Where Are the Growth Opportunities in AI Investing?

Investing in artificial intelligence brings risk, but there will be winners.

Artificial intelligence, or AI, has become far more sophisticated in recent years, creating both disruption and opportunity. We seek to support investors in their understanding of this space.

AI is largely expected to change the way business is conducted, especially with the progression in generative AI. The pace of change is remarkable, with investors naturally eager to understand the winners and losers. While we’d warn investors not to let hype dominate their investment decisions, we are seeing a tremendous shift in the makeup of equity markets, which is worthy of note for all investor types.

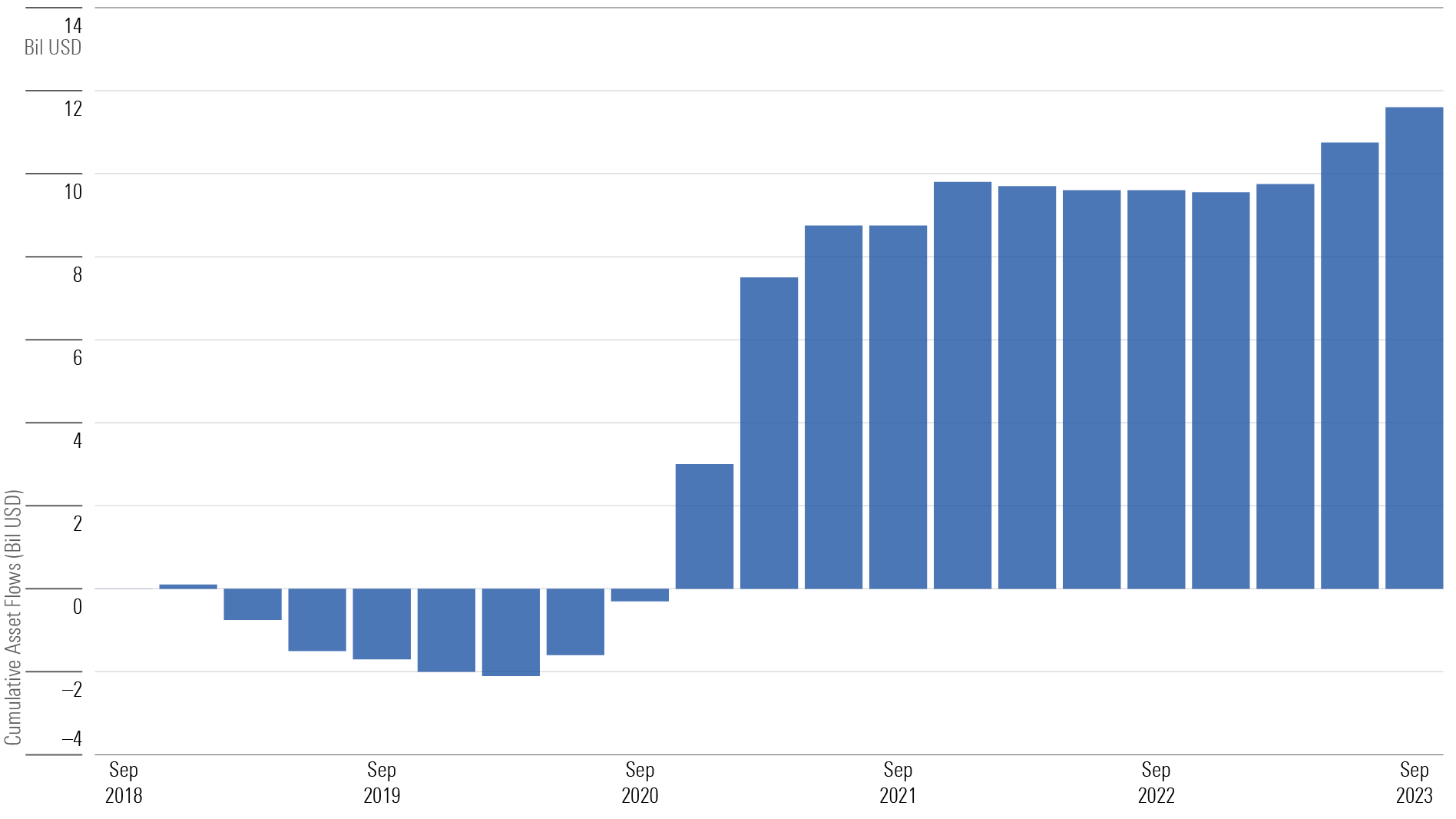

Cumulative Flows Into AI and Big Data Thematic Funds Globally Over the Past Five Years

