Can 2023′s Blockbuster Stock Market Rally Continue?

What could send the market higher—and what could drag it back down.

After a blistering rally to close out 2023, the first trading days of 2024 brought trouble. The Morningstar US Market Index fell 2.3% during the first week of January, and Treasury yields ticked up as investors began to digest the possibility that Federal Reserve rate cuts might not come as soon as they expect.

This time last year, market watchers were sounding the alarm about runaway inflation, restrictive interest rates, and a weary consumer, all of which pointed to an imminent and painful recession.

What a surprise, then, when the economy remained healthy and financial markets thrived alongside it. The US Market Index returned more than 26% for the year as megacap tech stocks soared, the Fed appeared to win its fight against inflation, and rate cuts became a serious possibility.

Could the same factors that sent stocks soaring in 2023 continue to power a rally in 2024? December’s jobs report came in stronger than economists expected, signaling that the central bank is one step closer to bringing down inflation without damaging the labor market. Of course, a labor market that’s too hot could have the opposite result for investors and force the Fed to keep rates higher for longer.

Here’s what could send the market higher in the months ahead—and what could drag it back down.

Inflation

“High inflation was a real challenge in 2021, 2022, and a little bit in early 2023,” says John Bellows, a portfolio manager at Western Asset Management. But now inflation has fallen off the 40-year highs it notched in the summer of 2022 and is hovering close to the Fed’s target.

If inflation stays low and stable this year, Bellows says, “it’s certainly a tailwind” for the market. With price growth under control, credit conditions can ease and investors can enjoy more flexibility when constructing their portfolios. On the other hand, a retrenchment in inflation could have the opposite effect.

Investors will be looking for more progress when the government releases price data for December on Jan. 11.

CPI vs. Core CPI

The Fed and Interest Rates

Friends or foes? That’s always the question with financial markets and the Fed.

In the middle of 2023, the central bank’s “higher for longer” messaging on interest rates put investors on the defensive. After four rate hikes over the year (in addition to the seven in 2022), stocks fell and bond yields soared. High rates make it more expensive for companies to do just about everything, and that tends to weigh on the prices of financial assets like stocks and bonds.

As inflation fell, the market changed its tune and began to look toward cuts. As of Jan. 5, bond futures markets were pricing in roughly six rate cuts over 2024, with investors expecting the first in March. That would bring the Fed’s target rate range down to 3.75%-4.00% by the end of the year.

Expectations for December 2024 Federal Reserve Meeting

But the bond market is notoriously overzealous with its predictions, and there’s always a chance that the Fed won’t deliver cuts as fast as investors expect them. Rates that remain historically high could prove a headwind for markets, according to Bellows, who points to disruptions we’re already seeing in the housing market, the manufacturing sector, and the credit market.

The Health of the Economy

Throughout 2023, Fed officials repeatedly emphasized that their decisions on monetary policy would be “data dependent.” They assured the markets that they would work with the state of the economy rather than a predetermined course of action.

That was ultimately good for investors, as the economy defied expectations in 2023. As rates rose and inflation fell, consumers kept spending and the job market didn’t falter—signs of a highly anticipated soft landing for the economy.

The outlook now is a little murkier, however. Most forecasters expect only a mild economic slowdown this year, not a recession. An economy that slows just enough could usher in rate cuts when investors expect them, boosting markets. But an economy that slows too fast could point to a recession and trigger rate cuts for the wrong reasons. An economy that heats up again could prompt the Fed to leave rates higher for longer. Both of the latter two outcomes could pressure stocks and bonds.

The Fed’s task is to determine how high rates are affecting the economy and whether they’re slowing growth too much, according to Adam Hetts, global head of multi-asset investing for Janus Henderson Investors. High rates could damage corporate profitability, which creates a cycle of stress that ultimately leads right back to the Fed. Less-profitable companies will “pay less and employ fewer people, and that’s going to hurt the consumer,” Hetts explained. That hurts companies even more, “and that’s when the Fed would have to start cutting rates.”

It’s a difficult needle to thread, even more so because it’s not yet clear whether there are still lagged effects from 18 months of policy tightening that have yet to appear.

For the Trading Week Ended Jan. 5

- The Morningstar US Market Index fell 1.72%.

- The best-performing sectors were healthcare, up 1.74%, and utilities, up 1.66%.

- The worst-performing sector was technology, down 4.19%.

- Yields on 10-year U.S. Treasury notes rose to 4.05% from 3.88%.

- West Texas Intermediate crude prices rose 2.78% to $73.89 per barrel.

