8 Undervalued Quality Healthcare Stocks

These wide-moat healthcare stocks are trading below their fair value estimates.

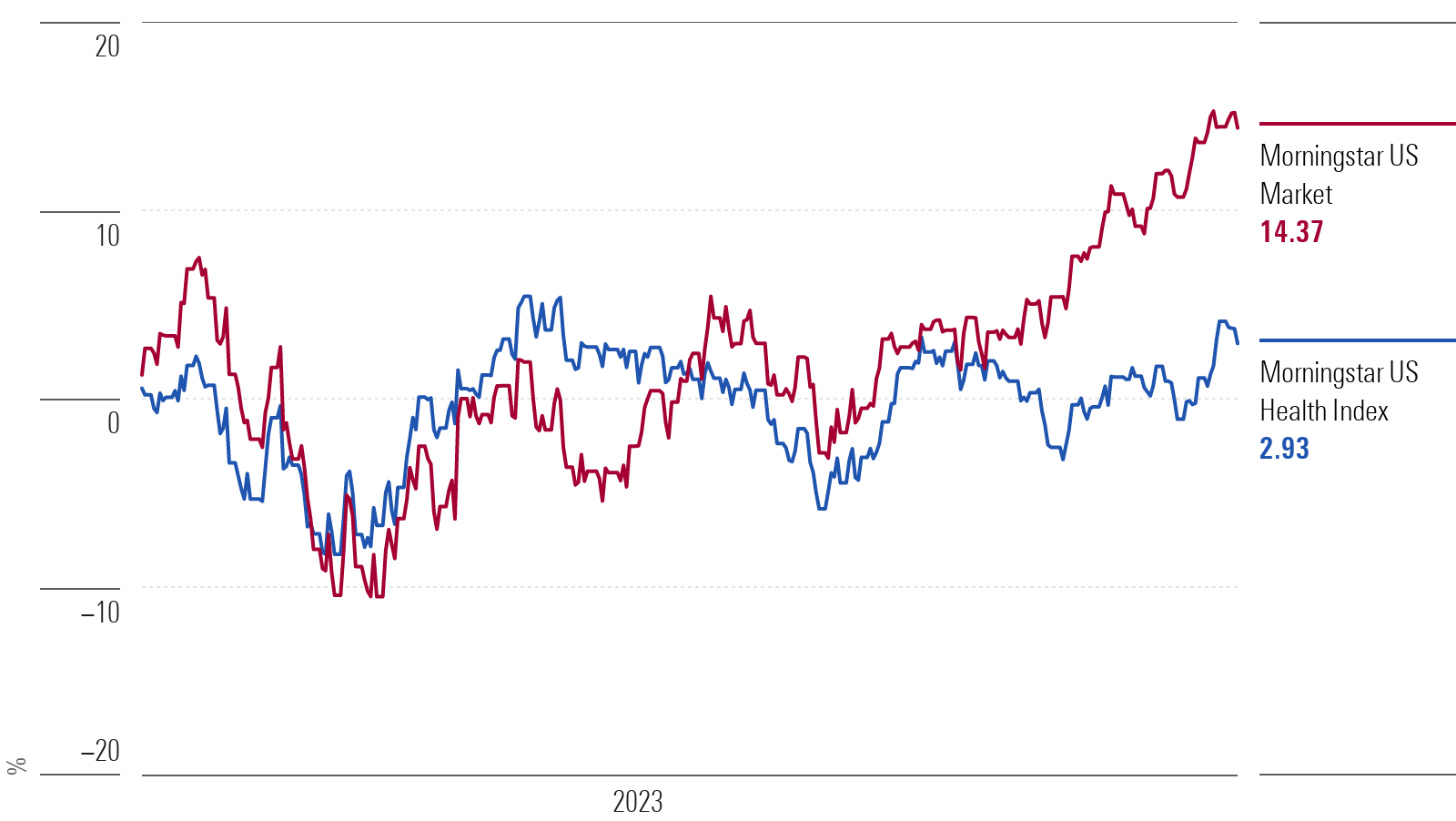

While the stock market has risen into the double digits in 2023, healthcare stocks have stayed relatively flat. This is good news for investors looking for long-term opportunities in the healthcare sector, as many high-quality healthcare stocks are still trading at undervalued prices.

The Morningstar US Healthcare Index gained 2.9% for the 12 months through July 28, 2023. The broader market rose 14.4% during the same period, as measured by the Morningstar US Market Index. Of the 176 stocks in the Healthcare Index, 77 are covered by Morningstar analysts. Of those, 46 were undervalued as of July 28, 2023.

Morningstar US Healthcare Index

What Are Healthcare Stocks?

A wide range of companies fall under this umbrella. The Healthcare Index comprises seven industries: biotechnology, drug manufacturers, healthcare plans, healthcare providers and services, medical devices and instruments, medical diagnostics and research, and medical distribution. Healthcare stocks fall under Morningstar’s defensive super sector, meaning they tend to do well even when the overall market is down.

