Technology Stock Outlook: After Taking Hits in 2022, Tech Hits Some New Highs in 2023

We see fewer buying opportunities even as the sector is now an outperformer to the broader market.

This article is part of Morningstar’s Q2 market review and outlook.

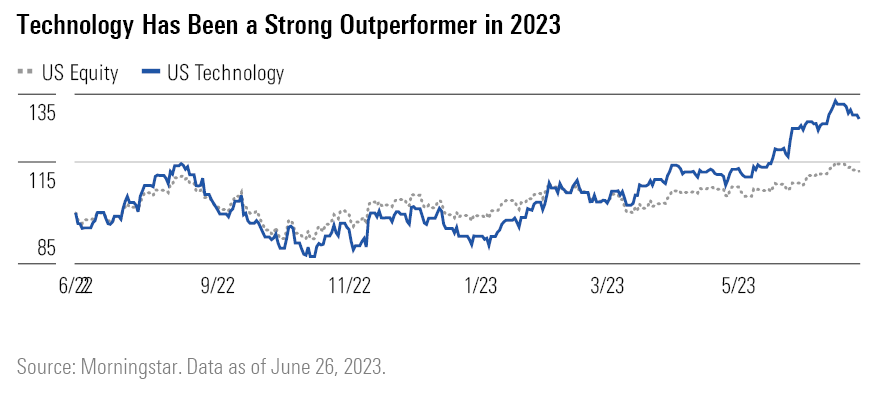

The year 2022 was rough for the technology sector, but it saw a recovery in the first quarter of 2023 and an even sharper rally in the second quarter, boosted at least in part by the tremendous hype and demand for all things associated with artificial intelligence. The sector is now an outperformer to the broader market over the past 12 months.

Mega-cap tech stocks (Apple AAPL, Microsoft MSFT) are still faring better than the overall group, and Nvidia NVDA emerged as another (brief) member of the $1 trillion club, but other tech stocks also recovered. We remain confident in secular tailwinds in technology, such as cloud computing, artificial intelligence, and rising semiconductor demand in a variety of end markets. We still see some select buying opportunities in semis and software, even with some macroeconomic concerns on the horizon.

Across the tech landscape, Nvidia’s spectacular outlook for 2023 indicates that leading cloud and Internet companies are racing to train and expand their AI models. We think AI has the potential to revolutionize industries and how people interact with the world. Meanwhile, the dreadful demand environment for PCs and smartphones seems to have bottomed, although we only anticipate a slow recovery. Automotive semis was the last sector to see headwinds, but supply/demand seems to be normalizing.

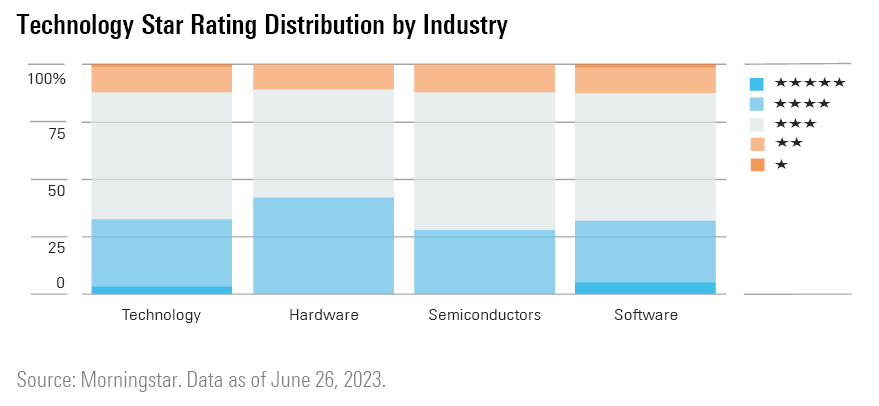

The Morningstar US Technology Index is up nearly 28% on a trailing 12-month basis, compared with the U.S. equity market up only 12%. Over the past quarter, tech rose 12% while the U.S. equity market rose only 5%. The median U.S. technology stock is 6% undervalued, and we see less of a margin of safety than when these stocks were 20%-25% undervalued nine months ago. The median hardware, software, and semis stock are undervalued in the 5%-7% range.

