Is It Time to Break Up With the Bonds in Your Portfolio?

What to do as cash rates near 5%.

Investors concerned about inflation have many lingering effects to worry about, including higher prices at the gas pump, in the grocery store, and on utility bills. But there is one bright spot: Because of persistently high inflation, cash rates have skyrocketed, with rates on some high-yield savings accounts, money market funds, and other cash instruments reaching yields as lofty as 5%.

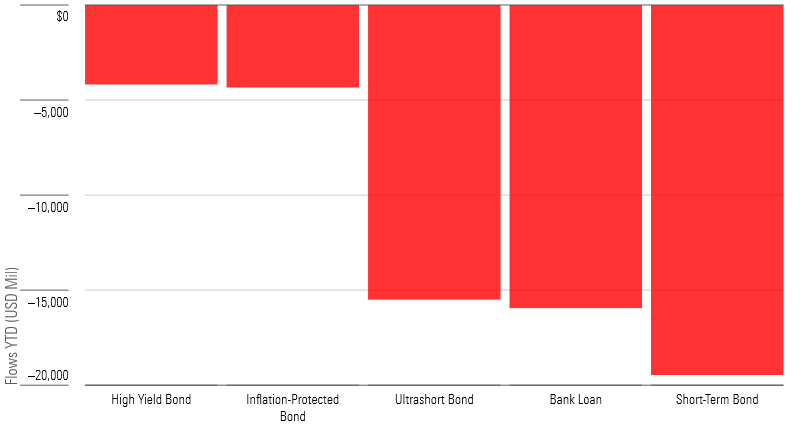

Bond investors might feel left out, especially if their investments are maturing soon. As of July 2023, 2-Year Treasury bonds issued in July 2021 pay out a paltry 0.2%, and funds in the short-term bond Morningstar Category lost an average of 5.2% last year. These facts might explain why short-term bond funds have the largest net outflows of any bond category this year to date, hemorrhaging $19.4 billion through the end of June. There’s reason to wonder if it might not be better to seek the sure thing and move into cash; with flows that massive, there’s reason to believe many investors already have.

Bottom 5 Bond Categories By Flows YTD

Why Should I Keep Bonds in My Portfolio?

With cash rates this high, are short-term bond allocations redundant? The short answer is no.

Cash rates are easy come, easy go. (Although investors with money parked in traditional savings accounts, which still yield less than 1% in many cases, might beg to differ.) Savings rates may be denominated in annual percentage yield terms, but they are rarely locked in for any sort of fixed term. Banks can dial the rate up or down, essentially at will.

That means cash lacks duration, one of the more useful tools in an investor’s quiver. Duration solves a different portfolio problem than cash, which means that bonds and cash shouldn’t be compared like-for-like.

Cash might be a handy parking spot for emergency savings, but for expenses any further than two years out, bonds are the better match. That’s because bonds are typically offered with a yield that’s fixed over the life of the bond.

For example, if you buy a bond with a duration that aligns with the time your payment is due, you can lock in a yield over that time horizon that fits with your liability. In the meantime, you won’t have to worry about reinvesting your savings to chase a better rate if interest rates fall—unlike investors who are keeping their money in cash.

Put another way, for investors that can hang on to their bond investment to maturity, what happens to interest rates after they buy their bond isn’t terribly important. If an investor holds a bond until it expires, at the end of that period, (assuming the issuer is creditworthy) they are made whole. When a bond matures, its owner gets their principal back, and they can use the proceeds to address their saving goals.

Sounds Great, Except …

In the meantime, your money is effectively tied up. It’s possible that bonds underperform other asset classes (like cash) while you hold on to them, and there’s not much you can do about it. It’s even possible to lose money if rates rise and you sell a bond before it matures.

But, again, investors generally won’t experience any observable losses in bonds held to maturity. On the other hand, investors in a short-term bond fund have a very different row to hoe, with both yields and returns fluctuating on nearly a daily basis. How is it possible that bond funds lose money when an individual holding a bond can always opt to stick it out and recoup their principal?

There are a few reasons for that. First, funds have to manage cash flows in a way that an individual owning a bond doesn’t. An investor owning a single bond only has to worry about the coupons they receive and the principal that the issuer repays at the end. But every single day people buy into and sell out of mutual funds; they’re a pooled investment, after all. Plus, managers can only distribute cash at certain pre-specified times, which means they must reinvest the coupons they receive in the interim. Bond managers trade bonds all the time, even if all their existing investors sit tight.

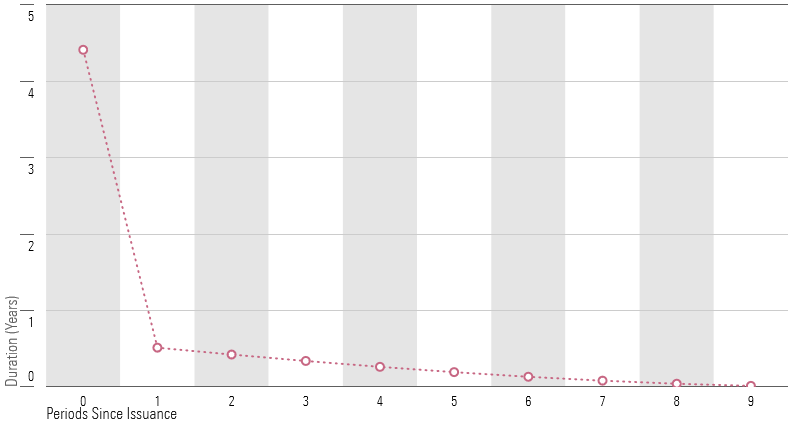

Beyond the constraints of the mutual fund vehicle, bond funds behave differently from individual bonds in another key respect. An individual bond’s duration will decline as it approaches maturity.