Some of these companies are engaged in the research, discovery, development, and production of innovative drugs and technologies. Others, such as health maintenance organizations and preferred provider organizations, offer a wide variety of managed health products and services. Some of the largest healthcare stocks include UnitedHealth Group UNH, Johnson & Johnson JNJ, and Eli Lilly LLY.

For this screen, we looked for the most undervalued stocks in the Morningstar US Healthcare Index with a Morningstar Rating of 4 or 5 stars. Then we looked for stocks that have also earned a Morningstar Economic Moat rating of wide, meaning they have durable competitive advantages expected to last at least 20 years. Stocks with moats and low valuations historically tend to outperform for long-term investors.

8 Undervalued Healthcare Stocks to Buy Now

These were the eight most undervalued stocks in the Morningstar US Healthcare Index as of July 28:

- Veeva Systems VEEV

- Pfizer PFE

- Biogen BIIB

- Gilead Sciences GILD

- Medtronic MDT

- Zimmer Biomet Holdings ZBH

- Agilent Technologies A

- Waters WAT

The most undervalued healthcare stock is Veeva Systems, trading at a 28% discount to the fair value estimate set by Morningstar analysts. The least undervalued on the list is Waters, trading at a 12% discount. Morningstar stock analysts believe all these stocks are high-quality and continue to be undervalued.

Undervalued Healthcare Stocks

Veeva Systems

- Fair Value Estimate: $275.00

“Veeva is the leading provider of cloud-based software solutions tailored to the life sciences industry. It provides an ecosystem of products to address the operating challenges and regulatory requirements that companies in the space face. Instead of focusing on a general system, Veeva has created platforms that are each designed to serve one industry. This vertical focus has allowed the company to shape its products for its customers to fit their specific needs. Veeva is deeply penetrated in its addressable market, and its expanding portfolio of applications makes the company one of the most attractive offerings in this space.

“The company operates in two categories: commercial solutions and R&D solutions. Commercial solutions entail vertically integrated customer relationship management services and end-market data and analytics solutions. Veeva CRM is Veeva’s cloud-based customer relationship management platform that markets to pharmaceutical and biotech companies with commercial needs.

“We assign Veeva a wide moat rating because we believe the firm’s high retention rate and its customers’ unlikeliness to move to a different product (switching costs) should continue to support economic profits for at least the next 20 years.”

—Keonhee Kim, equity analyst

Pfizer

- Fair Value Estimate: $48.00

“Pfizer’s foundation remains solid, based on strong cash flows generated by a basket of diverse drugs. The company’s large size confers significant competitive advantages in developing new drugs. This unmatched heft, combined with a broad portfolio of patent-protected drugs, has helped Pfizer build a wide economic moat around its business.

“Pfizer’s size establishes one of the largest economies of scale in the pharmaceutical industry. In a business where drug development needs a lot of shots on goal to be successful, Pfizer has the financial resources and the established research power to support the development of more new drugs. Also, after many years of struggling to bring out important new drugs, Pfizer is now launching several potential blockbusters in cancer, heart disease, and immunology.

“Further, we believe Pfizer’s operations can withstand the eventual generic competition, and its diverse drug portfolio helps insulate the company from any one particular patent loss. Following its merger with Wyeth several years ago, Pfizer has a much stronger position in the vaccine industry with its pneumococcal vaccine Prevnar. Vaccines tend to be more resistant to generic competition because of the manufacturing complexity and relatively lower prices.”

—Damien Conover, sector director

Biogen

- Fair Value Estimate: $327.00

“Biogen and Idec merged in 2003, bringing together Biogen’s multiple sclerosis drug Avonex and Idec’s cancer drug Rituxan. Today, Rituxan and the next-generation antibody Gazyva are marketed via a collaboration with Roche. Biogen also markets the novel multiple sclerosis drugs Plegridy, Tysabri, Tecfidera, and Vumerity. In Japan, Biogen’s MS portfolio is co-promoted by Eisai. Hemophilia therapies Eloctate and Alprolix (partnered with Sobi) were spun off as part of Bioverativ in 2017. Biogen has several drug candidates in phase 3 trials in neurology and neurodegenerative diseases and has launched Spinraza with partner Ionis. Aduhelm was approved as the firm’s first Alzheimer’s disease therapy in June 2021, followed by Leqembi in January 2023.

“We think Biogen’s specialty-market-focused drug portfolio and novel neurology-focused pipeline create a wide moat. While Rituxan is succumbing to biosimilar competition, Biogen is expanding its neurology portfolio beyond MS, including blockbuster neuromuscular disease drug Spinraza and several promising drugs, including Leqembi.”

—Karen Andersen, sector strategist

Gilead Sciences

- Fair Value Estimate: $97.00

“Gilead develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. The acquisitions of Corus Pharma, Myogen, CV Therapeutics, Arresto Biosciences, and Calistoga have broadened this focus to include pulmonary and cardiovascular diseases and cancer. Gilead’s acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of the combination drug Harvoni, and its acquisitions of Kite, Forty Seven, and Immunomedics boost Gilead’s exposure to cell therapy and noncell therapy in oncology.