The What, How, Who, and Why of AI

By now, the majority of people have seen the power of AI firsthand. We expect 2024 to be a year of phenomenal change in this space, with rife competition and practically every company in the world seeking to understand opportunities for automation or growth.

- What does AI solve? We see two streams that are additive to company performance. The first is automation, creating efficiencies in the back office and process improvements. The second is product and service enhancement, potentially creating new revenue growth opportunities.

- How do we expect it to be used? Anecdotally, back-office efficiency is the primary motive for most large companies at this stage. However, we expect generative AI and predictive analytics to play a greater role across practically every business function and industry.

- Who will be using it? With only a small dose of imagination, we can quickly identify use cases for over 90% of the workforce in developed markets and many emerging markets.

- Why is everyone chasing this theme? This technology offers a significant opportunity to expand profit margins at little cost. There is a race for market share.

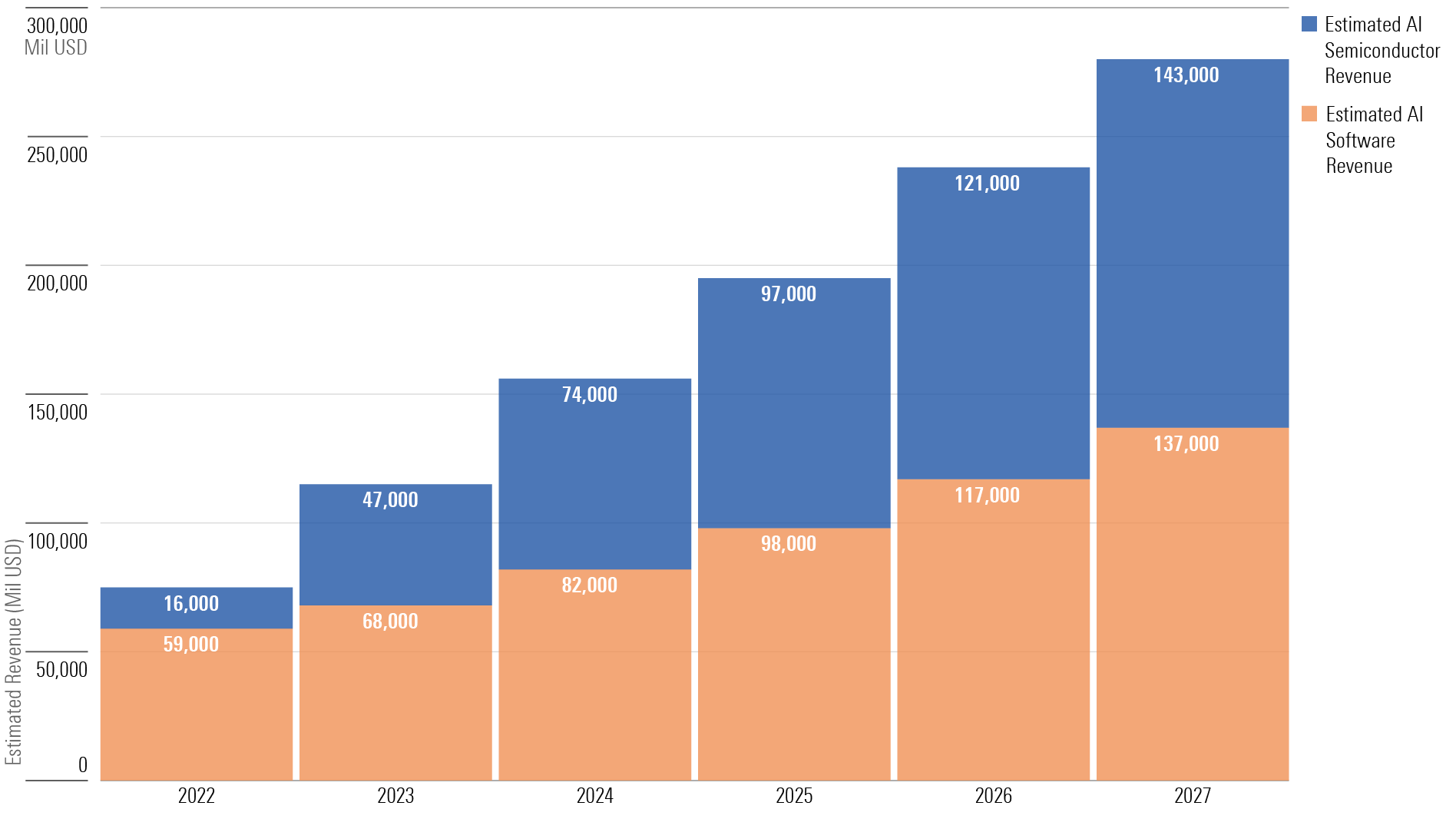

Between AI Semiconductors and Software, a Long Growth Runway Lies Ahead

The major players in the AI space are already household names. Share prices have run up quickly in anticipation of success, and many AI-focused companies now carry lofty valuations. They have a first-mover advantage, although they are still subject to risk.

The Top 10 Stocks Held in Artificial Intelligence and Big Data ETFs and Mutual Funds Globally

| Name | Ticker | Sector | Economic Moat |

|---|---|---|---|

| Nvidia | NVDA | Technology | Wide |

| Microsoft | MSFT | Technology | Wide |

| Alphabet | GOOGL | Communication Services | Wide |

| Amazon.com | AMZN | Consumer Cyclical | Wide |

| Advanced Micro Devices | AMD | Technology | Narrow |

| Tesla | TSLA | Consumer Cyclical | Narrow |

| ServiceNow | NOW | Technology | Wide |

| Meta Platforms | META | Communication Services | Wide |

| Taiwan Semiconductor Manufacturing | TSM | Technology | Wide |

| Snowflake | SNOW | Technology | None |

