Why Emerging-Markets Stocks Could Finally Shine

Attractive valuations and China reopening could lead long-lagging emerging stocks to outperform.

With expectations for returns on U.S. stocks limited, the time may be ripe for emerging-markets stocks to emerge from the shadows and take their turn in the spotlight thanks to attractive valuations and healthy economic fundamentals.

“Interest in emerging markets is bubbling up,” says Chapman Taylor, equity portfolio manager at Capital Group, which manages American Funds. “As modest amounts of capital start to move, emerging markets will move up quickly,” he says. “And because of where valuations are, there’s a lot of room to move.”

Right now, emerging-markets stocks are cheaper than they’ve been on average over the past 15 years—as measured by the Morningstar Emerging Markets Index—while U.S. stocks look slightly overpriced compared with their long-term average valuations based on the Morningstar US Market Index.

Emerging-markets stocks look poised to gain as multiple tailwinds emerge, including a weakening U.S. dollar, China’s quicker-than-expected reopening, and maturing economic conditions in several emerging-markets countries. Although emerging-markets stocks don’t come without risk, China, Southeast Asia, and Latin America appear to offer potential rewards for investors.

“There are opportunities in emerging markets,” says Candace Tse, managing director and global head of strategic advisory solutions at Goldman Sachs Asset Management. “You just need to be highly selective on what you’re buying within the space.”

