April Jobs Report Shows Strong Hiring—for Now

Signs of slowing labor demand suggest job growth will start to ease.

The April 2023 jobs report showed another month of strong hiring in the U.S. economy, but with employment gains moderating, it may only be a question of time before more of a slowdown is at hand.

For now, however, there were few signs of material softening in the April jobs data. The U.S. economy added 253,000 jobs, well above economists’ forecasts. The unemployment rate edged down to 3.4% from 3.5%, and wage growth showed an uptick.

“While jobs growth figures still look fairly strong for now, this conflicts with other measures showing weakening economic activity,” says Preston Caldwell, chief U.S. economist at Morningstar. “We still expect job growth to fall heavily over the next year.”

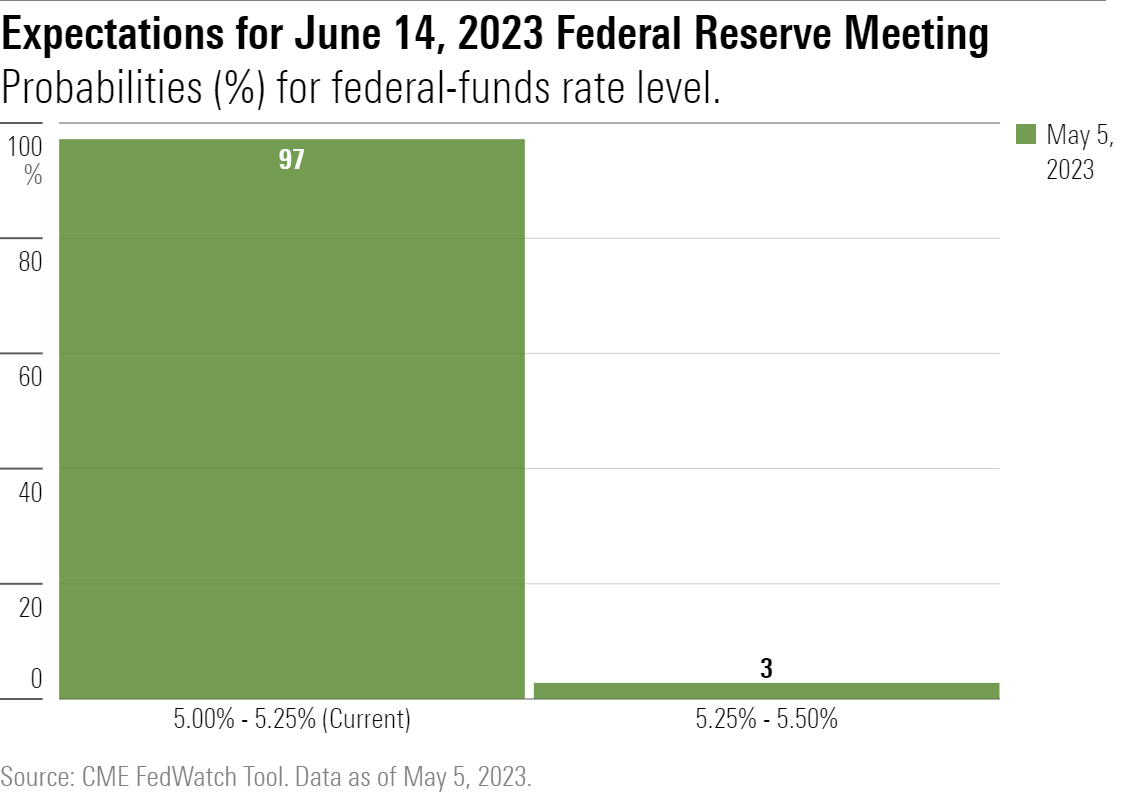

The release of the April jobs report, against a backdrop of continued nervousness about distress in the banking sector and sticky inflation, appears to have done little to change the sense among many in the markets that the Federal Reserve’s interest-rate hikes are now on pause.

The Fed this week raised interest rates at the 10th consecutive meeting, and while Fed Chair Jerome Powell refrained from saying what the next steps would be on monetary policy, his comments were interpreted as suggesting the aggressive series of rate hikes are over.

