Where We See Investment Opportunities in February

With the stock market fairly valued, here are several undervalued areas investors can take advantage of.

Key Takeaways:

- Earnings generally solid, but in some cases, guidance is failing to live up to expectations.

- Good time to take profits in overvalued growth stocks—technology stocks, in particular—and reinvest in undervalued value and small-cap stocks.

- Monetary policy will ease from restrictive stance, only question is when.

Earnings Solid, but Cracks Starting to Appear

Earnings season started on a solid note as the banks reported earnings and guidance largely in line with our expectations. Encouragingly, loan-loss reserves were also in line, indicating that the banks are not preparing for a recession. The financials sector traded up over the course of January, and while we continue to see value among the regional banks, the broad sector is now trading in line with the composite of our fair value estimates.

As earnings season progressed, several consumer-related companies, such as Procter & Gamble PG and Netflix NFLX, indicated that consumer spending has held up well. In the communications sector, both 4-star rated Verizon VZ and AT&T T reported strong free cash flow, margin improvements, and subscriber growth. Adding to the positive sentiment in the market, ASML ASML reported a shockingly high increase in 2025 bookings. Considering ASML is the leader in producing the high-end semiconductor manufacturing equipment geared for artificial intelligence, it appears anything to do with AI remains red-hot.

By late January, however, earnings season started to sour. While AI remains red-hot, 2-star-rated Intel INTC, Texas Instruments TXN, and Advanced Micro Devices AMD revealed that semiconductor demand in other areas such as servers, industrial, and commodity-oriented semiconductors was less than robust. All three stocks traded down immediately after earnings.

The focus then turned to the “Magnificent Seven.” While six of the seven stocks started 2023 rated either 4 or 5 stars (deep in undervalued territory), following their meteoric rise last year, three are now rated 3 stars, three are rated 2 stars (well above our fair value estimates), and only 4-star Alphabet GOOGL remains undervalued. While many of these companies reported solid earnings, their guidance was not enough to meet the market’s heightened expectations. For example, Tesla TSLA, Alphabet, and Microsoft MSFT all traded down after their respective earnings reports.

While there has not been a wholesale reduction in management guidance for the year, we are seeing some indications that the rate of economic growth is slowing. We continue to forecast that the rate of economic growth will slow sequentially until bottoming out in the third quarter. With the broad market already trading at fair value, markets may be under near-term pressure until investors begin to see signs of economic reacceleration.

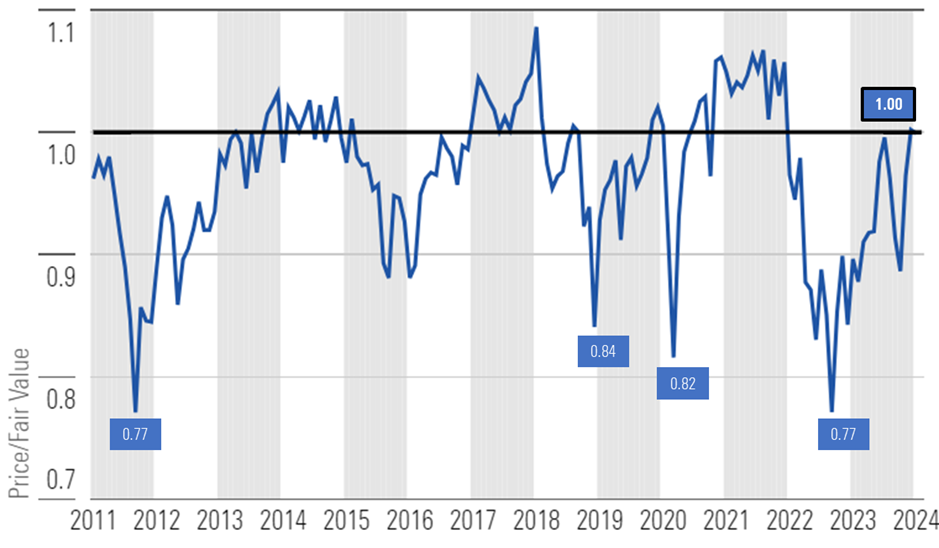

According to a composite of the over 700 stocks we cover that trade on U.S. exchanges, as of Jan. 31, 2024, the U.S. equity market was trading at a price/fair value of 1.00, meaning that the market is trading in line with a composite of our fair value estimates.

