It’s Not Too Late for Tax-Loss Harvesting

Despite a more hospitable market in 2023, investors can still find some stocks and funds with unrealized losses.

After suffering sharp losses in 2023, the markets have been kinder to investors so far in 2023. The Morningstar US Market Index gained about 25% for the year to date through Dec. 15, 2023, and broad bond market indexes have posted small gains over the same period. As a result, there aren’t as many opportunities for tax-loss harvesting as there were in 2023 when both stocks and bonds suffered double-digit losses.

But it’s still possible to find some opportunities for tax-loss harvesting, particularly in areas like long-term bonds, non-U.S. stock funds, and sector funds focusing on utilities, energy, and healthcare.

In this article, I’ll highlight some of the most widely held stocks and funds that have declined in price over the past couple of years. I’ll also give some practical guidance for selling securities to realize losses.

Is Tax-Loss Harvesting Really Worth It?

Admittedly, the benefits of tax-loss selling can be overhyped. As Michael Kitces points out, an investor who sells a security in a taxable account and replaces it with another one is simply trading in current taxes for future taxes, because the cost basis on the new holding is lower. But there can be some value in deferring taxes in certain situations. For example, if you’re able to hold off on realizing capital gains on the replacement security until after retirement when some investors might qualify for the 0% capital gains tax bracket.

