Q4 Stock Market Outlook: Equities Undervalued After Retreat

The pullback provides a chance to readjust allocations and take advantage of new undervalued opportunities.

The Fourth-Quarter 2023 Stock Market Outlook’s Key Takeaways

- Following the pullback, the U.S. stock market is trading at an attractive discount to our fair value.

- Growth stocks have fallen enough to move to market weight from underweight.

- Real estate overtakes communication services as the most undervalued sector.

- Utilities have been hit too hard this year and have now dropped to undervalued from overvalued.

- Interest rates higher for longer? Not in our view.

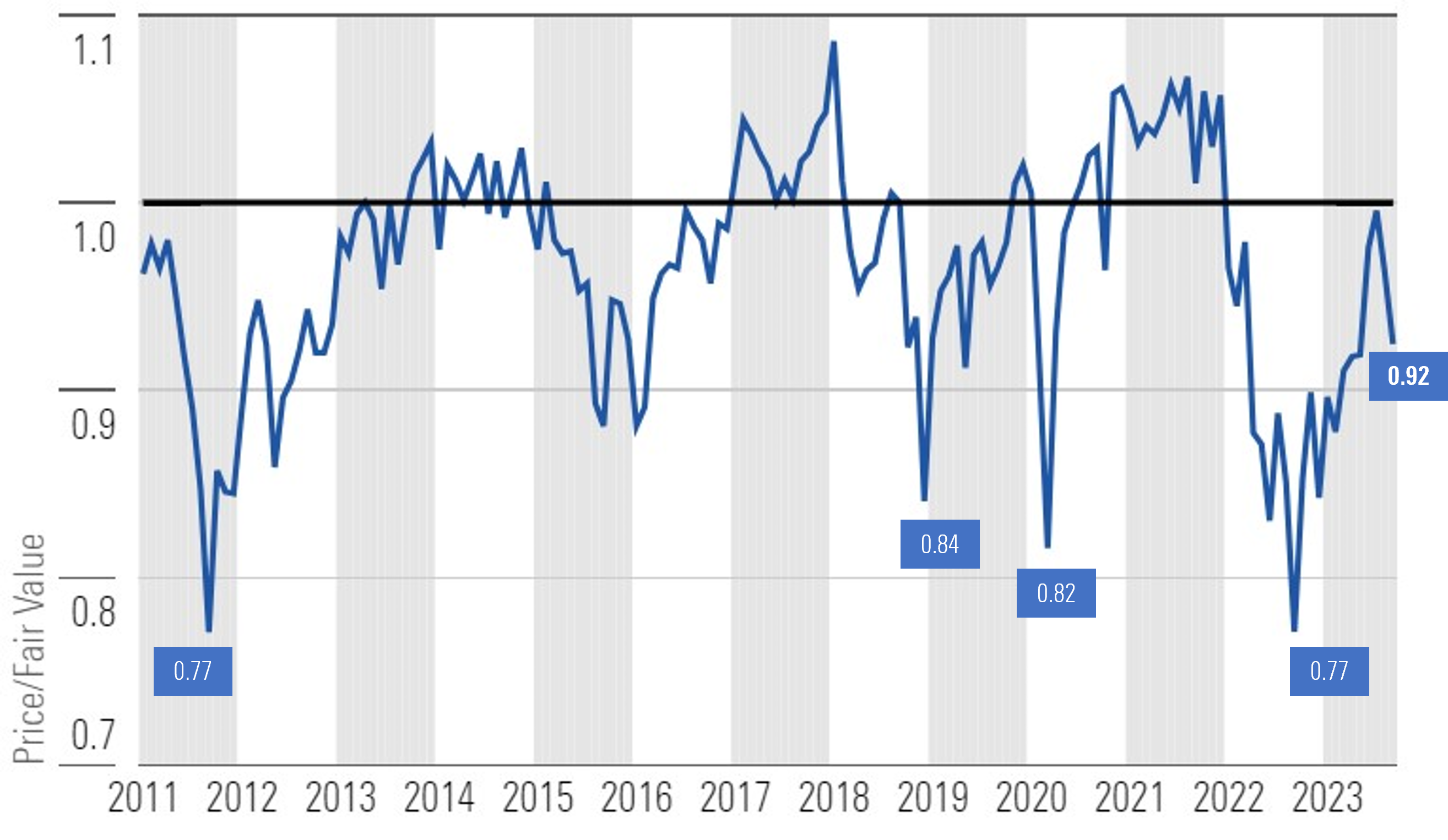

In our August 2023 Market Outlook, we noted that the stock market had traded up enough to reach our fair value estimate. We also opined that it was a good time to lock in profits and sell those stocks that had become overvalued and overextended. Between July 31 and Sept. 25, the Morningstar US Market Index dropped approximately 6%. Between the market pullback and raising our fair value estimates on a handful of stocks, the market is now back to trading at an attractive discount.

