3 Undervalued Wide-Moat Technology Stocks

Even as big tech leads the market, high-quality stocks like Teradyne and Tyler Technologies are trading at a discount.

After a rough 2022, when technology stocks saw losses in the double digits, the sector made a resounding comeback in 2023. Still, long-term opportunities remain among tech stocks. High-quality names like Autodesk ADSK and Tyler Technologies TYL are undervalued.

“The year 2022 was rough for the technology sector, but it saw a recovery in the first quarter of 2023 and an even sharper rally in the second quarter,” writes Brian Colello, technology sector director for Morningstar. The sector was “boosted at least in part by the tremendous hype and demand for all things associated with artificial intelligence,” and “is now an outperformer to the broader market over the past 12 months.”

Through Aug. 3, 2023, the Morningstar US Technology Index was up 43.1%, while the Morningstar US Market Index rose 18.2%. The tech rally in 2023 has lifted the index to a 24.1% return for the trailing 12-month period, while the U.S. market has gained 11.8%.

Morningstar US Technology Index

What Are Technology Stocks?

Technology companies are engaged in the design, development, and support of computer operating systems and applications. This sector also includes firms that make computer equipment, data storage products, networking products, semiconductors, and components. Companies in this sector include Apple AAPL, Microsoft MSFT, and International Business Machines IBM.

These companies fall under the Morningstar Sensitive Super Sector, which includes industries that ebb and flow with the overall economy, but not severely. Sensitive industries fall between defensive and cyclical, as they are not immune to a poor economy.

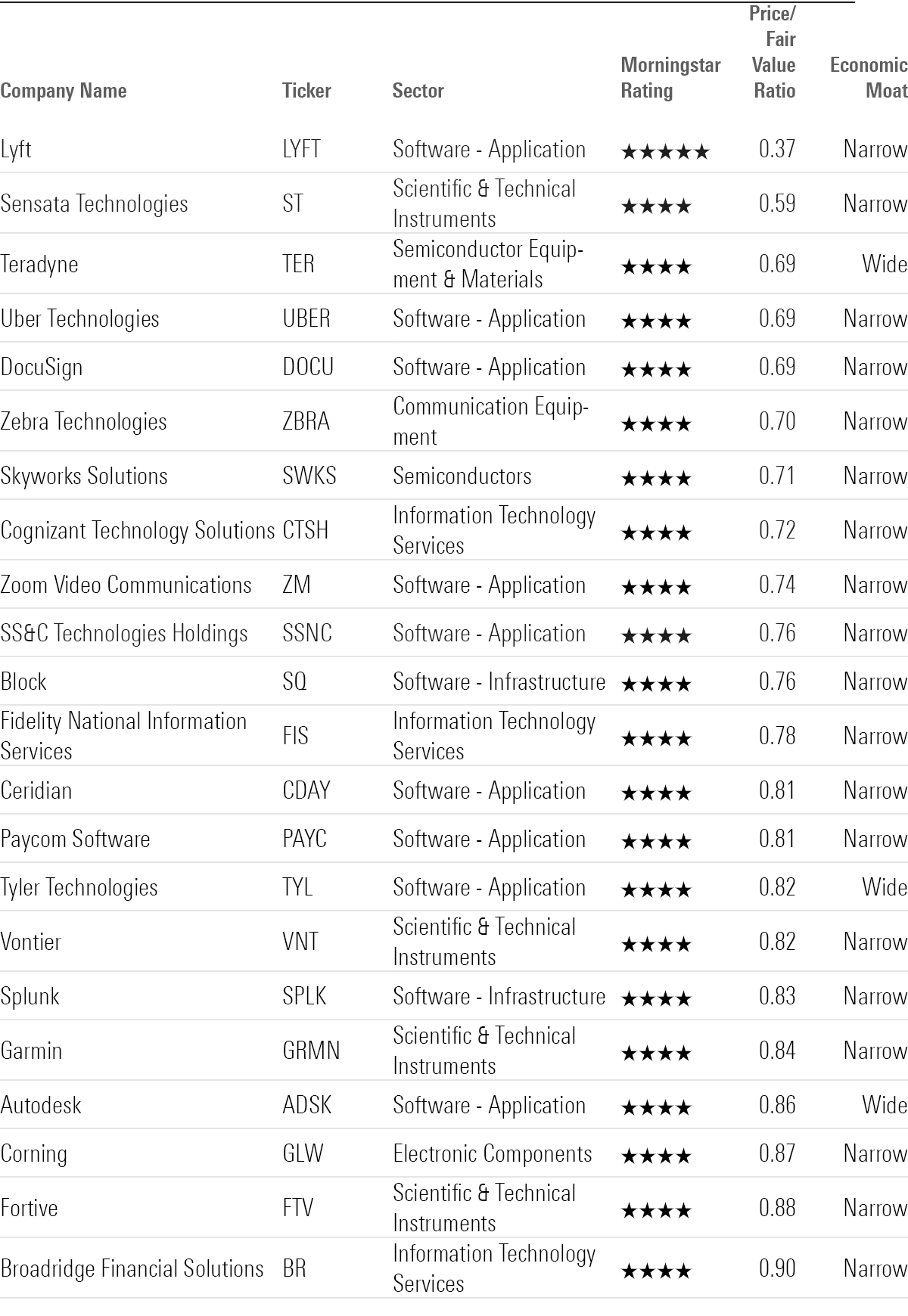

Undervalued High-Quality Tech Stocks

For this screen, we looked for the most undervalued stocks in the Morningstar Technology Index with a Morningstar Rating of 4 or 5 stars. As of Aug. 3, 22 stocks met this criteria. (The full list is at the bottom of this article.) Then we looked for stocks that have also earned a Morningstar Economic Moat rating of wide, meaning they have durable competitive advantages that are expected to last at least 20 years. Stocks with moats and low valuations historically tend to outperform over the long term.

