How to Use Allocation Funds in a Portfolio

These all-in-one funds can simplify the investment process and improve diversification.

Should you have an allocation fund in your portfolio? These funds—which combine major asset classes like stocks, bonds, and cash in a single package—can be a great way to start investing. And even if you already have an established portfolio, an allocation fund could be a logical addition thanks to this fund type’s built-in diversification and simplicity.

In this series on portfolio basics, I’ll explain some of the fundamentals of putting together sound portfolios. I’ll start with some of the most widely used types of investments and walk through what you need to know to use them effectively in a portfolio.

What Are Allocation Funds?

Allocation funds invest in more than one asset class. There are two major varieties. First, some allocation funds aim for a risk level that remains relatively static. Morningstar classifies these funds into six main categories, ranging from conservative to aggressive. In practice, these classifications mainly reflect the level of underlying equity exposure, which ranges from about 12%, on average, for conservative-allocation funds to 90% for aggressive-allocation funds.

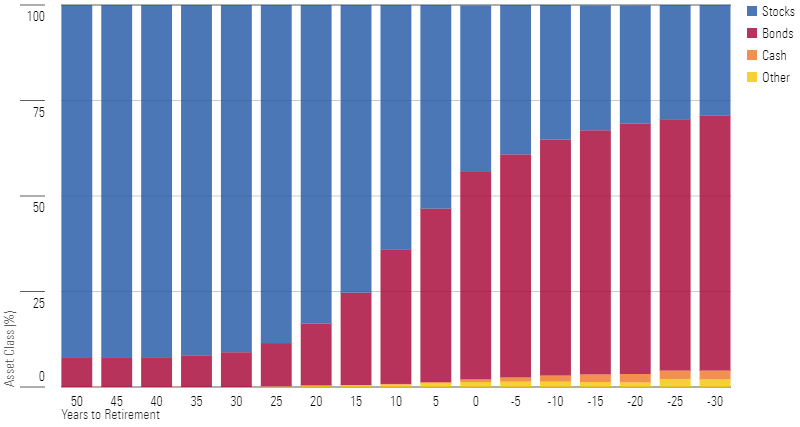

Second, target-date funds provide diversified exposure to stocks, bonds, and cash for investors saving up for retirement on a specific target date. These funds automatically adjust their asset mix to become more conservative as the target date approaches, following a preset glide path. Morningstar currently has several target-date fund categories, with future target dates ranging from 2025 to 2065. There are also several categories with target dates that are in the past (for investors who are already retired) or for funds that are geared toward retirees in general (without a specific target date).

As shown in the chart below, target-date funds typically start with heavier equity exposure for investors with many years left until retirement, gradually reducing their level of equity exposure to about 44% of assets at the retirement date. After retirement, the equity allocation continues to gradually decrease.

Average Target-Date Asset Mix Over Time

What Are the Advantages and Risks of Investing in Allocation Funds?

The main advantage of allocation funds is their simplicity. Because they’re already diversified across asset classes, investors don’t have to cobble together individual funds to put together a diversified portfolio. And in practice, Morningstar’s research on investor returns has consistently found that allocation funds are among the easiest types of funds to use, meaning that investors in allocation funds don’t typically make bad trading decisions and are therefore able to keep a larger portion of returns.

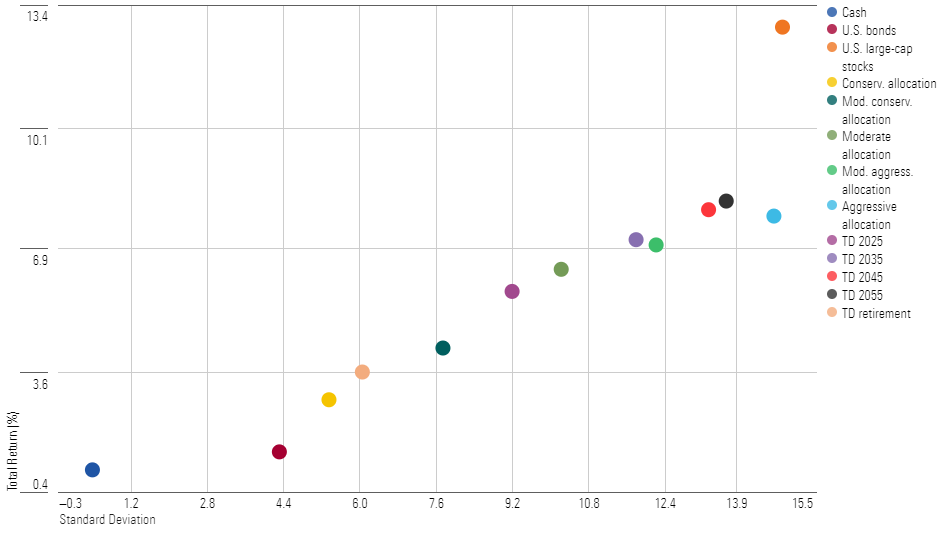

Because most allocations include both stocks and bonds, they generally provide middle-of-road risk and returns.

