July Jobs Report Forecast: Few Signs of a Slowing Economy

Fed seen on hold, even with another solid reading on employment.

Forecasts for the July U.S. jobs report call for yet another month of healthy gains in the labor market, with no signs of a recession. Still, if the report comes in on target, economists see little reason for the Federal Reserve to respond with yet another increase in interest rates from their already-high levels. While job growth is solid, it is down from peak levels, and as long as inflation continues its moderating trend, that should keep the Fed on the sidelines.

“The reality is that the labor market is strong, and that’s a big part of the reason the economy has been so resilient,” says AllianceBernstein chief economist Eric Winograd.

After the June jobs report showed solid increases, economists expect another round of similar gains. Nonfarm payroll employment is expected to increase by 200,000, according to FactSet’s consensus estimates. This follows an increase of 209,000 in June, and it would be down substantially from the 339,000 increase seen in May.

“While the labor market has been strong, there is some evidence that it is gradually starting to decelerate,” Winograd says. “I don’t want to say ‘weakened’ because it isn’t weakening. It is getting strong at a slower pace.”

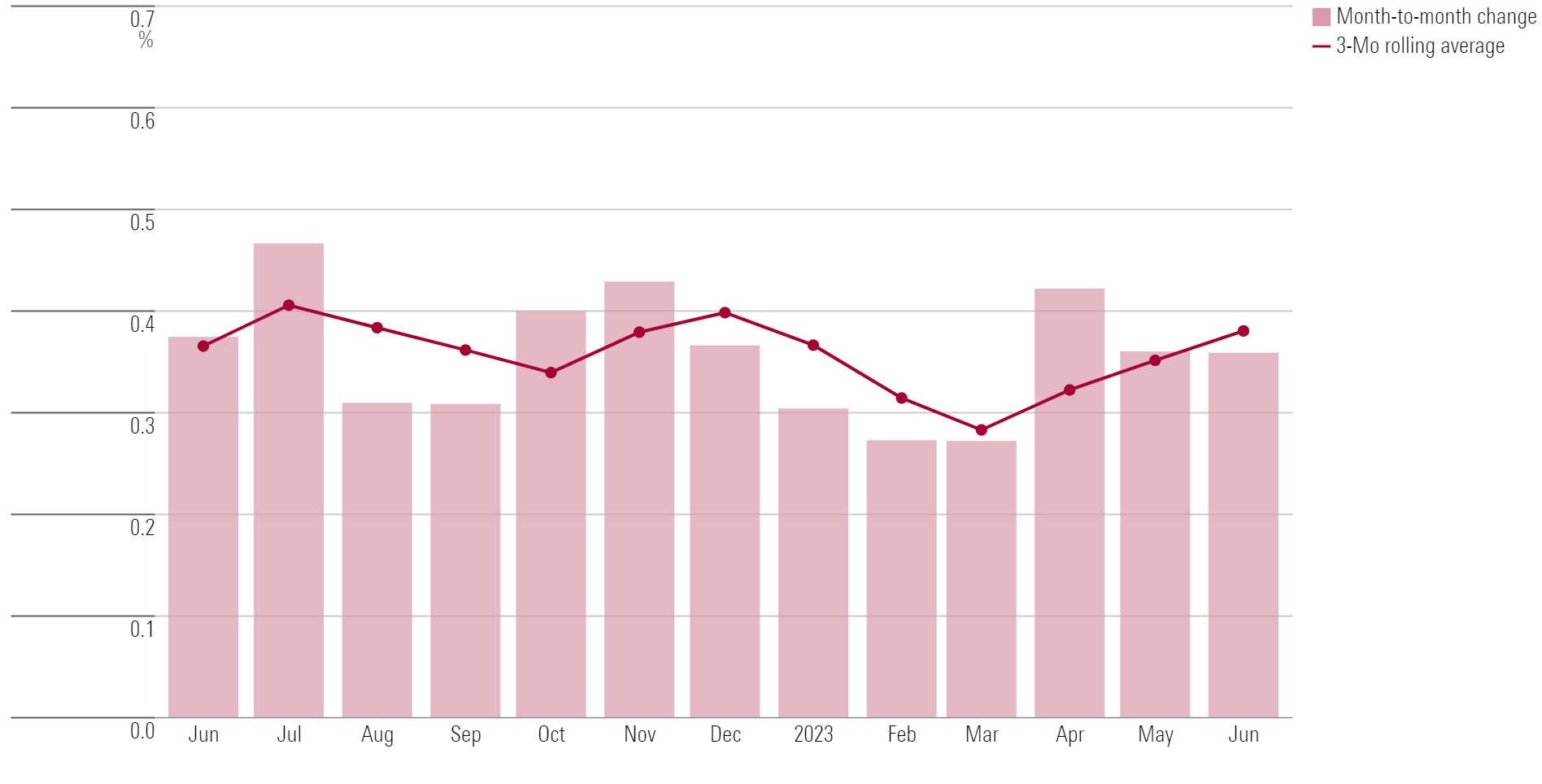

Monthly Wage Growth

July Jobs Report Forecast Consensus

- Nonfarm payroll employment to rise by 200,000 versus the 209,000 increase in June, according to FactSet.

- Unemployment rate to come in at 3.6%, seeing no change from June.

- Hourly earnings to rise 0.3%, slowing from 0.4% in June.

The monthly jobs report is also notoriously volatile, and consensus forecasts are often off by a wide margin. Winograd notes that going back to early 2022, economists have tended to underestimate the pace of job growth: “Forecasters have been too low in14 out of the last 15 months.”

Economists predict the unemployment rate will remain at 3.6%, in line with levels seen since early 2022. Kevin Nicholson, a chief investment officer at RiverFront Investment Group, points to the rate at which employers are filling in vacancies as a factor keeping the unemployment rate steady. “We’re replacing workers at the same level as we are adding more groups, in the sense that you have retirees that roll off payrolls and you have new workers that are added to the payrolls,” he says.