“We assign Gilead a wide economic moat. We think patent protection on newer HIV regimens and Gilead’s continued dominance in the hepatitis C market will be enough to ensure strong returns for the next couple of decades. Gilead’s expertise in infectious diseases and single-pill formulations is part of its research and development strategy, which we see as one of the strongest intangible assets supporting its wide moat.”

—Karen Andersen

Medtronic

- Fair Value Estimate: $112.00

“One of the largest medical device companies, Medtronic develops and manufactures therapeutic medical devices for chronic diseases. Its portfolio includes pacemakers, defibrillators, heart valves, stents, insulin pumps, spinal fixation devices, neurovascular products, advanced energy, and surgical tools. The company markets its products to healthcare institutions and physicians in the United States and overseas. Foreign sales account for roughly 50% of the company’s total sales.

“Medtronic’s wide moat is rooted in its dominant presence in highly engineered medical devices to treat chronic diseases, including those beyond its historical stronghold in heart disease. Medtronic’s strongest moat source are intangible assets and to a lesser extent switching costs that are associated with specific products.

“Medtronic’s standing as the largest pure-play medical-device maker remains a force to be reckoned with in the med-tech landscape. Pairing Medtronic’s diversified product portfolio aimed at a wide range of chronic diseases with its expansive selection of products for acute care in hospitals has bolstered Medtronic’s position as a key partner for its hospital customers.”

—Debbie S. Wang, senior equity analyst

Zimmer Biomet

- Fair Value Estimate: $175.00

“Zimmer designs, manufactures, and markets orthopedic reconstructive implants, as well as supplies and surgical equipment for orthopedic surgery. With the acquisitions of Centerpulse in 2003 and Biomet in 2015, Zimmer holds the leading share of the reconstructive market in the United States, Europe, and Japan.

“With the addition of Biomet, Zimmer is the undisputed king of large joint reconstruction. We expect favorable demographics, which include aging baby boomers and rising obesity, to fuel solid demand for large-joint replacements that should offset price declines.

“Zimmer’s wide economic moat stems from two major sources. First, there are substantial switching costs for orthopedic surgeons. The extensive instrumentations used to prepare bones and install implants are specific to each company. The learning curve to become proficient in using one company’s instrumentation is significant.”

—Debbie S. Wang

Agilent Technologies

- Fair Value Estimate: $151.00

“Agilent’s measurement technologies serve a broad base of customers with its three operating segments: life science and applied tools, cross lab (consisting of consumables and services related to life science and applied tools), and diagnostics and genomics. Over half of its sales are generated from the biopharmaceutical, chemical, and advanced materials end markets, but it also supports clinical lab, environmental, forensics, food, academic, and government organizations. The company is geographically diverse, with operations in the U.S. and China representing the largest country concentrations.

“Agilent’s strategy revolves around placing analytical instruments and informatics with relevant customers and then providing related services and consumables such as chromatography columns and sample preparation tools, which account for the rest of Agilent’s sales. About half of Agilent’s sales recur naturally. However, even instrument sales can be relatively sticky at the end of the instrument’s life cycle, especially in the highly regulated pharmaceutical end market and some of its other applications, where intensive, time-consuming training is required to master the scientific analysis. Agilent aims to increase its exposure to these sticky customer relationships.

“We believe a wide moat surrounds Agilent’s analytical instrument business, consisting primarily of chromatography (gas and liquid), mass spectrometry, and other testing tools. Intellectual property and ongoing innovation create an intangible asset moat source while regulatory and reproducibility factors contribute to switching costs for end users. Both moat sources are crucial to Agilent’s ongoing advantages in its target markets, and with these advantages, Agilent enjoys strong returns on invested capital including goodwill of more than double its capital costs, by our calculations.”

—Julie Utterback, senior equity analyst

Waters

- Fair Value Estimate: $323.00

“Waters sells liquid chromatography, mass spectrometry, and thermal analysis tools. These analytical instruments provide essential information on various products, such as their molecular structures and physical properties, to help clients enhance the health and well-being of end users.

“The firm’s strategy revolves around placing instruments, including preinstalled software, providing various services throughout each system’s useful life, and selling related consumables, such as chromatography columns and sample preparation kits and tools. About half of Waters’ sales are considered recurring, but even instrument sales can be relatively sticky, especially in the highly regulated pharmaceutical end market. We appreciate Waters’ concentration in this highly regulated space, which is more significant than many of its life science/diagnostic peers, given the healthy long-term growth profile and significant switching costs associated with the pharmaceutical field.

“We believe a wide moat surrounds Waters. Intellectual property and ongoing innovation create an intangible asset, while regulatory and reproducibility factors contribute to switching costs for end users. Both moat sources are crucial to Waters’ advantages in its target markets, and with these advantages, Waters enjoys profitability near the top of the life science market, with returns on invested capital over 25%, by our calculations.”

—Julie Utterback

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)