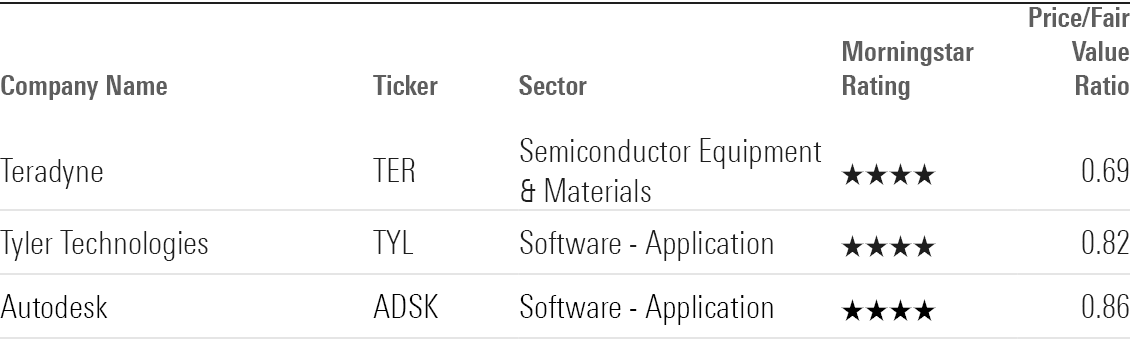

Here are three wide-moat stocks that are rated 4 stars:

- Teradyne TER

- Tyler Technologies

- Autodesk

The most undervalued stock is Teradyne, trading at a 31% discount to its analyst-assessed fair value estimate. The least undervalued is Autodesk, trading at a 14% discount.

Undervalued Wide Moat Tech Stocks

Teradyne

- Fair Value Estimate: $157.00

“Teradyne is a heavyweight supplier of automated test equipment for semiconductors, boasting market-leading capabilities that run the gamut of chips. It is one of two companies worldwide that can produce testers for the most cutting-edge semiconductors, thanks to robust engineering talent across hardware and software and a structural lead in organic investment. The firm is a vital partner to chipmakers across the industry and has an impressively strong relationship with Apple and Taiwan Semiconductor Manufacturing TSM. Teradyne’s market leadership exhibits itself in industry-leading margins, strong returns on invested capital, and a top market share.

“We assign Teradyne a wide economic moat rating based on a combination of intangible assets in semiconductor automated test equipment and switching costs created at chipmaking customers. We think Teradyne’s proficiency will enable the firm to earn impressive returns on invested capital that will continue for the next 20 years.”

—William Kerwin, analyst

Tyler Technologies

- Fair Value Estimate: $475.00

“Tyler Technologies provides a full suite of software solutions and services that address the needs of cities, counties, schools, courts, and other local government entities. The company’s three core products are Munis, which is the core enterprise resource planning system, Odyssey, which is the court management system, and payments. The company also provides a variety of add-on modules and offers outsourced property tax assessment services.

“Tyler reported second-quarter results that were ahead of our estimates for both revenue and profitability despite the accelerating software as a service transition, which tends to mute both measures. Management believes the demand environment remains at healthy levels, and we concur. We continue to see federal stimulus funds as supporting this healthy environment, and we predict consistent growth and margin expansion over time. We believe Tyler is the clear leader for municipal software needs and therefore continue to view its shares as attractive.

“We view Tyler as the clear leader in a slow-moving and underserved niche market of government operational software. We believe there is a decadelong runway for normalized top-line growth near 10% at Tyler, especially as demand for SaaS accelerates and the need intensifies to modernize local governments’ legacy enterprise resource planning systems.”

—Dan Romanoff, senior equity analyst

Autodesk

- Fair Value Estimate: $240.00

“Autodesk is an application software company that serves industries in architecture, engineering, and construction, product design and manufacturing, and media and entertainment. Autodesk software enables the design, modeling, and rendering needs of these industries.

“We think Autodesk will remain the industry standard, as its switching costs and network effect continue to reinforce one another and the company stays at the forefront of industry trends. Autodesk now has over 95% of revenue recurring, after a gradual transition from licenses over the past eight years. We think the change enables the firm to extract greater revenue per user as it upsells its loyal and increasingly maturing base.

“Rather than rest on its laurels and count on its network effect to do all the work in protecting its incumbency, Autodesk has continued to innovate. The firm has disrupted itself with its Revit 3D modeling software, which has served as a replacement for many AutoCAD users because of its use of parametric modeling to predict unknown variables. While Revit was acquired in 2002, its innovation since has us confident in Autodesk’s eye for the future.”

—Julie Bhusal Sharma, equity analyst

Undervalued Technology Stocks

3 Most Expensive Wide-Moat Stocks to Avoid

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BT5YFLNBJ5DW7KKACWJIGT2CEY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LBSSGWKXFBFK7NB3EFXZ4Q7S7Y.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/64HLN6SIIVBSXC273HJWRGOOOI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)