10 Stocks With the Largest Fair Value Estimate Increases After Q4 Earnings

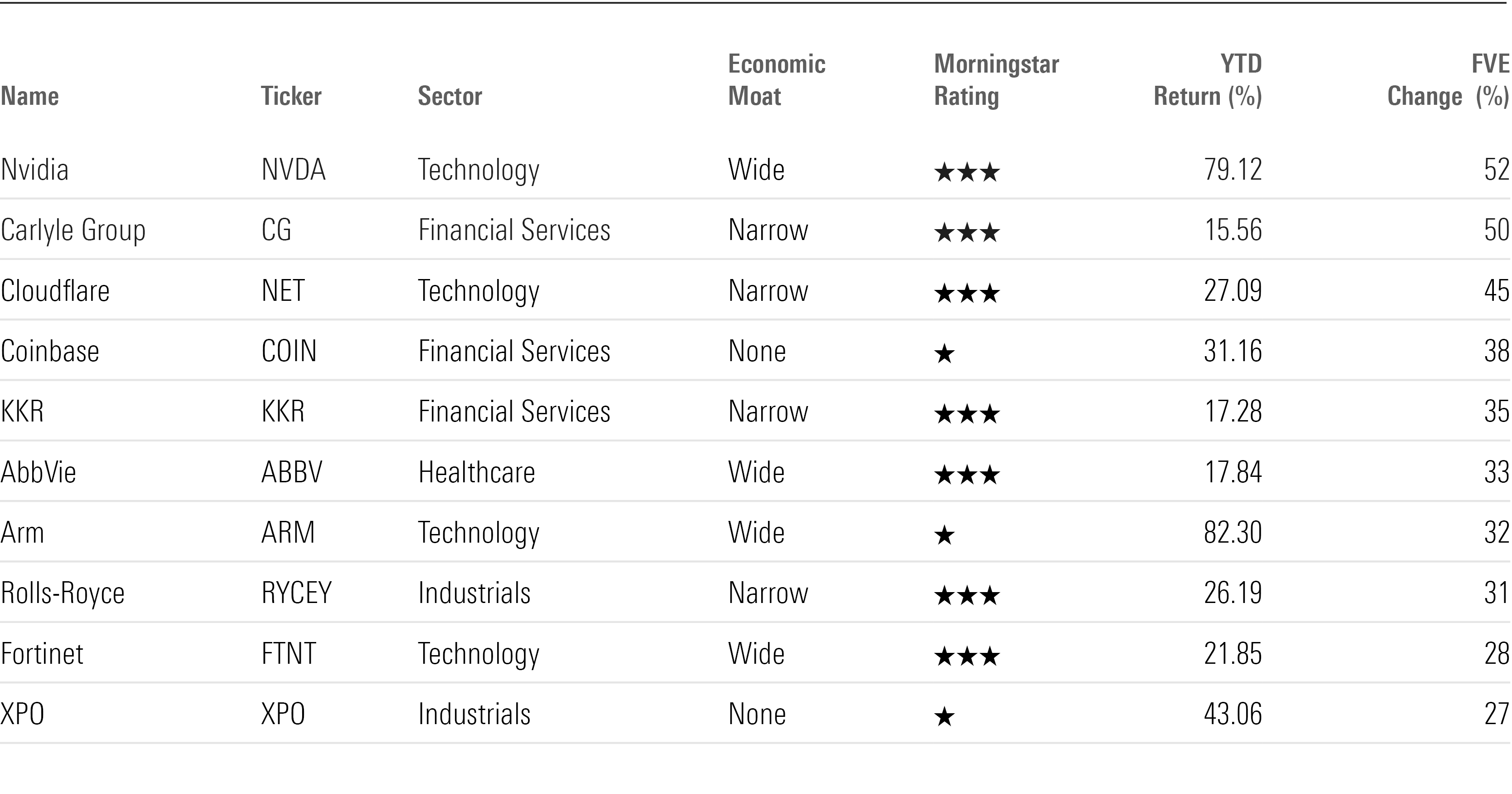

Nvidia and Carlyle Group saw the largest valuation bumps among US-listed stocks covered by Morningstar analysts.