April Jobs Report Key Stats

- Total nonfarm payrolls rose by 253,000 versus a revised 165,000 in March.

- The unemployment rate ticked down to 3.4% from 3.5% in March.

- Average hourly wages grew by 0.5% to $33.36 after rising 0.3% in March.

- Jobs in leisure and hospitality grew by 31,000. They are still trending upward, though at a slower pace compared with the average of 73,000 jobs per month over the prior six months.

Jobs Growth Still Strong, but Trending Slower

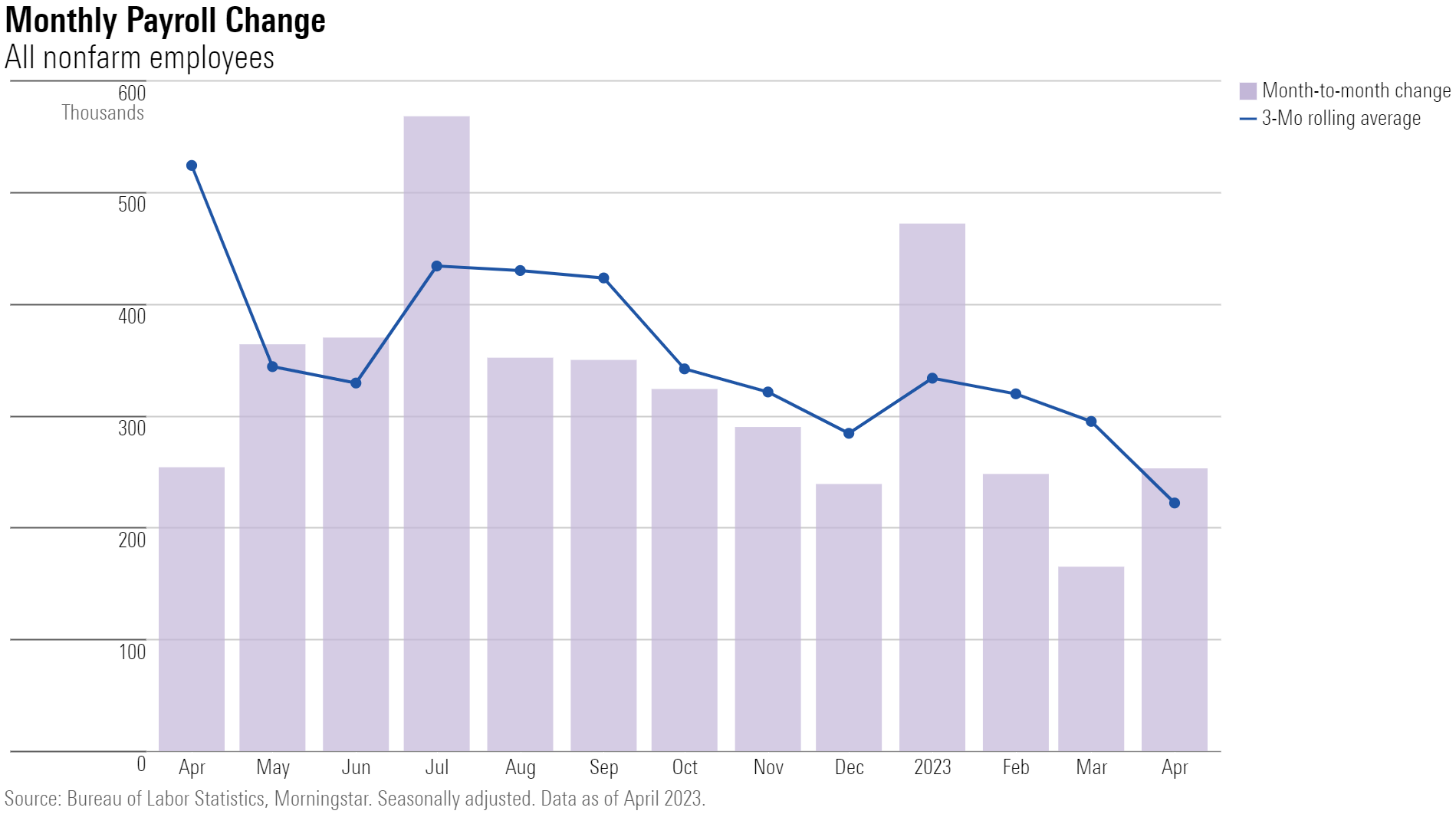

The April jobs report from the Bureau of Labor Statistics showed that total nonfarm payrolls rose by 253,000, which was above economists consensus expectations for an increase of 180,000 and brought the three-month moving average to 222,000.