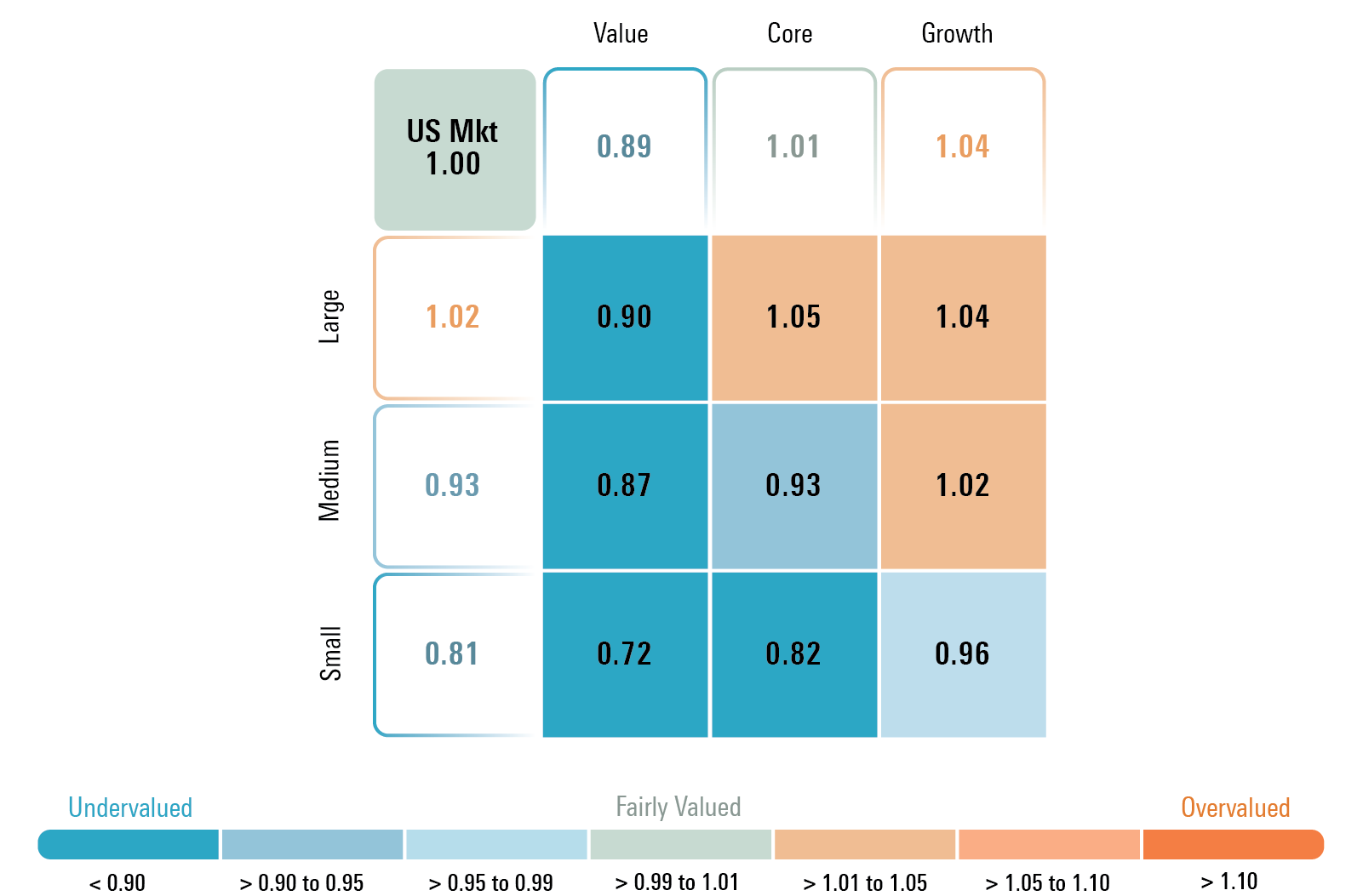

Price/Fair Value of Morningstar's U.S. Equity Research Coverage at Month End

Since we published our 2024 US Market Outlook, the valuation of the growth category has become further overextended as several of the largest stocks by market capitalization have soared this year. For example, Nvidia NVDA has risen 24% (pushing it into 2-star territory), Microsoft is up over 5%, Eli Lilly LLY 11%, and ServiceNow NOW 8%. With growth stocks trading at a 4% premium over a composite of our fair values, we think it’s a good time to underweight the category and use those proceeds to overweight the value category, which remains significantly undervalued.

Elsewhere, we think investors should remain overweight in small-cap and mid-cap stocks, whereas large-cap stocks are trading slightly above fair value and should be underweighted.

Price/Fair Value by Morningstar Style Box Category

Where Do We See Some of the Best Opportunities in Today’s Market?

