August Jobs Report: Fed Likely to Pause Rate Hikes As Hiring Frenzy Cools

While job growth is slowing, a continued solid pace means Fed rate cuts still off on the horizon.

August brought another strong month of job gains in the U.S. economy, but the overall jobs growth trend is slowing.

“Today’s report shows a job market that is steadily cooling off, albeit not at a pace that would shock the Fed into cutting interest rates,” says Preston Caldwell, chief U.S. economist at Morningstar.

The U.S. economy added 187,000 jobs in August, according to the latest report from the Bureau of Labor Statistics. This was in line with FactSet’s consensus estimate for an increase of 170,000. This followed a revised 157,000 gain in July.

The unemployment rate rose to 3.8% in August from 3.5% in July.

August Jobs Report Key Stats

- Total nonfarm payrolls climbed by 187,000 versus a revised 157,000 in July.

- The unemployment rate jumped to 3.8% from 3.5% in July.

- Average hourly wages rose by 0.2% to $33.82 after rising 0.4% in July.

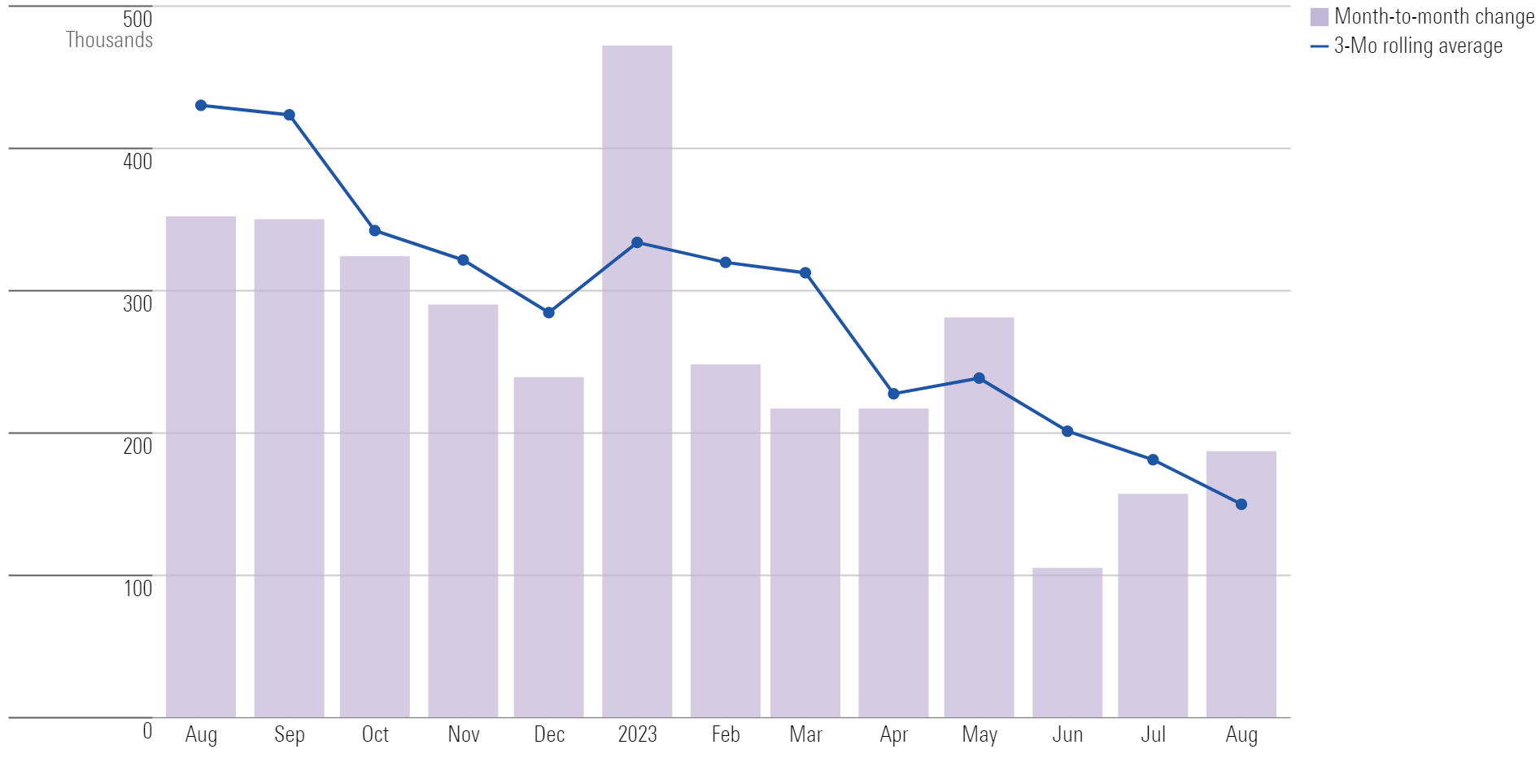

Job Growth Slows

“Nonfarm payroll employment continues to trend down,” Caldwell says. “Despite the acceleration in August versus July, the three-month moving average continues to trend down, owing in part to today’s downward revisions to June and July job gains.” Total nonfarm payroll employment increased by 187,000 in August, less than the average monthly gain of 271,000 over the previous 12 months.

In the past three months, job growth was 1.2% annualized, according to Caldwell, representing a major drop from the 2.4% increase in the first quarter of 2023. “It also stands below the 1.7% average annual growth over 2015-19, which we might use as a benchmark for a ‘normal’ rate of growth,” he says.

Monthly Payroll Change

“Job growth is now comfortably below GDP growth of 2.6% year over year in the second quarter,” Caldwell says. “This means productivity is expanding at a brisk pace, which makes sense, given that the supply chain issues seen since the start of the pandemic are being resolved.”

Unemployment Rate Rises

The unemployment rate rose to 3.8% from 3.5% in July, back above its prepandemic February 2020 rate of 3.5%. The rate remains little changed from its year-ago reading of 3.7%.

“The uptick in the unemployment rate was explained by a large jump in labor force participation,” Caldwell says. The labor force participation rate rose to 62.8% from 62.6% a month ago.

“The household survey, which produces this data, can be very noisy, but it does suggest that expanding labor supply is propelling job gains forward, even as labor demand cools off,” he says. “Falling labor demand is manifest in the downward slide in job openings, with the three-month average dropping to 5.6% in July, down from 6.6% at the start of 2023.”

