Arm IPO: A Dominant Chip Designer but at a ‘Very, Very’ Lofty Price

Shares of SoftBank’s Arm Holdings rallies nearly 25% after being priced at $51 per share.

This article has been updated to include the results of the Arm IPO and Arm stock’s first day of trading.

Investors snapped up the initial public offering of one of the most dominant semiconductor chip designers on the planet, but those shares are looking like they didn’t come cheap.

Shares of SoftBank-backed Arm Holdings ARM began trading Thursday and rose sharply from where the IPO was priced. Arm announced Wednesday that it had priced its shares at $51, at the top end of the expected $47-$51 range. That valued the chip designer at more than $54 billion, and made it the largest IPO since electric truckmaker Rivian RIVN debuted in 2021.

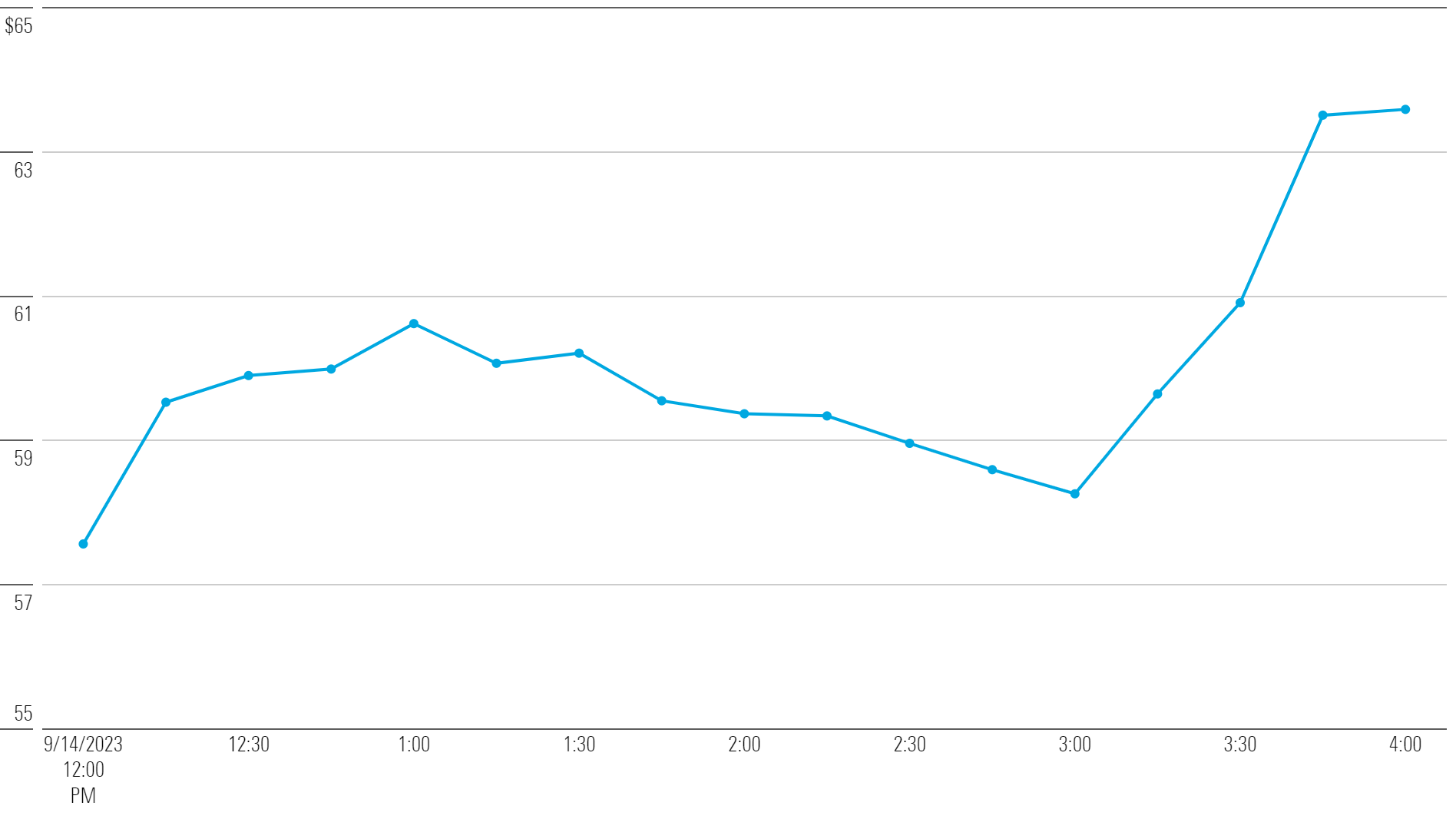

By the end of trading Thursday, Arm stock had risen by nearly 25% from its offering price to close at $63.59.