Technology Is At the Start of a Boom Cycle In AI Investments

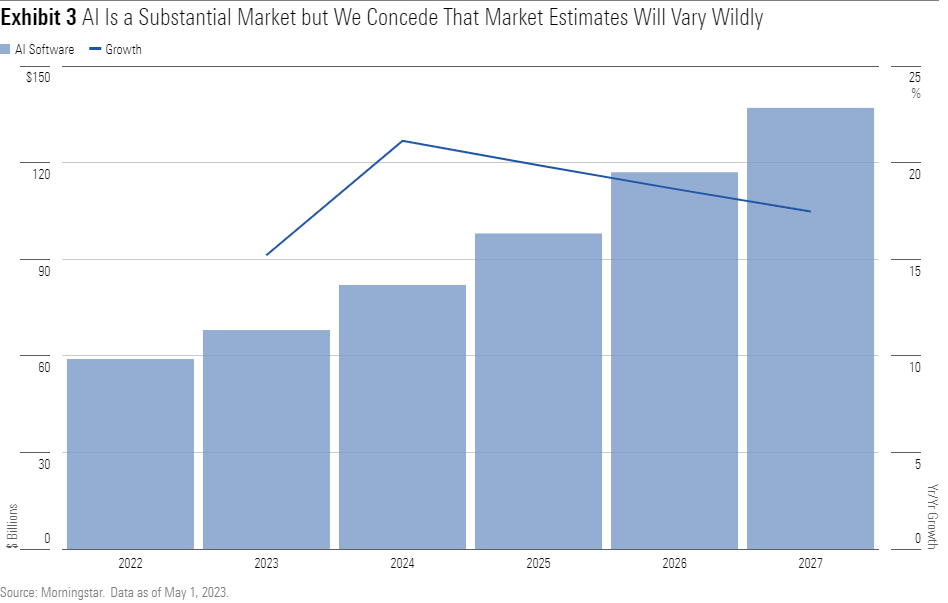

Consumers and businesses alike are interested in artificial intelligence, although there’s no clean and clear way to size this market. We anticipate that AI development will be enormous, but monetization may be scattered. Some firms may weave AI into existing products, while some may earn direct fees from AI models. We take our best attempt to size the market (see next chart), based on a blend of industry estimates, but we still think that the impact of AI may go far beyond the impact of higher software prices.

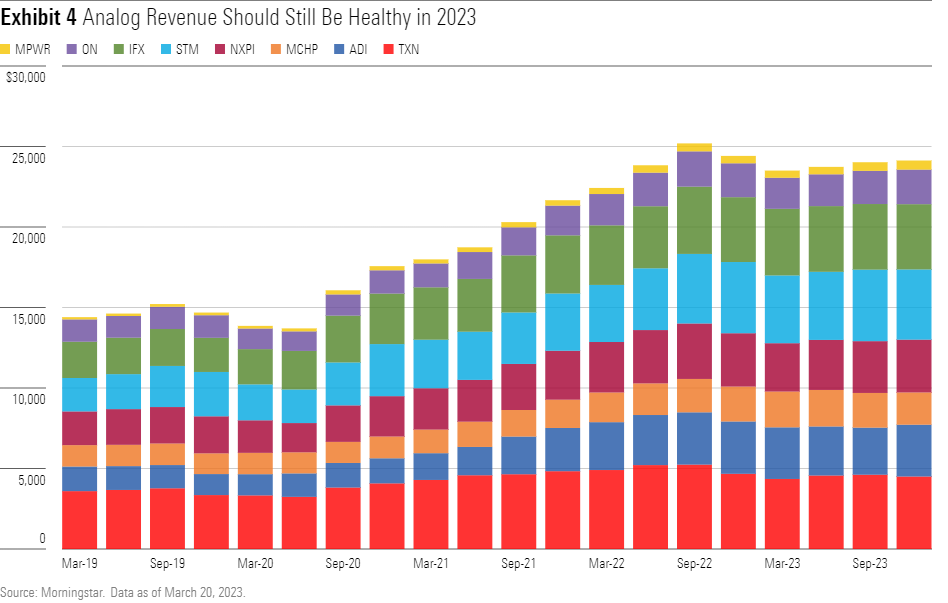

Elsewhere in tech, analog and mixed-signal semiconductor revenue growth has been stellar in recent quarters, thanks to the global chip shortage and high demand for content in automotive.

We’re seeing signs of a slowdown in 2023 as firms will likely face tough comps, but overall sales levels should remain healthy and are supported by large order backlogs.

Top Technology Sector Stock Picks

Salesforce CRM

- Fair Value Estimate: $245.00

- Star Rating: 3 Stars

- Uncertainty Rating: High

- Economic Moat Rating: Wide

We believe Salesforce represents one of the best long-term growth stories in large-cap software due to its ever-expanding portfolio of complementary solutions that allow users to completely embrace their customers, thereby building relationships, strengthening retention, and driving revenue. In our view, Salesforce will benefit further from natural cross-selling among its clouds, upselling more robust features within product lines, pricing actions, international growth, and continued acquisitions such as the recent deals for Slack and Tableau.

Cognizant Technology Solutions CTSH

- Fair Value Estimate: $91.00

- Star Rating: 5 Stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Narrow

We think Cognizant is well-positioned to push its reputation past being a back-office outsourcer to higher value technical offerings—like digital engineering and AI solutions—as well as digital transformation consulting. In our view, losers of digital transformation will be much smaller IT services players that lose out because of consolidation of accounts with larger vendors, like Cognizant. We bake in a five-year revenue compound annual growth rate of 8% for Cognizant, an acceleration of 5% over the last five years.

Teradyne TER

- Fair Value Estimate: $157.00

- Star Rating: 4 Stars

- Uncertainty Rating: High

- Economic Moat Rating: Wide

Teradyne is a chip-testing behemoth that uses a large research and development budget to produce top-tier automated test equipment and attain a leading market share, all while posting better profitability than its peers. Teradyne boasts especially strong relationships with Apple and TSMC, but we think the breadth and depth of its capabilities across many chip types and end applications represent impressive intangible assets that inform our wide economic moat rating.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)