- Of the 844 U.S.-listed companies covered by Morningstar, 576, or 68%, were up, two were unchanged, and 266, or 32%, were down.

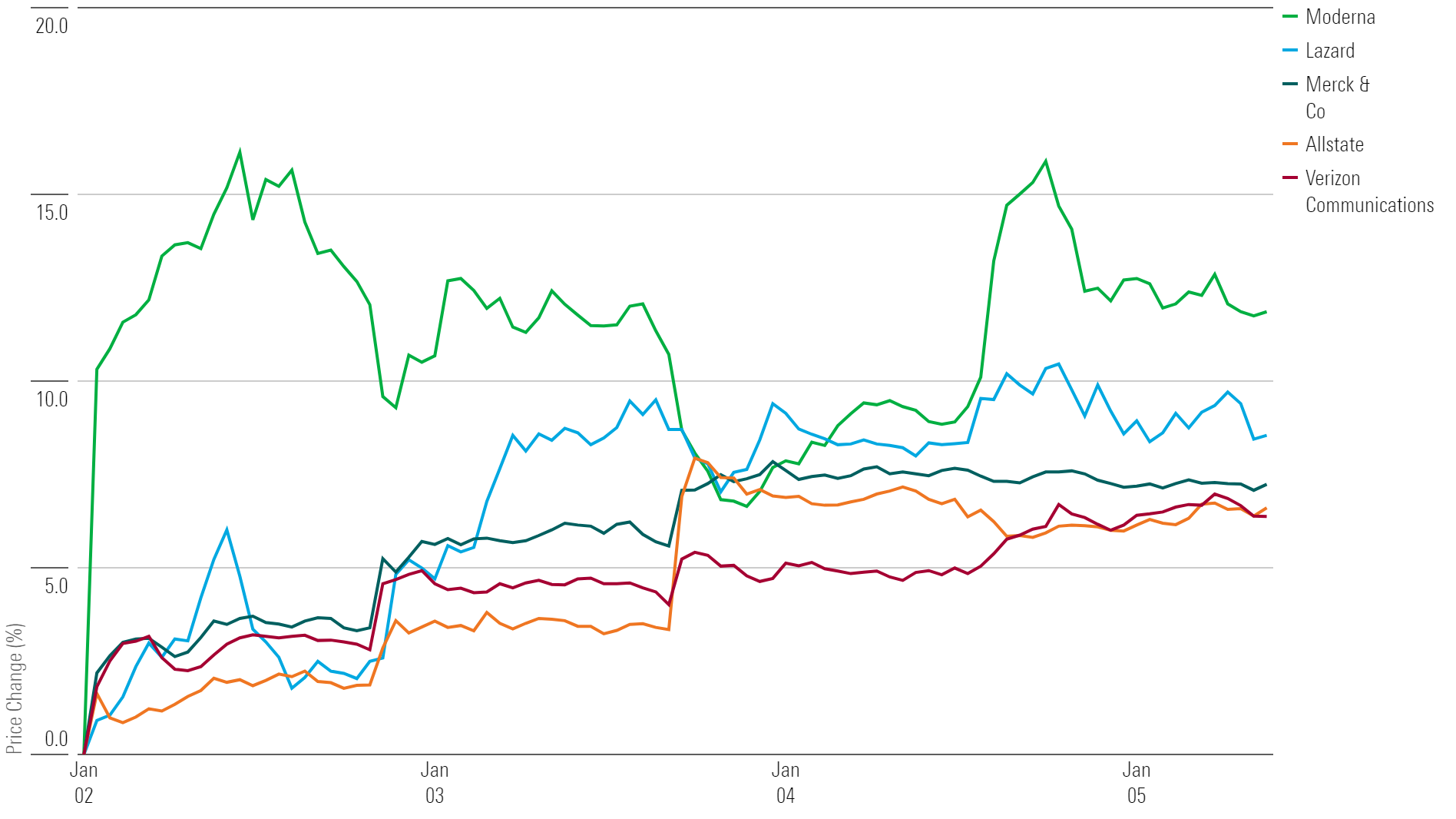

What Stocks Are Up?

Moderna MRNA, Lazard LAZ, Merck MRK, Allstate ALL, and Verizon Communications VZ.

Week's Top Winners

What Stocks Are Down?

SunPower SPWR, Sunrun RUN, SoFi Technologies SOFI, GDS Holdings GDS, and SolarEdge Technologies SEDG.

Week's Top Losers

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/N7VBPGEKIZDBPEAHLKIWYNRLBE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)