Markets Brief: Will the Volatility Continue?

Latest CPI report is on deck. Devon Energy and Occidental rally. Lyft shares plunge.

Will some good news on inflation help soothe the markets?

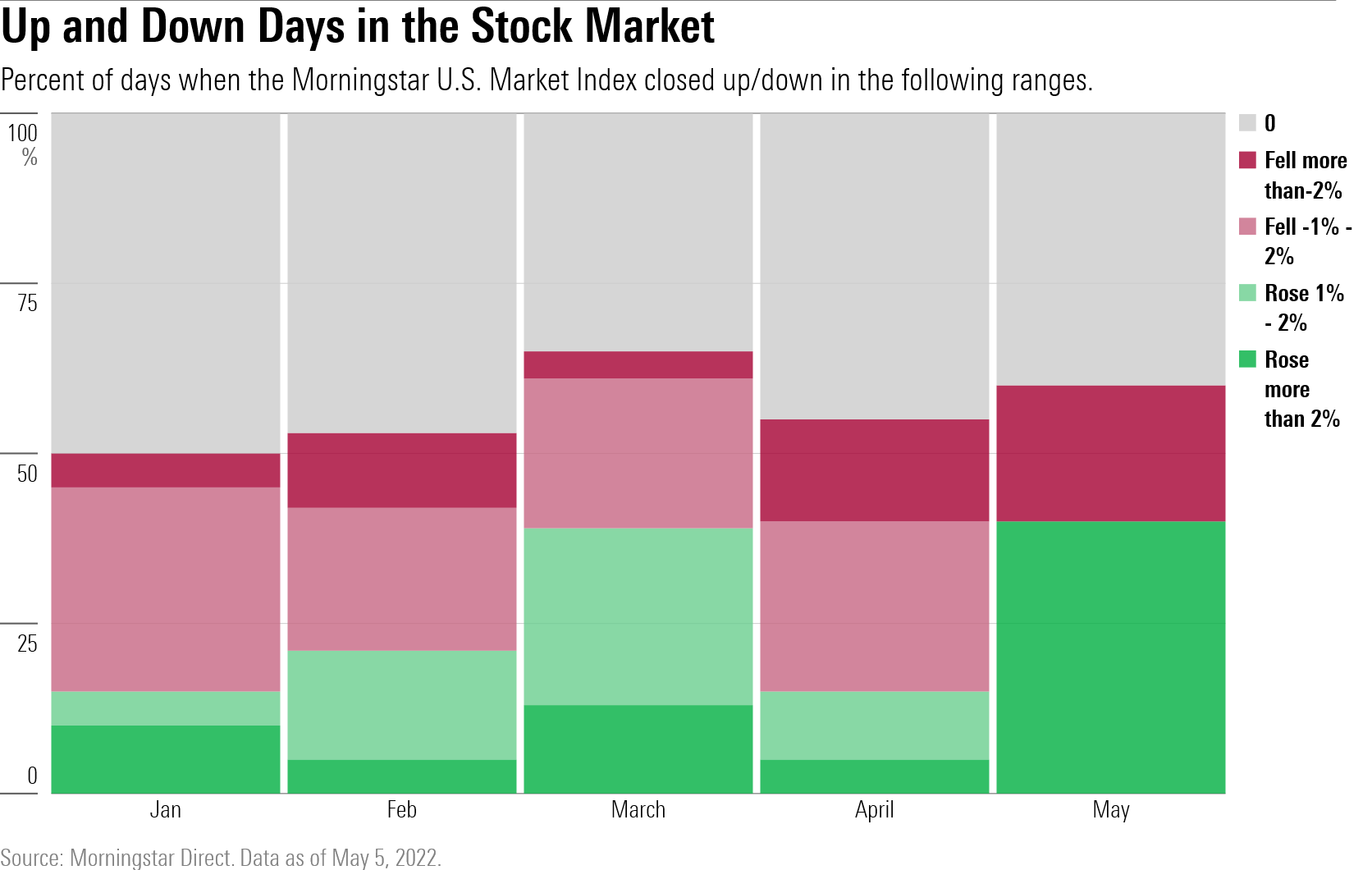

Stocks and bonds started May the way they left off April, with continued big swings in prices. With inflation being the big bugaboo, the upcoming Consumer Price Index report could help determine whether the roller-coasting ride continues.

This past Wednesday and Thursday, the Morningstar US Market Index saw a swing down and then up totaling 7%, the biggest two-day move since stocks were coming out of the pandemic-sparked bear market.