According to a composite of the more than 700 U.S.-exchange-traded stocks that we cover, as of Sept. 25, the U.S. equity market was trading at a price/fair value ratio of 0.92, representing an 8% discount to our fair value estimate.

Month-End Price/Fair Value of Morningstar's U.S. Equity Research Coverage

How to Take Advantage of This Pullback

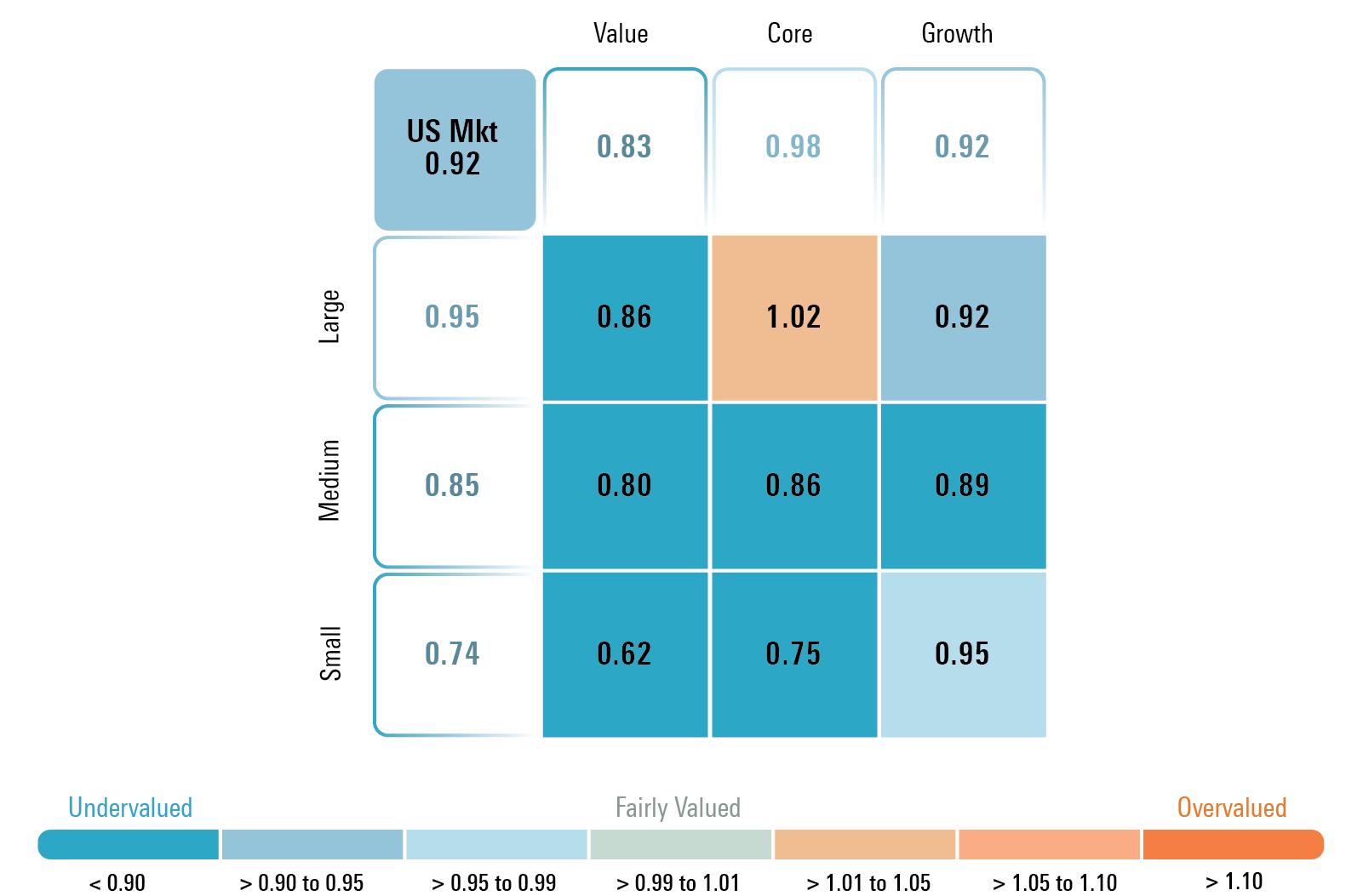

In the wake of this pullback, we see several opportunities for investors to adjust their portfolios. Although we continue to advocate for an overweight position in the value category and an underweight position in core, the growth category has dropped enough that it is now trading in line with the broad market discount. We think now would be a good time to move back to a market-weight position from the underweight position we previously advocated in July.

For active investors, adjusting exposure by category this year has been busy. At the beginning of the year, we advocated for a barbell-shaped portfolio consisting of overweight positions in the value and growth categories and an underweight in core. As growth rallied, we moved to a market weight in May and an underweight in July.

