6 Key Themes From Q2 Earnings

A look at the main trends emerging from U.S. and European earnings, including inflation, travel, and house prices.

Sometimes what we see in equity markets bears no relation to what is happening in the real economy. This is one of those times.

In both the United States and the eurozone, GDP growth is still relatively anemic—rising 1.6% and 1%, respectively, year over year in the first quarter of 2023. Despite this, earnings season has been pretty decent in both regions so far.

Rather than focus on earnings “beats” vs. “misses”—which merely reflect how well firms did at underpromising/overdelivering—it’s worth pulling back the lens and examining higher-level trends from this earnings season, as well as the differences between U.S. and European earnings.

Among the key themes we’re seeing:

- Healthier banks as lenders improve profitability

- The mixed impact of inflation on earnings

- Strong travel on both sides of the Atlantic

- Pandemic-era inventory build reversing

- Lower oil prices dampening energy firm earnings

- A divergence between the U.S. and European real estate markets

Banks On the Mend

Capital ratios are solid, particularly in Europe, while interest-rate rises are allowing banks to improve profitability after so many years of operating with tight spreads on their loan books. While some concerns remain in the U.S. around banks geared toward specific sectors, such as commercial real estate, most of the large banks we cover in both regions have proved resilient over the last quarter.

Inflation’s Impact On Earnings

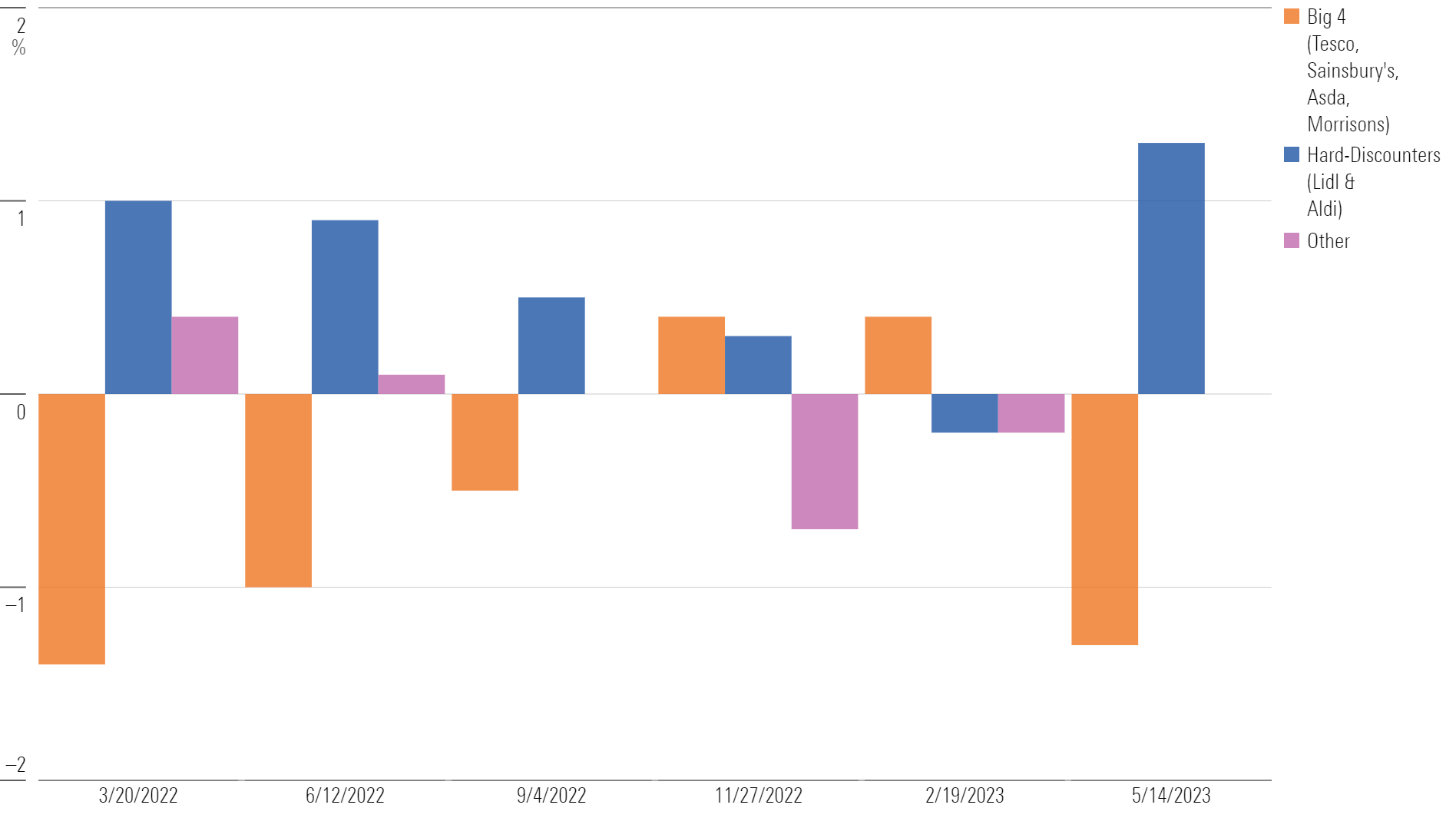

The ability to raise prices has never been so important in the consumer sector, with inflation finally falling but from elevated levels. Luxury goods firms—many of which are domiciled in Europe—have been particularly proficient at this, with their customers generally being less price-sensitive. Further down the food chain, however, it has been more heated, with consumer goods firms like Colgate-Palmolive CL pushing through price increases but barely offsetting rising costs. Similarly, U.S.-based Kraft Heinz KHC has increased prices at the expense of market share, with private label firms and smaller competitors pushing hard on promotional activity to gain market share. In Europe, this problem is even worse, with private label penetration even higher than in North America. In the U.K., recent data showed that hard discounters have been continually taking market share from large traditional supermarkets.

