These 5 Funds Were Upgraded in October

Five upgrades, seven downgrades, and four new ratings highlight Morningstar Analyst Rating activity.

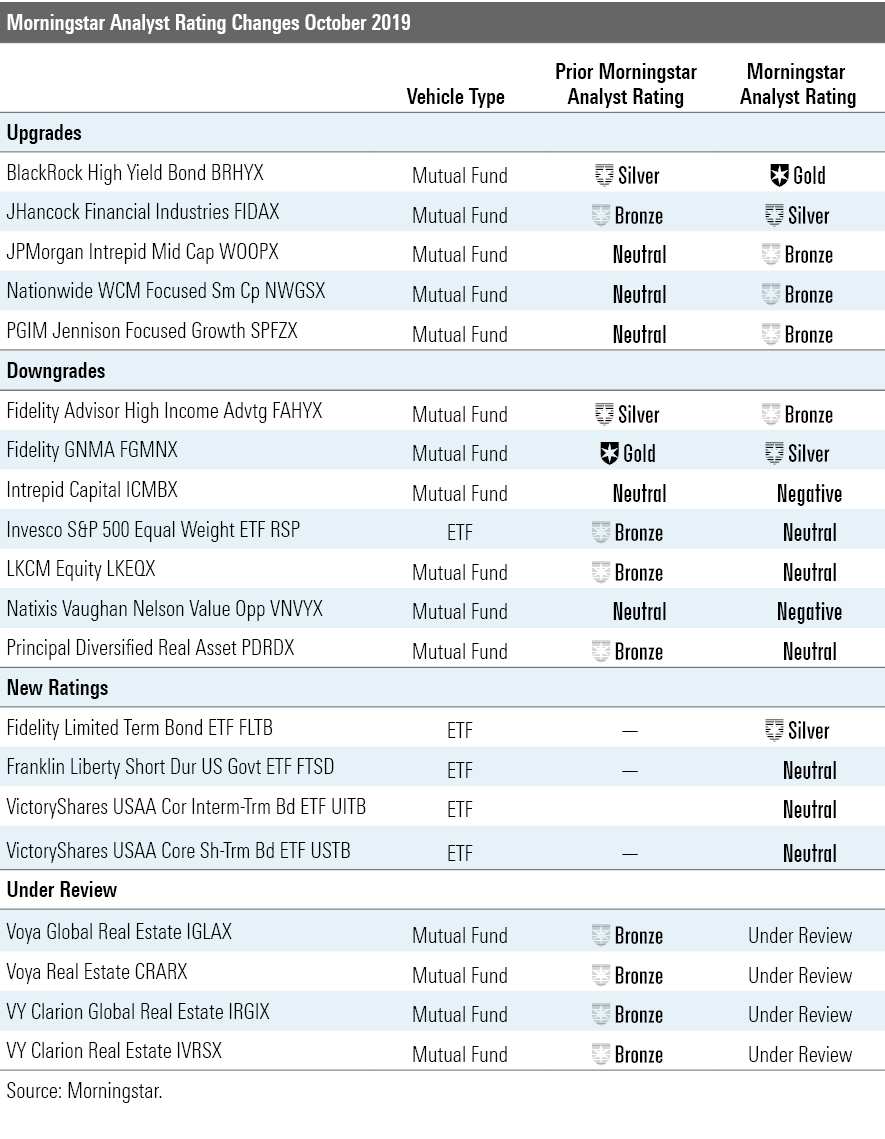

Morningstar manager research analysts published ratings for 146 mutual funds and exchange-traded funds in October. That tally included five upgrades, seven downgrades, and 126 reaffirmations. Another four strategies received inaugural ratings, while four went under review. These qualitative assessments were the last to be published ahead of a methodology enhancement to the Morningstar Analyst Rating for funds. Below are some highlights from the October ratings activity, along with a table of changes for the month.

Upgrades BlackRock High Yield Bond's BRHYX Analyst Rating increased to Gold from Silver because its distinctive and versatile approach benefits from one of the strongest teams in the high-yield Morningstar Category. Instead of targeting a sweet spot on the credit-quality spectrum, this fund's managers turn cautious when riskier bonds offer paltry compensation and bold when risk-taking pays. Given the strategy's girth--the $16.8 billion fund represents less than half of the team's over $45 billion high-yield bond market footprint--staying nimble is easier said than done. The managers have leveraged an expansive tool kit and the firm's impressive resources to navigate through various market environments and maintain the fund's edge over time.

Increased confidence in Nationwide WCM Focused Small Cap’s NWGSX disciplined, research-focused approach earned the strategy an upgrade to Bronze from Neutral. Hired in November 2017, a fairly nascent but solid three-person team at subadvisor WCM Investment Management is at the helm. Its thoughtful approach to portfolio construction has been well-executed over the strategy’s short history, which dates to a similarly run separate account’s 2014 inception. The managers look for 25-40 competitively advantaged businesses that are well-run but still a bargain. Such attention to quality, combined with a careful eye toward valuation, has helped the strategy outperform during market drawdowns while participating healthily on the upside.

Downgrades Fidelity Advisor High Income Advantage's FAHYX rating dropped to Bronze from Silver when its talented manager, Harley Lank, gave up his post to take on a new leadership role at Fidelity. The good news is that he turned it over to Mark Notkin, who has been running a similar strategy--in similarly successful fashion--in the form of Fidelity Capital & Income FAGIX since 2003, and added Brian Chang, who manages other high-yield portfolios as well. This one's risk profile is likely to change little. Both funds have held as much as 20% in equities, and Notkin has maintained a modest growth tilt among his choices in that sleeve compared with Lank's, but the funds' overall risk profiles have been effectively the same.

Recent investment team turnover, thin resources, high fees, and outflows challenge Intrepid Capital ICMBX. The fund’s Morningstar Analyst Rating fell to Negative from Neutral. After a long run of low turnover among senior investment professionals at Intrepid, the small firm has suffered meaningful departures in recent years. Inadequate resources are a concern, given management’s preference for research-intensive areas. Weak results have led to outflows, with fund assets dwindling to $124 million, as of August 2019, down from $474 million roughly five years ago. Performance could recover, but this fund is a risky bet.

New Ratings Fidelity Limited Term Bond ETF FLTB earned an inaugural Silver rating on the strength of its collaborative and seasoned trio of comanagers, who have ample resources. They implement a disciplined approach to investing in short-term bonds. The ETF and mutual fund versions of this strategy are modestly more aggressive than their sibling and fellow short-term bond Morningstar Category peer, Fidelity Short-Term Bond FSHBX. Both offerings maintain durations of less than three years and invest in a bevy of government, corporate, and securitized bonds, but this one tends to be more of a risk-taker, typically stashing 20%-35% of assets in midgrade corporate bonds.

/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_958dc30e28aa4c8593f13c19505966e3_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)