Unemployment Rate

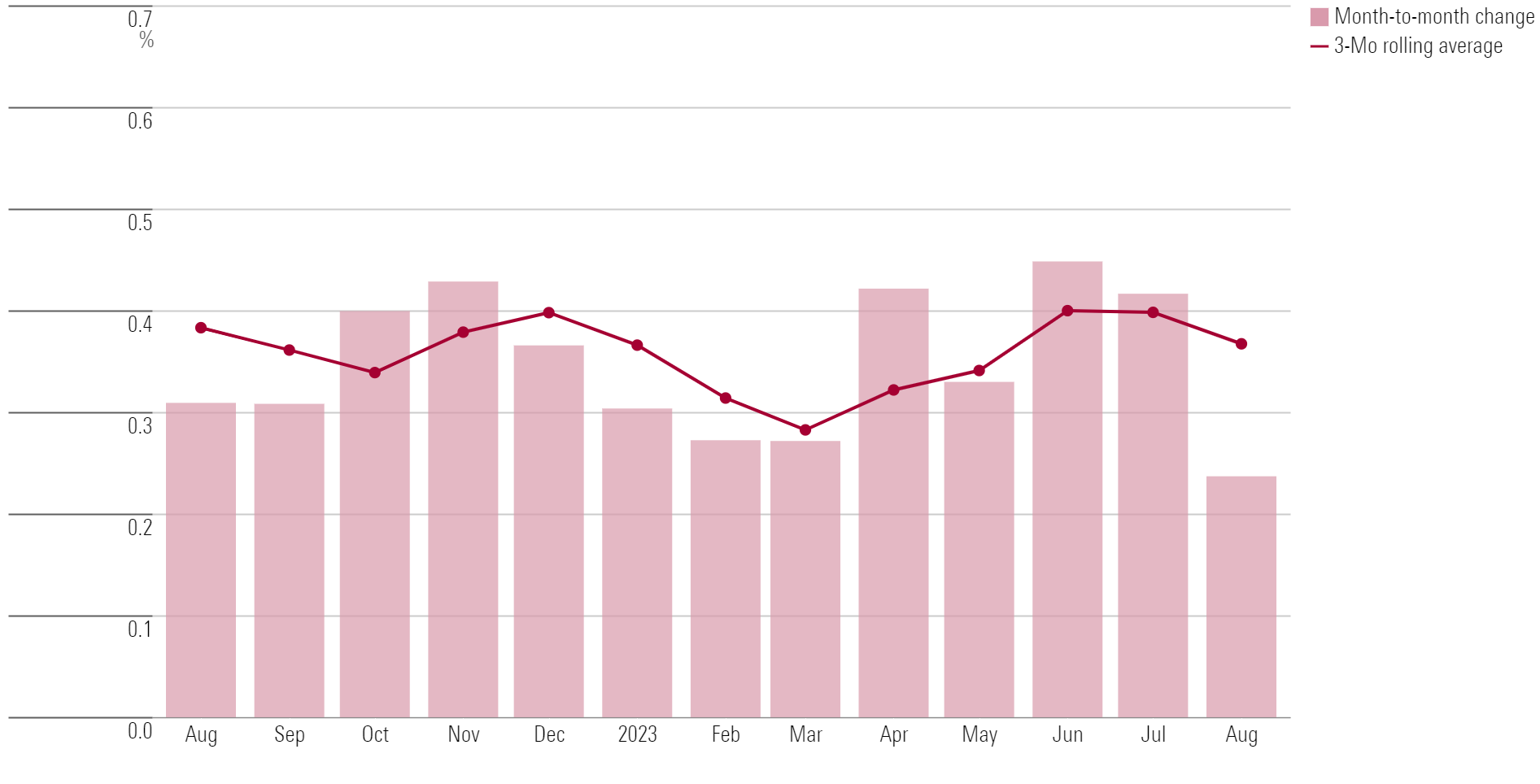

Wage Growth Trending Lower

Growth in average hourly earnings was 4.3% year over year in August, according to Caldwell. This metric has been fairly stable since the start of 2023, but it’s still substantially declined compared to 2022. In August, average hourly wages grew by 8 cents, or 0.2%, to $33.82.

The average workweek for all employees on private nonfarm payrolls increased to 34.4 hours over the month, up from 34.3 in July. For manufacturing employees, the average workweek rose to 40.1 hours in August, and overtime grew to 3.1 hours. For production and nonsupervisory employees, the average workweek edged up to 33.8 hours.

“A broader set of wage growth measures that we track shows an ongoing downtrend, which is consistent with labor demand expanding faster than labor supply,” Caldwell says. He expects job growth to slow meaningfully in 2024.

Monthly Wage Growth

Healthcare and Leisure Sectors Lead Job Gains

“At the industry level, job growth was quite skewed in the past three months,” Caldwell says. Healthcare and leisure grew at a 3.8% annualized rate and accounted for the bulk of the aggregate jobs gains.

“Construction and real estate employment growth has rebounded, likely driven upward by the surge in factory-building activity along with a nascent housing recovery,” he says. “Elsewhere, job growth was weak or negative for the past three months.” Caldwell says the “other services” category—which includes professional services and technology industries—saw a sharp fall in growth.

In August, healthcare added 71,000 jobs, following a similar gain in July. Leisure and hospitality jobs grew by 40,000, continuing the sector’s upward trend. Leisure and hospitality jobs rose by an average of 61,000 per month over the past year.