U.K. Grocery Market Share Developments

Travel Boom

Travel has been strong on both sides of the Atlantic, with hoteliers Accor ACCYY and Whitbread WTBDY reporting strong bookings and room revenues, despite many consumers feeling the pinch of higher mortgage rates and food bills. After an extended period of lockdown because of the COVID-19 pandemic, consumers are placing a high value on being able to travel once again. Vinci VCISY, the European-listed concessions firm, also affirmed this trend, reporting rising numbers of passengers through European airports.

Travel Demand (Room Nights) Continued to Outpace Other Retail Outlays

Drawing Down Inventories

Another knock-on effect of the pandemic was seen in bottlenecks in the shipping industry, which had industrial and consumer firms scrambling to get as much stock as possible. This quarter’s earnings have confirmed that many firms are finally destocking, resulting in chemicals firm BASF BASFY reporting a negative effect on sales and global third-party logistics firms Kuehne + Nagel International KHNGY and DSV DSDVY reporting falling volumes. The upside has been that materials, which have been harder and more expensive to come by, are finally becoming available again, according to European elevator manufacturer Kion Group KIGRY.

Energy Earnings Soften

The oil majors in the U.S. and Europe sang from the same hymn sheet this quarter, with the effects of depressed oil and gas prices earlier this year coming through in the form of lower revenues. A silver lining was seen in falling costs, which had risen in tandem with energy prices last year. Despite similar levels of performance, we see a big opportunity with the European oil majors, namely Shell SHEL and BP BP, over their U.S. counterparts Exxon XOM and Chevron CVX. The valuation gap is partly driven by ESG concerns from European investors—a situation we believe will rectify itself over time as the European majors ramp up investments in green energy.