Amid a stock market rally and strong fourth-quarter earnings, Morningstar analysts have been raising the fair value estimates of the companies they cover at the highest rate in two years.

The stocks that saw the largest fair value increases during the earnings season were semiconductor giant Nvidia NVDA, whose estimate was lifted by 52%, and asset management company Carlyle Group CG, which saw a 50% increase.

Here we’ll highlight the stocks with the largest increases to their fair value estimates.

Stocks With the Largest Valuation Increases

- Nvidia NVDA: $730 from $480

- Carlyle Group CG: $48 from $32

- Cloudflare NET: $87 from $60

- Coinbase COIN: $110 from $80

- KKR KKR: $85 from $63

- AbbVie ABBV: $168 from $126

- Arm ARM: $45 from $34

- Rolls-Royce RYCEY: $4.81 from $3.66

- Fortinet FTNT: $77 from $60

- XPO XPO: $75 from $61

Q4 2024 Sees the Biggest Valuation Increases Since 2021

Across the 885 US-listed stocks covered by Morningstar analysts, the average increase in fair value estimate this year was 2.07% through the end of February. That’s the largest such increase since the fourth quarter of 2021, which saw an average raise of 2.82%.

Morningstar Fair Value Estimate Average Change

Among the stocks we scanned for changes, 10% saw meaningful improvements of 10% or more to their fair value estimates. That was above the 7% quarterly average for the past decade.

On a sector level, technology and financial services saw increases at an even higher rate, with 19% of companies increasing by at least 10% and an average increase of 3.8%. Looking at financial services companies, 14% had a fair value increase of at least 10%, with an average sector increase of 3.3%.

Distribution of Significant Fair Value Estimate Increases By Sector

Industrials had the highest average increase at 4.9%, while it matched the overall rate of increases across all sectors, with 10% of stocks in the category seeing a meaningful fair value bump.

Here’s what Morningstar analysts had to say about these stocks.

Nvidia NVDA

Nvidia had the largest fair value estimate increase, going to $730 from $480, thanks to the surge in artificial intelligence computing demand. “Leading cloud computing companies plan to boost their capital expenditures to satisfy demand for AI training and inference, and it appears that virtually all this spending will fall into Nvidia’s pockets,” says Morningstar equity strategist Brian Colello. “More importantly, we anticipate healthy growth for Nvidia’s data center revenue beyond 2024, as Nvidia’s Cuda software should contribute to strong customer stickiness for existing AI models and workloads.”

Nvidia is trading close to its new fair value estimate and has a Morningstar Rating of 3 stars.

Carlyle Group CG

Carlyle Group had the second-largest fair value estimate increase, as it went to $48 from $32. “While some of the increase in valuation was due to the recovery in the equity and credit markets, much of it was due to changes management made to the firm’s compensation structure, with the firm moving some of its cash-based compensation over to performance revenue-related compensation,” says Morningstar strategist Greggory Warren. “This puts the firm in a much better position than we expected coming into 2024, allowing us to raise our fair value estimate by 50%.”

Carlyle Group is trading close to its new fair value estimate and has a Morningstar Rating of 3 stars.

Cloudflare NET

Software company Cloudflare saw its fair value estimate climb to $87 from $60. “We believe that an improving macro will benefit Cloudflare as customers increase their spending on cybersecurity after a slowdown in 2023,” says Morningstar equity analyst Malik Ahmed Khan. Additionally, “we believe Cloudflare’s impressive enterprise penetration reflects positively on the personnel changes the firm made to its go-to-market organization earlier this year, a good omen for the future if its sales execution remains strong amid an improving demand landscape.”

Cloudflare is trading close to its new fair value estimate and has a Morningstar Rating of 3 stars.

Coinbase COIN

Coinbase, a cryptocurrency exchange platform, saw its fair value estimate increase twice during the quarter. Morningstar equity analyst Michael Miller first raised it to $100 from $80 in early January, then raised it again to $110 in mid-February.