Duration of a Hypothetical 5-Year, 5% Semiannual Bond

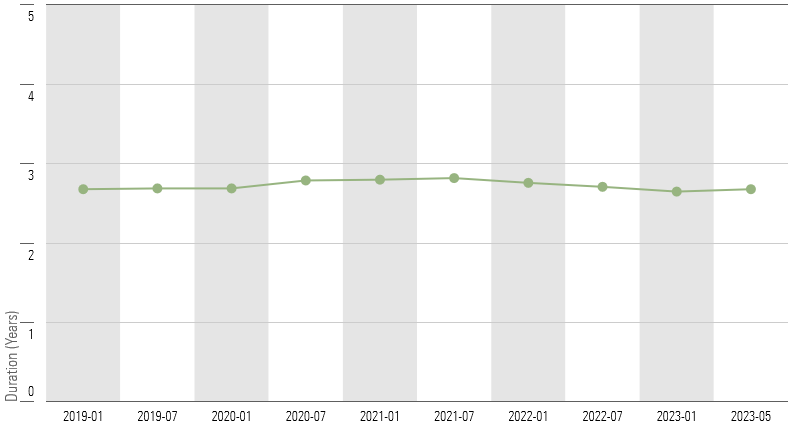

Bond fund managers typically maintain a constant maturity, which means that unlike an individual bond, the fund never expires. A fund that invests in short-term bonds will continuously roll forward its bonds so that its maturity will always be roughly several years out from today. As one bond nears maturity, the fund will buy another to nudge the portfolio’s maturity forward and keep its duration stable.

Duration of Vanguard Short-Term Bond ETF, 2019-2023

This mechanism causes the returns of an investment with a constant maturity, like a bond fund, to vary depending on the path that interest rates take.

Then Why Do Investors Stick With Short-Term Bond Funds?

Partly it’s a matter of convenience. Bond investing obeys the economies of scale, which makes it a good candidate for outsourcing. There’s an old rule of thumb in bond investing that you need at least $100,000 to adequately diversify a bond portfolio—hardly chump change. Plus, money managers get better rates on transactions than retail investors do.

Additionally, it may be easy to guess roughly when an event that you’ve been saving up for is going to occur, but in many cases it’s much harder to pin down the precise timing of the cash outlay. In these types of situations, individual bonds may be too fine an instrument. If you have a goal that you’re saving for with an uncertain start and end date, a basket of bonds with constant maturity gives you critical leeway in your portfolio.

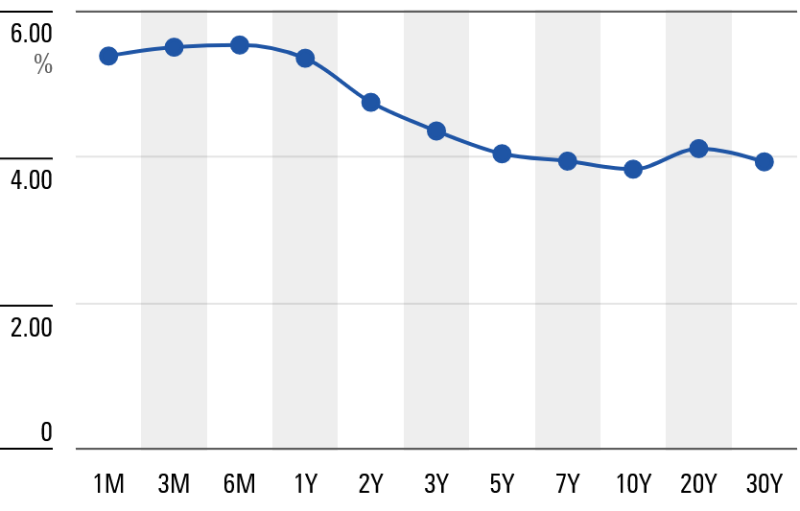

Finally, even if you don’t have a timed goal in mind, your portfolio may still stand to benefit from carrying some duration. Very short-term instruments like cash are currently paying more than longer-term investments because yield curves are inverted.

US Treasury Yield Curve

That’s not the normal state of affairs. Longer-term rates are typically higher than shorter-term rates, and eventually the current pattern will reverse. That means that over longer periods a yield boost does kick in for holding bonds instead of cash.

How much duration you should hold depends on a whole host of other factors, like your age and the time until the goal you’re saving for. No matter what your priorities are, it’s important to keep in mind that bonds tend to outperform stocks during bear markets. That makes them a good ballast to have on hand, no matter what else is happening in the markets.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)