U.S. vs. European Housing Markets

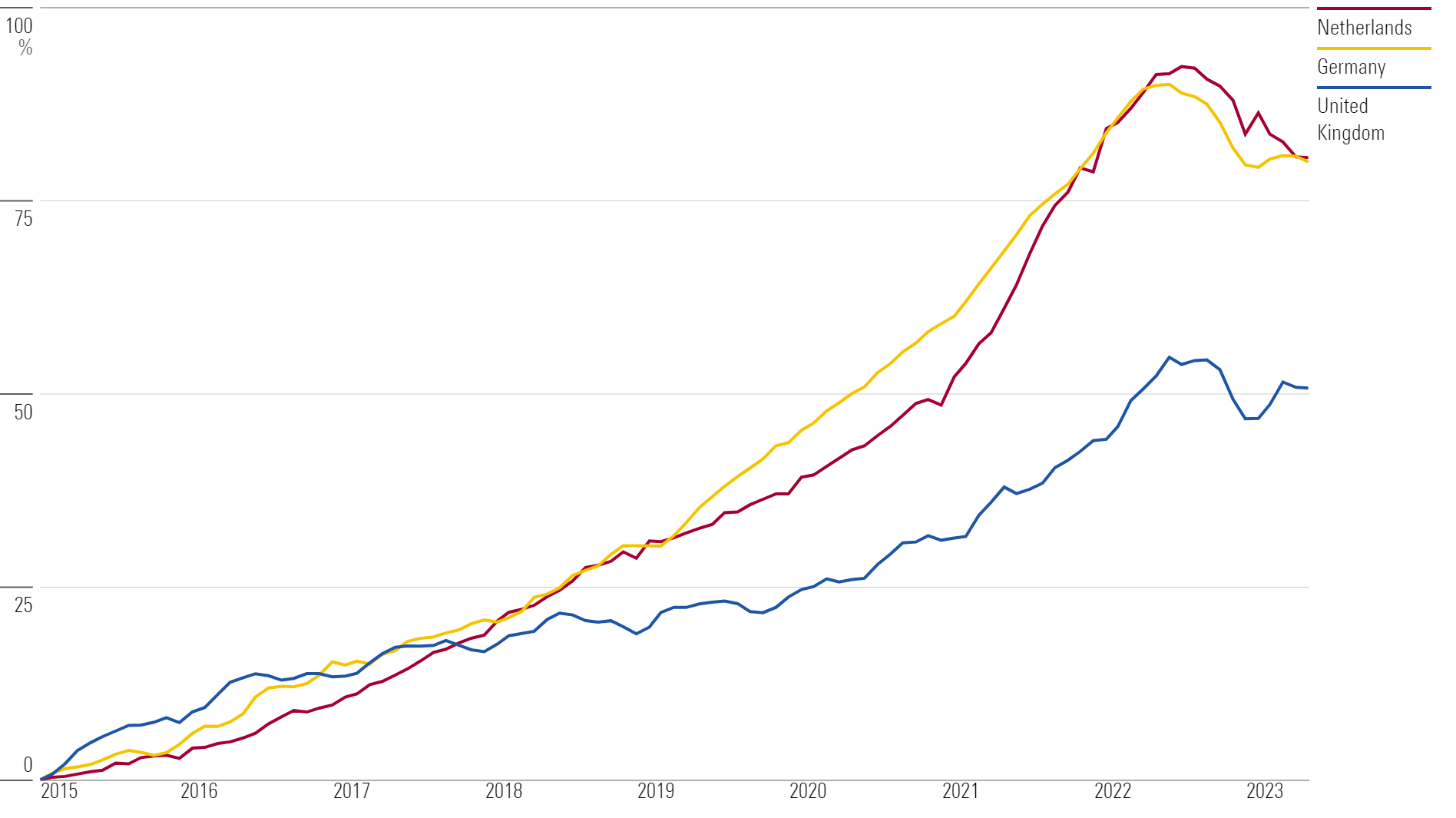

House prices in the U.S. have largely held up over the last year despite rising interest rates. In Europe, the price declines have been felt more sharply, heaping pressure on homebuilding stocks, some of which have more than halved in the last year. The good news is that interest-rate rises should soon be coming to an end, while input costs (namely housebuilding materials) are coming down from their recent highs. This should alleviate pressure on European homebuilders and allow their share prices to correct.

Housing Prices Are Cooling

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-03-2024/t_8ba91080cb4d43acae9d9119875abede_name_file_960x540_1600_v4_.jpg)