3 Trends to Watch in Digital Advertising

Podcasts, connected TVs, and e-commerce platforms will help grow digital ad spending.

Advertisers are increasingly turning to podcasts, connected TVs, and the websites of retail giants to get their message out to consumers.

Demand in these three areas--which include online retailers like Amazon.com AMZN, TVs with embedded streaming apps, and devices like Apple TV AAPL and Roku ROKU (the latter two are considered to be connected TVs)--is expected to help drive growth in digital advertising spending, according to recent Morningstar research. Morningstar Direct clients can read the full report here.

In the report, Morningstar senior equity analyst Ali Mogharabi explains how consumers use these platforms and what it means for growth in digital advertising spending. Here's a look at some of his findings:

Consumers Have Jumped on the Podcast Bandwagon

Before the pandemic, most consumers listened to podcasts during their commutes. But stay-at-home orders kept many consumers online, giving them more time to consume content like podcasts.

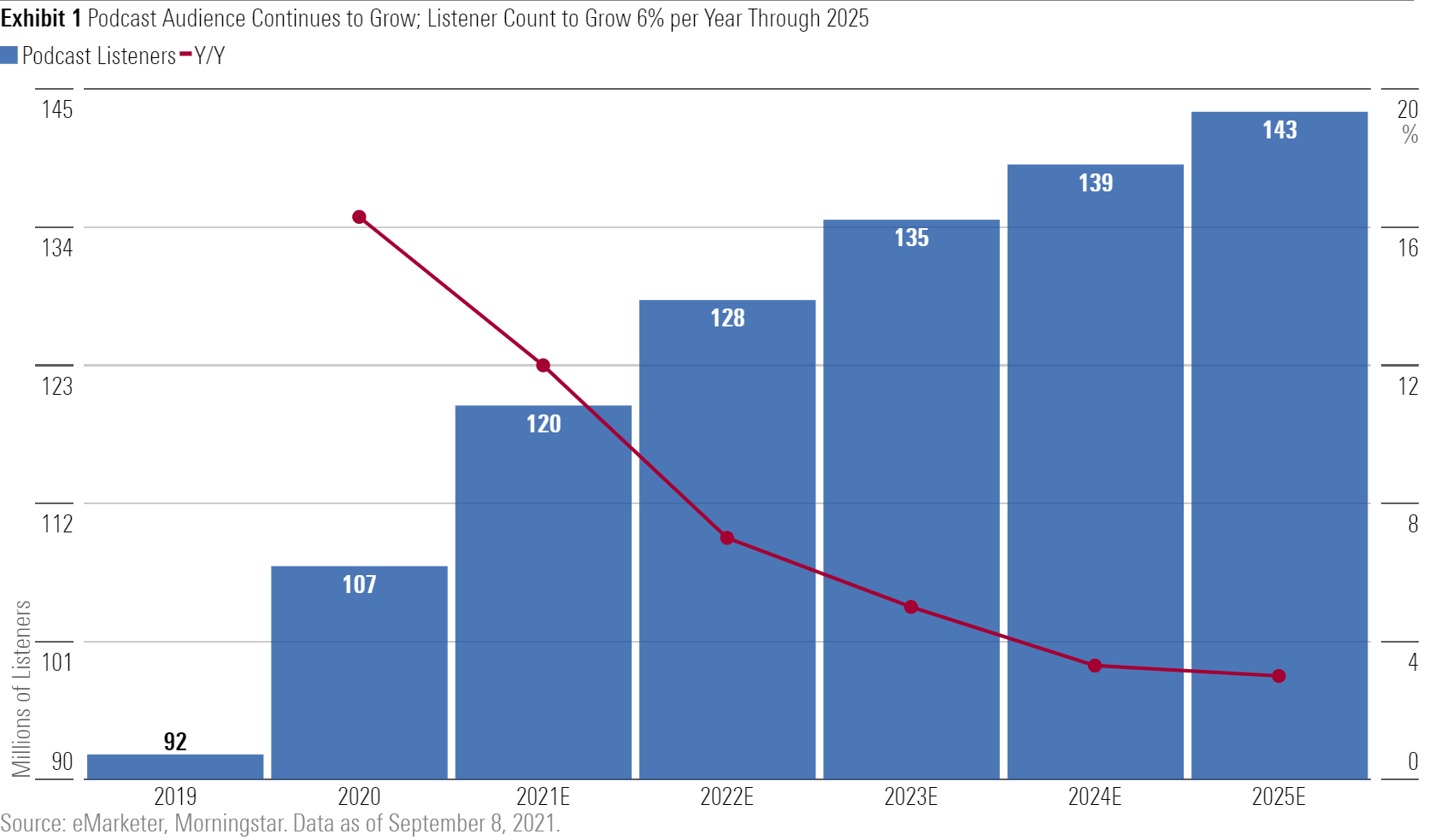

EMarketer estimates that the number of podcast listeners in the United States increased more than 16% in 2020 to 107 million--even without commuting for most of the year.

Mogharabi expects the number of U.S. podcast listeners to grow at a 6% annual rate through 2025 to 143 million total listeners. Exhibit 1 shows his forecast for podcast listener growth.

Exhibit 1 Podcast Audience Continues to Grow: Listener Count ti Grow 6% per Year Through 2025

He also forecasts that ad spending on podcasts will grow at a 23% rate through 2025 for a total of $2.7 billion.

Spotify SPOT will benefit most from the growth in podcast listening and the resulting higher demand from advertisers, Mogharabi says. However, it will face intense competition from Apple, Google GOOGL/GOOG, Amazon, and many others.

Consumers Are Moving Toward Connected TVs

The pandemic accelerated growth in connected TVs (TVs with embedded apps or external devices like Roku). The increasing number of viewers abandoning traditional TV--or never signing up in the first place--points to the growing importance of streaming content.

Mogharabi estimates around two thirds of U.S. households subscribe to traditional TV services today, which is an 80% drop from 2018.

Connected TVs have attracted a variety of viewers, which is good news for advertisers. EMarketer estimated that in 2020 connected TV viewers represented 48% of Generation Z, 57% of millennials, 49% of Generation X, and 33% of baby boomers.

Many viewers are also shifting their viewing preference to larger TV screens for content typically watched on mobile devices or desktops. As consumers learn to access content as easily on connected TVs, Mogharabi thinks there's room for growth in digital ad spending on this platform.