Price/Fair Value by Morningstar Style Box Category

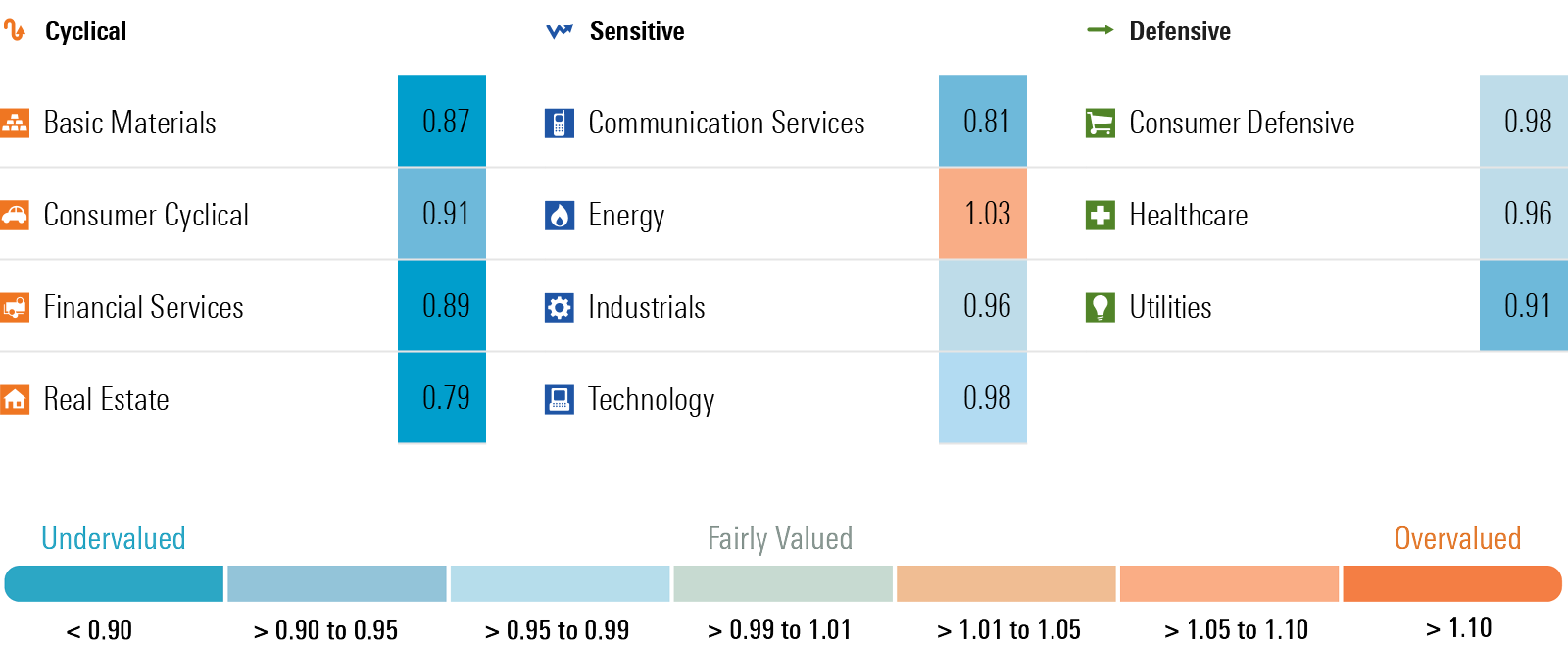

Notable Changes in Sector Valuations and Outlooks

Technology

Last quarter, we moved to an underweight position in the technology sector as it was trading at a 7% premium to fair value. The pullback across tech stocks in conjunction with raising the fair value estimate on Nvidia NVDA has brought the sector’s price/fair value down to 0.98. As such, now is a good time to move back to a market-weight position.

While the excitement surrounding the potential for artificial intelligence has boosted those stocks directly tied to AI, we think some of the more attractive undervalued opportunities are those that are derivative plays on AI. For example, most companies do not have the expertise or resources to build and maintain their own AI platforms. That’s where an IT consulting company comes in with its technical capabilities in AI services; Cognizant Technologies CTSH, which has a Morningstar Rating of 4 stars, is one such company. Another example is 4-star-rated Snowflake SNOW, a data-management provider that hosts the enterprise data on which AI models are run.

Communication Services

Coming into this year, communication services was by far the most undervalued sector. The Morningstar US Communication Services Index rose 3% in the third quarter through Sept. 25 and almost 39% thus far this year, yet at a price/fair value of 0.81, it still remains one of the more undervalued sectors. The bulk of this performance was driven by gains in Alphabet GOOGL and Meta Platforms META and bolstered by 4-star rated cable companies Comcast CMCSA and Charter Communications CHTR. We continue to see significant value among the traditional communications names. For example, AT&T T and Verizon VZ are both rated 5 stars, trade at 35% and 40% discounts to fair value, respectively, and pay a dividend yield north of 7%. Looking forward, we are starting to see signs that the wireless industry will operate like an oligopoly and will not compete as much on price, leading to higher operating margins.

Real Estate

