident in the firm's product pipeline and ability to innovate, which add up to a wide economic moat." - Debbie S. Wang, senior equity analyst

Wells Fargo

“Wells Fargo remains one of the top deposit-gatherers in the United States, even after the bank's scandals and an asset cap--with the third most deposits in the U.S.--behind JPMorgan Chase and Bank of America. Its strategy historically rested on deep customer relationships and sound risk management, and being perfectly positioned for the mortgage market after the financial crisis didn't hurt, either. We don't see the boost from the mortgage business ever coming back, and the bank's operational competence has been questionable for years, but we still see a bank with the right fundamentals in place and the potential to improve over time.

"Wells remains moderately undervalued within a banking sector that we view as relatively fully valued. The bank remains one of the most rate-sensitive banks under our coverage, and the catalyst of the asset-cap removal remains in play, although it admittedly may not happen until 2023. We think the gradual removal of more regulatory issues, particularly the asset cap, will help close the remaining valuation gap we see." - Eric Compton, senior equity analyst

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)