As mentioned above, though, their risk level mainly depends on the level of equity exposure. The level of risk spans a wide range. The standard deviation for conservative-allocation funds over the past 10 years, for example, has been just slightly higher than that of bonds. At the other end of the spectrum, aggressive-allocation funds have been nearly as volatile as stocks.

Trailing 10-Year Risk and Returns: Allocation Funds and Other Assets

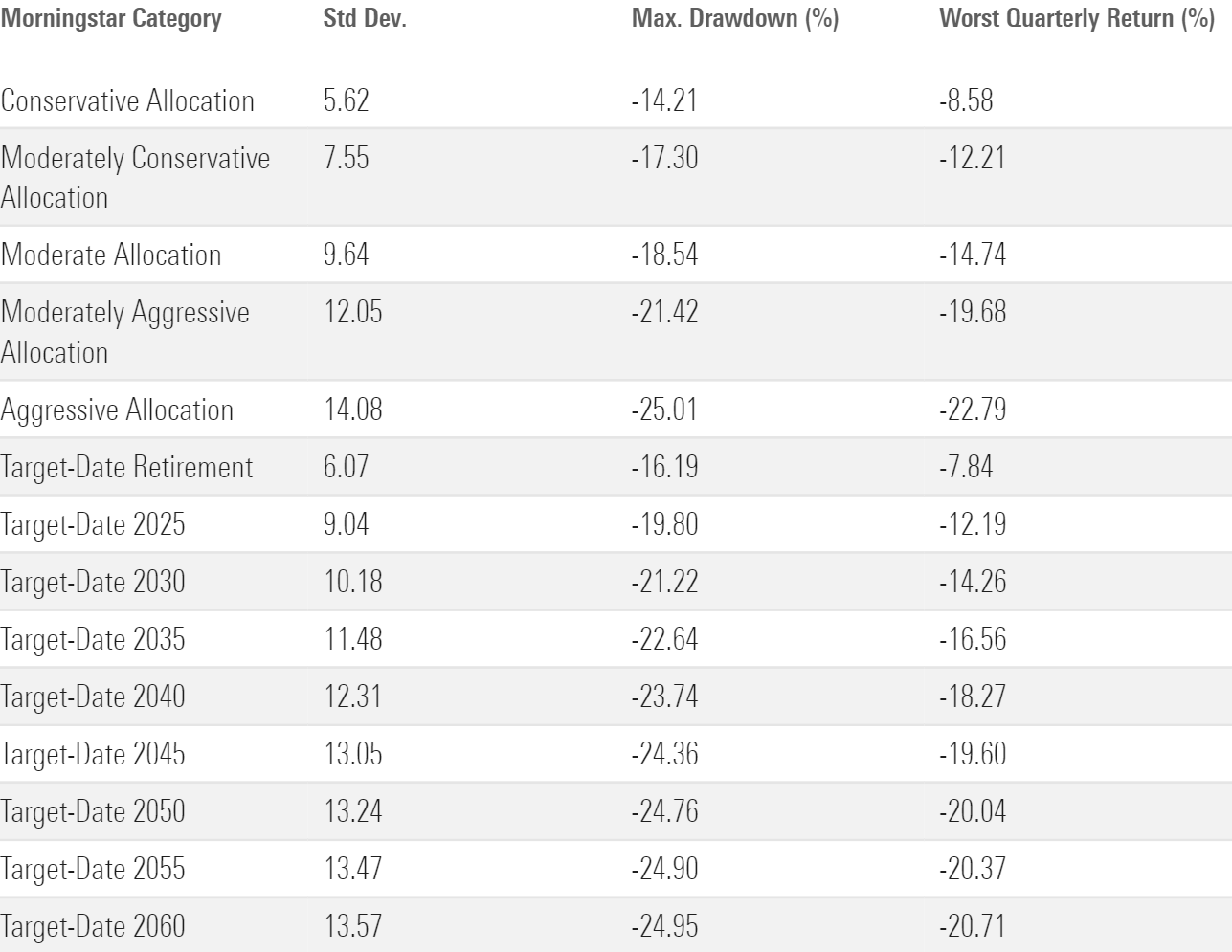

Drawdown risk for allocation funds also spans a wide range. As shown in the table below, aggressive-allocation funds have lost as much as 25% over the past 10 years, while conservative-allocation funds had more-limited losses of about 14%. Both returns reflect performance during the bear market that started in January 2022. Even though the market has reversed course since then, none of the categories below had quite made up all of their losses as of Aug. 31, 2023. The reason? While diversifying a portfolio across both stocks and bonds usually helps limit losses, that formula didn’t work in 2022 as rising interest rates and stubbornly high inflation roiled both stocks and bonds.

