The Strong Jobs Market Has Plenty of Room to Grow

The February employment report shows solid gains, but the labor market recovery is far from over.

Job growth continued to charge ahead in February 2022 as the omicron variant began to fade, reflecting a U.S. economy that remains very much on track for continued healthy growth and setting the stage for the Federal Reserve to start raising interest rates in March.

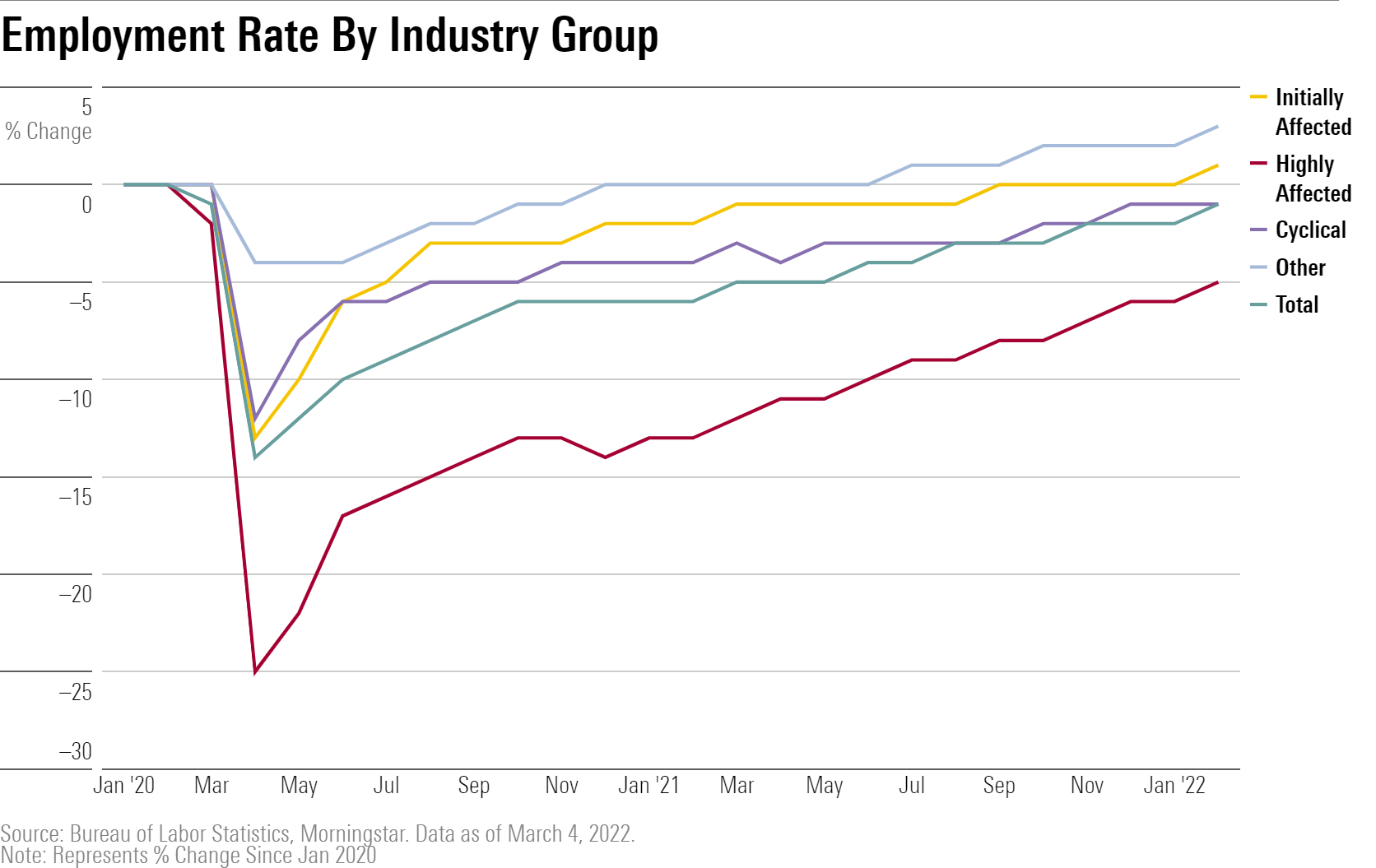

Even with the strong gains in employment in recent months, plenty of room remains for continued growth ahead, says Preston Caldwell, Morningstar's chief economist. "Today's report supports our thesis that the labor recovery is far from finished," he says. "The pace of hiring accelerated and wage growth declined, both likely reflecting easing constraints on labor supply."