The initial increase was largely due to increased trading revenue expectations. “News and speculation surrounding bitcoin spot ETFs have led to a major rally in cryptocurrency prices over the last few months, with the size of the overall cryptocurrency market increasing around 100% from the start of 2023,” said Miller. “Coinbase’s results have historically been highly correlated to cryptocurrency prices, and trading volume on Coinbase’s platform has already increased significantly because of these market trends.”

The second increase came after the company reported its fourth-quarter earnings. “The firm’s average pricing was more resilient than we had expected as more of its increased volume came from retail traders, who pay higher fees than institutional traders,” says Miller.

Coinbase is trading at a 117% premium to its new fair value estimate and has a Morningstar Rating of 1 star.

KKR KKR

Alternative asset management firm KKR saw its fair value estimate increase to $85 from $63, due to revised near-term expectations for assets under management, revenue, and profitability. “A good chunk of the increase was due to the recovery in the equity and credit markets, which should improve conditions for investments, realizations, and fundraising, but some of it was also due to KKR taking full ownership of Global Atlantic Group,” says Warren. “All of this puts the firm in a much better position than we’d been expecting coming into 2024, allowing us to raise our fair value estimate by 35%.”

KKR is trading close to its new fair value estimate and has a Morningstar Rating of 3 stars.

AbbVie ABBV

Pharmaceutical company AbbVie had two increases to its fair value estimate in the quarter. Morningstar director of equity strategy Damien Conover first raised it to $137 from $126 in late January, at the same time that its economic moat rating went from narrow to wide due to the company successfully navigating the Humira patent losses.

The second increase to $168 came in early February after the company reported its fourth-quarter earnings. “AbbVie’s performance with next-generation immunology drugs Skyrizi and Rinvoq looks exceptionally strong,” says Conover.

AbbVie is trading close to its new fair value estimate and has a Morningstar Rating of 3 stars.

Arm Holdings ARM

Semiconductor company Arm saw its fair value estimate increase to $45 from $34 due to “higher licensing revenue and royalty rates longer term after management confirmed that the new Arm v9 architecture carries double the royalty rates of its predecessor, v8,” says Morningstar equity analyst Javier Correonero. “At the same time, Arm chips continue to see growth from AI as they are used in conjunction with GPUs in the data center and to enable on-device AI features in smartphones.”

Arm is trading at a 204% premium to its new fair value estimate and has a Morningstar Rating of 1 star.

Rolls-Royce RYCEY

Aerospace and defense company Rolls-Royce saw its fair value estimate increase to $4.81 from $3.66, due to higher confidence in civil performance delivery. “Results confirmed that some of the structural improvements were delivered ahead of schedule, boosting our confidence in further performance improvements,” says Morningstar equity analyst Loredana Muharremi.

Rolls-Royce is trading close to its new fair value estimate and has a Morningstar Rating of 3 stars.

Fortinet FTNT

Cybersecurity firm Fortinet saw its fair value estimate increase to $77 from $60 in early February. “Along with strong quarterly results, we are impressed by the continued traction of Fortinet’s Secure Access Service Edge and security operations businesses,” says Khan. “Along with an improved financial outlook, we believe investing in newer areas of security could help strengthen the firm’s economic moat.”

Fortinet is trading close to its new fair value estimate and has a Morningstar Rating of 3 stars.

XPO XPO

Trucking company XPO saw its fair value estimate increase to $75 from $61, partially due to the bankruptcy of rival firm Yellow. “In the fourth quarter, underlying freight demand across the less-than-truckload landscape was still facing muted retailer restocking and sluggish industrial end markets, but Yellow diversions provided a strong offset for XPO and its peers,” says senior equity analyst Matthew Young. “We continue to believe XPO will see incremental share gains (and yield improvement) over the next few years driven by the opening of terminals it won from Yellow at auction and from lower-quality providers that have taken on too much Yellow freight at the cost of service levels.”

XPO is trading at a 67% premium to its new fair value estimate and has a Morningstar Rating of 1 star.

Stocks with the Largest Fair Value Estimate Increases

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G63LAO4AMRG3RG44ARMH6RM6FE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KFWIBRDMEZEAXJKNN2NO5JCV2Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)