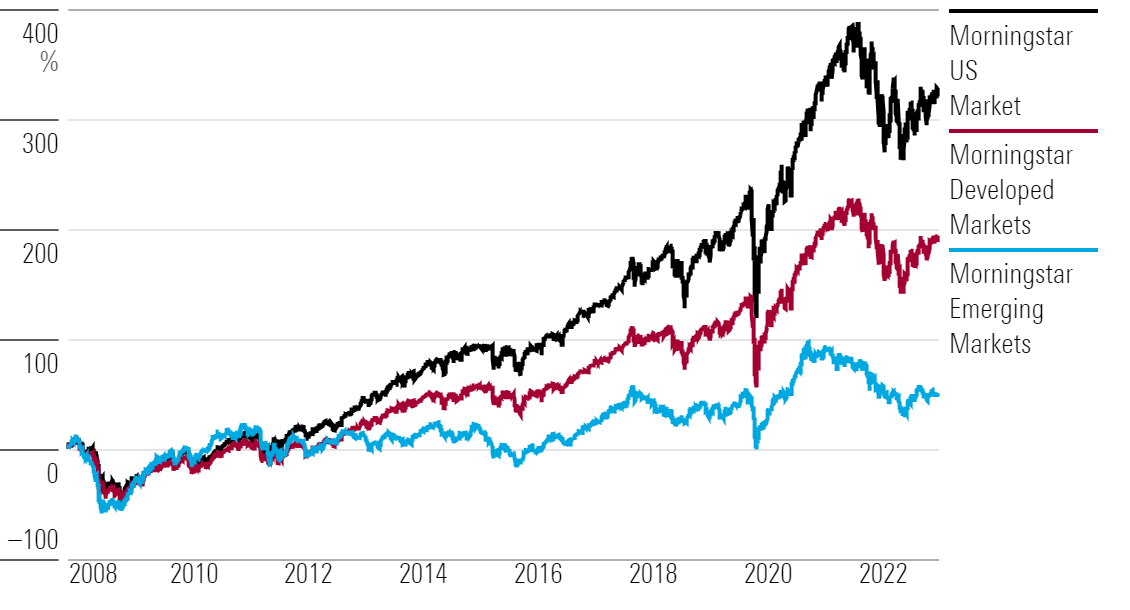

Global Markets vs. U.S. Market Performance

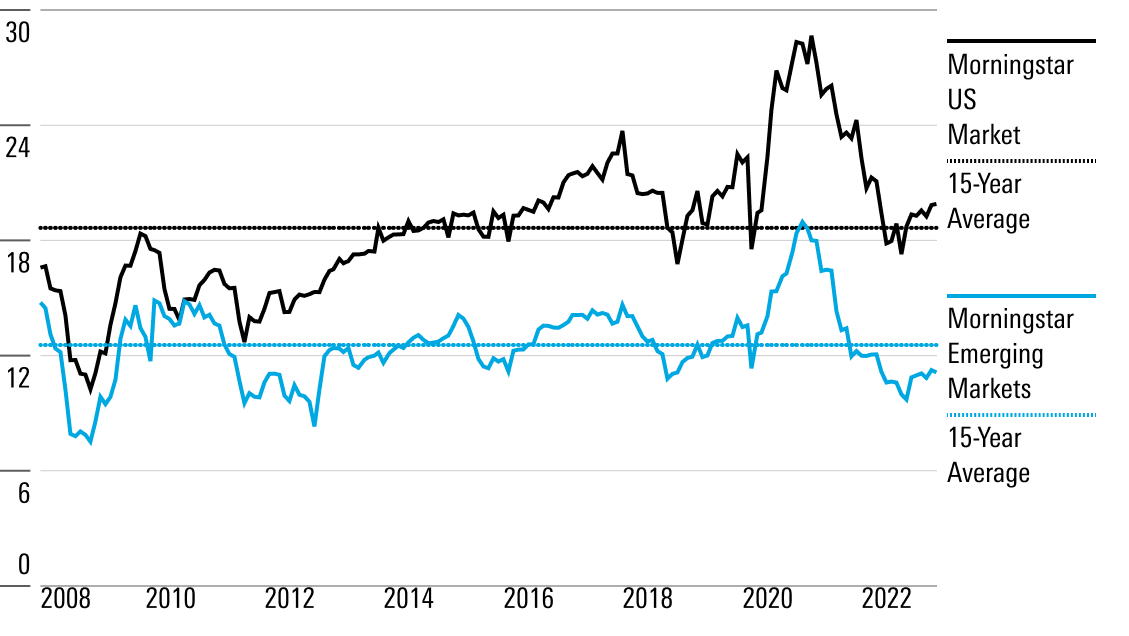

Emerging Markets Look Attractively Valued

Emerging-markets stocks look more attractive now than they’ve been over the past several years, strategists say, both in terms of their own valuations and relative to the valuations of U.S. stocks.

“Equity investors have both tactical and strategic reasons to combat home-country bias and go global,” writes Dan Lefkovitz, strategist for Morningstar Indexes. The U.S. share of global stock market value has climbed to nearly 60% based on the Morningstar Global Markets Index, which measures the performance of stocks located in developed and emerging countries across the world. “That’s far out of proportion to its 25% share of the global economy.”

At the same time, “Emerging markets represent nearly 70% of the world’s GDP growth, but only 20% of the total global equity market cap,” writes Philip Straehl, global head of research for Morningstar Investment Management. “A burgeoning middle class continues to develop in emerging markets and should present interesting opportunities for investors, albeit with higher volatility.”

On average, emerging-markets stocks are cheaper now than they have been over the past 15 years. That’s in terms of their price/earnings ratios, which are a commonly watched valuation metric comparing the stock’s price with its expected or historical earnings. The Morningstar Emerging Markets Index’s trailing 12-month price/earnings ratio is 11.1 as of April 2023—below its 15-year average level of 12.5.

Meanwhile, U.S. stocks look fairly valued or even slightly expensive overall compared with their average levels over the past 15 years. The Morningstar US Market Index’s current trailing 12-month price/earnings ratio lies at 19.8, just above its 15-year average of 18.6.

Price/Earnings Ratios

Tailwinds for Emerging Markets

Several factors are adding to the relative attractiveness of emerging markets stocks, including:

- A weakening U.S. dollar: “I think we’re going to see a weakening U.S. dollar that will provide a tailwind [for emerging markets],” says Goldman Sachs’ Tse. “But as investors start to realize that a ‘soft landing’ is a possibility here in the U.S.—and also in Europe and the U.K.—investors will see that other economies can actually recover,” Tse says. “When that happens, other currencies will outperform and accelerate over time. That means opportunity for emerging markets.”

- Ripple effects from China’s reopening: China has reopened much quicker than expected, Tse says, and much of the strong growth that was expected to come forth next year is starting to happen now. “The rebound that comes with China’s reopening is not going to peter out after a quarter or two,” she says. “This is a pretty significant trend that’s going to continue for some time.” Capital Group’s Taylor shares a similar view: As China grows and needs to hire labor offshore because of changing demographics and rising labor costs, “India, Indonesia, and Mexico is where they’ll go,” he says. “We see a lot of attractive companies, in Southeast Asia in particular, that will feel the derivative impacts of China’s growth.”

- Maturing economies within emerging markets: New stability brought by “structural reform” in emerging markets is starting to pay off, Taylor says, though the market has yet to appreciate this. He cites several stats, including debt/gross domestic product ratios, which have lowered substantially for several emerging-markets countries. “A number of these countries now have lower debt/GDP ratios than the developed world,” he says. Taylor says that emerging-markets countries no longer have the fixed exchange rates, higher debt levels, and political uncertainty that they once had, yet “valuations are now at a discount of about 40%.” Structural reform slows countries down for a time, and then the benefits come later, and he sees those benefits emerging now. “Indonesia has gone through several elections without a hiccup,” he says, later mentioning that the country is now home to the largest stainless steel plant in the world.

“Clearly, from a relative standpoint, emerging markets look much more attractive than they have historically, and on a relative basis compared to the headwinds that we all see in developed markets,” Taylor says.