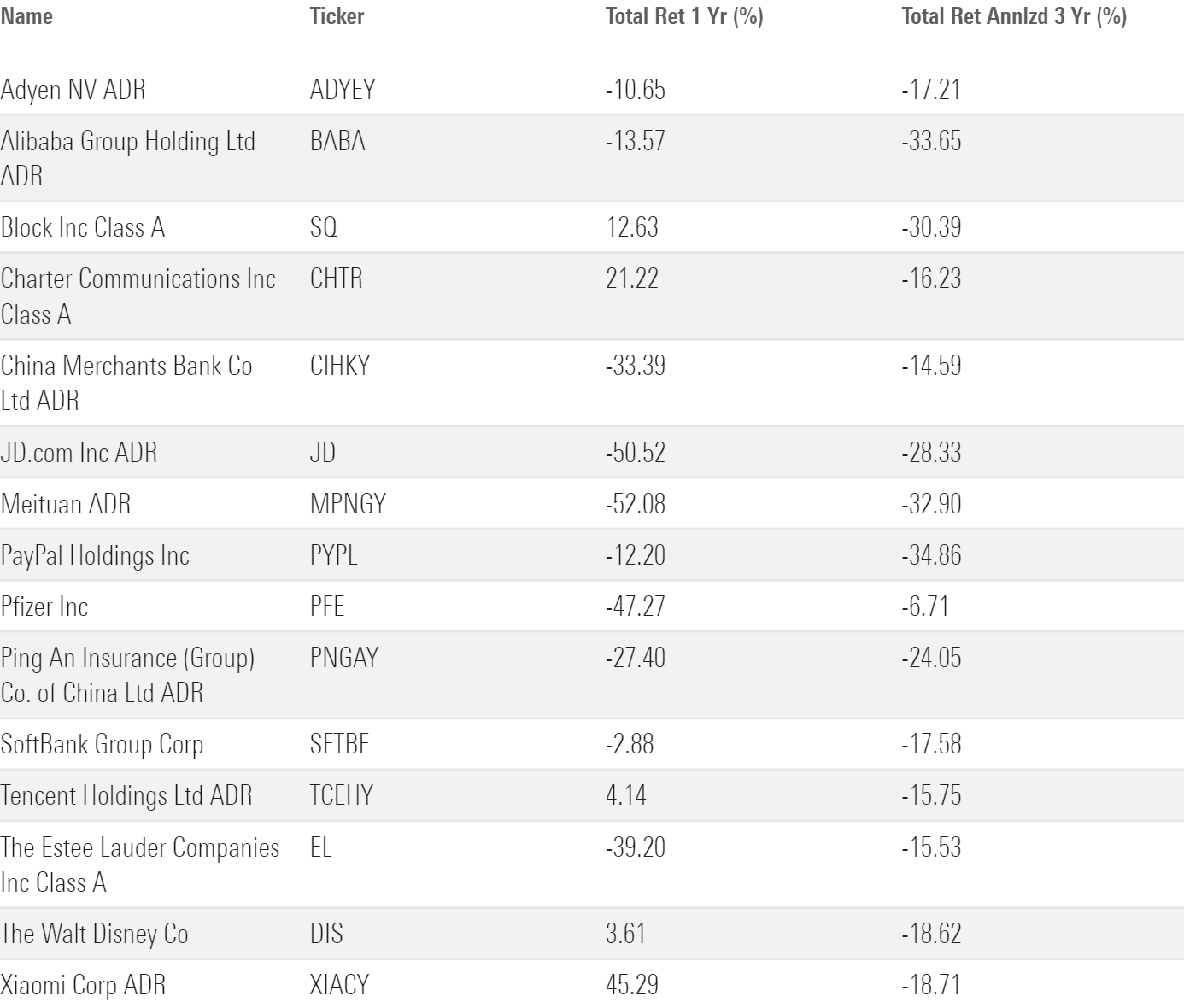

Stock Ideas for Tax-Loss Harvesting

Opportunities for harvesting losses on individual stocks are less prevalent than they were a year ago but can still be found. Roughly one third of the 1,000 biggest U.S.-traded stocks in Morningstar’s database have suffered price declines over the trailing one-year period, and about one fifth of the largest stocks have posted losses over the trailing three-year period. The table below shows some of the most widely held stocks that might be good candidates for tax-loss selling. (Note: Investors will need to check their account statements and cost basis as shown on the brokerage platform’s website to confirm declines for any specific positions; they should also make sure they’ve owned the security for at least one year if they intend to realize long-term losses.)