Source: Morningstar Global Thematic Database. Economic moat data as of Oct. 31, 2023. For illustrative purposes only. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities Exchange Act) to purchase or sell that specific investment.

Be Aware of the Risks in AI Stocks

Regarding investment risks, AI does bring some new challenges to the table.

- Regulation and safety. Let’s start with the risk of artificial intelligence itself. The technological capabilities are under immense scrutiny from governments and regulators. While it is widely acknowledged as a force for good, it also creates significant threats. We do expect regulation, although this will be regional, and big policy changes are likely to come in 2025.

- Valuation. Even fast-growing businesses can be poor investments if investors overpay for shares. It’s also important to keep in mind that the largest portion of a growth company’s value is derived from cash flows generated many years in the future. Companies that develop durable competitive advantages are more likely to sustain long-term free cash flow growth and could warrant richer valuations. However, this is a very expensive race with significant uncertainty about who the future winners and losers will be. A lot has to go right for the primary AI stocks to continue to deliver, which could happen, but the risk/reward trade-off can deteriorate if investors overpay.

- Concentration. As with any emerging technology trend, AI brings new uncertainties to companies and industries. As investors, we should acknowledge this higher level of uncertainty when considering position sizes.

- Obsolescence. It’s far too early to confidently identify companies that will see their products and services become less relevant because of AI. Still, AI will likely bring change to many industries, and we should remain alert to potential shifts in a firm’s industry structure. We’re equally skeptical of company managers who downplay AI risks as we are those who overhype AI benefits.

- Hidden portfolio risks. Even well-informed investors have limited insight into the distant future. We shouldn’t assume because a company seems insulated from AI risks today that it will remain protected in five years’ time. Further, investing heavily in AI-related companies can also bring significant portfolio tilts that could adversely alter the reward/risk trade-off in a total portfolio context.