Bond yields, meanwhile, also saw big moves. Yields fell after Federal Reserve Chairman Jerome Powell threw cold water on expectations that the bank would be getting even more aggressive than it already is with it’s half-point increase in the federal-funds rate. On Thursday and Friday yields resumed their march higher. The U.S. Treasury 10-year note finished the week at 3.13%, up from 2.89% just a week earlier, and the highest it’s been since November 2018.

“The next few months are going to be filled with volatility and ups and downs,” says Kristina Hooper, global chief market strategist at Invesco.

Hooper says that as the year goes on the impact of the rate increases, rising bond yields, and a lower stock market will help cool an overheating economy. Inflation should also begin to moderate. But until then the Fed will remain aggressive with its rate increases.

Morningstar’s chief U.S. economist Preston Caldwell offered up a similar take on the wage inflation front following the April jobs report.

“Wage growth appears to be moderating to a more sustainable pace, with private wages averaging just a 0.3% monthly increase in the three months ending in April, or a 3.7% annual pace,” Caldwell says. “If this keeps up--and other supply side headaches offer relief--the Fed will have room to ease off the brakes in the second half of 2022.”

Investors will be looking for any signs of relief on the consumer inflation front Wednesday when the Labor Department releases April's Consumer Price Index report. Economists are looking for a rise of 0.4%, and a 6% increase on a year-over-year basis, according to FactSet. Last month, CPI came in higher than expected with a 1.2% rise in March from February, and a 12-month increase of 8.5%.

Proxy season continues in the coming week, along with shareholder meetings for ConocoPhillips COP and Phillips 66 PSX, both of which will hold votes on resolutions for setting targets for greenhouse gas emissions. Similar resolutions were approved by a majority of shareholders at last year’s meetings, but were not implemented by the companies.

Events scheduled for the coming week include:

- Monday: BioNTech BNTX reports earnings.

- Tuesday: SoFi Technologies SOFI reports earnings. ConocoPhillips annual meeting. Fortinet FTNT and Shell SHEL investor days.

- Wednesday: April Consumer Price Index report. Walt Disney DIS, Occidental Petroleum OXY, Beyond Meat BYND, and Roblox RBLX report earnings. Phillips 66 annual meeting.

- Thursday: Fastly FSLY investor day.

For the trading week ending May 6:

- The Morningstar US Market Index fell 0.57%.

- Energy was the best-performing sector, up 9.57%.

- The worst-performing sectors were real estate, down 3.65%, and consumer cyclical, 2.97%.

- Yields on the U.S. 10-year Treasury rose to 3.13% from 2.89%.

- Oil prices were up $5.08 to $109.77 per barrel.

- Of the 868 U.S.-listed companies covered by Morningstar, 363, or 42%, were up, and 505, or 58%, declined.