15 Stocks That Might Offer Tax Losses

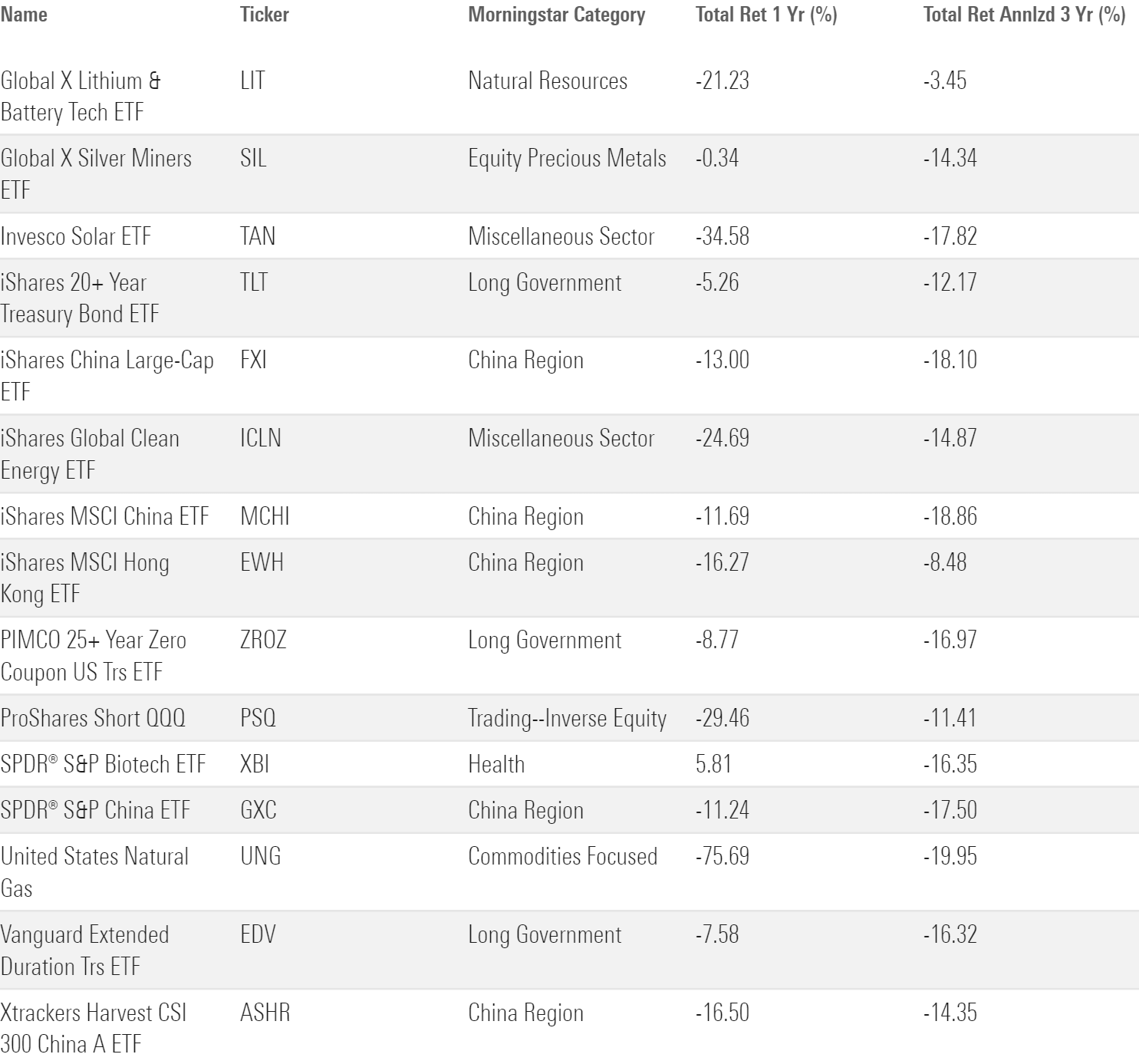

Fund Ideas for Tax-Loss Harvesting

The 2022 bear market created tax-loss harvesting opportunities across a broad swath of funds, especially on the bond side. Bonds have fared better in 2023, but many long-term government-bond funds currently remain in the red for the trailing one- and three-year periods. Vanguard Extended Duration Treasury ETF EDV, for example, posted annualized losses of more than 16% over the trailing three-year period through Dec. 15, 2023.

On the equity side, losses have been more concentrated in specialized categories, such as regional funds focusing on China, natural resources and clean energy funds, and healthcare and financial offerings.

The table below shows some of the largest funds that have accumulated losses over the trailing one- and/or three-year periods, but smaller offerings in the same categories might also be candidates for tax-loss selling.

15 Funds That Might Offer Tax Losses

Tax-Loss Harvesting Reminders

There are a few things to keep in mind when selling securities to take advantage of losses in a taxable account. To avoid running afoul of wash-sale rules, make sure to avoid selling securities at a loss and then buying substantially identical securities within 30 days either before or after the sale.

The IRS has not published guidance as to exactly what qualifies as “substantially identical,” but it’s probably safest to replace fund holdings with a vehicle that tracks a different index. For example, an investor selling Vanguard 500 Index VFIAX, which tracks the S&P 500, could replace it with Vanguard Total Stock Market Index VTSAX, which tracks the broader CRSP US Total Market Index. On the stock side, investors would want to avoid replacing a stock with another share class of the same stock, but they could replace it with another company in the same industry (such as replacing Moderna MRNA with Biogen BIIB).

It’s also important to maintain good records. Before selling a stock, investors will need to identify specific lots with the highest cost basis. For funds, it’s best to use the specific share identification method, which you can select in your brokerage platform’s account options. (The default method is usually average cost, which doesn’t optimize tax losses.)

Finally, use tax losses strategically. Investors can use harvested tax losses to offset any realized gains or up to $3,000 in ordinary income for the current tax year but can also carry them forward indefinitely to offset future capital gains.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)