What’s Going on With Consumers?

The postpandemic spending bonanza may be coming to an end. What does this mean for stocks?

Consumers have been in very good shape over the past two years, but the last six to nine months suggest that the climate may be shifting.

Savings rates had spiked amid scarce spending opportunities at the height of the pandemic, and the spending of all that pent-up cash has defined markets ever since Europe and North America reopened for business. As consumers played catch-up, one obvious rebound area of spending was travel, the consumer segment most limited by lockdowns. Air travel rebounded materially—although the United States has run slightly ahead of Europe, both regions have now essentially recovered to prepandemic levels.

Air Travel Volume

Hotel bookings tell a similar story. In the United Kingdom, chains are reporting strong growth on this time last year, with room rates rising in tandem. Consumers desperate to go on vacation are also bidding up the cost of these trips as demand outpaces supply.

In the U.S., growth in hotel bookings has been outpacing retail sales for quite some time now, meaning that consumers are happier to spend their cash on hotels than most other forms of discretionary spending. However, this growth is fading and slowly converging with general retail sales, as consumers finally get the need for that vacation out of their systems.

Retail Sales vs. Travel

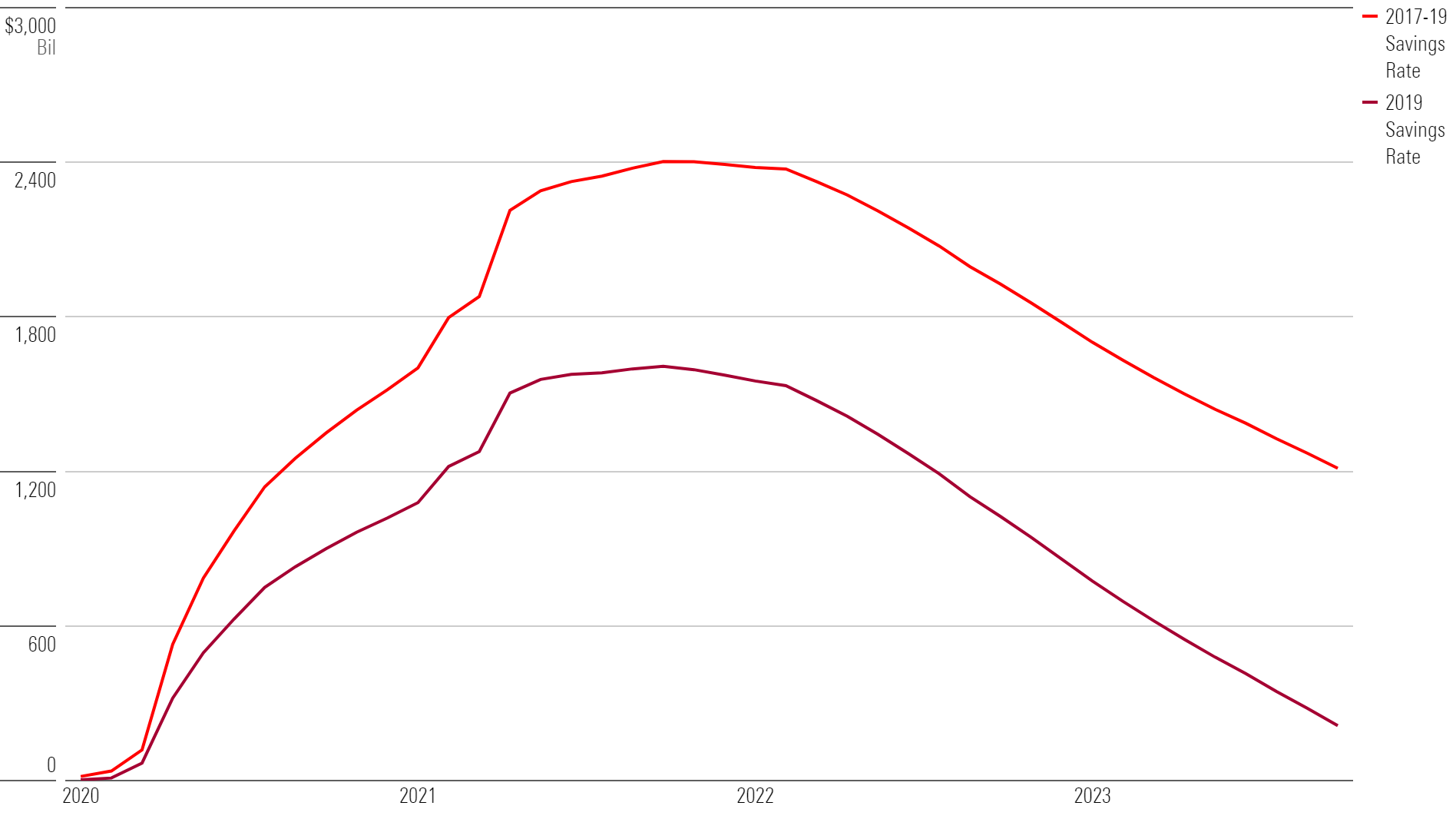

This slowdown in travel bookings makes sense when we look at what is happening to consumers’ savings. That large pile of savings many households built up during lockdowns is finally nearing depletion, and consumers are being forced to cut back.

Pandemic-Era Savings Piles Are Dwindling

Savings aren’t just dwindling because consumers are blowing their cash on holidays, though. A large part of the trend can be explained by increasing costs of everyday necessities, such as housing. For homeowners, mortgage costs are rising rapidly. In the U.K., mortgage interest costs have risen by half in the last year alone, driven by central banks’ attempts at combating inflation.

Average U.S. 30-Year Fixed Rate Mortgage

Spending on big-ticket items like houses and appliances has seen major falls in 2023. U.K. homebuilder Persimmon reported new housing starts down a third on 2022 levels in its recent earnings release, while U.S. home improvement giant Home Depot HD has reported a strong slowdown in appliance sales.