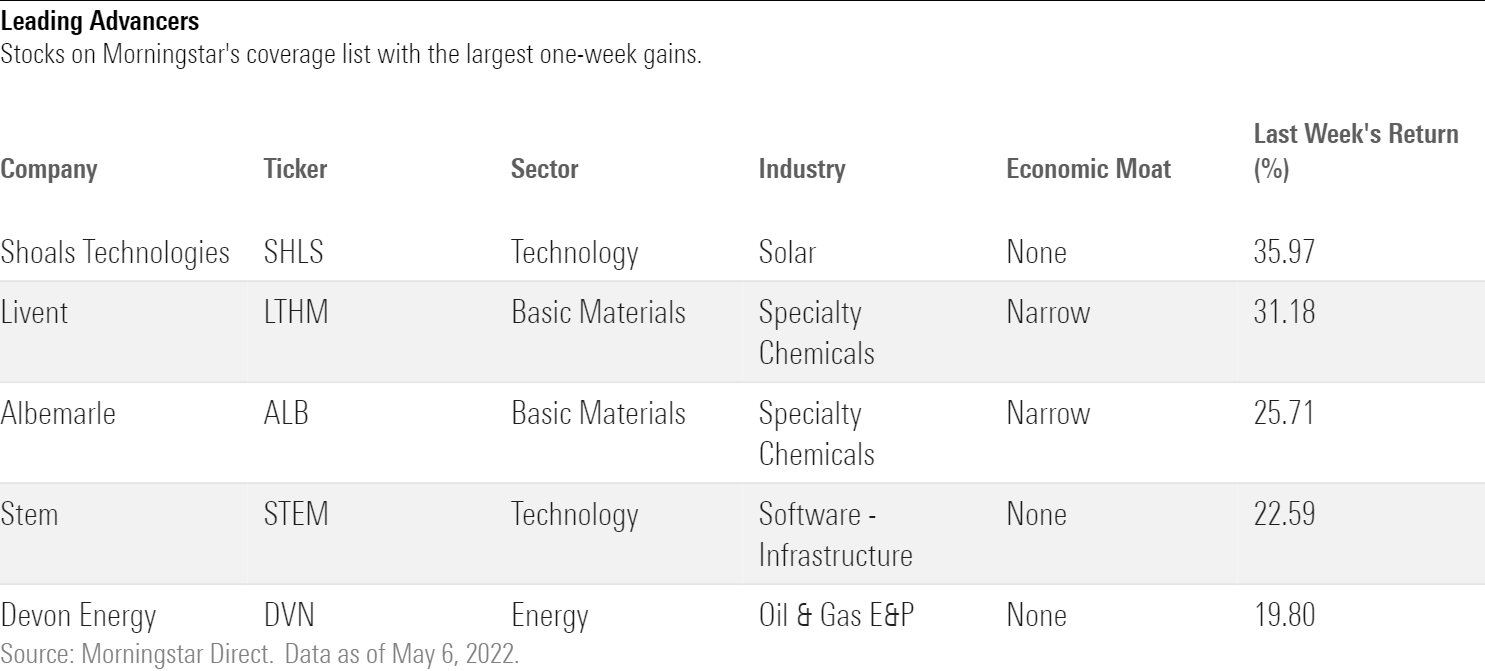

What Stocks Are Up?