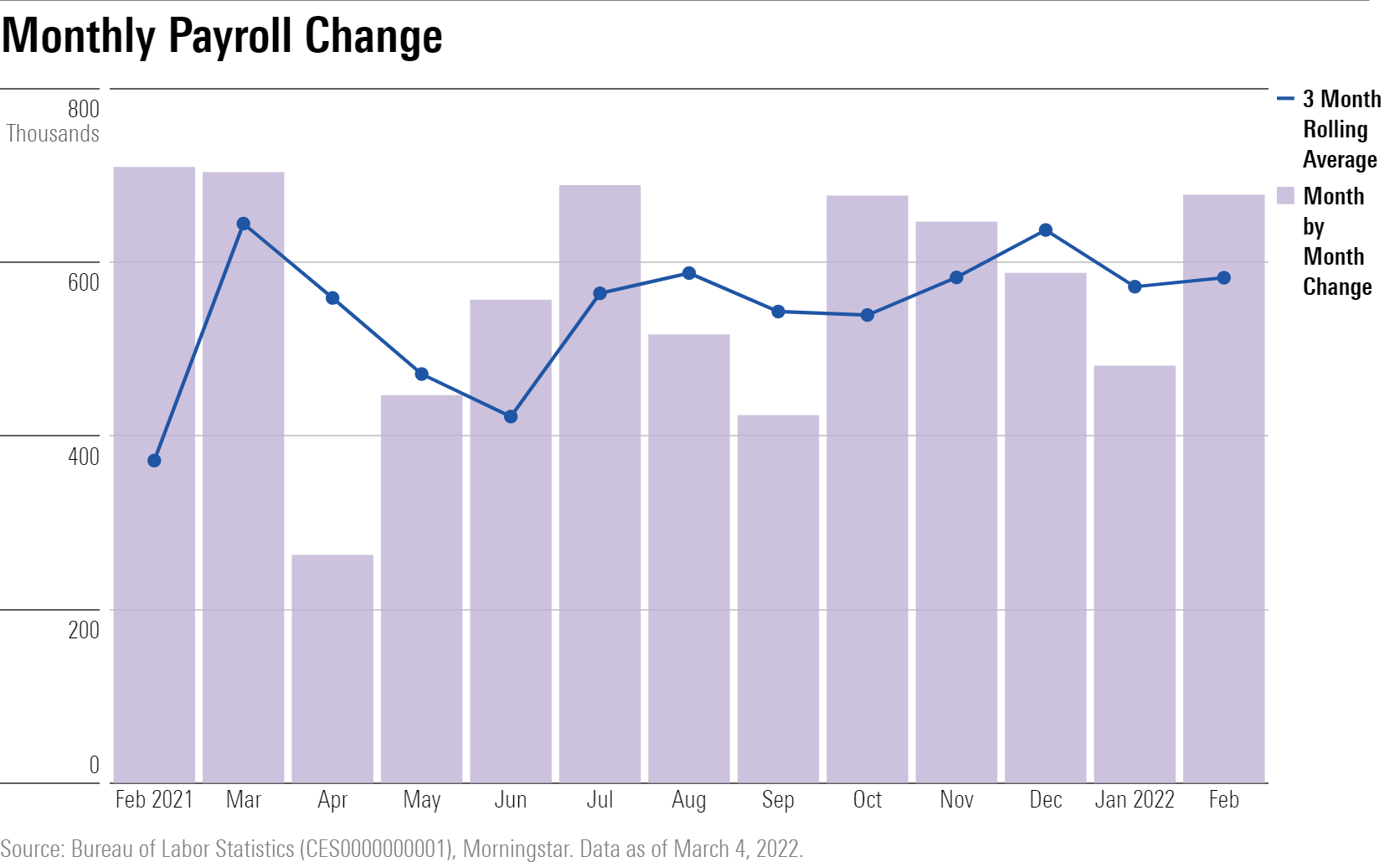

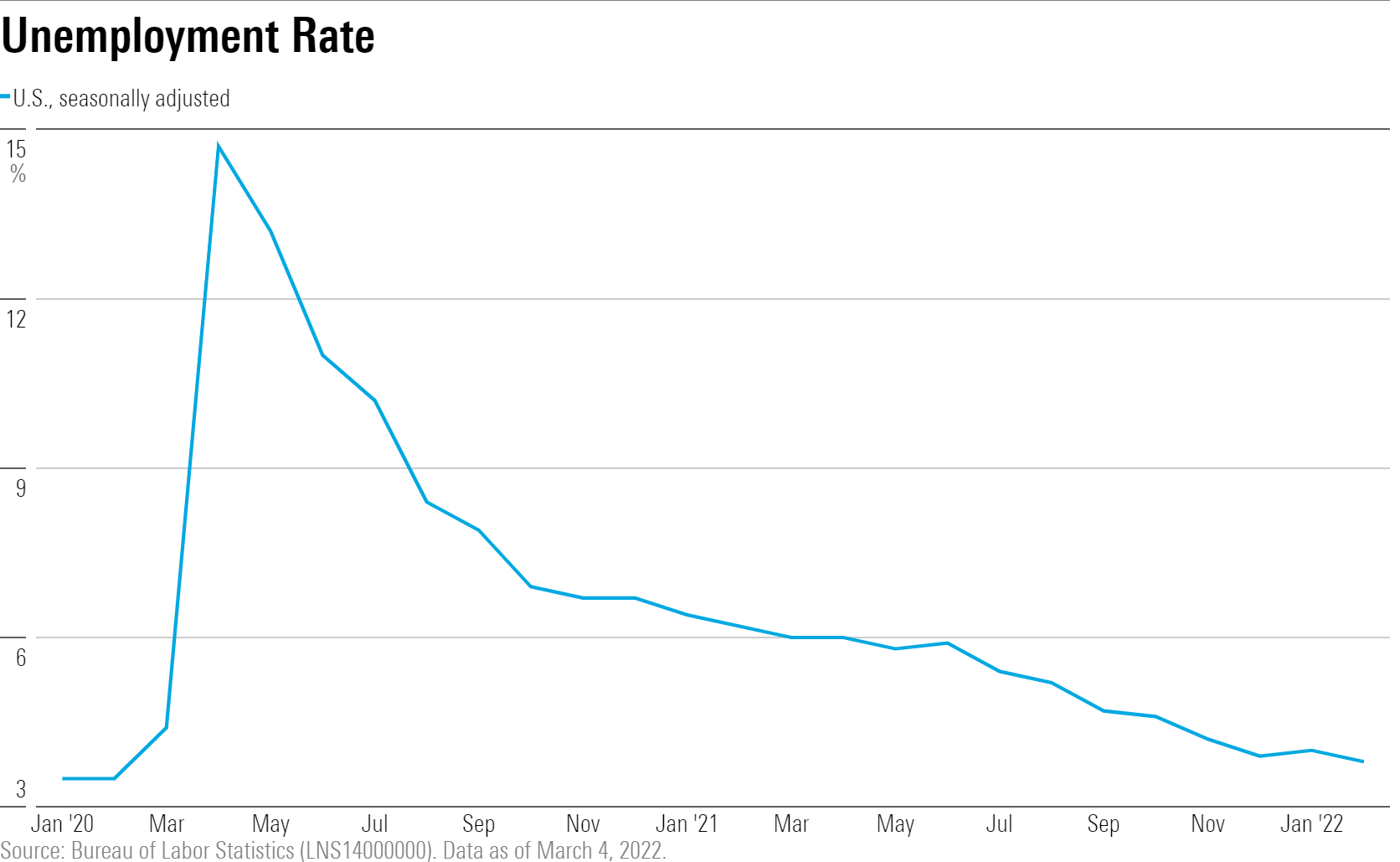

The Labor Department reported that the U.S. economy added 678,000 jobs during February, a stronger-than-predicted increase that followed a 481,000 rise in nonfarm payroll employment in January. Meanwhile, the unemployment rate fell to 3.8% in February from 4.0% the prior month. While that's still up from 3.5% before the onset of the pandemic in February 2020, by historical levels, unemployment is very low.

"Jobs growth in February was surprisingly strong, likely benefiting from the return to work of people held back by omicron in January," Caldwell says. "Many people in January missed work because of the need to quarantine themselves or care for quarantined children." Caldwell noted that when month-to-month swings in hiring are smoothed out, the three-month moving average for job growth has been largely consistent in the 500,000-600,000 range over the past year.