It’s not just big-ticket items that consumers are cutting back on; austerity is even reaching everyday necessities. Food inflation, while falling, remains high. In the U.K., supermarket prices are still almost 7% higher than last year, piling pressure on the consumer. Consumer staples giant Kraft Heinz KHC recently reported strong sales, driven by price increases. The sting in the tail, however, was that the company is struggling to pass through the full cost increases it is experiencing, which is eating into margins. There’s a migration of consumers from branded goods to cheaper white-label items, and theft from stores is on the rise. Some U.S. retailers such as Dick’s Sporting Goods DKS and Walmart WMT made a point of mentioning the rise of shoplifting in their recent earnings releases, using the sterile industry term “shrinkage.” The British Retail Consortium, a trade association, reported that theft from stores across the U.K. has risen by more than one fourth year-over-year.

Is Luxury Still a Haven?

Over the last 12 months, we’ve been banging the drum on the luxury sector as the best place to hide from these negative consumer trends. Traditionally, luxury goods firms have been very successful at passing through cost increases to consumers, given that their clientele are usually less price-sensitive. But today, it seems even affordable-luxury goods providers are not completely insulated, with jewelry giant Pandora PNDORA reporting negative like-for-like sales growth in the U.S. and flat sales in Europe.

The outlook is murky, as some headwinds to consumer spending are gradually being replaced by others. Costs are slowly falling for retailers as supply chains right themselves, which helps profitability and lessens the need to raise prices. On the other hand, labor markets are once again loosening, making further large wage increases unlikely. The biggest catalyst remains interest rates and how quickly they will fall, or at least stop rising. Until that happens, consumers’ wallets will continue to be squeezed—a situation that will get worse as more households roll off fixed mortgages and are forced to refinance at higher rates.

Attractive Consumer Stocks

So, while we wait with bated breath for interest rates to fall, where should investors be looking in the consumer space? Luxury goods, our traditional hideout, is suffering from high valuations, a victim of its own success. There are some bright spots in the staples segment, areas that have traditionally shown defensiveness in the face of adverse market conditions. They include brewers like Anheuser-Busch InBev ABI, hotel groups like Accor AC, and tobacco firms like Imperial Brands IMB.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)