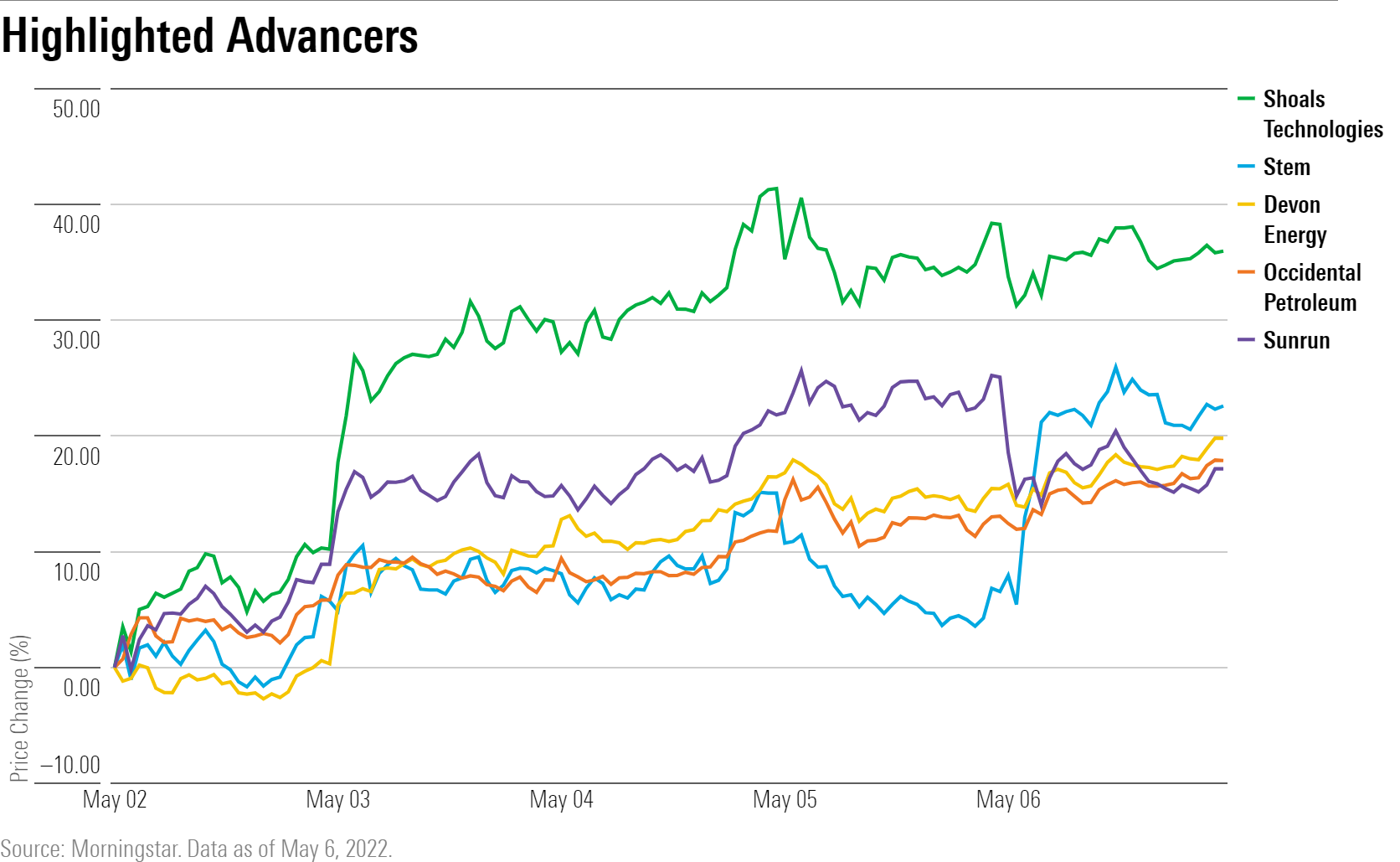

The best-performing companies in the past week were Shoals Technologies SHLS, Livent LTHM, Albemarle ALB, Stem STEM, and Devon Energy DVN.

Solar energy company Sunrun RUN rallied after beating Wall Street revenue estimates by 24%, according to FactSet. The rally extended to renewable equipment and storage solutions companies, such as Shoals Technologies and Stem, which also closed higher.

Several oil companies rose after they posted earnings beats and prices in the market rose. Devon Energy, Pioneer Natural Resources PXD, and Coterra Energy CTRA advanced. Occidental Petroleum finished higher ahead of its earnings report next week.

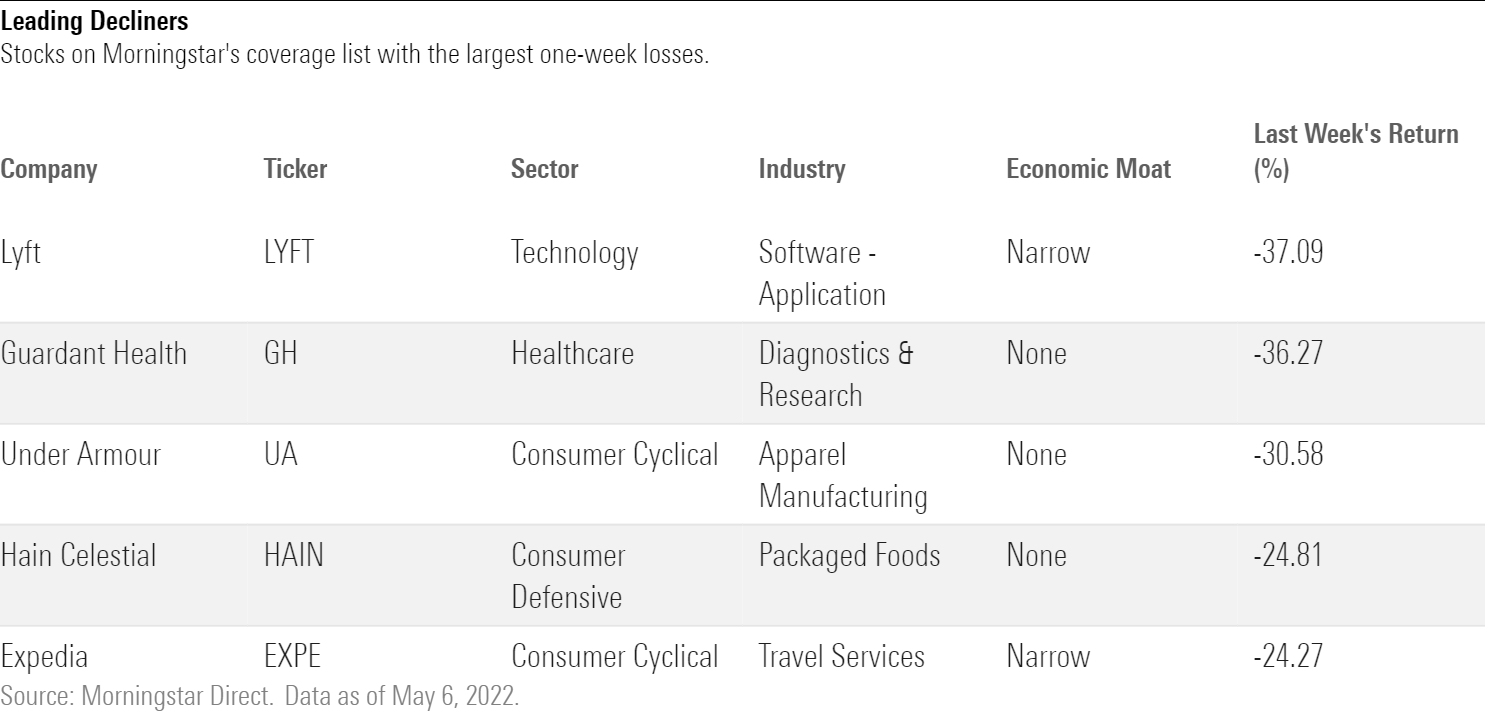

What Stocks Are Down?