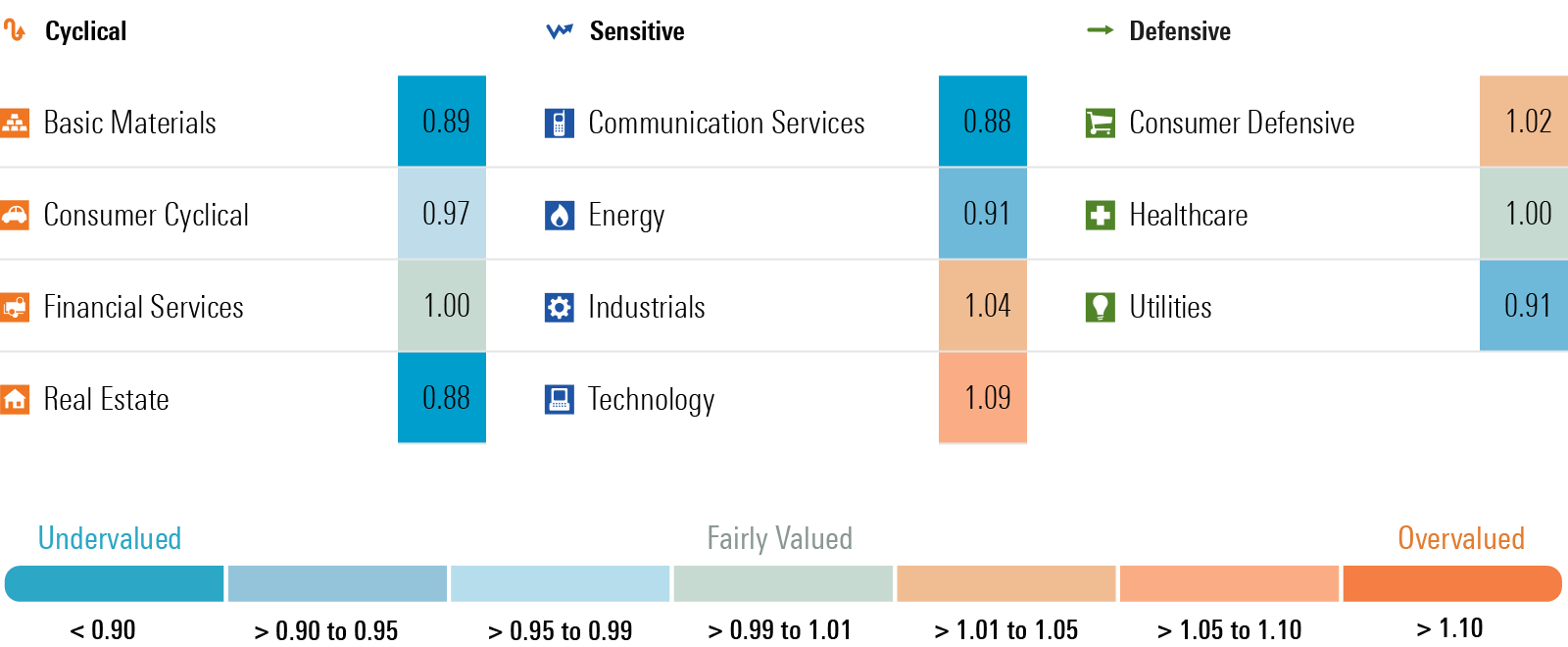

We are about halfway through earnings season and have seen almost an equal amount of hits and misses in the technology sector. Technology remains well in overvalued territory, trading at a 9% premium to a composite of our valuations. Other than the beginning of this year, the last time technology traded at a higher premium was in January 2022; at that time, we warned investors that the markets, and technology in particular, were overvalued. And indeed, tech stocks fell dramatically in 2022.

Although the technology sector started 2023 as one of the most undervalued sectors, following its 59% surge last year and almost 4% gain thus far this year, it is now trading well into overvalued territory.

Basic materials was the worst-performing sector in January and has fallen further into undervalued territory. In particular, we think the market is overly pessimistic regarding the long-term value we see among lithium, agricultural chemicals, and gold miners.

Real estate and utilities also struggled in January and remain two of the most undervalued sectors. Valuations for urban office space remain volatile, but we see opportunity in other real estate subsectors, such as healthcare, high-end shopping malls, apartments, and data centers.

The utility sector sold off last year as interest rates rose, but we think the market has overcorrected to the downside. We think the fundamental outlook for utilities is as strong as ever. The transition to renewables and focus on shoring up infrastructure for the electric grid provides the sector with a long runway for growth. Considering our U.S. economics team forecasts long-term interest rates will decline over the course of 2024 and into 2025, we expect declining interest rates will provide a good tailwind for both utilities and real estate.

Energy stocks were relatively unchanged in January. We think investors are overly pessimistic about the long-term outlook for the energy sector. In fact, we are now seeing some of the most attractive valuations in energy since the end of 2021.

