2024 Market Outlook: What a ‘Return to Normal’ Means for Stocks

2024 is lining up to be the first year after the pandemic when we are finally past all the disruptions and dislocations.

2024 Stock Market Outlook Key Takeaways

- The U.S. stock market is now trading equal to a composite of our fair value estimates.

- Value stocks and small-cap stocks still trade at attractive discounts.

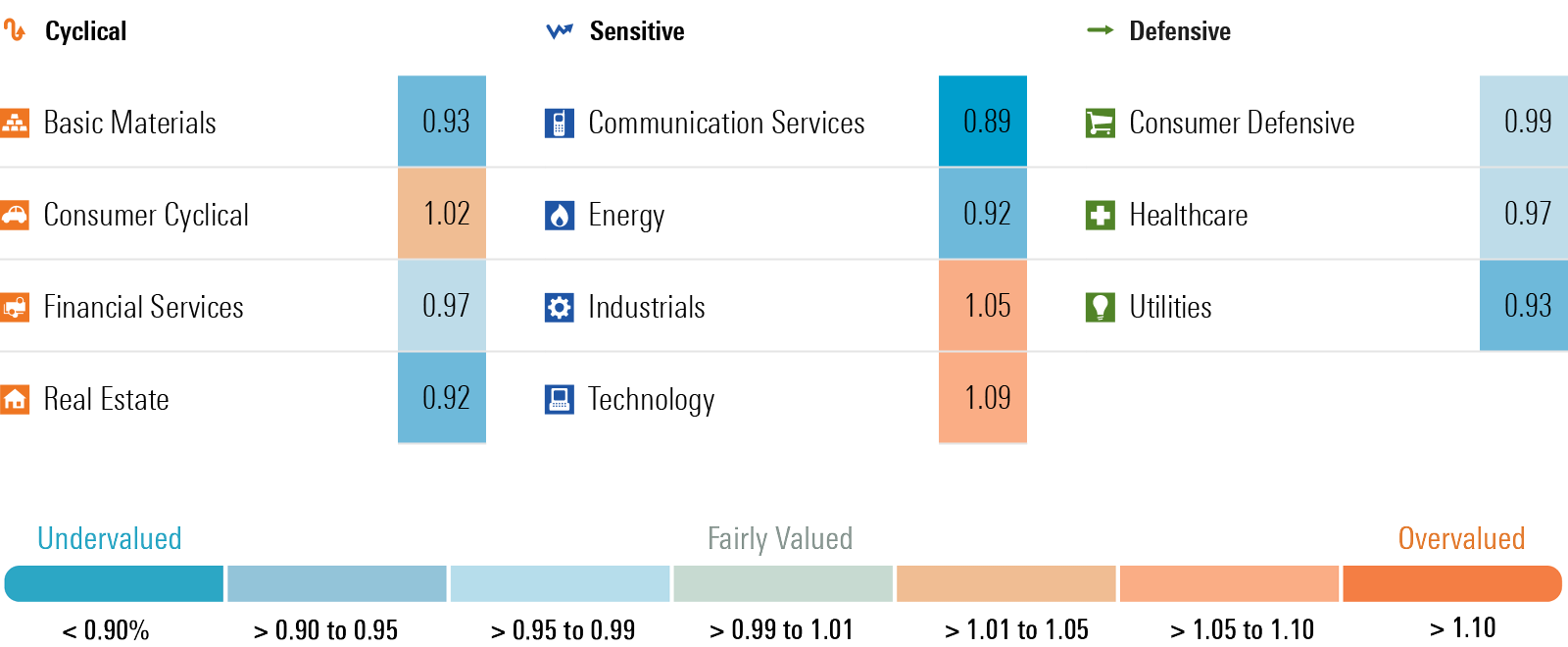

- The technology sector moved back to a choice for underweighting along with industrials, whereas communications, basic materials, real estate, and utilities are attractive overweightings.

- The rate of economic growth is forecast to slow in 2024, but no recession.