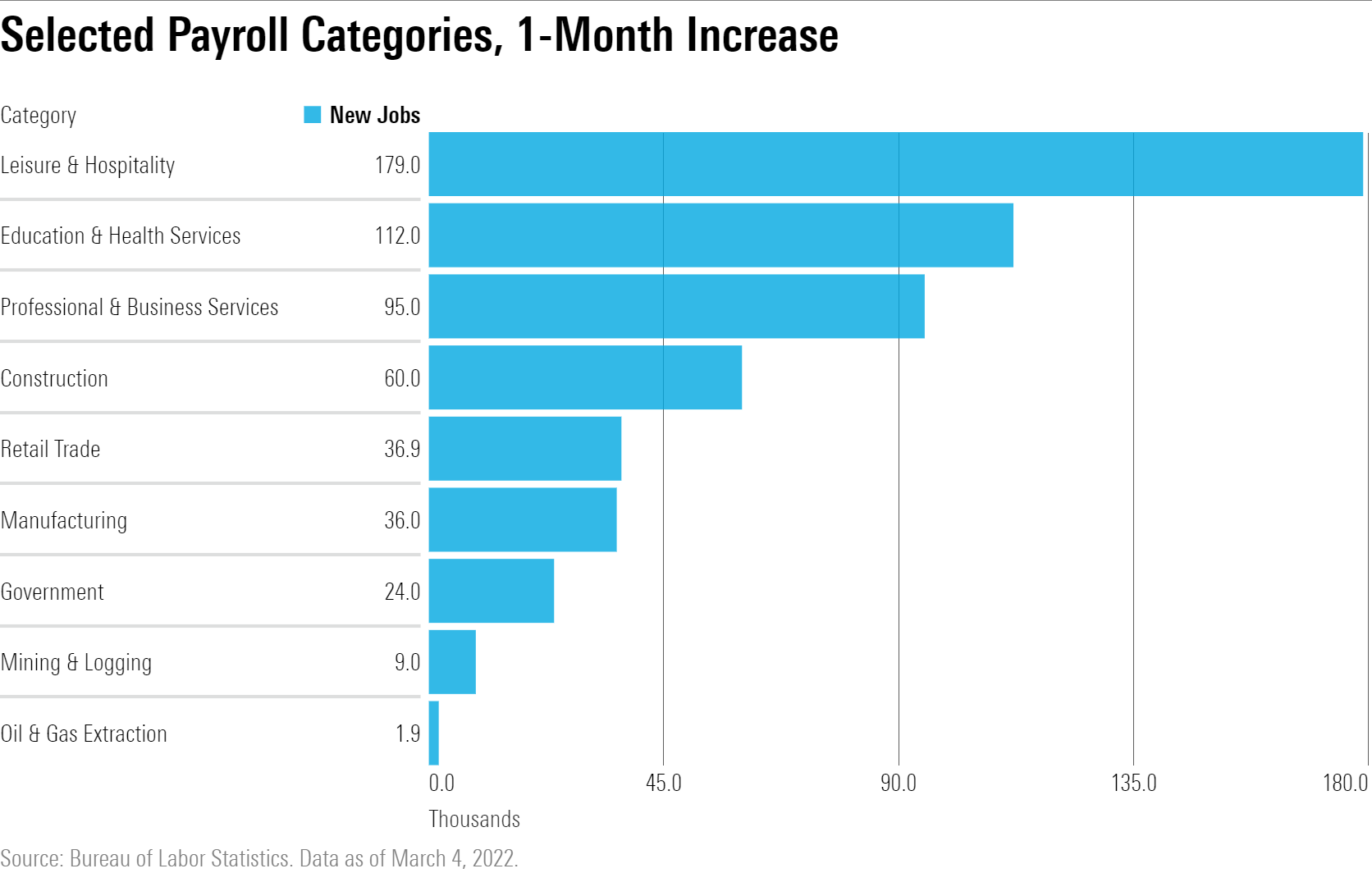

The Labor Department reported "widespread" gains in employment, with notable increases in leisure and hospitality, healthcare, and professional and business services. Construction also posted gains, having seen a strong revival in recent months.

Meanwhile, the unemployment rate resumed its decline after a small increase in January from December's reading. With the drop to 3.8% in February, the unemployment rate is at its lowest level since the pandemic began.

Caldwell points to a roughly 300,000 increase in the labor force for February as the driver behind the rise in employment reported in the household survey, which is the portion of the monthly report that produces the unemployment rate. "In particular, the labor force participation rate for prime age workers increased by 0.2%," he says. "This supports our thesis that labor supply is far from maxing out, and the recovery in labor force participation has plenty of room to run."