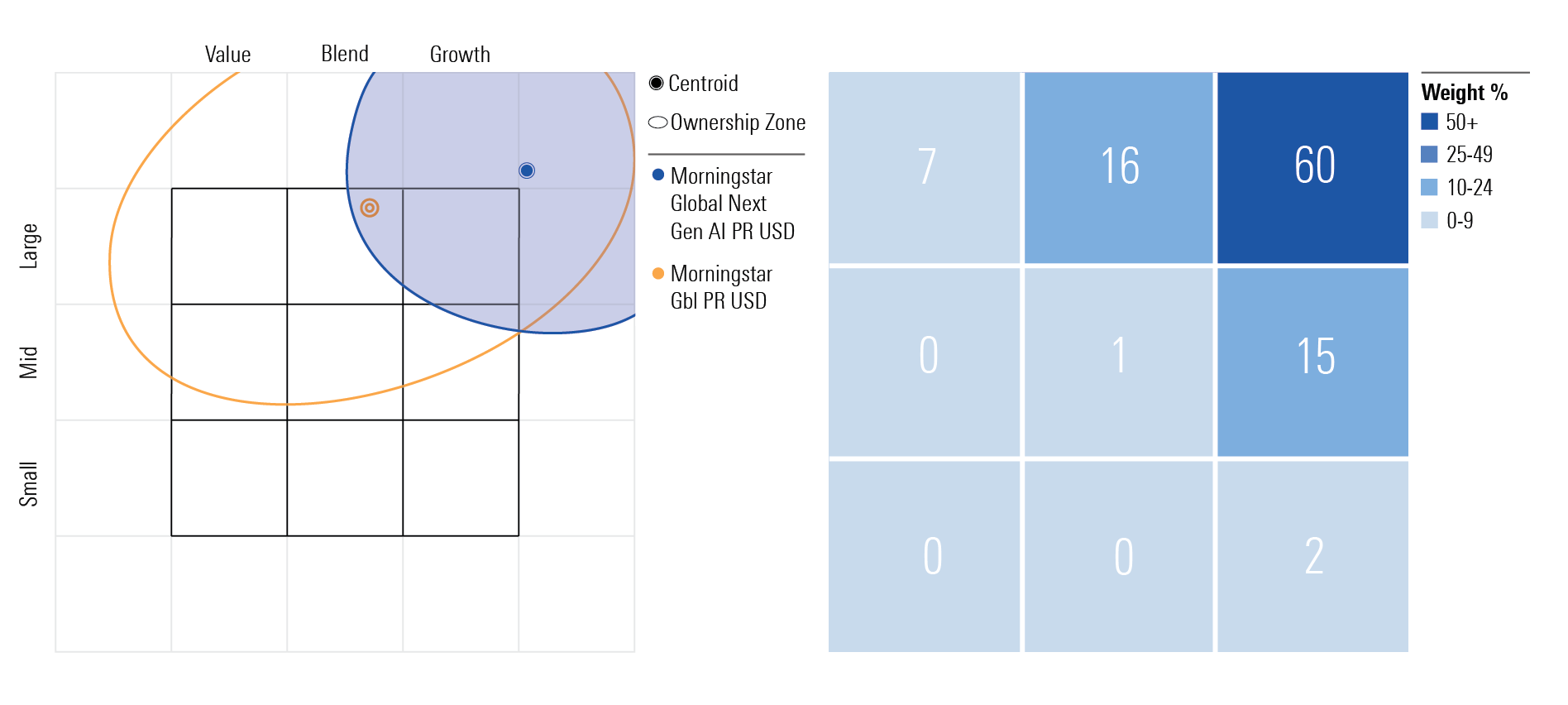

Know What You’re Buying: At a Portfolio Level, Beware of Significant Style Biases

The AI Opportunity Entering 2024: Second-Derivative Plays

While the excitement surrounding the potential for artificial intelligence has boosted those stocks directly tied to AI, we think some of the more attractive undervalued opportunities are those that are second-derivative plays on AI.

Here are four examples that we’d describe as second-derivative plays:

- Most companies do not have the expertise or financial wherewithal to build and maintain their own AI platforms. That’s where an IT consulting company such as Cognizant Technology Solutions CTSH comes in with its technical capabilities in artificial intelligence services.