As long-term interest rates rose and the 10-year U.S. Treasury bond neared 5% last fall, stocks sold off, dropping well into undervalued territory. However, this year’s “Santa Claus Rally” came early as long-term interest rates subsided in November and then the rally was boosted even further following the December Fed meeting. The market interpreted Federal Reserve Chair Jerome Powell’s remarks to indicate that not only is the Fed done hiking rates, but it is also now considering when to begin easing monetary policy.

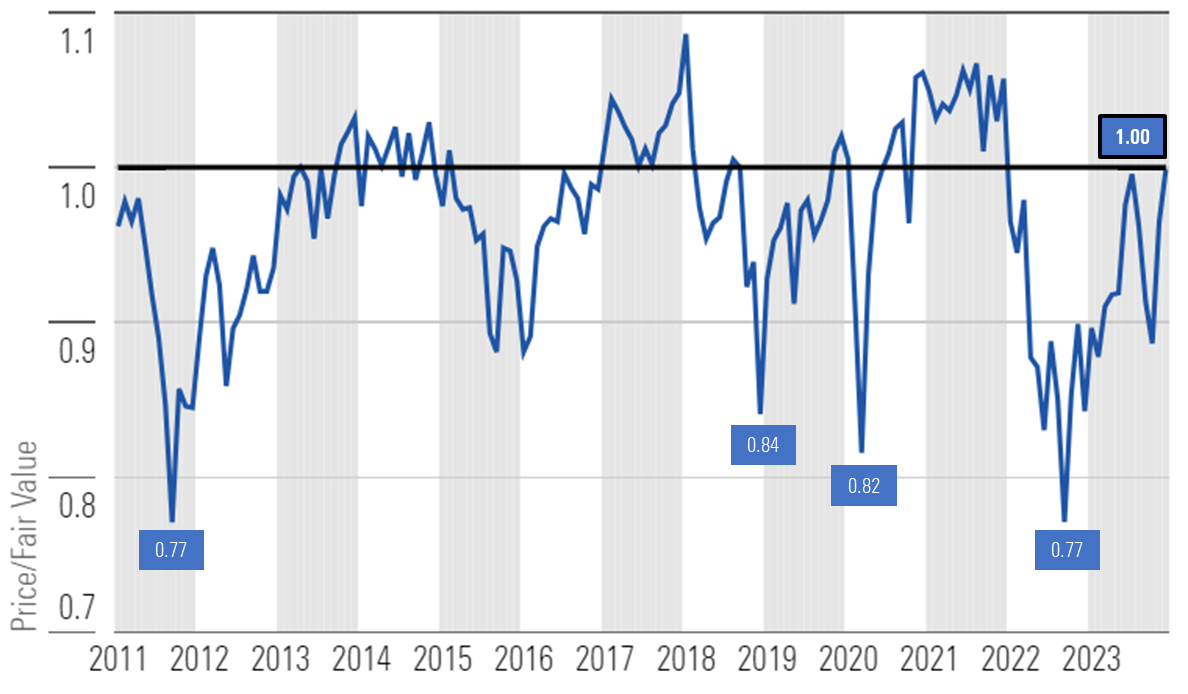

According to a composite of the over 700 stocks we cover that trade on U.S. exchanges, as of Dec. 21, 2023, the U.S. equity market was trading at a price/fair value of 1.00, meaning that the market is equal to a composite of our fair value estimates.

Price/Fair Value of Morningstar's U.S. Equity Research Coverage at Month End

With Stocks Fairly Valued, How Should Investors Position Themselves in 2024?

After four years, 2024 is lining up to be the year that the economy and individual behavior have finally recovered and normalized. The massive disruptions caused by the pandemic and dislocations caused by those disruptions are behind us. While we forecast that the rate of economic growth will slow and stocks have already rallied and are nearing their highs, we still see multiple undervalued areas that provide relatively large margins of safety.