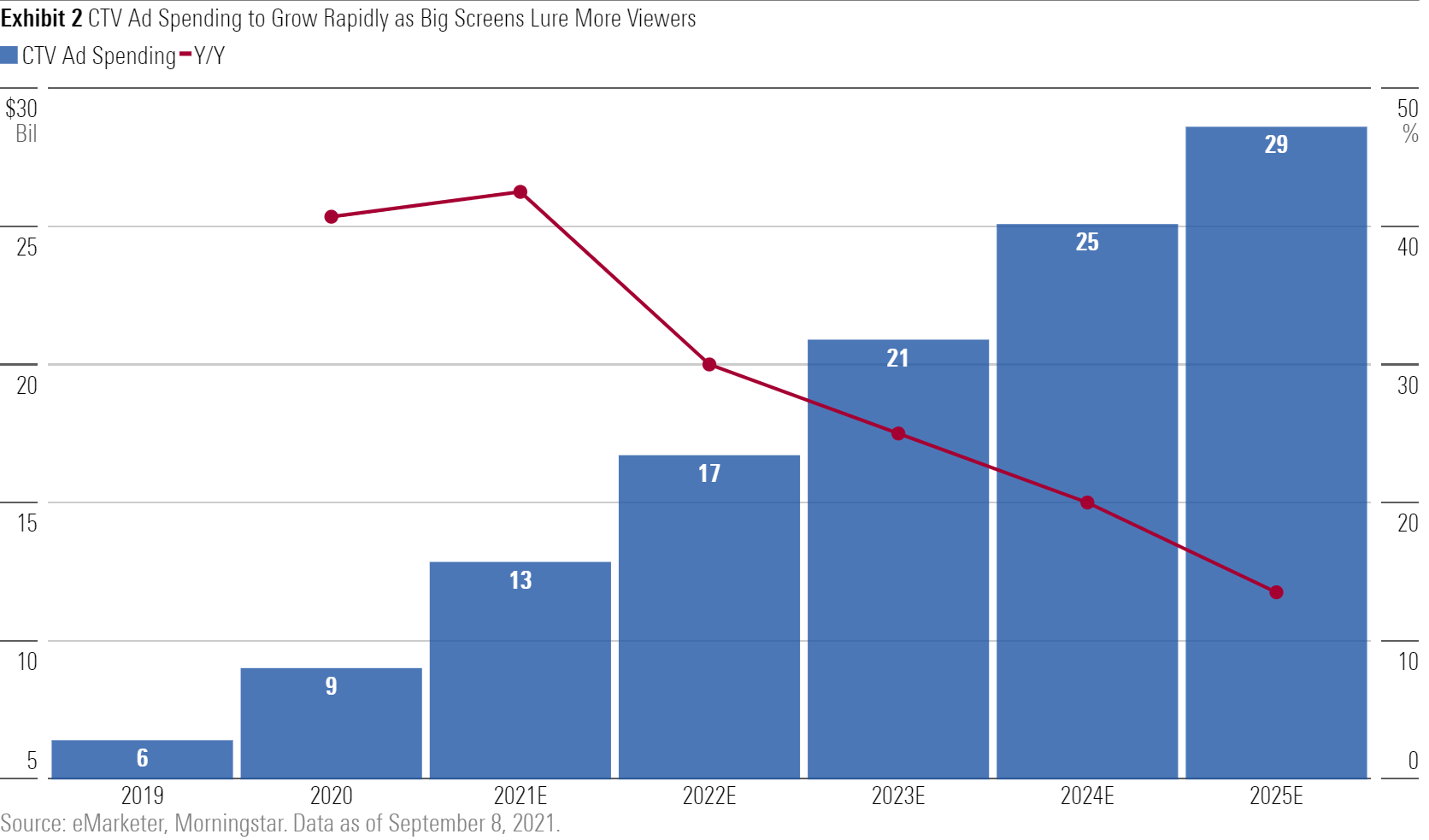

Ad spending budgeted for connected TVs will eventually overtake traditional TV ad spending. But in the near to medium term, advertisers will continue to purchase traditional TV ads while gradually increasing connected TV ad spending, Mogharabi says.

Mogharabi expects connected TV ad spending to grow at an average rate of 26% per year in the U.S. to $29 billion by 2025. Large U.S. media companies like Disney DIS, NBCUniversal, and Warner Media collected $45 billion in overall ad revenue in 2020.

Exhibit 2 shows Mogharabi's growth forecast for connected TV ad spending.

Exhibit 2 CTV Ad Spending to Grow Rapidly as Big Screens Lure More Viewers

The largest connected TV ad suppliers include YouTube, Roku, and Hulu, but multiple traditional media firms are racing to online streaming services. NBCUniversal's Peacock and ViacomCBS' VIAC Paramount+ both offer ad-supported tiers at lower price points, and even WarnerMedia launched an ad-supported version of HBO Max.

Large Online Retailers Have Attracted Digital Advertisers

Growth in e-commerce, especially as it has accelerated during the pandemic, will likely increase growth in digital ad spending. And as traffic on retail sites or apps increases, advertisers create new revenue opportunities for retailers.

Aggressive investments by large retailers like Amazon, Walmart WMT, and Target TGT strongly support Mogharabi's view that online retail is attracting more digital ad dollars. Each of these companies has either created or acquired platforms to make advertising easier for sponsors.

While retailers will be prime beneficiaries from the growth in retail advertising, Mogharabi believes Google and Criteo CRTO are likely to benefit the most among media and ad technology firms.

Google is well positioned given its one-stop shop for ad technology. Its primary role in e-commerce will help retail sites effectively manage their ad inventories and optimize ad placement.

Like Google but on a much smaller scale, Criteo manages ad supply for various retailers and applies its customer data to make ad inventories more attractive to advertisers.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)