Revisions to previous month’s payroll increases took the three-month average of job gains through March down to 295,000 new jobs per month from 354,000.

Over the past six months, nonfarm payroll employment has grown by 290,000 per month on average.

“It now looks like job growth is trending down again, albeit at a slower pace than we would’ve expected given the Fed’s aggressive monetary policy tightening,” Caldwell says,

Nonfarm payroll employment has grown at a 1.7% annualized pace in the past three months, the slowest rate since January 2021, according to Caldwell.

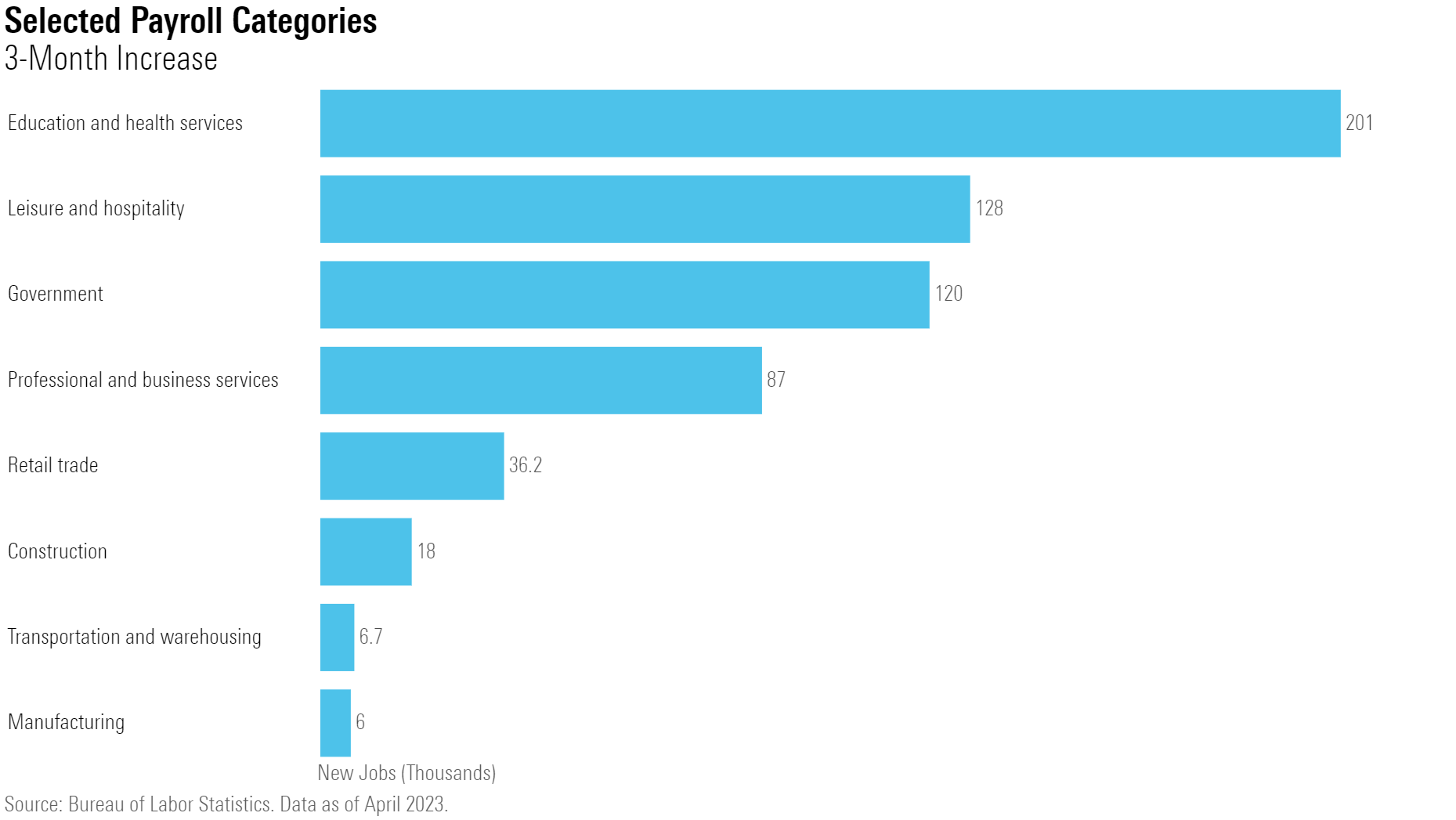

Job gains continued growing in professional and business services, healthcare, leisure and hospitality, and social assistance.

Altogether, nonfarm payrolls had increased 2.9% year over year in the first quarter 2023, significantly exceeding the 1.6% year-over-year increase in real gross domestic product, according to Caldwell.

“If this trend of excess hiring continues, it will cut into employers’ profits,” he says.

Corporate profits data for the first quarter is yet to be released, but the Bureau of Labor Statistics estimates that the labor share of nominal GDP in the business sector increased to 57.2% in the first quarter, roughly in line with an increase of 56.9% in the prior quarter, Caldwell says.