- Another example is Snowflake SNOW, a data management provider that hosts enterprise data on which artificial intelligence models are run.

- AI requires extremely high speeds to train its data models and we expect Arista Networks ANET to have proficiency at the highest networking speeds to allow it to reap the benefits of spending brought on by investments in generative AI. While we continue to see Nvidia’s NVDA InfiniBand technology being bundled with its graphics processing unit sales for communication between GPUs in the near term, we also see AI builds prompting network refreshes and new demand for Arista’s Ethernet switches for the “front-end” part of the network that links AI clusters with the rest of the network.

- Data centers will likely experience a long tailwind from the explosion of growth in AI. As AI is built, trained, and rolled out, it will require a great deal of computing power and data storage. As such companies such as Digital Realty DLR stand to benefit by hosting these needs.

A Focus on Economic Moats Could Be a Sensible Approach

During periods when product development is in overdrive, it is a dangerous game to chase the winners. A more sensible approach would be to focus on durable competitive advantages.

Companies with economic moats could be more likely to benefit and may be less susceptible to disruption from AI than those without moats. Moats based on a combination of customer switching costs, unique datasets, and brands could be particularly valuable. Companies with durable advantages could use AI to improve their products and services and strengthen their competitive positions. On the other hand, change brought about by AI could erode companies’ economic moats or shift consumer demand away from their products and services. Investors should be on the lookout for permanent changes in industry structures and customer preferences.

In the end, stronger management teams that allocate capital effectively could influence better investment outcomes. Effectively integrating AI into existing products and services will be a complex endeavor for managers. Navigating new competitive threats will require sound strategy and solid execution. Moreover, managers may be tempted to overspend on AI-related product development or pursue ill-advised acquisitions. Consider investing in businesses whose managers have a track record of sensible capital allocation and effective execution.

Actions for Fund Selectors Who Want AI Exposure

Investors may also use funds as a tool to gain exposure to the artificial intelligence theme. These have multiplied in number, and now investors can choose from a veritable smorgasbord of options.

A look back at the commercialization of technologies in the past shows that picking the eventual winners can be anything but straightforward.

In 2007, the year the iPhone was launched, Nokia NOK sold almost 40% of the world’s mobile phone handsets. It is equally as likely that some of the biggest winners in AI will not be those that the markets have crowned today. Or said another way—if you own a thematic fund, rather than a single stock, you are less likely to entirely miss the biggest winners.

For thematic funds, the fundamental fund characteristics that boost the chances of achieving long-term investment success, such as low fees, a seasoned management team, and a trusted parent organization, still apply equally and should form the foundation of any evaluation. That said, the distinctive characteristics of thematic funds mean a more tailored approach to due diligence is required.

One manager may build a high-conviction portfolio of stocks selected for their high-growth potential, while another may track the same theme by building a broader portfolio of stocks based on their exposure to a theme and integrating other investment metrics such as quality screens into the portfolio construction process, which will result in a strikingly different exposure.

Looking beyond a name to really understand how a fund targets its theme is even more crucial when it comes to AI. By glancing at a fund name, it may not be straightforward to determine if the fund manager uses artificial intelligence to select stocks or if they are selecting stocks exposed to AI (or on the occasion where they do both).