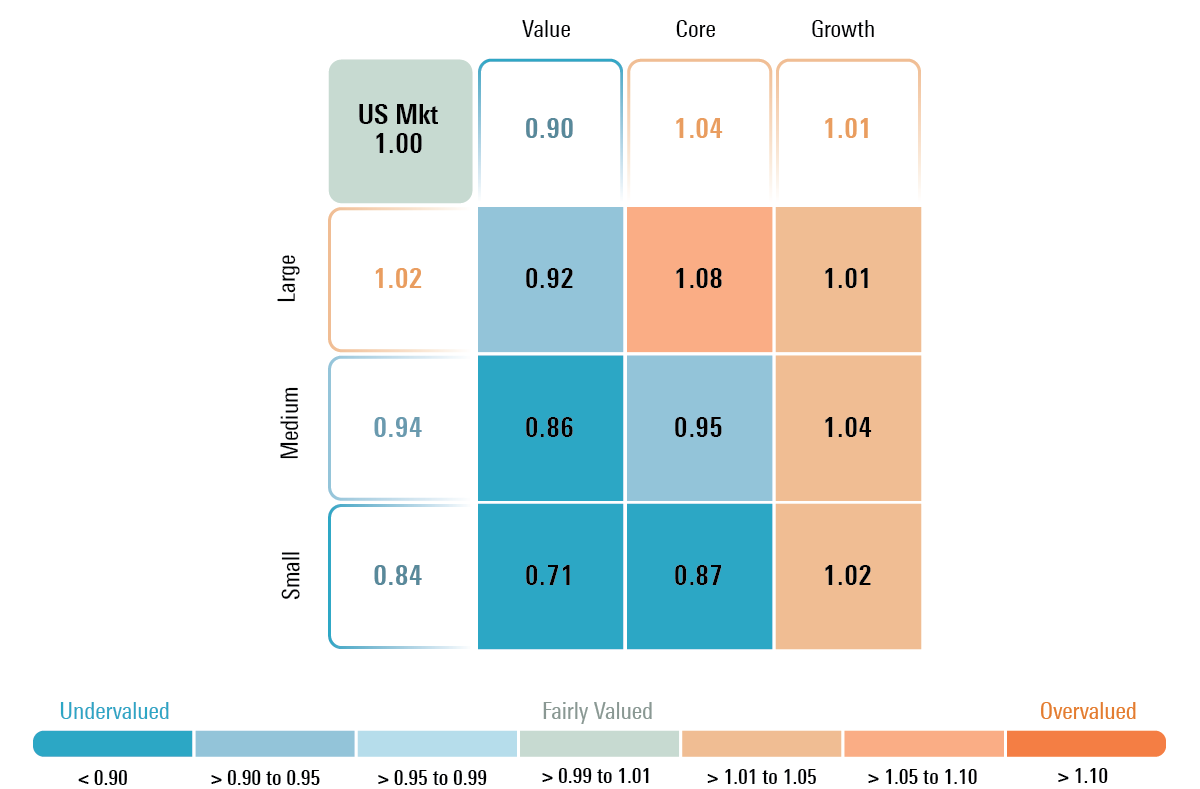

By capitalization, small-cap stocks remain the most attractive at a 16% discount, followed by mid-caps at a 6% discount, while large caps are a little above fair value. By category, for long-term investors, according to our valuations, value stocks remain the most attractive, trading at a 10% discount to fair value, while core stocks are trading into overvalued territory and growth are essentially at fair value.

Price/Fair Value by Morningstar Style Box Category

After dominating the market in the first half of 2023, the “Magnificent Seven” (Apple AAPL, Amazon.com AMZN, Alphabet GOOGL, Meta Platforms META, Microsoft MSFT, Nvidia NVDA, and Tesla TSLA) have run out of steam. Only Alphabet remains undervalued, whereas five others are now trading in fair value territory and Apple is overvalued.