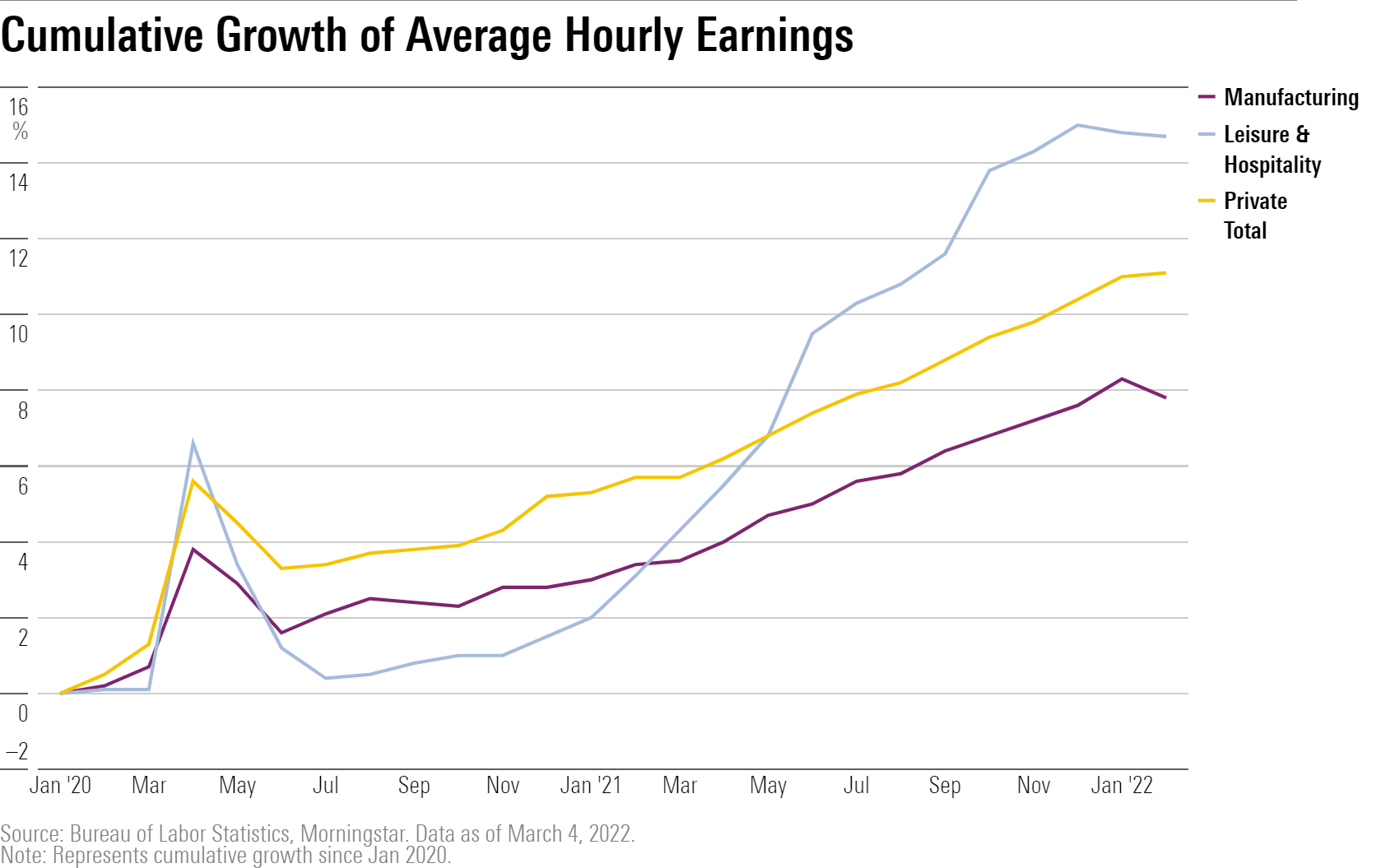

"Restaurant employment is still down 7% versus prepandemic levels, with other leisure--such as hotels--down 15%," says Caldwell. "Those are areas where we've seen continued strong hiring in recent months."