Morningstar Price/Fair Value by Sector

Monetary Policy to Ease, Only Question Is When

Markets were already in the red prior to Federal Reserve Chair Jerome Powell’s press conference on Wednesday, Jan. 31, from profit-taking in Alphabet and Microsoft, along with other stocks trading down after earnings. But markets took a sharp leg lower following a hawkish reply from Powell to a reporter’s question.

In his response, Powell said, “Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting, to identify March as the time to do that [cut interest rates], but that’s to be seen.” Investors were shocked by this statement since, historically, Federal Reserve officials do not provide such a direct statement on future monetary policy for an upcoming meeting.

While our original base case was the Fed would begin cutting rates in March, we remain confident that inflation will be low enough to spur the Fed to begin easing monetary policy at either its March or May meeting. Our U.S. economics team continues to forecast that inflation will subside and that the April core PCE reading will drop to 2.1%. We are still forecasting a total of 150 basis points of cuts in 2024 and the federal-funds rate to end the year in a range of 3.75%–4.00%.

Although the probability of a March cut has declined, we note a significant addition to the language in the Federal Open Market statement. “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” This is the first instance in this policy cycle that the Fed had used the word “reduce” in relation to the federal-funds rate.

We also note that Powell was quite emphatic that inflation has been able to fall quite rapidly in the face of stronger-than-expected economic growth and a healthy job market. It appears that the Fed no longer thinks it needs to see softness in the economy or job market for inflation to return to its target.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)