Looking forward, we expect further gains will continue to be driven by a widening out of returns across the market. In fact, we have already started to see this trend emerge. Gains are increasingly spreading out across other areas in the market that had been left behind. For example, the Magnificent Seven accounted for 75% of the market return at the end of June, but as of Dec. 21, they account for only 52%. Specifically, we continue to see the best opportunity for investors in the value category, which remains the most undervalued according to our valuations, as well as down in capitalization into small-cap stocks.

Over the next few months, we think the next test for the markets will come in February and March when companies report earnings. We are not as concerned about earnings as we are that management teams may look to lower the bar on the market’s expectations for earnings growth in 2024 as the rate of economic growth is poised to slow.

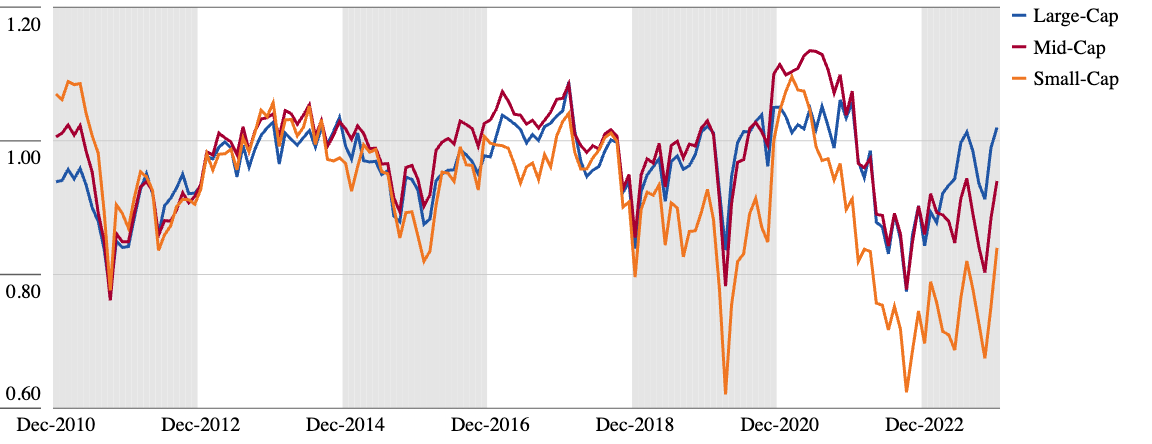

Historical Comparison of Morningstar’s Valuations by Capitalization and Category

On a price/fair value basis, small-cap stocks remain near some of the greatest discounts to large-cap and mid-cap stocks that we have seen since 2010. Small-cap stocks sold off harder and faster during the early stages of the pandemic as investors feared smaller companies would not have the wherewithal to survive. This past fall, small-cap stocks were under additional pressure as investors were concerned that small-cap stocks would be more adversely affected by rising interest rates as they typically have shorter duration debt and may need to refinance at high interest rates. In addition, bank funding has become more restrictive as banks are less willing to extend loans to higher risk credits.

In our view, this sets the stage for small-cap stocks to outperform. We think 2024 will be the first year that both the disruptions from the pandemic and all the subsequent dislocations caused by those disruptions will be behind us. While the rate of economic growth may slow, we expect that, in a more normalized economic environment, the prior fears about small-cap solvency should alleviate. In addition, we forecast interest rates across the curve will subside in 2024 and 2025, thus mitigating much of the refinancing risk.