The title for the most undervalued sector now belongs to real estate at a price/fair value of 0.79. Rising interest rates have been playing havoc in this space, and commercial real estate, especially urban office space, has been under intense investor scrutiny. Valuations for office space have been declining as employees show a continued preference to work from home, with average urban office occupancy levels stabilizing at only 50%. While office valuations may remain under pressure, we see value for investors in other real estate assets. Examples include retail mall owners such as Macerich MAC, healthcare REIT Ventas VTR, cell-tower operator American Tower AMT, and triple-net lease provider Realty Income O.

Utilities

Utilities stocks are some of the most highly correlated with changes in interest rates, and this year has been no exception. While the utilities sector was one of the most overvalued sectors coming into 2023, it has now dropped over 8% this year and is now trading in line with the average broad market discount. We think the market is overreacting to the increase in long-term rates this year and have seen a sharp increase in the number of stocks in this sector entering 4-star territory.

Examples of undervalued utilities stocks include 5-star-rated Entergy ETR, which offers one of the most attractive combinations of yield, growth, and value in the sector with a 4.6% dividend yield and our 7.0% annual earnings growth outlook. Another example is 5-star NiSource NI, which, in our view, has one of the longest runways of growth in the sector. NiSource’s transition from fossil fuels to clean energy in the Midwest supports at least a decade of growth potential.

Energy

Surging oil prices have led to a broad rally across the energy sector. However, while the price per barrel of oil surged 27% during the third quarter, the Morningstar US Energy Index only rose 12%. According to our valuations, we think returns were held back as the sector was only trading at a slight discount to fair value coming into the quarter. For the most part, the only values we see in the energy sector are among the pipelines, such as 4-star-rated Equitrans ETRN. However, in the oil exploration and production industry, we think Devon Energy DVN is undervalued as its stock is also rated 4 stars.