Other Risk and Drawdown Stats (Since Sept. 1, 2013)

How to Invest in Allocation Funds

As the wide range of drawdown risk highlights, it’s important to consider your time horizon and level of risk tolerance before homing in on a specific type of allocation fund. Expenses are another important consideration. Because most allocation funds are funds of funds (meaning they invest in other mutual funds or exchange-traded funds), they have two layers of fees: the expenses for the fund itself, plus the cost of the underlying funds they invest in. For example, Allspring Asset Allocation EAAFX has an expense ratio of 1.04%, but its underlying holdings have additional expenses averaging about 0.57%.

Taxes are another thing to consider. Because most allocation funds hold a portion of their portfolios in bonds, they’re typically not the most tax-efficient. This makes them better holdings for a tax-deferred account such as a 401(k) or IRA, where taxable distributions won’t lead to a higher tax bill. If you’re looking for an allocation fund for a taxable account, consider a tax-managed offering such as Vanguard Tax-Managed Balanced VTMFX.

Most allocation funds are active to some extent, in the sense that they actively shift their mix of stocks, bonds, and other asset classes. But funds that invest in passively managed underlying funds will generally have lower costs overall. The most active type of allocation funds—tactical allocation funds—have a terrible track record as a whole. I’d avoid them.

When Do Allocation Funds Perform Best?

Allocation funds are designed to provide diversification and simplicity, not to maximize returns. As a result, they typically won’t outperform other types of funds in any given year. In risk-adjusted terms, though, allocation funds fare best when both stocks and bonds are generating positive returns. They also perform best during periods when the correlation between stocks and bonds is negative, which reduces risk at the portfolio level.

How Long Should I Hold My Investment in An Allocation Fund?

The answer to this question depends on the type of allocation fund you’re holding. If you’re using a target-date fund to save up for retirement, you’ll want to hold it at least until the specified target retirement date. Most target-date funds these days are designed to allocate their assets up until the retirement date and beyond, so you can continue holding them even after you’re retired.

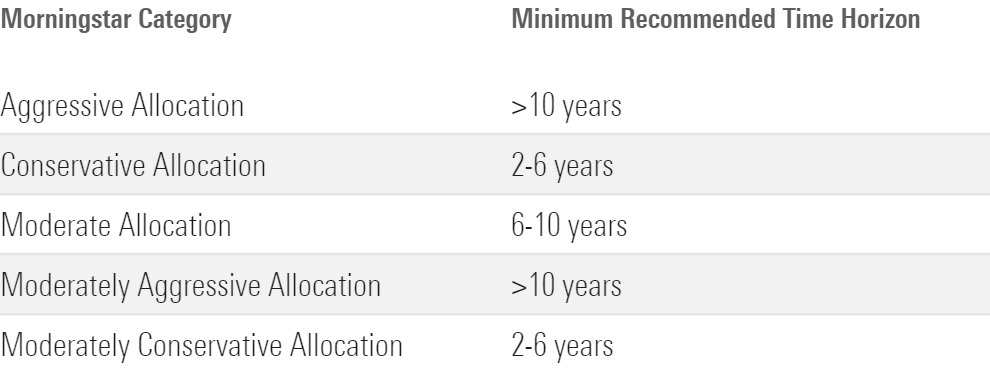

For other types of allocation funds, Morningstar’s Role in Portfolio framework recommends the minimum holding periods shown in the table below.

Minimum Recommended Time Horizon for Selected Allocation Categories

We came up with these guidelines mainly by looking at the average level of equity exposure within each category. The higher the equity exposure, the greater the chance of incurring a loss over shorter periods. To minimize the odds that an investment is in the red when you need to access the money to fund a goal, it makes sense to plan a longer holding period for allocation funds with higher levels of equity exposure.

How Much of My Portfolio Should Be in Allocation Funds?

The answer to this question partly depends on how simple you want to keep your portfolio. If you want to keep things super-simple, allocation funds can be a one-and-done solution, especially if you’re saving for retirement. In fact, Morningstar’s Role in Portfolio framework considered allocation funds to be the only type of fund suitable as a stand-alone holding that makes up the entirety of a portfolio.

If you don’t mind a little more complexity, you could dedicate your retirement assets to a single allocation fund (such as a target-date fund) and hold other types of investments (such as dedicated stock and bond funds) in another type of account.

What Are the Best Allocation Funds?