Small-Cap Stocks Remain at Wide Discount to Large-Cap and Mid-Cap Stocks

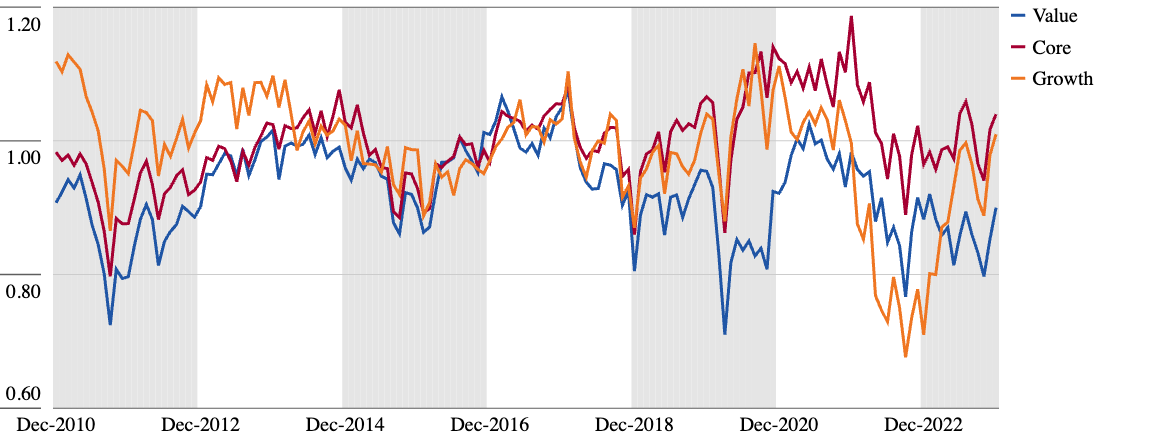

Value stocks also appear to be well positioned to outperform. Many growth stocks were able to initially benefit from the pandemic. For example, as employees shifted to working from home, they required a wide array of technological services and products. Value stocks were hit by a double whammy of near-term earnings deterioration as they disproportionately suffered from a rapid change in consumer behavior and subsequent economic dislocations, as well as investors applying lower market valuation multiples.

Value Stocks Remain at Wide Discount to Core and Growth Stocks

Notable Changes in Sector Valuations and Outlooks

No sector has been as volatile as the technology sector in 2023. Technology started 2023 as the third-most undervalued sector as compared with our valuations. Technology rallied up to fair value, overshot to the upside, retreated back to fair value, and has bounced back well into overvalued territory. Consumer cyclicals started 2023 as the second-most undervalued sector, yet it is now fully valued following its outperformance. Lastly, industrials have moved into overvalued territory.

While real estate remains significantly undervalued, following its strong fourth-quarter performance, the title for most undervalued sector returns to communications. Communications started 2023 as the most undervalued sector, and even after incorporating its above-market returns, it remains undervalued. And it is not just Alphabet that’s undervalued—we see undervaluation across a wide swath of traditional communications stocks.

After starting the year as the most overvalued sector, energy is now one of the more undervalued sectors, following its underperformance for the year to date as oil prices have fallen. After dropping precipitously as interest rates rose, the utility sector is now undervalued. We continue to find value in the basic materials sector as the bubble in lithium prices has popped and fallen too far to the downside and gold-mining companies provide an attractive upside option.