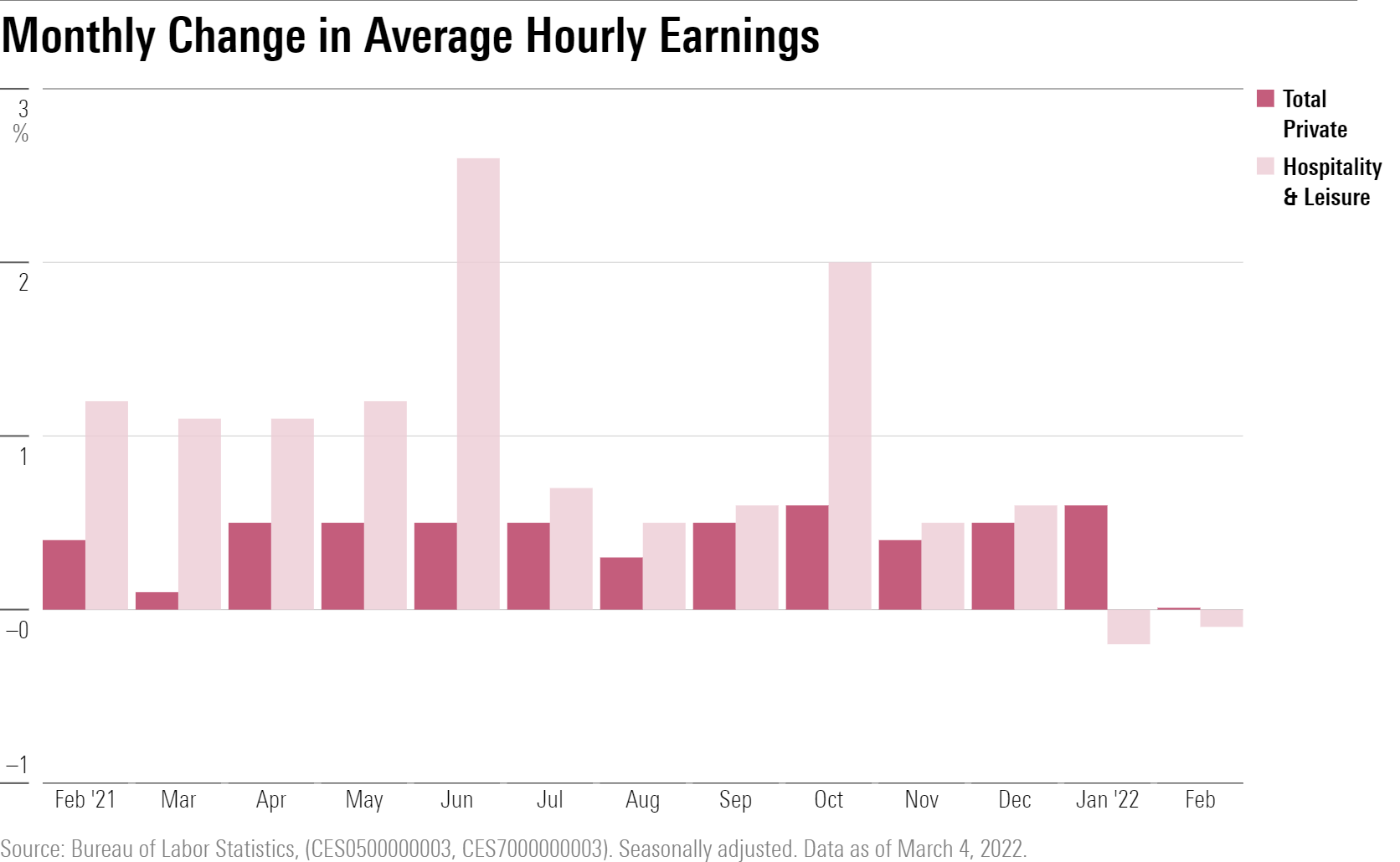

On the wages front, average hourly earnings held steady in February from the month before, rising $0.01 to $31.58. Economists and policymakers have been keeping a close eye on the pace of wage increases amid worries that rising inflation could be leading to a so-called wage-price spiral where higher prices force higher wages, which then creates more demand for goods and still higher prices.

On a year-over-year basis, average hourly earnings rose 5.1% in February, down from a 5.7% increase in January.

"We should be cautious in interpreting the abrupt slowdown in wage growth, which may just be temporary noise," says Caldwell. "Nonetheless, flat wages support the view that labor supply is expanding, and that bodes well for an easing of inflationary pressures."