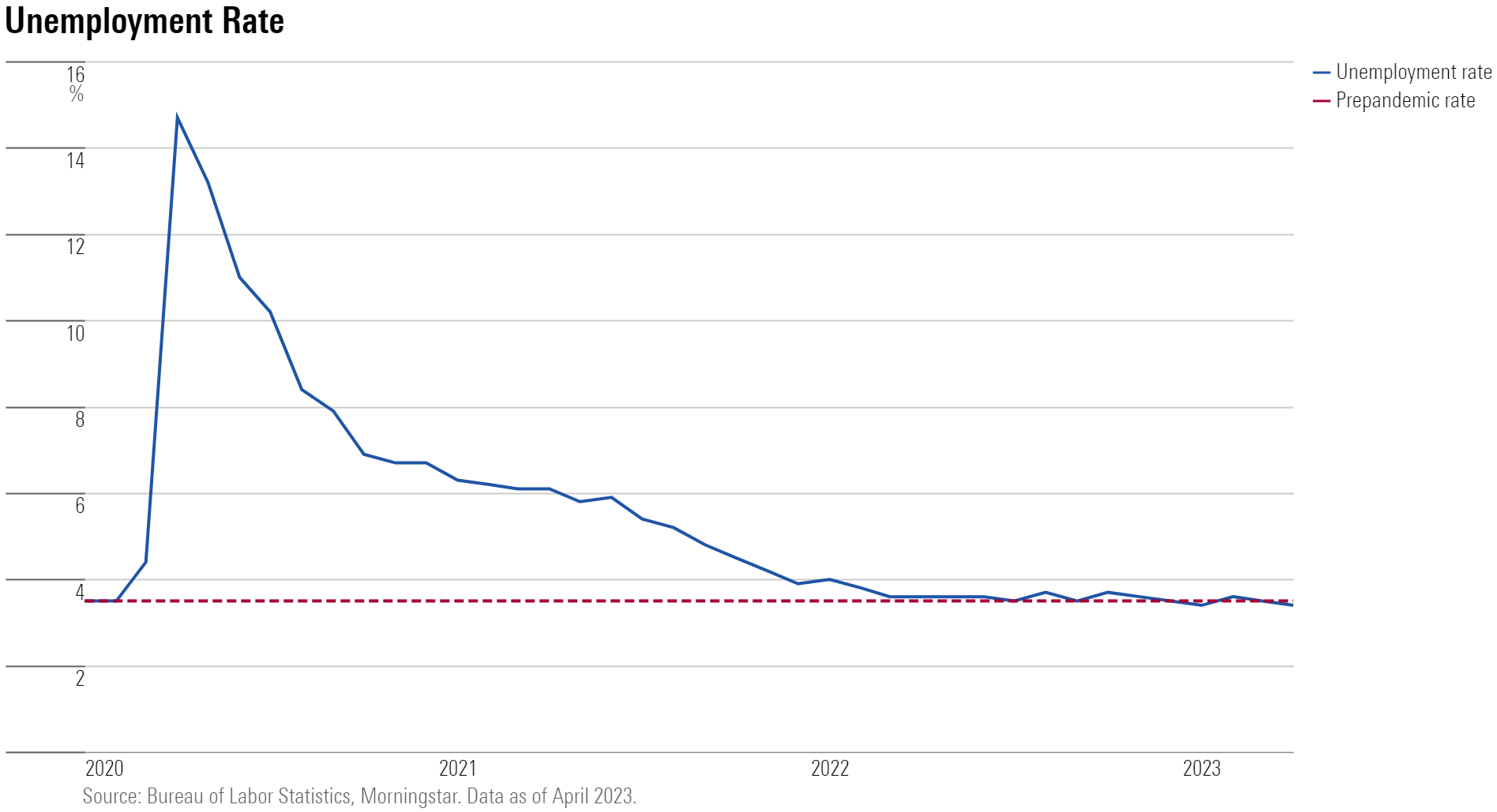

Unemployment Rate

The unemployment rate edged downward in April to 3.4% from 3.5%, dipping back down to its lowest level since 1969. Since March 2022, the unemployment rate has hovered in a narrow band, holding between 3.4% and 3.7%.

Pandemic-Era Jobs Recovery Is Wrapping Up

At the industry level, jobs in healthcare and leisure continue to lead the way, Caldwell says, with a collective 3% annualized growth rate in the past three months. “That growth should subside soon, as the return to normal for consumers is wrapping up.”

The construction and real estate employment category continues to eke out gains, which Caldwell says is also due for a slowdown as housing demand remains weak.

Within the jobs report, healthcare jobs rose by 40,000 in April, compared with an average monthly gain of 47,000 over the prior six months. Employment in leisure and hospitality rose by 31,000 for the month, driven by job gains in food services and drinking places. Employment in the leisure and hospitality industry remains below its prepandemic February 2020 level by 2.4%, or 402,000 jobs.