Morningstar Price/Fair Value by Sector

Our Outlook for the U.S. Economy and Monetary Policy

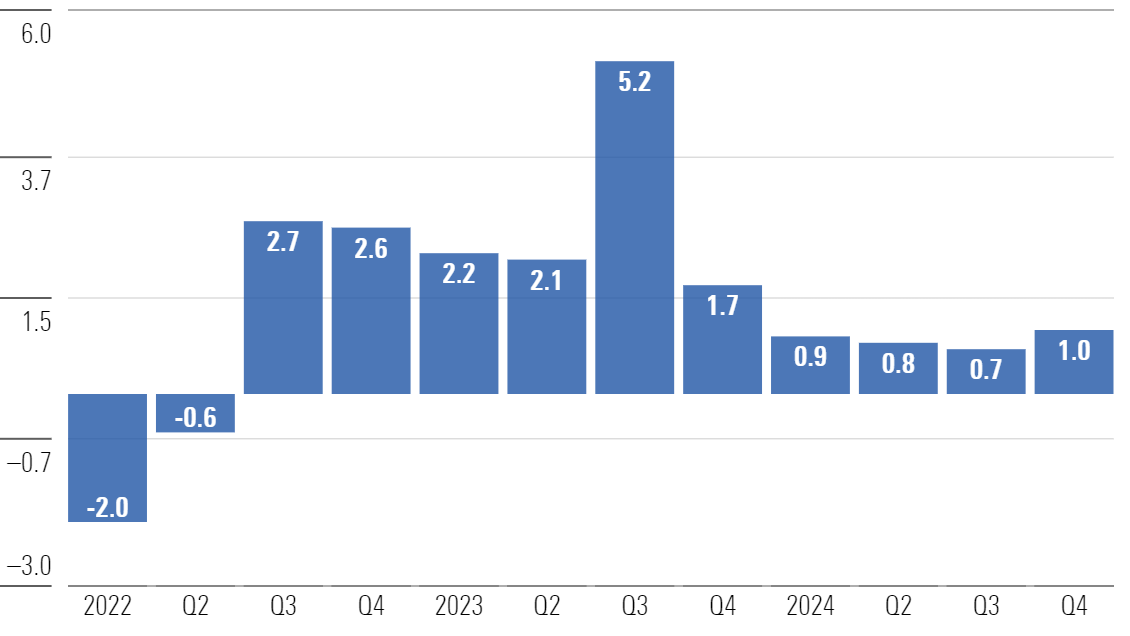

The U.S. economy continued to defy restrictive monetary policy in 2023 as real gross domestic product surged to 5.2% in the third quarter, leading us to increase our real GDP forecast for 2023. However, we still expect that higher interest rates, restrictive monetary policy, and tight lending restrictions will take their toll on the economy. We forecast that the rate of economic growth has begun slowing in the fourth quarter of 2023 and the rate of growth will continue to slow until bottoming out in the third quarter of 2024. From there, our expectation for easier monetary policy will allow economic growth to begin to expand steadily thereafter.

Forecasted U.S. Annualized Real GDP

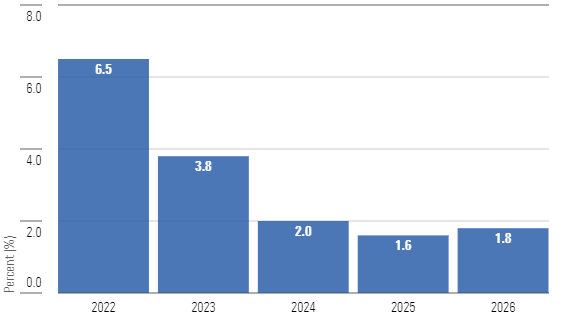

Both headline and core Consumer Price Index readings have remained on a downward trend in 2023. We continue to forecast that inflation will moderate over the course of 2024 and into 2025. According to our projections, the major drivers of high inflation, such as supply chain bottlenecks, shortages, and other disruptions, will further unwind over the next few years, providing prolonged deflationary pressure. In fact, our below-consensus forecast calls for inflation to fall below the Fed’s 2% inflation target in 2025 before beginning to slightly rise back up.

Forecasted U.S. Inflation Rate

As we expected, the Federal Reserve held the federal-funds rate steady at its December meeting. We had previously noted that we had expected the July hike would be the final interest-rate increase of this monetary policy tightening cycle.

This monetary tightening cycle has been the steepest and fastest over the past 40 years, yet far less restrictive than the policy during the 1970s and ‘80s. While the economy has held up better than expected in the face of this tightening cycle, we still expect that the rate of economic growth will slow throughout most of 2024.

Looking forward, we expect that the combination of slowing economic growth and declining inflation will prompt the Fed to begin loosening monetary policy and begin lowering the federal-funds rate, possibly as early as March 2024. We forecast six interest-rate cuts over the course of 2024, double that of the Fed’s current projection.

U.S. Interest-Rate Forecast

2024 Market Outlook Webinar

Join me and Morningstar’s Chief U.S. Economist Preston Caldwell on Wednesday, Jan. 10, 2024, at 11 a.m. Central/noon Eastern as we:

- Break down our valuations and identify undervalued opportunities across categories, sectors, and stocks.

- Highlight investable long-term secular growth themes.

- Provide our forecasts for real U.S. gross domestic product, inflation, and interest rates.

- Answer live audience questions.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)