Morningstar Price/Fair Value by Sector

For This Rally to Continue It Needs to Broaden

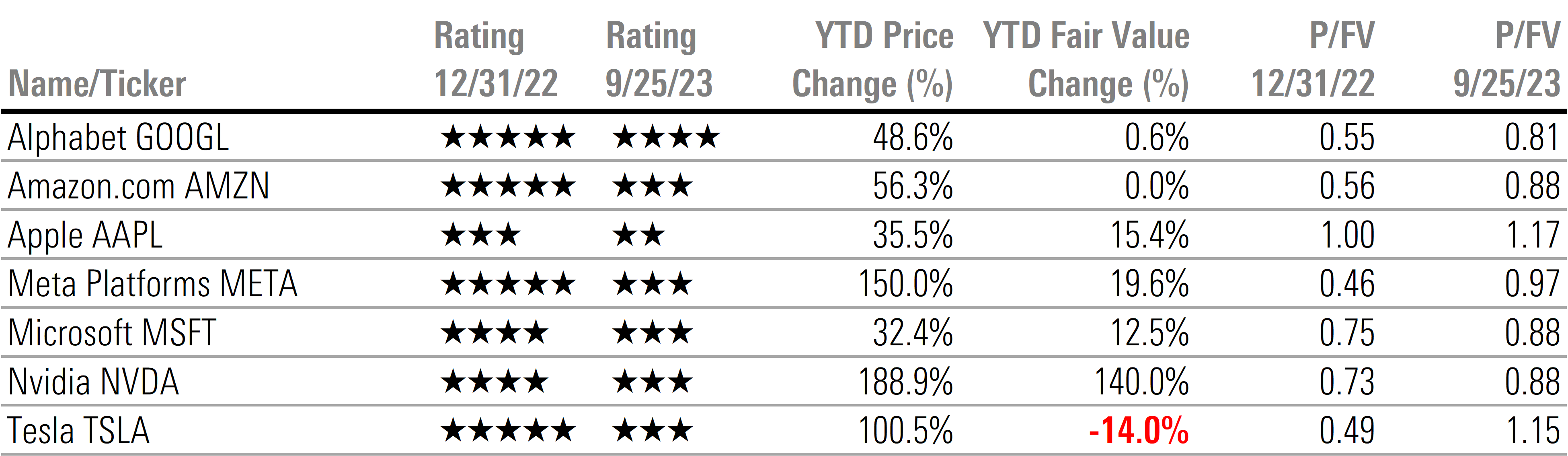

In our June 2023 market outlook, we noted that only a handful of stocks were responsible for the preponderance of the entire market gains. Of the aptly named “magnificent seven,″ six were significantly undervalued and rated 4 or 5 stars at the beginning of the year. However, following immense gains, only Alphabet remains undervalued, four are now fairly valued, and two are overvalued.

Based on our valuations, we think the tailwind that these stocks provided to drive the market higher is behind us. As we noted over the past few months, for the rally to continue, it will need to broaden out into value stocks and down in capitalization into mid- and small-cap stocks.

Magnificent 7: Further Returns From These Stocks May Be Limited

Looking Forward: Higher for Longer? Not in Our View

Stocks took a leg lower following the Federal Reserve’s September meeting. While the Fed left interest rates unchanged, the market interpreted Chair Jerome Powell’s remarks to mean that the Fed intends to keep interest rates higher for longer.

Despite Powell’s hawkish tilt, we see a different path. According to Morningstar’s senior U.S. economist Preston Caldwell, slowing economic growth and falling inflation will lead to sharply lower rates in 2024 and 2025. Additional details are provided in “Fed Signals Higher Rates for Longer, but We Expect Aggressive Cuts in 2024.”

Over the next three quarters, we forecast that the combination of tight monetary policy and declining credit availability will take its toll on the economy. While we do not project a recession, we expect the rate of economic growth will slow sequentially over the next three quarters. The slowing economy will pressure earnings growth, which in turn will test the markets. In our view, investors should look past this potential short-term volatility and, where their risk tolerance allows, use pullbacks to move from market-weight positions back into overweight positions.

Q4 US Stock Market Outlook Webinar

Join me and Morningstar’s senior U.S. economist Preston Caldwell on Wednesday, Oct. 4, at 11 a.m. Central/noon Eastern as we:

- Break down our valuations and identify undervalued opportunities across categories, sectors, and stocks.

- Highlight investable long-term secular growth themes.

- Provide our forecasts for real U.S. gross domestic product, inflation, and interest rates.

- Answer live audience questions.

Register here.

Q4 US Stock Market Outlook - Save the Date

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A7YHHS6HQJB7RJU76FB5C2TXV4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)