The U.K.-based company designs software for the computer chips that power cellphones, tablets, wearable technology, and even cars. It then licenses those designs to companies that make and use those chips. The company was taken private by SoftBank in 2016. After the listing, SoftBank will own 90.6% of the company’s shares. A sale to Nvidia NVDA was scrapped in 2022 amid regulatory concerns.

“From a valuation point of view,” says Javier Correonero, an equity analyst at Morningstar, the stock looks “very, very expensive.”

“Everything would have to go beyond perfect for them to be able to justify that $50 billion valuation,” Correonero says.

Arm is also contending with significant geopolitical uncertainty thanks to its operations in China, analysts say.

Arm Holdings Stock Price

Arm’s Dominant Position

The broad adoption of Arm’s technology gives the company “a very solid competitive position,” says Correonero.

According to the company’s own estimates, Arm’s chip architecture was present in 99% of the smartphones in the world in 2022. The company says more than 30 billion Arm chips were shipped in the fiscal year that ended in March 2023, and more than 250 billion chips have been shipped since the company’s inception.

The company’s list of potential investors and users of its technology is a who’s who of tech giants, including Intel INTC, Nvidia, Apple AAPL, Alphabet GOOGL, Samsung, and Advanced Micro Devices AMD, to name a few.

“They’re a technology leader,” says Nick Einhorn, director of research at Renaissance Capital. “They’ve done very well in a lot of use cases, particularly smartphones.”

Arm’s market share is so dominant that they basically “are the market,” Einhorn says, adding that Arm will “certainly” benefit as demand for CPUs continues to expand.

Of course, this also means that it will be difficult for Arm to gain more market share—and much easier to lose it. Analysts say an open-source chip architecture called RISC-V has the potential to cut into Arm’s market share down the road.

Software and Semiconductor Stock Performance

Arm’s IPO Comes With China Exposure Risks

In its registration statement with the Securities and Exchange Commission, Arm highlighted several risks to its business. Chief among these, according to Morningstar’s Correonero, is its exposure to China.

Arm’s operations in China are handled by Arm China, which is now an entirely separate entity from the main company. Nearly a fourth of Arm’s revenue came from Arm China—which Arm does not control—in the 2023 fiscal year. Ongoing geopolitical tensions between the U.S. and China surrounding the distribution of semiconductors could also impact Arm’s operations.

“It’s a strong business, but there’s a decent degree of uncertainty,” Correonero says.

Correonero also points out that weaknesses in financial reporting disclosed in the company’s most recent filing could be an issue down the road.

Arm’s IPO Looking ‘Quite Expensive’ Compared With Competitors

In the most recent fiscal year, Arm generated $2.7 billion in revenue and net income of $524 million, down about 4.5% from net income of $549 million in the previous fiscal year.

Correonero says the firm is growing in the “high single digits,” and while Arm is profitable, it is less so than before it was taken private by SoftBank in 2016. He attributes the decline to a significant uptick in spending on research and development.

With a valuation of over $54 billion, Correonero expects Arm stock to trade at a multiple of about 20 times revenue.

That would make the stock “quite expensive” compared with its competitors, a number of whom are growing more than triple Arm’s rate but trading at multiples closer to 12 or 15 times sales. Nvidia is also trading at a 20-times multiple that’s comparable to Arm’s, but experts expect that company to grow at a rate of about 100% this year. Nvidia also has a much more expansive variety of business operations compared with Arm.

Arm is “not a fast-growth company anymore,” Renaissance Capital’s Einhorn says, and that may affect how excited investors are about the listing and how much they are willing to pay for shares.

That said, the likelihood that Arm will be a relevant company over the next decade-plus is “quite high,” Correonero says, thanks to its strong competitive position, cutting-edge technology, and long-term relationship with its clients.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)