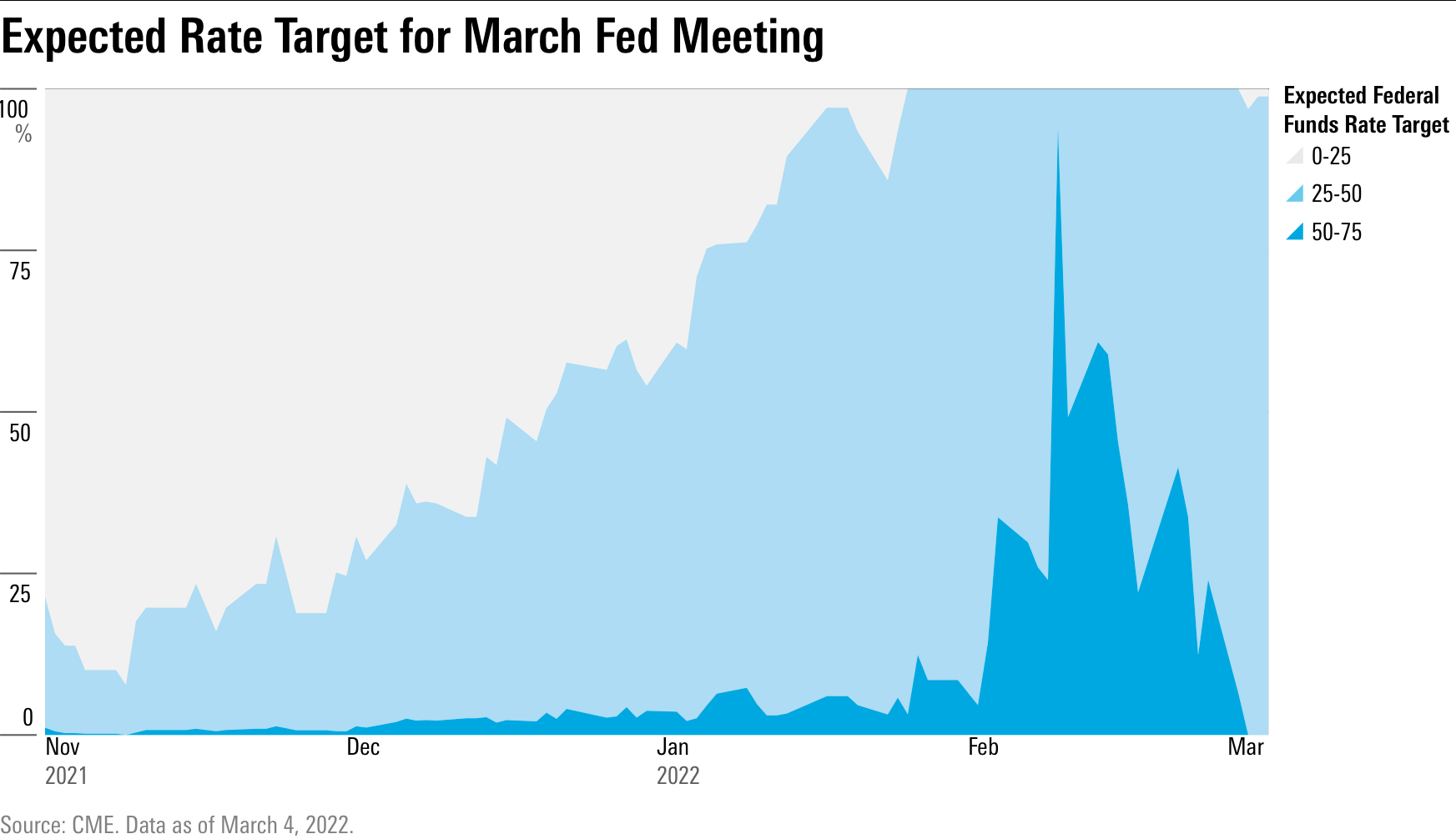

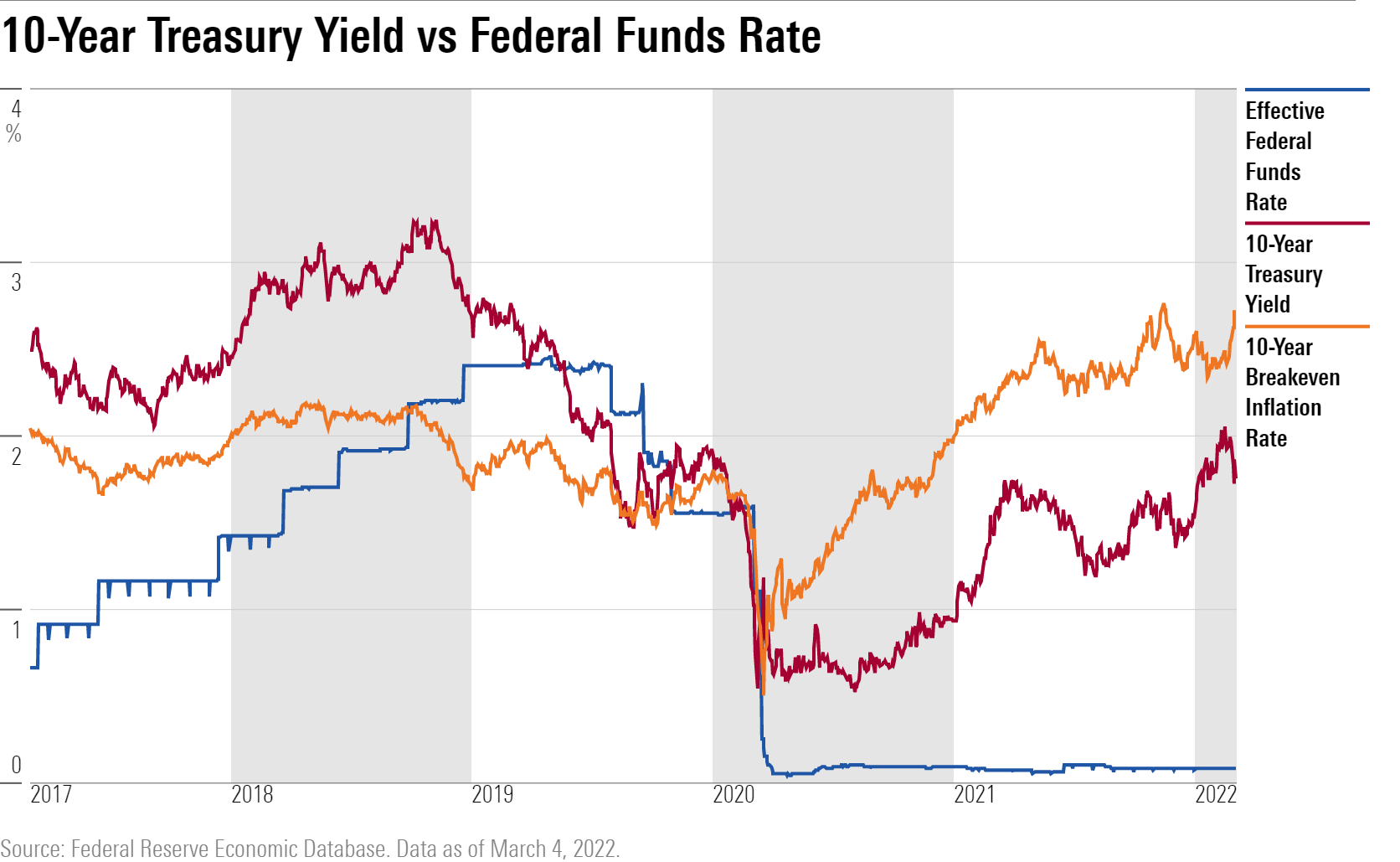

With job growth strong and inflation pressures high, expectations in the bond market are set for the Fed to start raising rates at its two-day meeting that begins March 15.

Prior to the Russia's invasion of Ukraine, investors had been expecting the Fed to kick off its rate increases with a half-percentage point boost to the federal-funds rate from zero, where it has been since the pandemic recession hit. But with the invasion of Ukraine spelling more uncertainty about the global economy, and with Fed Chair Jerome Powell signaling in favor of a quarter-point increase, those expectations have shifted dramatically.

According to the CME FedWatch Tool, odds are north of 90% that the Fed will raise the federal-funds rate by 0.25%.

Caldwell notes that the bond market is still pricing five or six rate increases in 2022, "which seems reasonable."

"The war in Ukraine remains the big wild card," he adds. "In theory, the Fed shouldn't react to short-term inflation generated by higher oil prices from the disruption unless there's a risk that inflation expectations begin to rise, which would cause inflation to become persistent. The Fed can't actually know what causes inflation expectations to rise, so I think we should--and will--see tighter monetary policy in response to higher oil prices. If oil prices stay at current levels or higher throughout the year, we might see seven hikes through December."

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)