Construction jobs growth also trended up, in line with the average monthly gain over the past year. Transportation and warehousing jobs fell by 34,000 in August.

Employment by Industry Group

August Jobs Report Unlikely to Affect the Fed’s Interest-Rate Trajectory

“Today’s news won’t have much impact on the Fed’s decision-making,” Caldwell says. “We expect the Fed to refrain from hiking the federal-funds rate at its September meeting.”

He continues: “The excess in labor demand we saw in 2021 and 2022 has worn off. Yet job growth—along with economic activity—has continued at a solid pace despite the Fed’s monetary tightening campaign. We are still far from the conditions which would be needed for the Fed to start cutting interest rates at this stage.” Caldwell says the Fed’s next move depends on what the upcoming consumer price index report indicates for inflation.

In the wake of the report, 93.0% of the bond market expects the Fed to hold rates steady at the current range of 5.25%-5.50%, according to the CME FedWatch Tool, which tracks bets made by traders on the direction of interest rates. Only 7% expect the Fed to increase rates as it did in July.

Further out, a smaller majority of bond market participants (61.5%) expect the Fed to hold rates at current levels through December. Roughly a third expect the target rate to rise to a range of 5.50%-5.75% by the end of the Fed’s Dec. 13 meeting. Just 2.0% foresee the Fed raising rates to a higher range of 5.75%-6.00% by that time, while the remaining 5.4% expect the Fed to cut rates below current levels to a range of 5.00%-5.25%.

Expectations for the Federal Reserve Meeting on Dec. 13, 2023

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)