Procter & Gamble Earnings Show Resiliency but Stock Overvalued

While the company is withstanding economic and competitive headwinds, investors should wait for a more attractive entry for the stock.

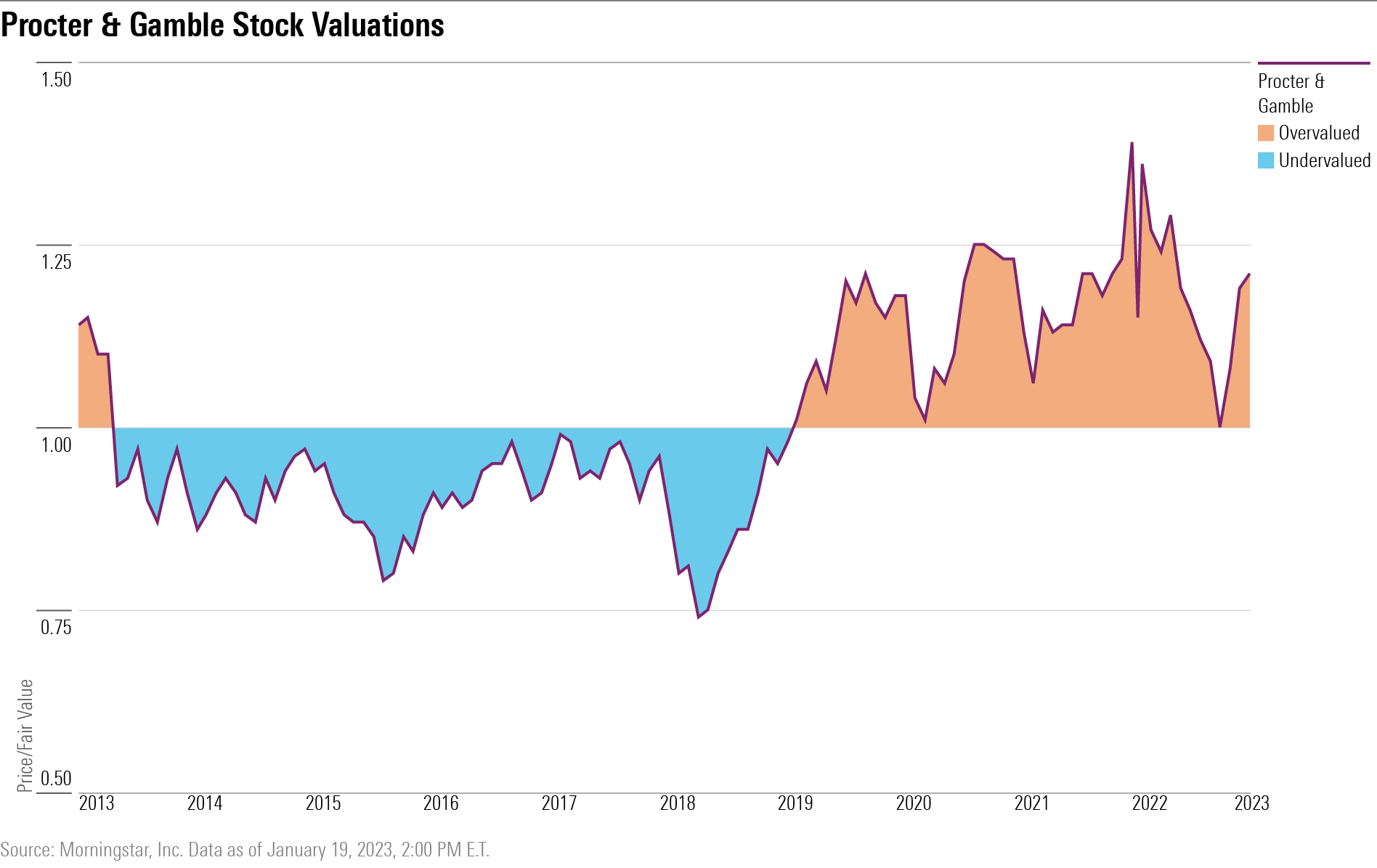

Procter & Gamble’s PG fiscal second-quarter 2023 earnings showed the consumer goods giant is weathering macroeconomic and competitive headwinds well, but the stock is trading above Morningstar’s fair value estimates, meaning investors likely should keep their powder dry.