Labor Demand Slows

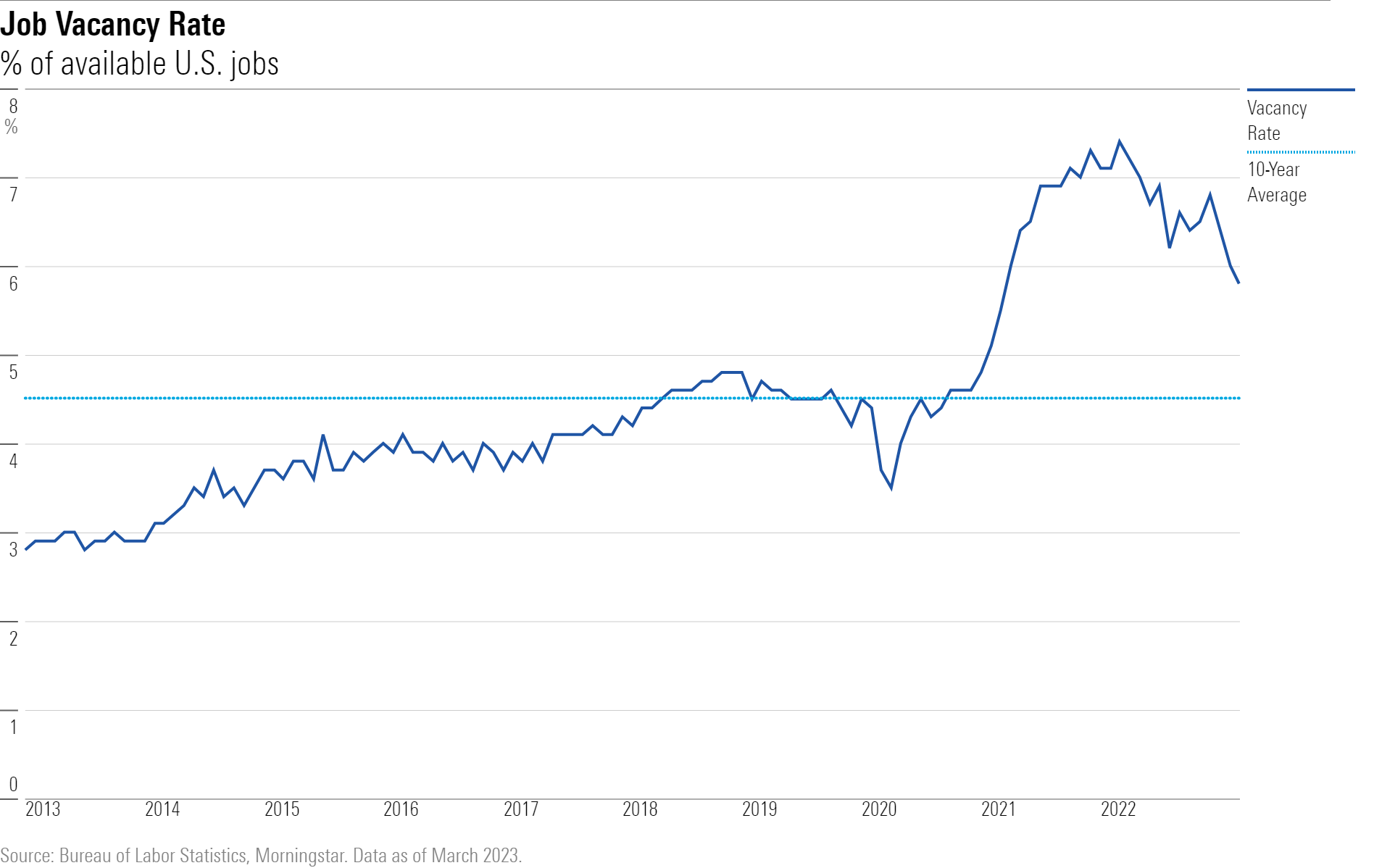

Caldwell says that “it does appear that labor demand is pulling back, but labor supply is expanding to drive continued job gains.”

On the labor demand side, the job openings rate fell to an average 6.1% in the past three months, down from a peak of 7.2% in early 2022 by Caldwell’s measures. “The job quits rate also has fallen to 2.5%, almost back to normal, as a reduction in available jobs is inducing workers to stay put at their current firm.”