Nicholson also says he will keep a close watch on household employment, which includes people launching their own businesses or taking on side hustles. “They’re not going to get counted in payroll for the nonfarm payroll numbers, and so looking at that household employment is important for us to be able to tell how well is the economy doing and what is the actual strength of the market,” he explains.

On the wages front, hourly earnings are expected to rise 0.3% after increasing 0.4% in June. Morningstar senior U.S. economist Preston Caldwell says that “the picture can vary greatly depending on which wage data you’re using,” but that based on an average of four main measures including average hour earnings, “this shows that nominal wage growth has been slowing since the beginning of 2022.”

Recession Still Further Out

Nicholson also says that being in a strong labor market “allows more time for corporations to be able to adapt to market conditions.” Companies lowering their input costs are still able to price their products high for longer while inflation comes down, which he says will help their profitability.

“As long as people are employed and they’re spending, that’s going to help those corporations and is going to help earnings,” Nicholson adds. “That’s going to have a knock-on effect and push a recession further out.”

Unemployment Rate

Despite Strong Jobs Market, Fed Seen on Hold

“If the labor market is too strong and the Fed has to raise rates much more, that could cause a recession, but I think we’re a long way from that outcome,” Winograd says.

Winograd adds that one aspect of the Fed’s rate-hike effort is its goal to bring better balance between the number of job openings and the number of Americans entering the workforce. “If the labor market does rebalance (or continues to rebalance) as they expect, then they probably won’t have to raise rates any further,” Winograd says.

For now, the general expectation in the bond market is that the Fed will hold interest rates steady at its Sept. 19-20 meeting. According to the CME FedWatch Tool, which tracks traders’ bets on the direction of interest rates, there is an 80.5% chance the Fed will leave rates unchanged.

The Fed raised the federal-funds rate by 25 basis points during its Federal Open Market Committee meeting on July 26, bringing its target rate to a range of 5.25%-5.50%.

“The strong labor market gives the Fed cover to continue to raise rates and normalize rates,” Nicholson says. “We are a nation of consumers, and as long as employment is strong, people are going to spend. That’s going to put upward pressure on inflation that will cause the Fed to have to either have an additional hike or at the very least keep rates higher for longer.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)