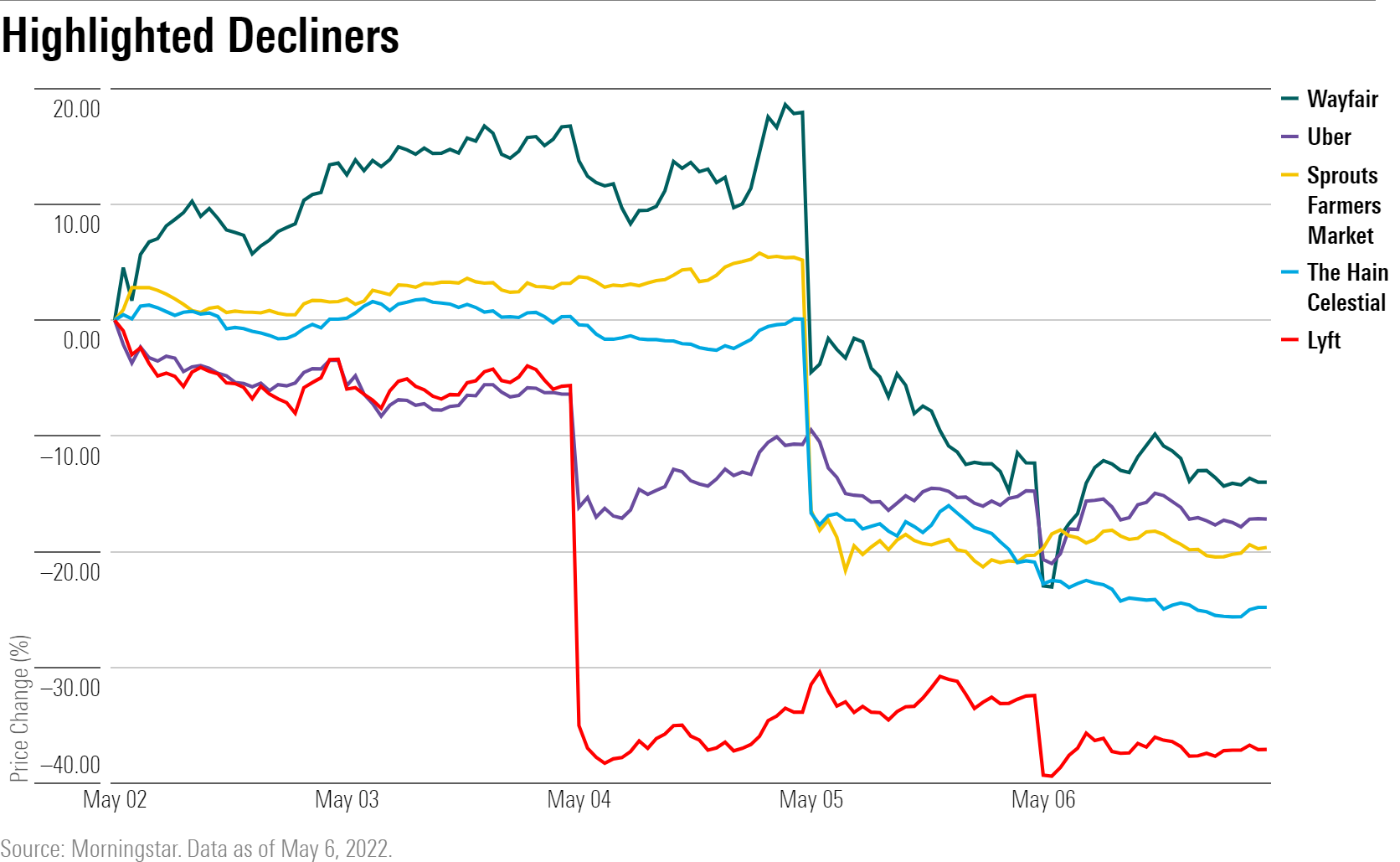

The worst-performing companies were Lyft LYFT, Guardant Health GH, Under Armour UA, Hain Celestial HAIN, and Expedia EXPE.

Lyft dropped after it lowered expectations for revenue and net income for the second quarter. Industry rival Uber UBER also traded lower despite showing solid earnings results in the first quarter.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BHYIMOHDUREGTCIGI46ZAN6UWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VPCBITMQP5FKLIZ32POIXOV3MQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)