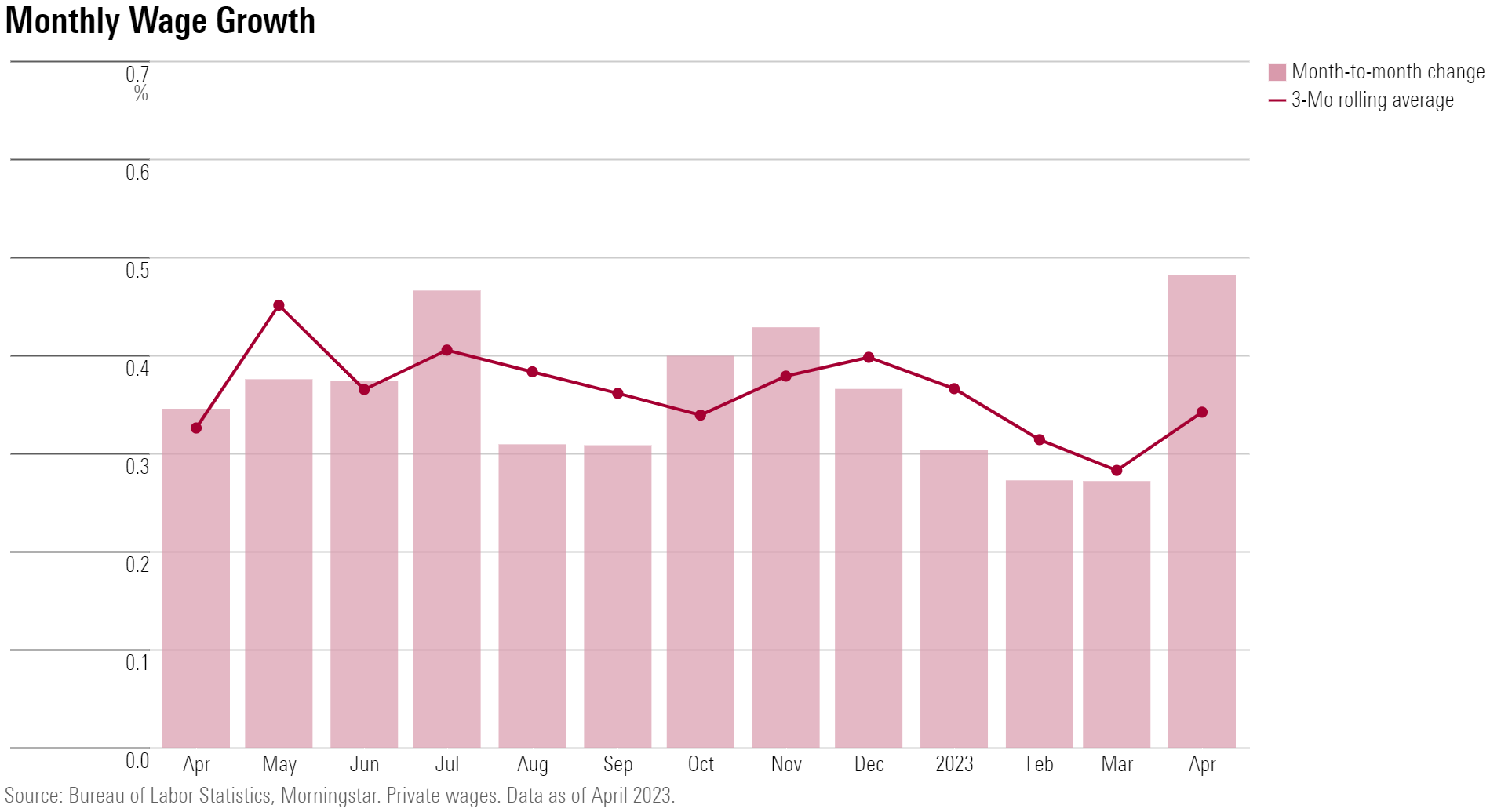

Wage Growth Softens

“Wage growth appears to be moderating, consistent with falling demand and increasing supply for labor,” Caldwell says.

The softening looks particularly clear within the private average hourly earnings figures from the Bureau of Labor Statistics establishment survey, Caldwell says, where growth has averaged 4.2% annualized in the past three months.

In April, average hourly wages rose by $0.16—or 0.5%—to $33.36. Over the past 12 months, average hourly earnings have risen by 4.4%. The average hourly workweek was unchanged in April at 34.4 hours.

“Some measures show continued higher wage growth, but on average, the measures are trending down,” Caldwell says.

April Jobs Report Muddies the Economic Picture

“Our assessment of the economy—and the Fed’s—is being muddied by the dissonance between continued robust job growth yet weakening economic activity,” Caldwell says.

Caldwell notes that the Fed will review two more Consumer Price Index reports and other economic data before its next interest-rate-setting meeting in mid-June, “so today’s jobs report probably won’t play a pivotal role in their decision.”

Markets appeared to react very strongly to the jobs report in early trading, Caldwell says, with the two-year U.S. Treasury yield rising 17 basis points. “That implies that the jobs report is a strong signal of continued growth in economic activity, but we don’t think this is correct, given that employment tends to lag the business cycle during downturns.”

Nearly all of the futures market currently expects that the Fed will pause interest-rate hikes at the June 14 meeting: 97% of participants see the rate holding steady at its current 5.00%-5.25% level, while just 3% of the market expects the Fed to issue another quarter-point hike, according to the CME FedWatch Tool, which would bring the federal-funds rate to a range of 5.25% to 5.50%. A month ago, expectations were much more varied, with 54% of market participants expecting a federal-funds rate of 4.75% to 5.00% by the June meeting.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)