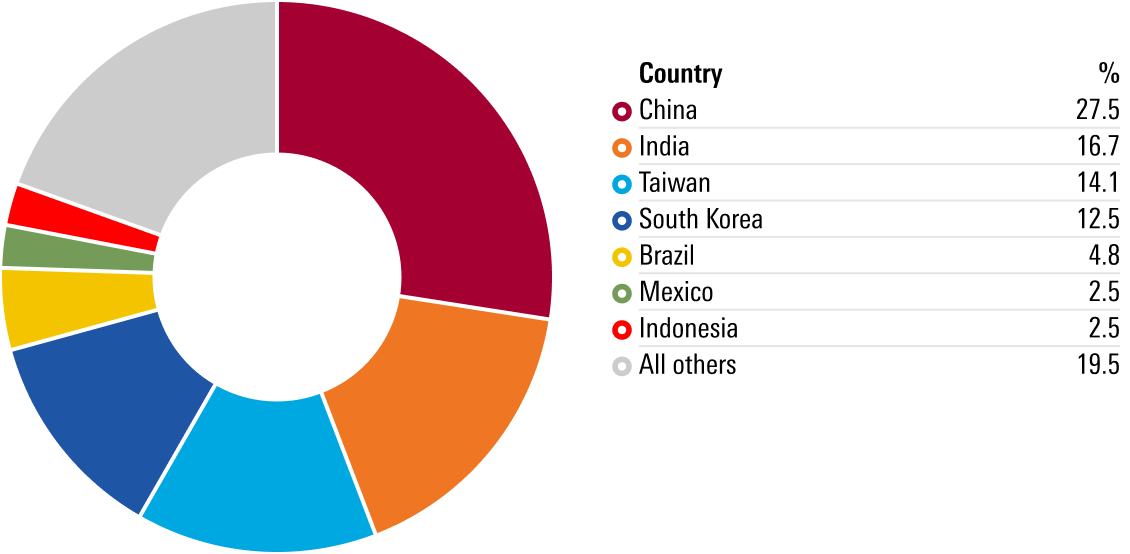

Emerging-Markets Country Risk Exposure

Roughly one third of the Morningstar Emerging Markets Index is made up of Chinese stocks on a market-cap-weighted basis. Other index heavyweights include India—comprising 16.7% of the index—and Taiwan, adding an additional 14.1% to the total index weight.

“Emerging-markets indexes invest heavily in China, so investing broadly in the index comes with more geopolitical risk,” says Doug McGraw, portfolio manager at Morningstar Investment Management. “Major companies, and the market as a whole, have at times been constrained by government policies in order to support employment or promote what’s seen as healthy for the country.” McGraw mentions, for example, that the Chinese government has restricted the ability of video game companies to market their products while limiting the number of new games released.

Four of the 10 largest stocks in the emerging-markets index are Chinese companies: social-media giant Tencent TCEHY, with a current market capitalization of $387 billion as of May 31; e-commerce giant Alibaba BABA, with a current market cap of $204 billion; food-delivery services company Meituan MPNGY, with a market cap of $87.9 billion; and Beijing-based China Construction Bank CICHY, with $162.5 billion in market cap.

At the same time, as McGraw points out, many of the largest emerging-markets companies generate substantial revenue from outside their home countries. For example, Taiwan Semiconductor TSM—the largest company in the emerging-markets index, with a market cap of $470.9 billion—generates 66% of its total revenue from the United States. “The economic exposure goes beyond Taiwan,” he says, “It’s people all over the world buying electronic devices and computers.”

Roughly 10% of total emerging-markets revenue exposure comes from the U.S., by McGraw’s measures. “It’s important to look under the hood at the individual companies within the index to understand what kinds of risks and revenues you’re really exposed to.”

Emerging-Markets Country Risk Exposure

Current Opportunities in Emerging Markets

“China is currently a cheap market with abundant opportunity from the bottom up,” says Justin Thomson, T. Rowe Price’s head of international equity. “There are sector plays in technology within software, automation, and semiconductors,” he says. “In addition, there are consumer plays—particularly where local brands are substituting for global brands—consolidation in fragmented industries, and environmental plays.”

Thomson sees additional opportunities in India for the country’s structural growth and in Latin America “because equities and financial exchange rates are outright cheap.” Finally, he adds, he’s also keeping an eye on Taiwan Semiconductor for its ability to manufacture the nodes required for AI chips.

Capital Group’s Taylor also views select industries within certain countries as attractively valued. In Mexico, for example, “one very attractive sector is industrial real estate,” he says. “There is huge demand for land there in terms of companies looking to set up industrial facilities in Mexico, especially Chinese companies.” In China, Taylor is also interested in the biopharmaceutical industry, as well as companies that own factories in India and Indonesia.

Emerging Markets vs. U.S. Market Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)