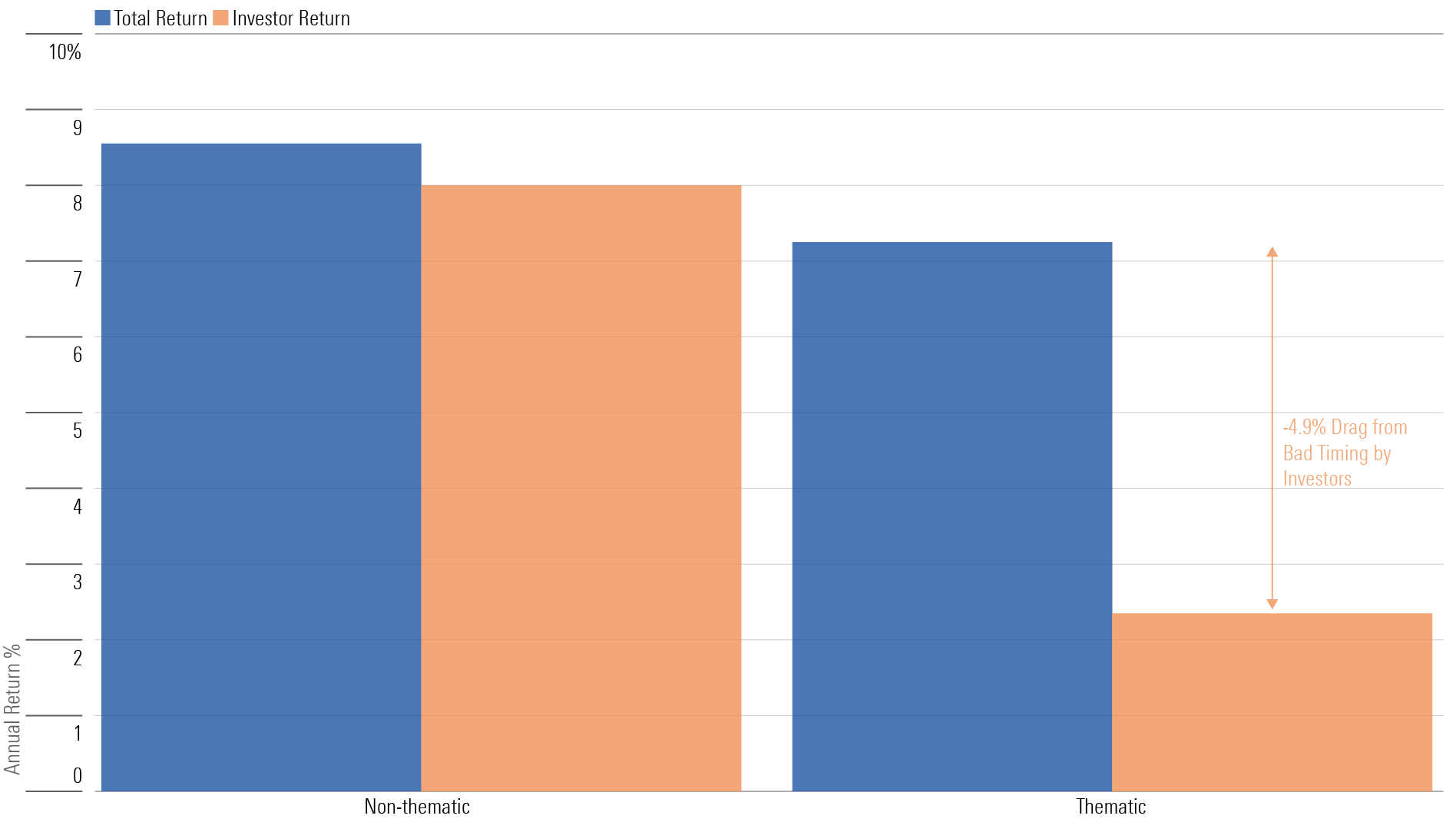

The volatile return profiles of many thematic funds, coupled with low- or no-commission trading and the intraday trading capabilities of thematic ETFs, can encourage the worst type of investor behavior and potentially result in poor investment outcomes.

Findings in our recent study, The Big Shortfall, show that on aggregate, poor investor buying and selling habits connected with thematic funds over the past five years have destroyed most of the returns provided by thematic funds. It goes to show, you can pick the right theme and right fund, but if you use them in the wrong way, you can still end up empty-handed.

Investors Have a Bad Track Record of Timing the Entry and Exit of Thematic Funds

The Bottom Line

Artificial intelligence is an exciting theme, and we expect a lot of market interest in 2024. One effective way to access the AI theme without paying huge valuation premiums is via second-derivative plays. These are not the chipmakers or those that offer technology interfaces, but rather, those who can effectively embed AI into their workflow and drive new revenue growth opportunities. The principles of good investing still apply.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/s3.amazonaws.com/arc-authors/morningstar/93a178f7-9fba-48fa-b146-9b56e127ae6c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/93a178f7-9fba-48fa-b146-9b56e127ae6c.jpg)