Results were largely in line with market expectations. Revenue declined about 1% year over year to $20.77 billion, which marginally beat FactSet consensus estimates of $20.75 billion. Earnings per share met expectations of $1.59.

Procter & Gamble Key Earnings Takeaways

- Revenue: $20.77 billion versus Factset’s mean estimates of $20.75 billion.

- Earnings per share: $1.59 versus mean estimates of $1.59.

- Guidance for organic sales growth increased to a range of 4%-5% from 3%-4% on recovery expectations in the Greater China Market.

- Headwinds from unfavorable currency exchange rates and inflation have slightly abated with the firm’s forecast aftertax impact having declined 5%.

“While we believe Procter & Gamble’s [fiscal] second-quarter results—5% organic sales growth and modest degradation in gross and operating margins—suggest it’s withstanding macro and competitive challenges quite well, we are less sanguine on shares at current levels,” writes Erin Lash, Morningstar’s director of equity research, consumer companies.

P&G Stock Looks Expensive

P&G stock slid following the company’s earnings release. But trading around $143, shares remain rich relative to Lash’s current fair value estimate of $125 for P&G stock. The consumer goods company is still one of the more overvalued stocks in the sector, at about a 15% premium compared with the average consumer defensive sector’s 3% discount.

“Shares trade at a 15%-20% premium to our intrinsic valuation, but if a more attractive entry point comes to fruition (likely on economic concerns), we’d be eager buyers,” writes Lash.

P&G Stock Stats:

- Sector: Consumer Defensive

- Industry: Household & Personal Products

- Fair Value Estimate: $125

- PG Stock Morningstar Rating: 2 Stars

- Economic Moat Rating: Wide

- Moat Trend: Stable

Procter & Gamble Fiscal Second-Quarter Earnings Recap

Sales volume declined by 6% during the quarter, accelerating from the 3% decline during its 2023 fiscal first quarter. “However, we don’t believe the headline numbers tell the whole story,” says Lash.

“Half of the volume pullback was reflective of P&G’s decision to ratchet down its Russian business and due to temporary retail inventory reductions (particularly in China) rather than deteriorating consumption trends,” Lash writes in a stock analyst update. After stripping the impact from China and Russia, Andre Schulten, chief financial officer at Procter & Gamble, said in the company’s conference call that the volume decline from changing consumer behavior was about 3%.

Organic sales growth hit 5% and extended the company’s now-18th consecutive quarter record of mid- to high-single-digit growth, according to Lash. Price increases added as much as 10 percentage points to sales growth, and a favorable mix of product sales added another percentage point, she says.

A key concern for the consumer sector has been how long customers would be willing to absorb price increases before switching to cheaper alternatives from private-label competitors, also known as “trading down.” While Lash and her team expect that companies across the sector will continue to raise prices in 2023, P&G’s recent results may indicate that customers are sticking to their products despite them.

“If you look at sequential share, absolute share of a private label, it continues to hover around 16% at three, six, and even 12 months. So there hasn’t been a significant shift in consumer behavior in terms of trade down,” says P&G’s Schulten.

P&G Shows Resiliency

“The resiliency of the business amid such pronounced headwinds thus far has stemmed from actions taken over the past decade, anchored in pruning its mix and extracting inefficiencies to fuel investments in its brands and enhance the agility of its response to consumers’ evolving preferences. And even if the economic landscape deteriorates further, we surmise that P&G should remain unscathed, given its portfolio is weighted in daily use, essential categories that consumers are unlikely to abandon,” says Lash.

Procter & Gamble also raised its outlook for organic sales growth to a range of 4%-5%, from 3%-4% previously, driven by expectations of improvement in the Greater China market, where sales have declined 7% in the last year owing to “COVID lockdowns and weaker consumer confidence.” Still, recovery in the Greater China market is expected to be slow, but the company anticipates that it will return to strong underlying growth rates in the long term.

However, cost pressures from unfavorable currency exchange rates and the rising cost of materials continue to act as a significant headwind. Yet conditions appear to have improved. The company now foresees the impact of combined currency and commodity headwinds totaling $3.7 billion in aftertax costs, which is a decrease from the $3.9 billion estimate provided during PG’s 2023 first fiscal quarter results.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)