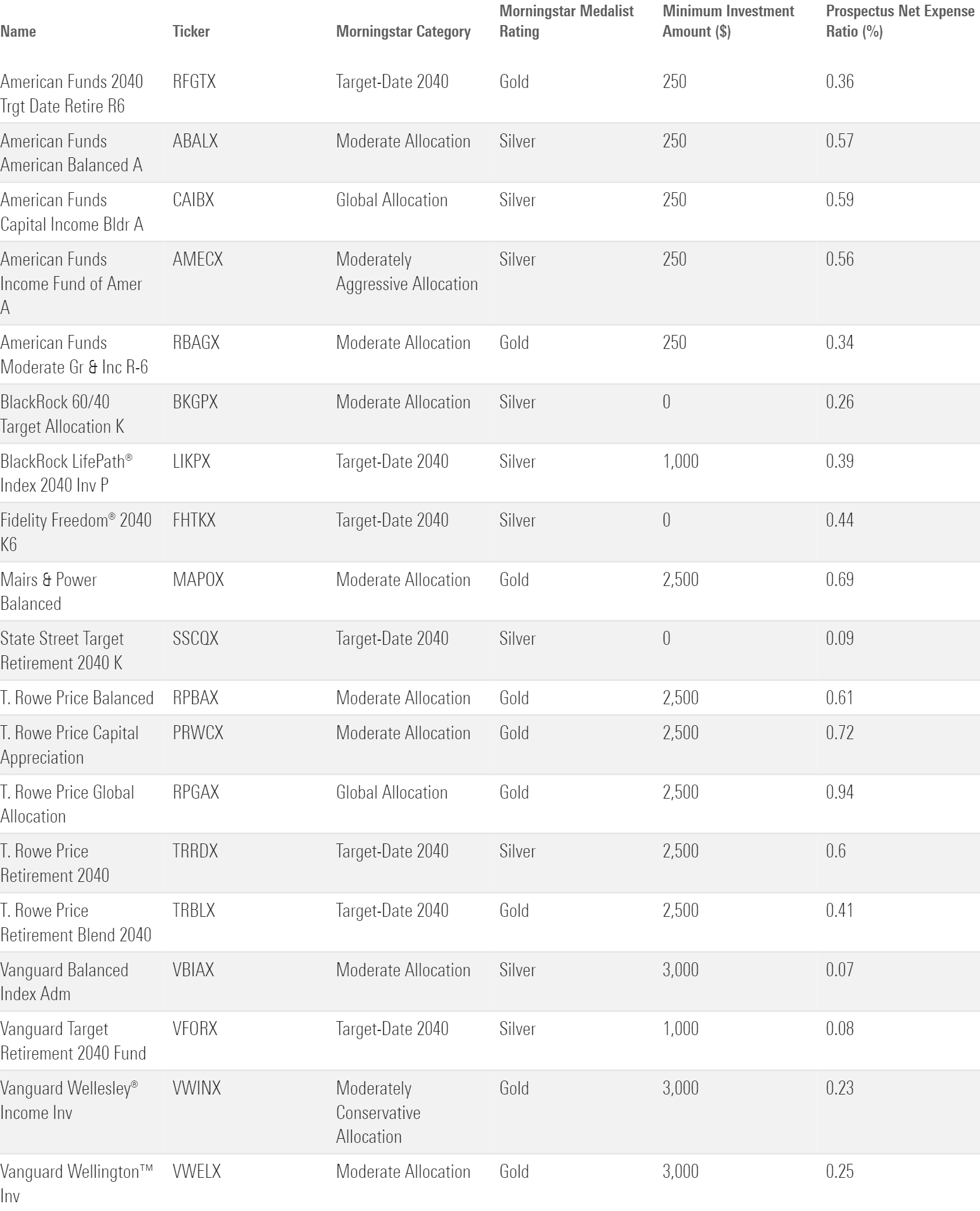

The table below shows a few highly rated allocation funds in various categories. About half of these are funds of funds that employ index funds as their underlying holdings, while the remainder, including American Funds American Balanced ABALX, Vanguard Wellington VWELX, and Vanguard Wellesley Income VWINX, are actively managed portfolios that invest directly in stocks and bonds.

A Few Highly Rated Allocation Funds

What Funds Pair Well With Allocation Funds?

As I mentioned above, you don’t necessarily need to add other funds if you’re already holding an allocation fund. But if you already hold an allocation fund in a tax-deferred account, you could consider adding more specialized funds, such as funds we consider core holdings or building blocks, to a taxable account.

Are Allocation Funds a Good Investment?

My answer to this question is unequivocal: yes. Allocation funds give you built-in portfolio diversification, thereby solving one of the most difficult parts of investing for many people. Their simplicity also helps investors avoid many of the major pitfalls of building portfolios, such as buying into popular asset classes at the wrong time and failing to choose the right mix of assets for their goals.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)